Top Story

Stocks Close Out Week on Strong Note & Help Snap Losing Streaks, Consumer Spending Up in April

• US stocks rose Friday, helping the Dow and S&P 500 snap multiple-week-long losing streaks. Encouraging economic data may have fueled the rally to close out the week, as the Fed’s preferred inflation gauge eased in April, and consumer spending increased.

• Some economists argue this isn’t the bottom for the market’s recent sell-off, given the many headwinds at present. Perhaps most notably is the Fed’s tightening monetary policy, which has sparked fears of a more protracted downturn. Of course, rising prices themselves, the war in Ukraine, and COVID-19 lockdowns in China are also weighing on sentiment.

• Last week’s earnings reports shed a significantly more positive light on the retail sector. While Walmart (WMT) and Target (TGT) gave investors pause while citing increased labor and fuel costs earlier this month, Macy’s (M) and several other retailers were upbeat. Dollar Tree (DLTR) and Dollar General (DG) indicated discount stores may also be faring better at present, although Gap (GPS) said its Old Navy brand is struggling because lower-income consumers are feeling the pinch of inflation.

What to Be on the Lookout for Today

• May’s consumer confidence index is set for release. Investors will be paying close attention given the recent focus on the retail sector and inflation’s perceived impact on Americans’ spending habits. The Conference Board’s index edged down in April, but remained high by historical standards.

• May’s national home price index is also due from S&P Case-Shiller and the FHFA. These track the change in single-family home prices, year-over-year. Home prices are significantly higher now than before the pandemic, fueled by historically low interest rates and tight supply.

• Salesforce (CRM) will announce earnings. Last week it was reported the cloud-based software company had joined with Microsoft (MSFT) to invest $300 million in the US-based First Movers Coalition, which focuses on new technology aimed at reducing carbon dioxide in the air.

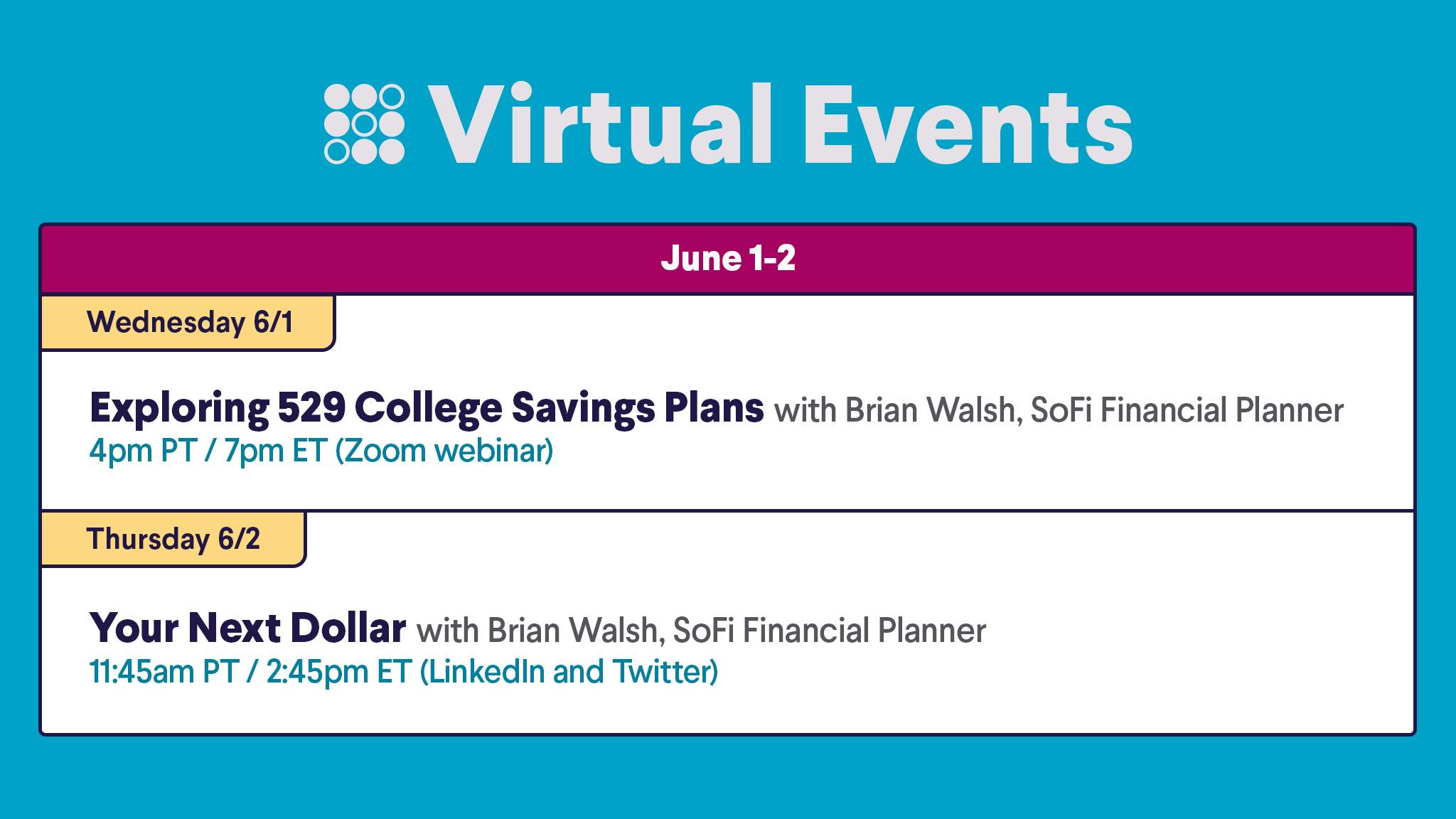

Member Events Calendar

Ready to get the 411 on 529s? Brian Walsh will share tips on college savings plans, including the tax benefits. Then join Brian for this week's Your Next Dollar livestream. Save your seat in the SoFi app!

A Few Headlines That Should Be on Your Radar

A recent report argues Lululemon (LULU) is well positioned to ride out inflation, all while investors are trying to figure out how rising prices are affecting consumer spending. Broadly speaking, headwinds facing retailers include rising fuel and labor costs. In the same vein, skyrocketing gasoline prices may be affecting how people are shopping. The retail sector has been a major focus on Wall Street lately, as inflation remains at a 40-year high, threatening to sap spending overall. Read more >> Uber (UBER) and Lyft (LYFT) are chasing elusive profits as they face both a worker shortage and waning demand. Riders may appreciate company-offered incentives to offset higher fares. The ride-sharing companies will make cost cutting a top priority, while trying to attract customers and drivers alike. Read more >> Americans returning to the office are seeing their take-home pay shrink, as everything from the cost of transportation to their coffee-breaks have gotten more expensive. In this tough environment, workers are finding ways to cut back. Still, with seemingly everything costing more these days, many will be challenged to make headway. Read more >> If you think you can’t afford a house in today’s market, all hope may not be lost. How can anyone afford a house under these conditions? Here are some options you may consider in your quest for homeownership: Read more >>Not-So-Breaking News

-

Pot stock Canopy Growth (CGC) posted a wider-than-expected loss in its fourth quarter, sending its share price plummeting. The company says it’s focused on achieving profitability in Canada while investing in its BioSteel drinks and its US “THC ecosystem.”

-

Discount retailer Big Lots (BIG) surprised analysts by posting a loss in its fiscal first quarter, while also missing on sales. Executives note the company’s gross margin has shrunk, adding the plan is to focus on pricing, overcome supply chain challenges, and ensure stores have enough inventory.

-

Gap (GPS) significantly lowered its profit outlook for the year and cited weak sales at Old Navy as the main reason. Executives note Old Navy targets lower-income consumers, who are starting to feel the impact of inflation.

-

Sporting goods retailer Hibbett (HIBB) fell short of analyst expectations for profit during its fiscal first quarter citing increased costs. Its sales declined by $82.8 million, year-over-year. Executives said consumer spending habits were affected by the absence of COVID-19 stimulus payments but also noted supply chain disruptions have improved.

-

With the retail sector generating headlines recently, Costco (COST) delivered a somewhat mixed earnings report last week. While the big-box retailer saw its revenue increase by $1 billion in its most recent quarter, same-store sales growth missed estimates. Costco says it remains on track to reach $200 billion in revenue this year.

Financial Planner Tip of the Day

“Depending on your employment circumstances, there are many possible retirement plans in which you can invest money for retirement. Some are offered by employers, others can be set up by an individual. Likewise, the benefits for each of the available retirement plans differ, though they all share one positive attribute: Investing in them is an important step in saving for retirement.”

Brian Walsh, CFP® at SoFi