Top Story

Markets Rise on Friday but Not Enough to Wipe Out Weekly Losses

• US stocks rose on the final day of the week. However, Wall Street is still worried about macro factors including rising inflation, a hawkish Federal Reserve, and the ongoing war between Russia and Ukraine. Analysts attributed Friday's pop to some investors scooping up beaten down technology companies.

• The University of Michigan preliminary consumer sentiment for May fell to 59.1. The figure clocked in at 65.2 in April and was below market forecasts of 64. According to the survey, 36% of consumers tie their negative assessment to inflation.

What to Be on the Lookout for Today

• The New York Fed will release this month’s regional manufacturing survey. Known as the Empire State Manufacturing Index, the reading increased significantly from March to April, easily beating analyst expectations. The report noted this followed three months of sluggish activity, with 40% of respondents saying conditions had improved.

• Chinese music streaming service company Tencent Music Entertainment (TME) will hand in its latest report card. At the end of last month, Paris-headquartered music company Believe renewed its agreement with Tencent Music. In Q4 2021, Tencent Music reached 76.2 million paying users, up 36.1% year-over-year.

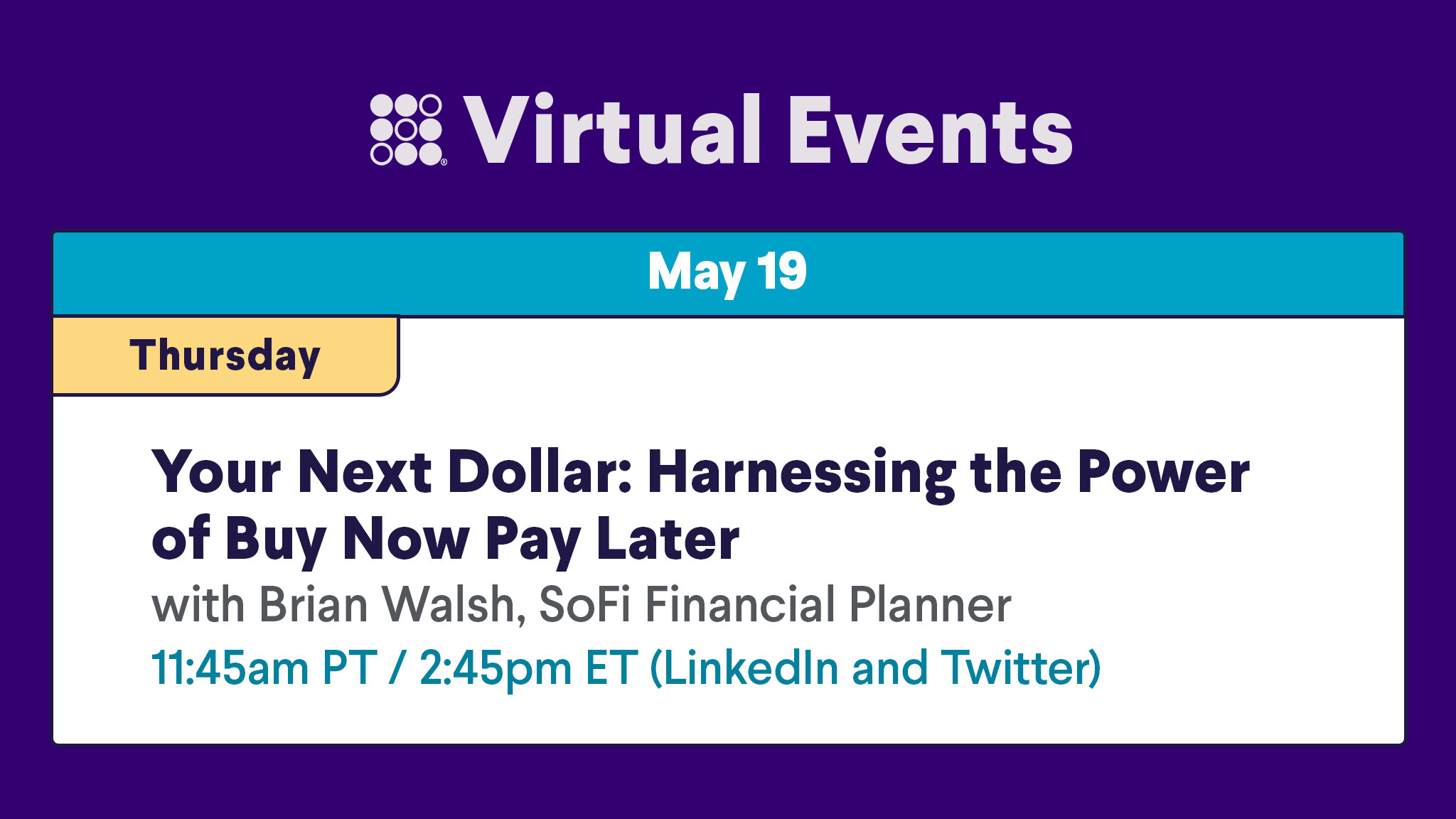

Member Events Calendar

Join us for the Your Next Dollar livestream for a discussion about buy now pay later financing. Tune in to hear about the pluses and minuses, and see if this is a good option for you. Save your seat in the SoFi app!

A Few Headlines That Should Be on Your Radar

During the early stages of the pandemic, Home Depot (HD) and other home improvement retailers flourished, as people stayed indoors and worked on renovation projects. Now as the company gets ready to post earnings, investors want to see what kind of impact inflation is having on sales. Analysts explain that home renovation may soon return to pre-pandemic levels, all while inflation is causing prices to spike, leaving some consumers less willing to spend. Meanwhile, Home Depot has beat Wall Street expectations on the top and bottom lines during its last four earnings calls. Read more >> There’s an ongoing shortage of baby formula, which has parents alarmed and lawmakers scrambling. Factory shut-downs and shipment delays have contributed to the problem. With just two manufacturers producing 80% of the product in the US, immediate solutions are in short supply. The maker of Enfamil is running its factories 24/7. Read more >> As mortgage rates soar ever higher, consumers are looking for ways to contain costs. A credit score tune-up may be just the solution. Mortgage interest rates just hit 5.27% in a dizzying ascent from levels just a few months ago. Home buyers are looking for ways to stay in the game. Read more >> Buying in a hot market with a small down payment is challenging but doable. Here’s some help navigating the current real estate market if you have a small down payment. Read more >>Not-So-Breaking News

-

Twitter (TWTR) shares tumbled after Elon Musk announced his deal to buy the social media platform is on hold. The Tesla (TSLA) CEO contends that he’s “still committed to the acquisition” but first wants to see data on fake accounts.

-

Stablecoin Luna (LUNA) collapsed amid volatility in its linked cryptocurrency, TerraUSD, which recently decoupled from its supposed peg to the dollar. The value of Luna plunged to zero.

-

Honest Co. (HNST) quarterly results came in just short of estimates as online sales dropped by almost 20%. The “clean” consumer goods company has left its full-year outlook for flat revenue unchanged.

-

Rivian Automotive (RIVN) has recalled 502 trucks due to a safety issue with the passenger seat airbag. The startup company’s first recall affects about 10% of vehicles it’s produced since inception.

-

Governor, Gavin Newsom, announced California will bump up its minimum wage to $15.50 per hour, effective January 1, 2023. The increase is in response to runaway inflation that is eroding Americans’ purchasing power.

Financial Planner Tip of the Day

“One strategy to approaching home additions is to create your dream list, then have alternate choices in mind if your budget, material availability, or other external factors create a need to alter the project down the road. For example, you may love the look of marble flooring, but its price point might be higher than you’d initially estimated—or perhaps it doesn’t blend in with the rest of your house once you’ve started laying out the plans. Having a back-up plan—and one that’s cost-efficient at that—could help keep your budget in check.”

Brian Walsh, CFP® at SoFi