Top Story

Stocks Down to End the Week as Investors Focus on Fed’s Tightening Monetary Policy

• US stocks fell Friday, as investors reacted to the latest indications from the Fed that it will continue to aggressively pursue a hawkish monetary policy. This followed comments from Fed Chair Jerome Powell just a day earlier, in which he suggested a 50-basis-point rate hike could be coming at the central bank’s meeting next month.

• The bond market selloff seemed to stabilize to end the week, as the yield on the benchmark 10-Year US Treasury has been rising lately. The yield hit a three-year high at one point on Friday. Analysts say rising bond yields put pressure on stocks, as lower expected upside diminishes the willingness to accept their risk.

• Both manufacturing and services expanded at a slower pace this month in comparison to March, according to S&P Global Mobility’s purchasing managers survey. The market intelligence firm’s chief economist says this suggests a slight loss of momentum, compared to what was a strong rebound in March.

What to Be on the Lookout for Today

• The Chicago Fed will release last month’s National Activity Index. The reading edged downard in February, indicating a slight decrease in economic growth. The Dallas Fed will also publish that region’s Manufacturing Index for April.

• Video game giant Activision Blizzard (ATVI) will hand in its latest report card. Reports indicate the company’s popular World of Warcraft, Hearthstone, and Call of Duty franchises have expanded their user bases, and helped boost in-game spending.

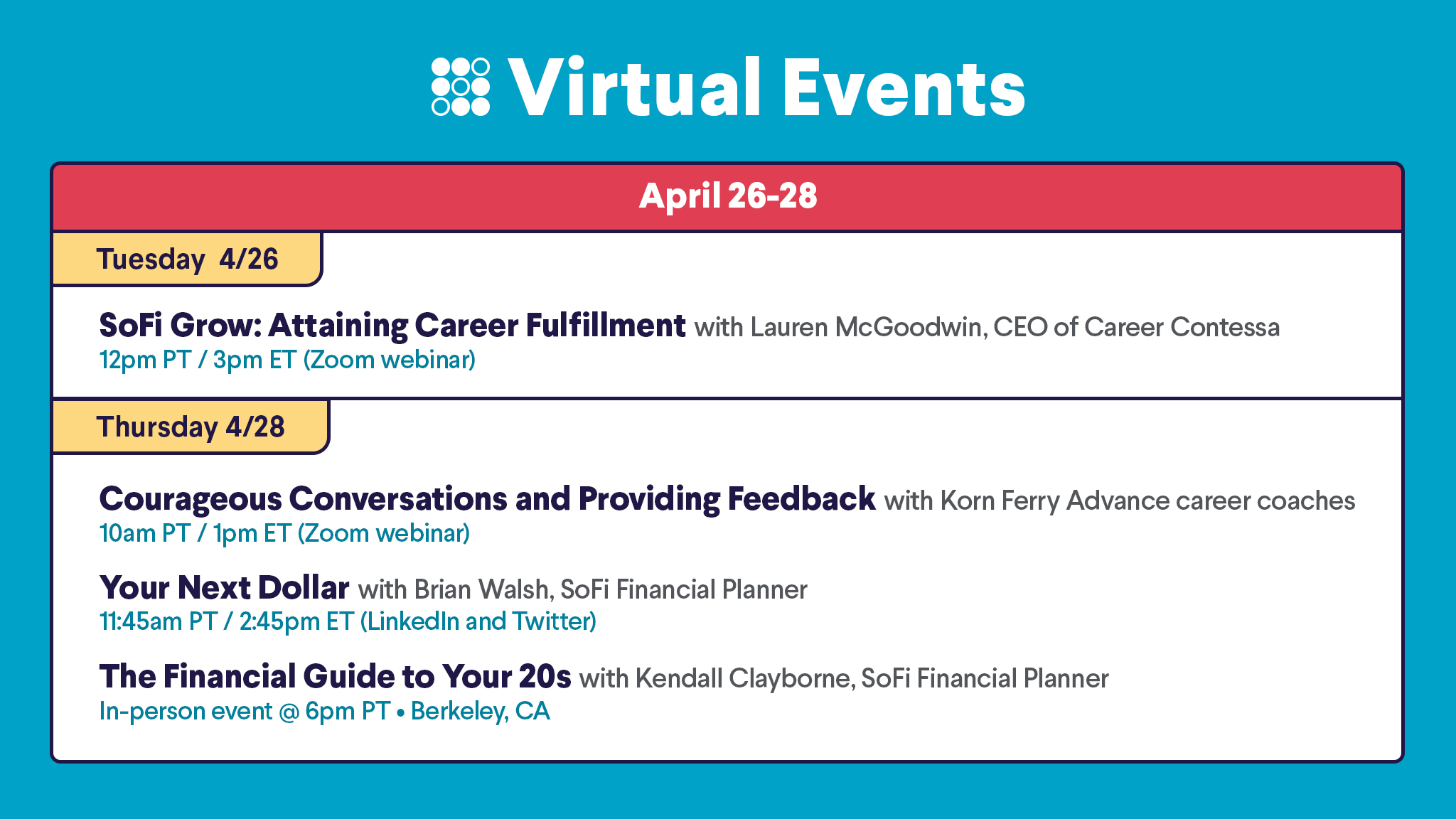

The Week Ahead at SoFi

This week’s events include talks on attaining career fulfillment and having courageous workplace conversations, plus an in-person event in Berkeley, CA. Also, check out our Your Next Dollar livestream. Save your seat!

A Few Headlines That Should Be on Your Radar

Earnings season presses forward, and investors are looking to see how some of the stock market’s biggest names are handling inflationary pressures. Is McDonald’s (MCD) feeling the pinch? How is Chevron (CVX) performing amid volatile oil prices? Plus, key housing market data is on the way this week. Wall Street is looking at things like mortgage applications, the average rate on a 30-year loan, and pending home sales, as the housing market is traditionally busy this time of year. Meanwhile, the big names reporting earnings will be sure to make headlines, including Ford (F) and video game giant Activision Blizzard (ATVI). Read more >> Amazon (AMZN) is looking to further extend its reach by offering Prime membership benefits on third-party sites. The retailing giant is investing $1 billion in an attempt to spur innovation to both logistics and supply chain infrastructure. Shoppers that are Prime members will soon be able to enjoy fast shipping and easy fulfillment when shopping at online merchants outside of Amazon. Retailers and customers may cheer, but Fedex (FDX) and UPS (UPS) may end up taking a hit. Read more >> Lululemon (LULU) expects new initiatives to pay off and eventually help double the company’s revenue by 2026. Product line and geographic expansion are expected to fuel its growth, as well as a newly announced membership program. The upscale athleticwear company will make clothes for a more diverse range of activities, such as golf and tennis as it expands its reach to China and Europe. It also plans to launch a membership program with both free and paid options,to increase product sales, brand loyalty, and customer outreach. Read more >> It is possible to earn passive income with crypto, but returns will depend on the method chosen and the amount of crypto you have to start. Given its volatility, there’s no guarantee that any crypto strategies will deliver any returns. Still, those holding large amounts of crypto have several avenues to potentially generate yield with crypto. It’s up to you to weigh the risks of trying to earn a yield on their crypto and its potential rewards vs. the risk/reward ratio of simply holding for potential long-term gains, or cashing out some or all of your holdings. Read more >>Not-So-Breaking News

- Clothing and accessories retailer Gap (GPS) cut its first-quarter sales guidance, as executives pointed to “execution challenges” within the Old Navy division. The company also announced that Nancy Green is set to leave her role as Old Navy’s chief executive.

- Verizon (VZ) said it lost fewer-than-expected phone subscribers during the first three months of the year, while net income fell by 12.4%. Analysts had predicted the loss of 49,300 subscribers, but Verizon reported just 36,000. This could be a sign the company’s massive investment into 5G expansion and new broadband networks is paying off.

- Consumer products company Kimberly-Clark (KMB) increased its full-year forecast and posted first-quarter profit that exceeded Wall Street estimates. Kimberly-Clark’s brands include Kleenex, Huggies, and Scott paper products. The company also acquired a majority and controlling stake in Thinx during its most recent quarter, which makes menstrual underwear.

- Newmont (NEM) missed analyst expectations for both profit and revenue, as the gold miner says costs outpaced sales during its first quarter. The company’s share price hit its high-water mark on April 18, closing at $85.42 per share. Newmont estimates it lost $17 million due to COVID-19 in the first three months of 2022.

- Oilfield services company Schlumberger (SLB) beat analyst expectations on the top and bottom lines during its first quarter, and the company announced a 40% increase in its dividend. Executives say the company’s digital and integration, well construction, and reservoir performance divisions all exceeded expectations.

Financial Planner Tip of the Day

“In general, individuals should have 8-12 times their annual income in life insurance coverage. On average, term insurance costs 10% to 30% for the same amount as whole life, so one way to protect your family without breaking the bank is term insurance.”

Brian Walsh, CFP® at SoFi