Wednesday,

March 8, 2023

Market recap

Dow Jones

32,856.46

-574.98 (-1.72%)

S&P 500

3,986.37

-62.05 (-1.53%)

Nasdaq

11,530.33

-145.41 (-1.25%)

Top Story

Significant changes to federal tax brackets could take the sting out of high inflation.

Several tax provisions will be adjusted in 2023, allowing Americans to keep more of what they earn.

US stocks finished lower Tuesday after Powell’s much-anticipated testimony on Capitol Hill

• Fed Chair Jerome Powell acknowledged that the latest inflation data clearly demonstrates the fight against rising consumer prices is far from over. As such, Powell believes returning to the 2% target will likely require higher interest rates than previously anticipated.

• Dick’s Sporting Goods (DKS) surpassed Wall Street’s top-and-bottom line estimates with adjusted earnings of $2.93 per share and $3.6 billion in revenue. Investors were pleasantly surprised by the company’s resilience in the face of inflation-battered consumers, with same-store sales more than double the Street’s projections. Dick’s also offered full-year guidance above analyst expectations.

• The Justice Department filed a lawsuit to block JetBlue’s (JBLU) acquisition of Spirit Airlines (SAVE). The $3.8 billion takeover, if approved, would create the fifth-largest airline in the country and, according to the Justice Department, “eliminate the unique competition that Spirit provides and about half of all ultra-low-cost airline seats.”

What to be on the lookout for today

• Investors will get a sense of which direction the job market is trending with the release of the JOLTS job openings report. The number of job openings sat at nearly 11 million in December — the largest figure in five months. Investors will also receive readings on the balance of trade and the 30-year mortgage rate. The latter sat at 6.71% as of its last reading.

• Wall Street will get earnings announcements from Campbell Soup (CPB) and productivity software provider Asana (ASAN). Campbell Soup sales can often be viewed as a recession indicator, so investors will listen closely to what they have to say.

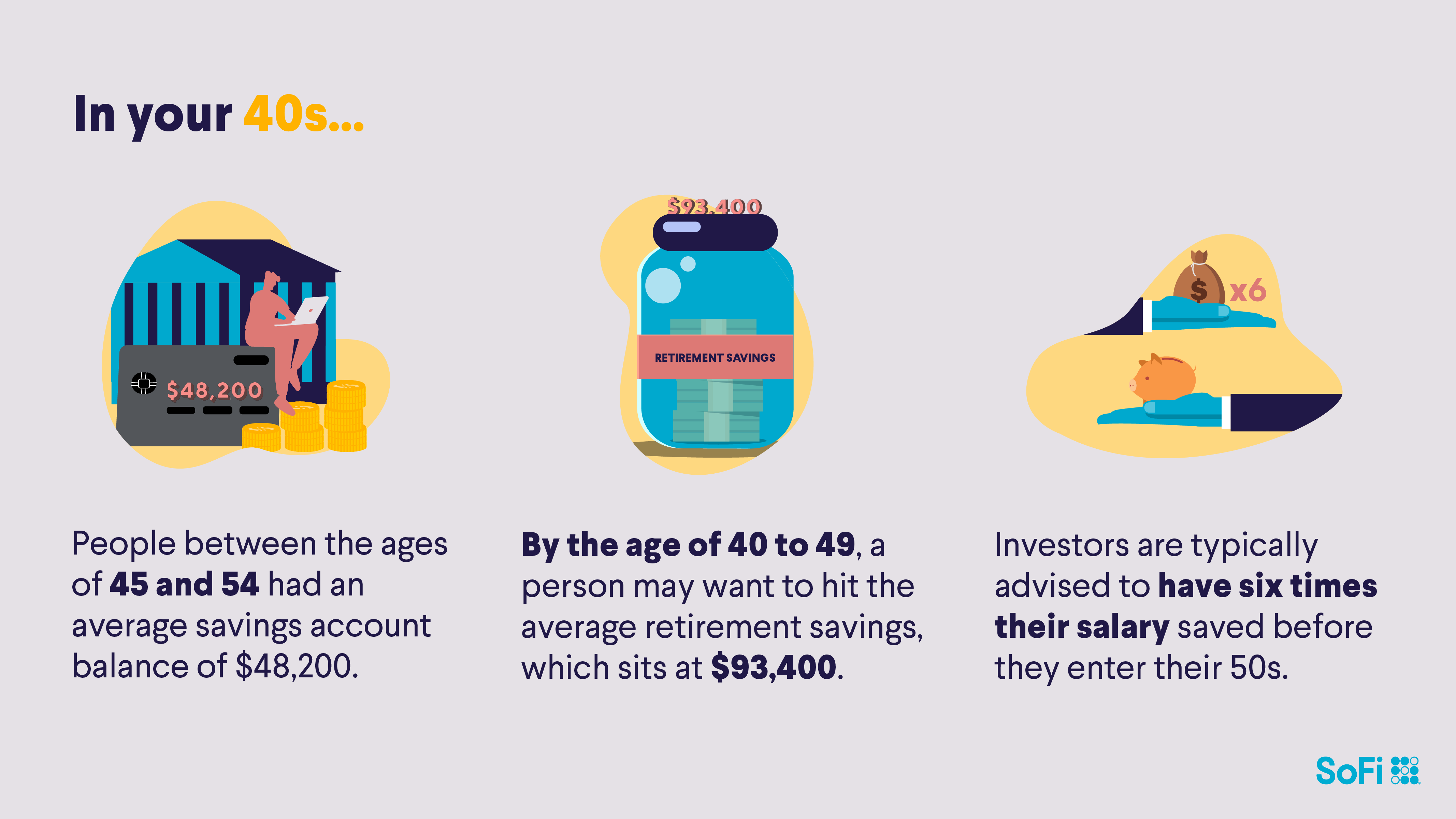

Your 40s are a complicated decade where sound financial planning is crucial for a secure future.

It’s never too late to take control of your finances. In your 40s, you are likely entering your prime earning years, so it’s a good moment to focus on paying down debt, preparing for the next chapter of your children’s lives, and saving and investing to get ready for retirement. With some wise money moves, you’ll be set to make the most of this decade and beyond.

Recommended reading: Financial Tips for People in Their 40s

Today’s top stories

Funding for vertical farms is drying up, which could mean pricier produce is on the way. The first few harvests from vertical farms have not impressed investors. Read on to learn how this unique industry is faring — and how it impacts your wallet. Read more >> This toy has hardly changed since the 1930s. But it’s still the bane of its competitors’ existences — and feet. Its staying power is one part consistency and one part partnering with other successful brands to stay relevant. Read on to learn which toy we’re talking about. Read more >> They say that diamonds are a girl’s best friend, but did you know that you can also build credit with jewelry purchases? By purchasing jewelry on credit, it’s possible to build your credit score. Here are a couple of ways that you can do so. Read more >>Not-so-breaking news

-

HelloFresh (HELFY) lowered its profit guidance for 2023, citing reopening economies and inflation as its main concerns. After rising in popularity during the pandemic, many food delivery services have struggled over the past year.

-

Atlassian (TEAM) laid off 500 employees, or about 5% of its workforce. Looking forward, the business software provider plans to prioritize focus on key areas, such as cloud migrations.

-

Google (GOOGL) plans on promoting fewer employees to senior roles. After laying off 12,000 employees, the internet giant seeks to keep employee growth proportionate to its diminished workforce.

-

Meta Platforms (META) announced another round of layoffs, continuing a trend after letting go of 13,000 employees last November. CEO Mark Zuckerberg wants to slash Meta’s costs, labeling 2023 “The Year of Efficiency”.

-

Salesforce (CRM) is releasing a suite of new tools powered by ChatGPT. Its new AI-powered software, called Einstein GPT, is intended to help salespeople, customer service agents, and marketers do their jobs more efficiently.

Financial planner tip of the day

"When figuring out how to become financially independent, it can behoove individuals to invest early and often. Even if it’s only $25 or $50 per month, small amounts can add up. By investing earlier than later, money has more time to grow and for interest to compound."

Brian Walsh, CFP® at SoFi