Monday,

November 15, 2021

Market recap

Dow Jones

36,100.31

+179.08 (+0.50%)

S&P 500

4,682.85

+33.58 (+0.72%)

Nasdaq

15,860.96

+156.68 (+1.00%)

Amid evolving news surrounding COVID-19 and the economic reopening, your financial needs are our top priority. For more information,click here.

Top Story

The Week Ahead on Wall Street

Economic News

Today, the Empire State Manufacturing Index for November is released. This data point is released monthly by the New York Federal Reserve and provides insight into manufacturing activity in the influential New York State region. In October the index declined to 19.8, which was below market forecasts. Investors will want to see if the metric fell more in November.

Tomorrow, retail sales for October are released. In September, retail sales posted an unexpected 0.7% gain despite supply-chain problems and rising prices. With prices for everything from gas to groceries rising, investors will be eager to see if consumer spending will be impacted.

Wednesday, housing starts for October are released. This tracks the number of new residential construction projects that begin in a given period. In September housing starts fell 1.6%, below expectations as builders dealt with supply and labor shortages. With inflation still rising and supply-chain problems persisting, investors will be paying close attention to this data point.

Thursday, initial and existing unemployment claims for the week prior are released. The number of new people seeking unemployment benefits hit a new pandemic low last week. Claims dropped to 269,000 versus the 275,000 economists expected.

On Friday, there is no economic data scheduled to be released.

Earnings Reports

Tomorrow, Walmart (WMT) reports quarterly earnings. With supply-chain chaos delaying shipments and retailers including Walmart having a tough time staffing stores, investors will be paying close attention to what the company has to say about operations. To get ahead of what is expected to be a busy holiday season, Walmart has already announced its Black Friday holiday shopping deals.

On Wednesday, be on the lookout for Target (TGT) to report quarterly earnings. The retailer is among the companies President Biden asked to help speed up shipments to ensure consumers have access to the goods they want to purchase. Biden has also asked retailers to lower their prices. Investors will want to hear more about this when Target reports quarterly earnings.

Also Wednesday, graphic chipmaker Nvidia (NVDA) shares its quarterly results. Nvidia’s graphic cards business is performing well. It is also churning out products for the autonomous driving market. Nvidia just announced a partnership with Luminar Technologies (LAZR) through which Nvidia will work on hardware for self-driving vehicles. Investors will want to hear more about this collaboration when Nvidia reports.

On Thursday, be on the lookout for Macy’s (M) to report quarterly earnings. The department store operator is competing with other retailers for workers amid severe shortages. To get an edge it’s raising its minimum hourly wage for new and existing workers to $15 per hour. The change goes into effect in May. Macy’s will also cover the total cost of college tuition for its workers. Investors will want to hear about the impact this could have on the retailer’s bottom line.

On Friday, Foot Locker (FL) reports quarterly earnings. Last month the retailer announced the launch of a new apparel line dubbed LCKR by Foot Locker. The line of casualwear includes hoodies, sweatpants, zip-ups, and pants sets. As Foot Locker expands into more categories it will be interesting to hear what the company says about its outlook.

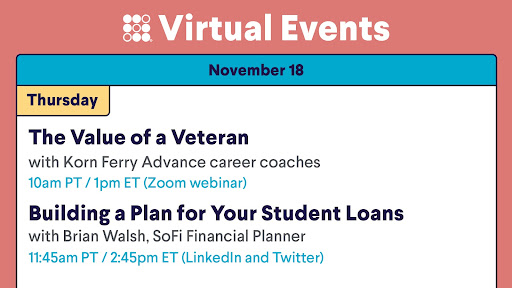

The Week Ahead at SoFi

Join us for a webinar to explore what veterans can bring to the workplace. Then Brian Walsh will discuss how to make a plan for paying back your student loans. RSVP in the SoFi app!

Johnson & Johnson Plans to Spin Off Its Consumer Unit

J&J Bets that Smaller Is Better

Johnson & Johnson (JNJ) is spinning off its consumer healthcare unit which churns out Band-Aids and aspirin as it doubles down on prescription drugs and medical devices. The consumer division, which makes $15 billion per year, will be spun off into its own public company in the next 18 to 24 months. The world’s largest healthcare products company said the move will position it for long-term growth.

The spinoff comes in the same week that General Electric (GE) said it would split into three publicly traded companies. Like J&J, GE said the standalone companies would be in a better position to grow.

Following in the Footsteps of Pfizer and Merck

Plans for the spinoff are in the early stages. J&J is still working out what the consumer company will be called, who will lead it, and other details. J&J does plan to structure the transaction in a way that is tax-free.

Spinning off the consumer unit is a big strategy shift for J&J but it is not shocking. In recent years, Pfizer (PFE) and Merck (MRK) also shed their consumer units to focus on their drug businesses. J&J’s consumer unit has helped cushion the blow from setbacks in its drug unit, but sales have been slowing. The unit’s margins are also lower than other J&J businesses.

J&J Narrows Its Focus

By shedding the consumer unit, J&J said it can focus more on drugs. It wants to hire more experts who will be able to navigate the regulatory environment and work with doctors, hospitals, and health insurance companies. J&J will also have more time and resources to spend on drug development, which can take years and requires significant investment. J&J’s drug business already makes treatments for several diseases including prostate cancer. Additionally, it is one of only three drug companies to have a COVID-19 vaccine approved in the US.

With the drug market poised for growth, J&J is doubling down by spinning off its consumer unit. The healthcare product giant is joining other conglomerates which are betting that focusing on drugs will be beneficial.

Job Openings Hit 10.4 Million in September

Retailers Feeling the Brunt of Job Openings

Initial and existing unemployment claims are hitting new pandemic lows, but the nation’s businesses are still struggling to find workers. That is particularly true for retailers which rely on employees to pack and ship goods and serve customers.

According to the Labor Department, at the end of September there were 10.4 million job openings, the same as August. In July, job openings stood at a record 10.9 million. At the same time, the number of people quitting their jobs hit 4.4 million in September. Prior to the pandemic, peak job openings were about 7.5 million.

Tight Labor Market Expected to Persist

The problem is not expected to improve for the remainder of the year as businesses look to hire more staff for the holidays. This year is expected to be a strong one in terms of consumer spending. As a result, retailers are gearing up to hire as many as 665,000 seasonal workers. That is up from 486,000 last year.

Target said it wants to hire 100,000 seasonal workers while Walmart and Amazon each want to add 150,000 staff members for the holidays. UPS is aiming to bring on 100,000 seasonal workers as well. To lure workers, companies are raising salaries and offering bonuses.

Consumer Confidence Cracking

The increase in job openings is not only impacting the retail, shipping, hospitality, and delivery markets. Consulting firms, human resource departments, software companies, and pharmacies are all facing a dearth of workers. The rising job openings come at the same time consumer confidence is starting to drop. In November, consumer confidence reached a 10-year low as inflation hit levels not seen in more than thirty years. One in four consumers indicated they reduced their living standards due to higher prices.

Companies are struggling to fill empty positions even as consumer confidence starts to deteriorate. With inflation continuing to rise and consumers getting pinched, it will be interesting to see if those job openings begin to get filled.

Not-So-Breaking News

-

Daimler Truck is more concerned about the impact chip shortages are having on operations than COVID-19. The company said the lack of semiconductors makes it hard to forecast future sales.

-

Foxconn, which supplies chips for iPhones, warned that semiconductor shortages will spill into the second half of 2022. The lack of chips prompted Foxconn to warn that revenue for its electronics unit, which includes mobile phones, will decline 15% in the fourth quarter.

-

AstraZeneca (AZN) will start making a small profit from its COVID-19 vaccine. The drugmaker had agreed to sell the shot at cost during the pandemic. AstraZeneca is now in talks with countries about deliveries in 2022 which would help it make profits.

-

Tesla’s (TSLA) CEO Elon Musk sold more shares late last week, unloading about $700 million worth of the EV’s stock. It is the second time this week Musk sold a big block of stock. Tesla’s market cap has soared to over $1 trillion and Musk is cashing in on this growth.

-

Toshiba (TOSBF), the Japanese conglomerate, is breaking up into three different entities. The decision comes amid pressure from activist investors to break up the electronics company. Toshiba said the split will help make it more nimble.

-

Investment funds use the buying power of many investors to invest in a collection of securities. In particular, the mutual investment fund is a popular choice for investors. Here’s why.

Financial Planner Tip of the Day

“For individuals who want to invest in the markets and not think about it, then the broad exposure—and generally lower fees—offered by index funds may make sense. Investing in index funds tends to work best when you hold your money in the funds for a longer period of time, or use a dollar-cost-average strategy, where you invest consistently over time to take advantage of both high and low points”

Brian Walsh, CFP® at SoFi