Top Story

Stocks Finish Flat in Wild Session to Close Out Week, Retail Remains in Focus

• US stocks were mixed after a strong opening kicked off a volatile session. The Dow closing out its eighth-straight down week, and the S&P 500 continuing to flirt with bear market territory. Broadly speaking, investors seem concerned about the health of the US and global economy given rising inflation and the Fed’s tightening monetary policy.

• China’s central bank cut its rates in a surprise move, as the nation’s economy is facing lagging growth. Mortgage rates can be highly influenced by such a move, and equities seemed to get a boost early on in response to the news.

• The retail sector was a major focus last week on Wall Street, as both Walmart (WMT) and Target (TGT) posted downbeat reports. Both companies said rising fuel and labor costs are eating into margins. Meanwhile, Ross Stores (ROST) became the latest retail stock to report earnings at the close of the week, and saw its share price plummet after sharing weaker-than-expected sales.

What to Be on the Lookout for Today

• Advance Auto Parts (AAP) reports its most recent quarterly results. With inflation soaring and new cars hard to come by due to supply-chain and chip-shortage problems, auto aftermarket companies are in a position to succeed. Broadly speaking, analysts say consumers are more willing to keep driving older cars at present.

• Zoom Video (ZM) is also set to hand in its latest report card. A pandemic darling, Zoom has fallen from its highwater mark and saw its share price decline by 15% during April. Still, some analysts contend Zoom is set to grow its customer base thanks to a series of new product offerings.

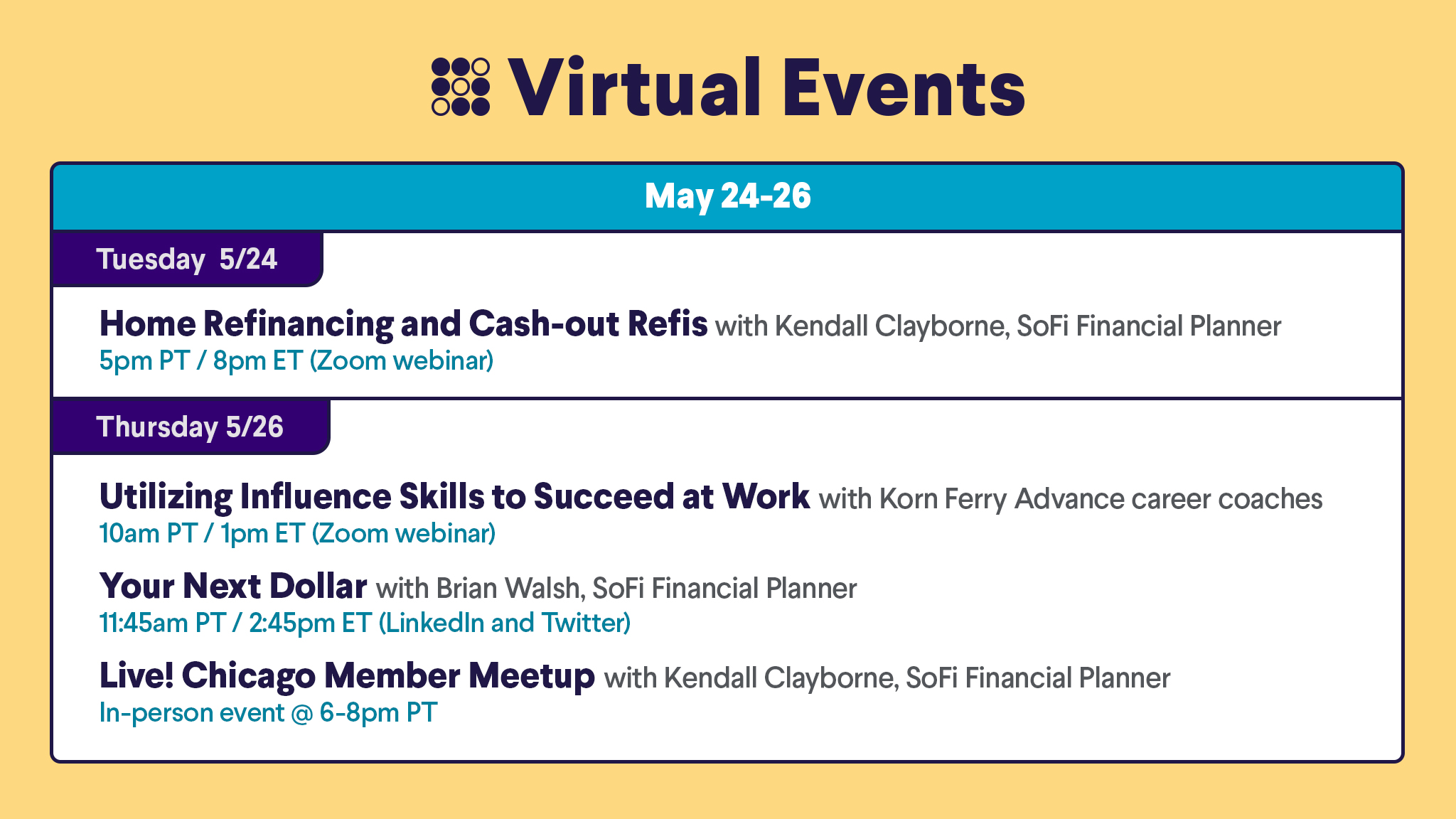

The Week Ahead at SoFi

Lots happening this week, including talks on home mortgage options, how to use your mad influence skills at work, plus an in-person event in Chicago. Also, check out the Your Next Dollar livestream. Save your seat!

A Few Headlines That Should Be on Your Radar

It was a rough last week for retail, and now Costco (COST) is up next with its latest earnings report. Investors will be looking to see how inflation is affecting big box retail and Americans’ spending habits. As if the downbeat reports from peers Walmart (WMT) and Target (TGT) weren’t enough to deal with, Costco also faced a false rumor that it was increasing the price of its food court hot dog due to inflation. Analysts say the more real concern is that fuel and labor costs are rising. Read more >> After seeing a run-up in home values, homeowners are looking for ways to protect gains. Several strategies exist, but the tradeoffs, costs, and risks may not be for everyone. A variety of tools exist that homeowners can use to offset any potential future decline in the price of their homes. With the future of the housing market uncertain, careful consideration of the potential downside in any strategy is important. Read more >> Rolex watches are in scarce supply. This has speculators seeing profit opportunities in trading the luxury timepieces on the secondary market. Limited production of new rolexes means supply falls far short of demand. Investment interest in the watches has pushed their secondary market prices sky-high, leaving some market observers wondering if time is running out on those types of valuations. Read more >> Interest rates do fluctuate, but here we’ll take a look at the latest numbers in terms of savings account interest rates and how your money can grow faster. With savings accounts, you accrue different interest rates depending on the bank. Learn about what is a good interest rate for a savings account. Read more >>Not-So-Breaking News

-

Foot Locker (FL) reported first-quarter profit that exceeded Wall Street estimates. Analysts had been expecting comparable sales to decline by 4.1%, but the number instead slipped by just 1.9%.

-

Heavy equipment maker Deere & Co (DE) beat expectations on the top and bottom lines in its most recent quarter, with executives saying “strong demand” helped overcome issues related to the supply chain. The company behind the John Deere brand also maintained its sales forecast for the year as a whole.

-

New legislation that has bipartisan support in Congress aims to force Alphabet’s (GOOGL) Google to break up its digital advertising business. It’s called the Competition and Transparency in Digital Advertising Act and was advanced by a group of senators that serve on the Judiciary subcommittee on antitrust.

-

Coca Cola (KO) is rolling out a new bottle cap feature in an effort to cut down on litter. The beverage giant is tethering its bottle caps to the bottle itself in the UK, because the little plastic pieces so often end up as trash. It’s a pilot program aimed at making it easier to recycle the whole thing. All bottles of Coke, Fanta, Sprite, and Dr Pepper are expected to have the tethered caps in Britain by 2024.

-

Canada announced it will ban 5G gear from China’s Huawei Technologies and ZTE (ZTCOF) in an effort to protect national security. The country is joining the so-called Five Eyes intelligence-sharing network in making the move. Officials say both companies must remove their 5G gear by June 2024, while 4G equipment needs to be out by the end of 2027.

Financial Planner Tip of the Day

“You don’t have to cancel your cards, since that may negatively impact your credit score. You can store them somewhere you won’t have easy access to them, or even cut them up so you’re not tempted to use them.”

Brian Walsh, CFP® at SoFi