Top Story

Data suggests money just might buy happiness after all.

New research shows higher incomes mean happier people — and there’s no apparent income threshold that diminishes the growth rate of improved emotional well-being.

US stocks finished higher Tuesday after Secretary Yellen said the government could backstop more bank deposits.

• Treasury Secretary Janet Yellen previously said only deposits held at systemically important banks would be insured over the $250,000 FDIC limit. But her latest statement underscored the government’s commitment to protecting smaller regional banks as well.

• Existing home sales in the US, which include completed transactions, jumped 14.5% to 4.58 million in the month of February. This was the largest monthly gain since July 2020, well above market expectations of a 5% increase. The latest move also snapped a 12-month decline.

• Moody’s (MCO) upgraded Tesla’s (TSLA) credit rating from junk to investment-grade. The credit agency pointed to the company’s profitability and role as one of the foremost electric vehicle makers — factors that may continue to strengthen as its global presence expands.

What to be on the lookout for today

• The Federal Reserve will give its next interest rate decision. The central bank raised the fed funds rate by 25-basis-points last month, dialing back the size of its hikes in each of its 2023 meetings.

• Petco (WOOF) and Chewy (CHWY) will both report earnings. Along with its announcement, Chewy may look to ease concerns of antitrust violations regarding its relationship with PetSmart. The two pet care giants separated in 2022, but still share some board members across both companies.

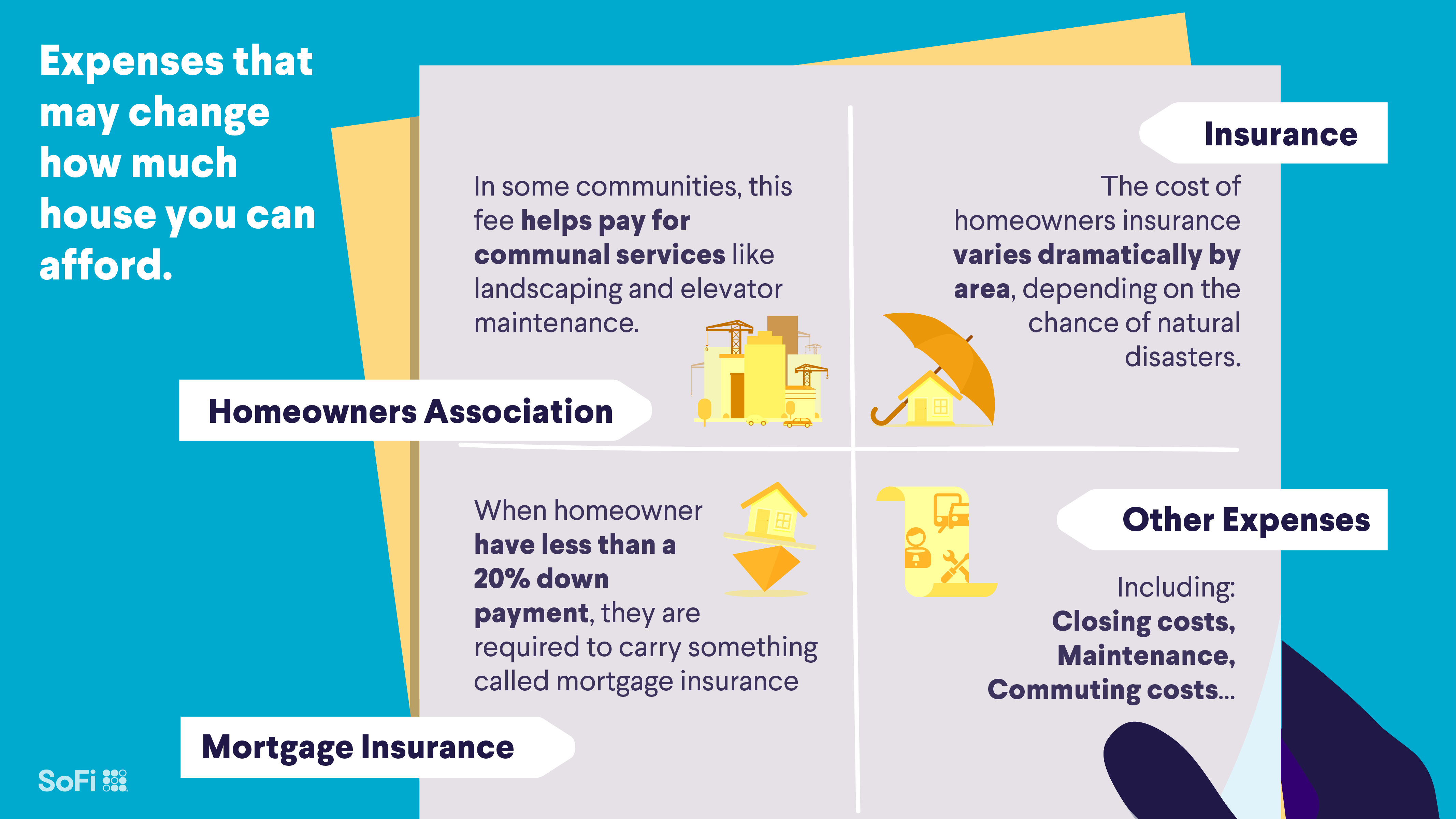

Expenses that may change how much house you can afford.

Keep these expenses in mind to help you avoid any budget-busting surprises.

Today’s top stories

Thrifting has become trendy on TikTok, which is making it pricier to shop at places like Goodwill or The Salvation Army. Younger consumers have gotten into thrifting as a way to save money and shop sustainably. But some say the trend has gone too far – and, ironically, they’re using TikTok to spread the message. Read more >> There are more experimental, sugar-filled snacks options than ever before, and consumers can’t seem to get enough. Americans started snacking more during the pandemic, and it seems they never stopped. Read more >> The cost of living can help determine where you’d like to live and buy a home. Here’s a list of cost of living figures by state to help you along the way. Read more >>Not-So-Breaking News

-

Amazon (AMZN) will lay off another 9,000 employees, bringing its total employee reduction count to 27,000. Despite this, some experts believe the company still has too many employees.

-

Fanatics will replace Adidas (ADDYY) as the jersey sponsor of the NHL. The 10-year deal — Fanatics’ first official professional sports league sponsorship — will start in the 2024-2025 season.

-

Google (GOOGL) is rolling out its generative AI tool Bard to select users in the US and UK this week. The highly anticipated AI chatbot will compete with OpenAI’s ChatGPT.

-

President Biden’s plan to build an electric-friendly highway system has begun to take effect. EV chargers manufacturers expect an industry-wide slowdown as companies attempt to comply with these rules.

-

Dollar General (DG) committed $100 million to improving staffing at its stores. The discount retailer said understaffing had led to substandard stores.

Financial planner tip of the day

"Whether it’s in a wallet or bank account, cash money means something. It’s liquid, which means a person can get to it whenever they need to and the returns don’t fluctuate. That stability comes with the drawback of purchasing power. Cash investments don’t keep up with inflation."

Brian Walsh, CFP® at SoFi