Top Story

US Stocks Fall the First Week of 2022

• US stocks got off to a rough start during the first trading week of the new year. Rising interest rates and hawkish comments from the Federal Reserve’s December meeting caused a selloff in growth stocks. Technology companies, and cloud computing firms in particular, came under pressure. These stocks are generally sensitive during rising rate environments because higher debt cost can weigh on future growth. This can then make future cash flow look less valuable to investors.

• Mixed economic data didn't help buoy sentiment on Wall Street. For example, private job growth as measured by ADP totaled 807,000 in December. This handily beat estimates of 375,000 and was the best reading since May 2021′s 882,000 figure. But on Friday, nonfarm payrolls came in at just 199,000 in December, which was well below the 422,000 expected. The jobless rate did fall to 3.9%, however the mixed signals have been tough to read for investors.

• Elsewhere, oil prices gained ground. Brent crude for example rose above $82 which was the highest level in eight weeks. According to industry analysts, output may be impacted by protests in Kazakhstan, a major crude-producing country, along with a snap of cold weather in North Dakota and Alberta, Canada.

What to Be on the Lookout for Today

• Fresh economic data is due today. The Commerce Department releases its revised report on wholesale inventories for the month of November. This metric measures monthly changes in inventory held by wholesalers before they sell goods to retailers. Late last month, the initial snapshot showed a 1.2% increase in November after wholesale inventories rose by a record 2.5% in October.

• Tilray (TLRY) reports quarterly results. The Canadian pharmaceutical and cannabis company is expected to show increased sales but not enough to post a profit. Zooming out, Tilray is the first major cannabis company to post quarterly results. Considered a pioneer in cultivation, distribution, and research, the company supports more than 20 brands in over 20 countries, which is significant as laws and attitudes concerning marijuana are constantly in flux.

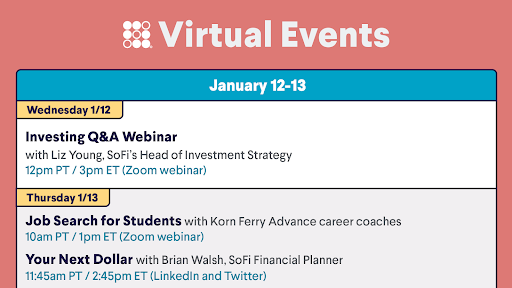

The Week Ahead at SoFi

Start your new year with webinars featuring the basics of investing and best practices for students looking to land the perfect job. Plus check out Your Next Dollar. Sign up in the SoFi app!

A Few Headlines That Should Be on Your Radar

A handful of economic data reports are published this week including the consumer and producer price indexes. These metrics track inflation which is not only top of mind for consumers but also investors and the Federal Reserve. November's CPI report showed an annual increase of 6.8%, the largest spike since 1982. Both investors and the Federal Reserve are monitoring inflation carefully and the updated numbers will likely impact portfolio allocation and the timing of rate hikes. Read more >> In an effort to boost company profits and investor appeal, GameStop is diving into the NFT and cryptocurrency space. The retailer is planning to create a marketplace for NFTs, or non-fungible tokens, and establish cryptocurrency partnerships. GameStop is hoping to capitalize on the growing popularity of these digital assets as part of a turnaround plan, focusing on virtual video game goods including weapons and character skins. Read more >> Shares of cloud software companies started the first trading week of 2022 on a rocky note. The rising rate environment which has weighed on the tech sector at large was acutely prevalent in the cloud-computing space. Changing interest rates tend to greatly impact high-growth software stocks. Higher interest rates mean lower future cash flow, and many cloud software companies don't yet turn a profit. Read more >> Tax Day will be here before you know it. Plan ahead to ensure the process goes smoothly. Wondering which documents you should bring to your tax preparer? Read on to learn which materials you should give your accountant. While some documents arrive at the beginning of the year, you’ll need to track down and tabulate other information — which is why waiting until the last minute is a subpar strategy. Read more >>Not-So-Breaking News

-

Non-farm payrolls rose by 199,000 in December, failing to meet expectations of 223,000. Still, the unemployment rate dropped by 1.2% and wages rose 4.7% year-over-year, driven largely by gains in the hospitality and leisure sectors.

-

BMW (BMWYY) is unveiling a new all-electric concept vehicle that changes colors. The German automaker showed off the iX Flow at the CES tech conference last week, including its "E Ink" color-changing body wrap feature.

-

Bitcoin took a beating last week, falling to its lowest level since late September 2021 as hawkish comments from the Fed triggered a stock market selloff that also weighed on cryptocurrencies. The issue was compounded by an internet outage in Kazakhstan, which is the world's second-largest Bitcoin mining hub.

-

Papa John's (PZZA) is partnering with a Hong Kong private equity firm to open over 1,350 franchised store locations in southern China by 2040. The Louisville-based pizza chain describes China as among the world’s fastest-growing delivery markets.

-

DraftKings (DKNG) Mobile Sports Book is live in New York City as of this past weekend, over three years after doing so in neighboring New Jersey. New York lawmakers permitted sports betting this past April, and analysts predict a domino effect with surrounding states following suit.

Financial Planner Tip of the Day

“According to the CFPB, a characteristic that all financially well people share is that they are committed to learning about how to manage their money. They understand that both the work and th education is a continuous process.”

Brian Walsh, CFP® at SoFi