Monday,

March 20, 2023

Market recap

Dow Jones

31,861.98

-384.57 (-1.19%)

S&P 500

3,916.64

-43.64 (-1.10%)

Nasdaq

11,630.51

-86.76 (-0.74%)

Top Story

In a huge win for many Americans, insulin will soon be price-capped by many major drugmakers.

Did these companies have a change of heart? Not exactly. Here’s why this vital drug is finally headed down to affordable levels – and just how low the price is expected to go.

US stocks finished lower Friday as concerns over regional banks and Credit Suisse continued to weigh on Wall Street

• Bank stocks and the broader financial sector remained under pressure. Large financial institutions committed $30 billion to First Republic Bank (FRC), while the Swiss National Bank lent $54 billion to Credit Suisse (CS). Still, both stocks finished lower.

• FedEx (FDX) beat the Street’s bottom line expectations, with earnings per share of $3.41, compared to the expected $2.73. Revenue came in slightly below projections, but the company hiked its full-year earnings forecast, adding that its cost-cutting measures offset weakening demand.

• The Michigan Consumer Sentiment index dropped for the first time in four months from 67 to 63.4. The market expected the figure to remain flat. All three components of the index – individual financial situation, near-term economic outlook, and long-term economic outlook – saw a relatively even decline.

What to be on the lookout for today

• Chinese ecommerce company Pinduoduo (PDD) will kick off the earnings week. Investors will want to hear about the success of Pinduodo’s Temu shopping app. The app was growing remarkably even before its popular “Shop like a Billionaire” ad ran during the Super Bowl. In the week ended January 29, Temu posted a record $46 million in gross merchandise value.

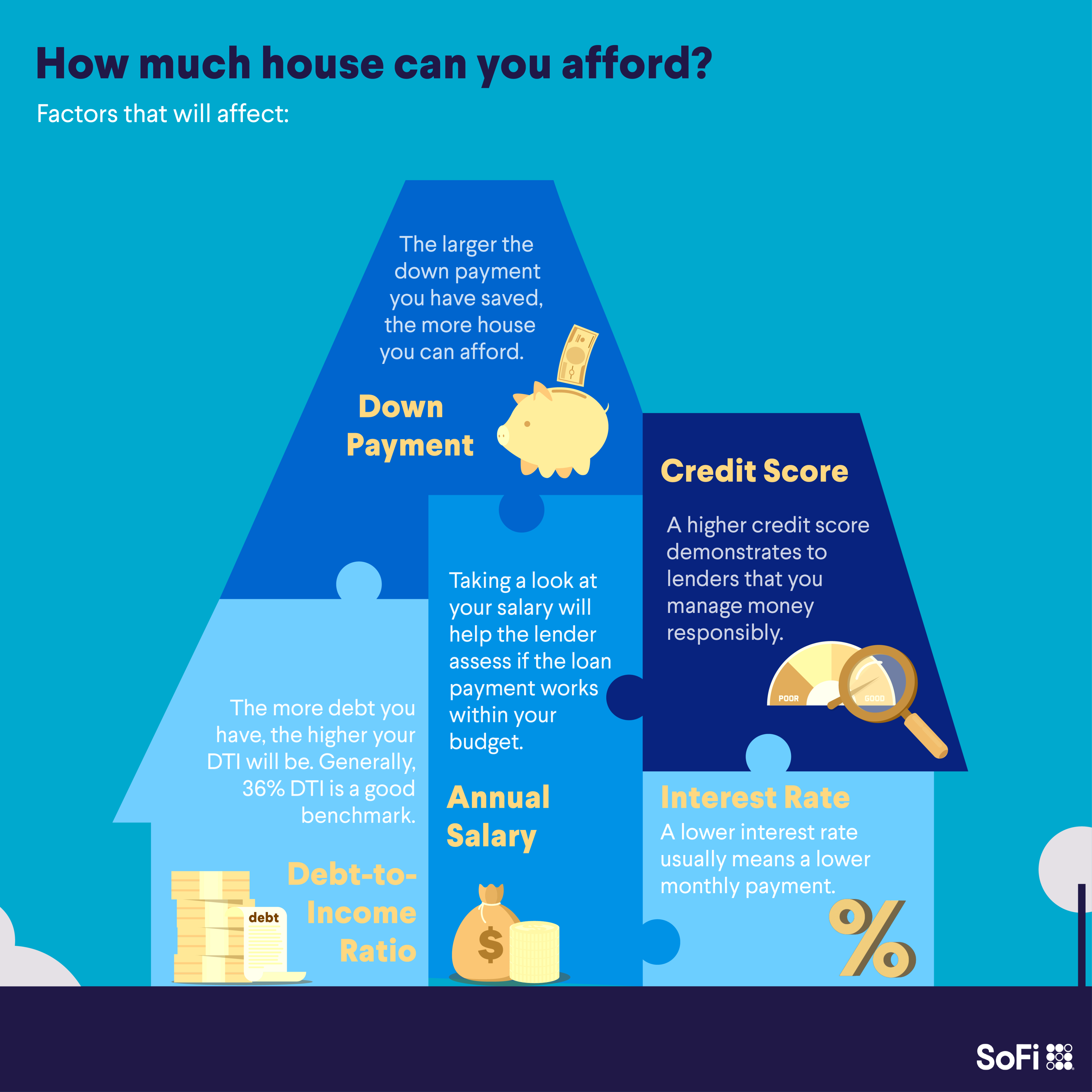

How much house can you afford? Here are the factors that go into it.

There are several factors that will affect how much house you can afford.Get a better idea of how much of a house you can afford by using our home affordability calculator.

Today’s top stories

Pinduoduo (PDD) is set to speak on the success of its shopping app Temu, of Super Bowl ad fame. Also, will the Fed continue its unprecedented streak of interest rate hikes? Find out, this week on Wall Street. Read more >> Microsoft (MSFT) wants to use AI to ease office work. Three decades after Microsoft Office launched, the tech giant’s new AI-powered product Copilot wants to change the way you work again. But two more companies are hot on its heels. Read more >> Upfront costs for your new home may be steeper than you think. Though the down payment is widely acknowledged as the first major step in buying a home, closing costs should be a close second. Here’s what you should know and how to prepare. Read more >>Not-So-Breaking News

- SVB Financial Group, former parent group of Silicon Valley Bank, filed for bankruptcy on Friday. Separate from the FDIC’s sale of Silicon Valley Bank assets, the company expects the Chapter 11 filing to help it appease stakeholders and preserve its value.

- Royal Caribbean (RCL) plans to build a second “private island” experience on Paradise Island in the Bahamas, following the success of its “Perfect Day at CocoCay” package. But the Atlantis resort, also located on Paradise Island, has pushed back against the announcement.

- Taco Bell (YUM) is bringing back the Volcano Menu. Items like the Volcano Burrito, Volcano Taco, and Lava Sauce will be available for a limited time starting on June 29th.

- Ford (F) is recalling over 1.2 million vehicles over a brakes-related issue. Owners of Ford Fusion and Lincoln MKZ models from 2013 to 2018 can get the issue fixed at a dealership free of charge.

- This year, US employers will take an estimated hit of $17 billion in lost worker productivity due to March Madness. These losses result from employees watching games and filling out brackets while on the clock.

Financial planner tip of the day

“Depending on the type of loan you have, if you make a down payment that’s less than 20%, your lender probably will require that you purchase private mortgage insurance. PMI could add about 0.3% to 1.5% to the cost of your mortgage. And you’ll likely have to pay it every year until your equity in the home reaches 20%.”

Brian Walsh, CFP® at SoFi