Monday,

March 22, 2021

Market recap

Dow Jones

32,627.97

-234.33 (-0.71%)

S&P 500

3,913.10

-2.36 (-0.06%)

Nasdaq

13,215.24

+99.07 (+0.76%)

Amid evolving news + uncertainty surrounding COVID-19, your financial needs are our top priority. For more information on COVID-19 and your finances click here.

Top Story

The Week Ahead on Wall Street

Economic Data

Today, February existing home sales will be released. Existing home sales were 6.69 million in January. Analysts expect that the housing market may slow down as interest rates begin to climb.

Tomorrow, the Q4 current account deficit and February new home sales will be published. New home sales totaled 923,000 in January. The cost of materials used to build new homes, from lumber to copper, is climbing because of high demand and a slow recovery from supply chain issues at the onset of the pandemic.On Wednesday, March Markit Manufacturing PMI and March Markit services PMI will be published. February core capital goods orders and February durable goods orders will also be released. Durable goods orders increased for the ninth month in a row in January.

On Thursday, Q4 gross domestic product and initial jobless claims will be published. Jobless claims rose slightly to 770,000 last week but still remain close to the lowest levels seen over the course of the pandemic.

On Friday, February personal income, consumer spending, core inflation, and trade in goods will be published. March consumer sentiment will also be released. Consumer sentiment dropped between January and February, partially because of slow vaccine rollout.

The Week Ahead at SoFi

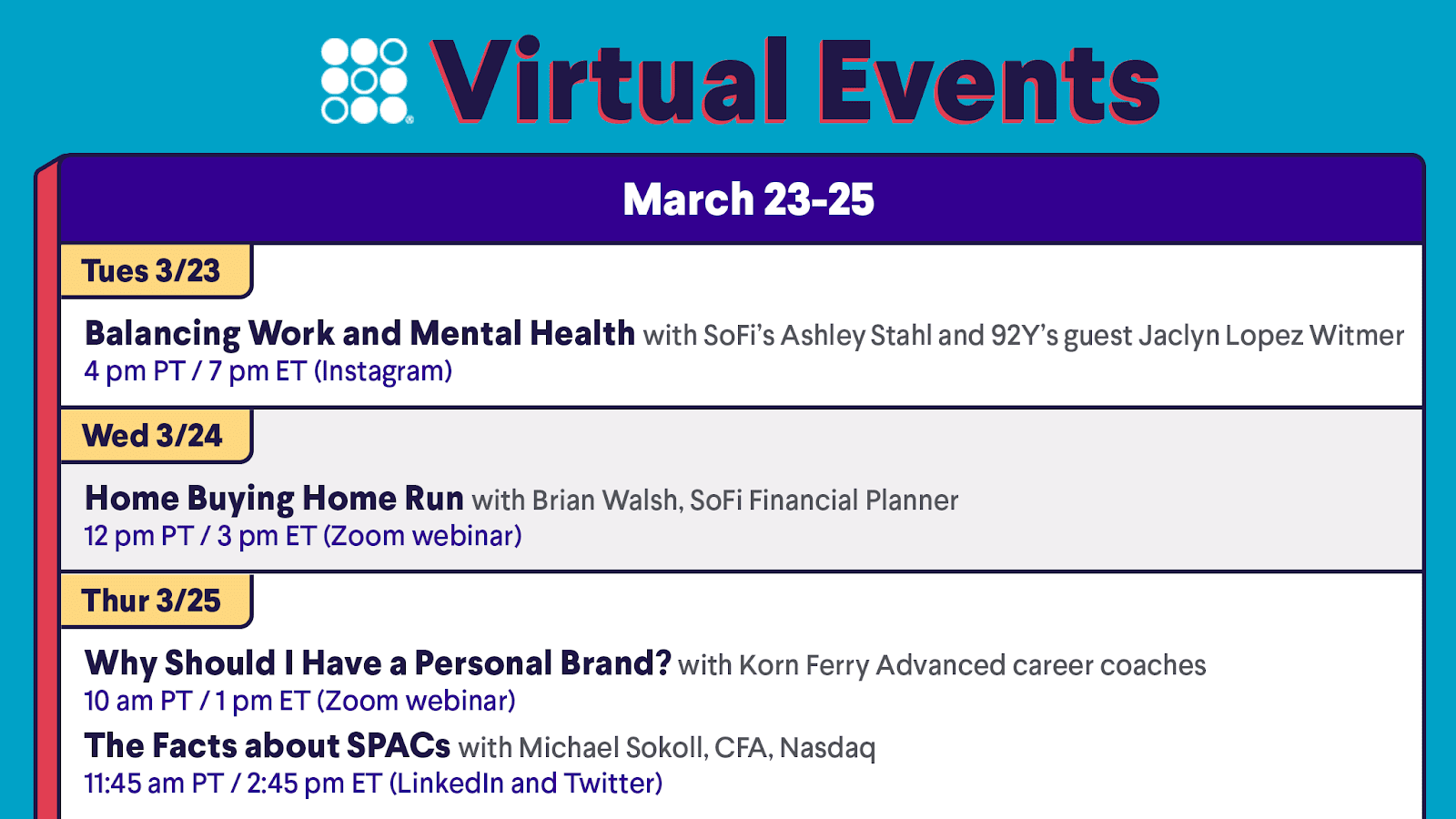

From Balancing Work and Mental Health to SPACs: What’s the 411?—and more—there’s a virtual event for everyone. Join us live on LinkedIn, Twitter, and Zoom. Register in the SoFi app!

The New York Times Invests in Mobile Gaming

Lower Subscriber Numbers Expected

Last year, the most-searched words on the New York Times (NYT) website were not related to politics or to COVID-19. They were the words “crossword” and “Spelling Bee,” which is the name of the newspaper’s online word game.2020 was a tumultuous year for the news cycle. Subscribers flocked to The New York Times to stay up-to-date about the presidential election, vaccine development, and other news. But analysts warn that this subscriber growth likely will not continue into 2021. For this reason, The New York Times is looking for ways to diversify its revenue sources and it sees the $100 billion mobile games market as a way to do this.

The Times’ New Hire

At the end of 2020, The Times had 840,000 games subscribers. This represented a 40% increase from the same period a year earlier. For context, the company has 5.1 million digital news subscribers, so games are still a small part of its business, but the company is investing more money in games than ever before.

The Times recently hired Jonathan Knight, who was part of the team which created viral games like Words With Friends and FarmVille at Zynga Inc. (ZNGA). Knight will build a team to design unique, creative games that go beyond crossword puzzles and Spelling Bee.

Navigating a Difficult Time for Journalism

The 170-year-old newspaper is nowhere near becoming exclusively a gaming company. But it wants to offer more services than just news, and it wants to provide products which compliment its news offerings. For example, it hopes users will take breaks from reading intense stories to play a quick game and then continue reading articles.

The New York Times’ share price climbed over 60% last year—its fourth straight year of gains. Though the journalism industry as a whole is struggling financially, The Times has so far been able to navigate a difficult landscape. Mobile games may help it continue to achieve success.

Delivery Apps and Grocery Stores May Not Be the Perfect Match

DoorDash, GrubHub, and Other Apps Make Deals With Grocery Stores

Over the past year, a number of food delivery apps inked deals with grocery stores, including DoorDash (DASH), GrubHub (GRUB), and Deliveroo, the UK company which is preparing to make its public debut in London in the coming weeks.

These apps began by specializing in delivering restaurant food, but during the pandemic they filled a need for small grocery deliveries. In some ways, this business model is perfect: People who make large weekly grocery orders often need extra milk or a spur-of-the moment ingredient, and delivery apps have fleets of workers who can get small orders to consumers’ doors in a matter of minutes. However, profitability remains a concern.

Thin Margins Make Profitability Difficult

The global grocery business is worth about $7.6 trillion per year, but grocery margins are notoriously thin. When a delivery app transports a meal for a restaurant, they usually take roughly a 30% commission. Often this still results in losses for delivery apps.

Grocery stores can only afford to pay a 15% to 20% fee to delivery companies. If consumers are mainly using these services for small purchases, like a carton of eggs or pint of ice cream, transactions are not profitable for delivery companies. At the same time, if delivery companies mark up their prices too much, consumers will probably opt to just walk to the corner store instead of ordering small grocery deliveries.

Post-Pandemic Outlook

Margins on small grocery deliveries also depend on what types of items customers order. Cheap items which are bulky and difficult to carry, such as toilet paper or bread, make logistics and profitability extra difficult. In contrast, small, high-value items like alcohol tend to be more profitable.

Though the pandemic has caused surging demand for online ordering and delivery, not all forms of ecommerce are equally profitable. As more of the population receives COVID-19 vaccines and people begin to feel comfortable going to in-person stores, ecommerce for small grocery orders may become an even more difficult business.

Not-So-Breaking News

- Property and casualty insurer Chubb (CB) has offered to buy Hartford Financial Service Group (HIG) for $23.24 billion in cash and stock.

- China is reportedly restricting the use of Tesla (TSLA) vehicles for its state and military employees because of security concerns. Tesla’s Chinese sales more than doubled last year, reaching $6.66 billion.

- Nike (NKE) shared mixed results last week. Congested ports in the US and continued store closures in Europe weighed on the company’s overall sales during its fiscal third quarter, though ecommerce sales surged 59%.

- AMC Entertainment (AMC) opened 98% of its movie theaters on Friday, including all 25 of its Los Angeles County theaters. Masks are required in all theaters and capacity restrictions are dependent on state regulations.

- Ford (F) has decided to partially assemble its F-150 pickup trucks and its Edge SUVs in North America without certain parts because of the global semiconductor shortage and supply chain issues related to the recent winter storms in the central US.

- Saving money can bring security, freedom, and fun. Here are easy ways to save money each month.

Financial Planner Tip of the Day

“When people don’t know how much they spend and when, it can be difficult to stick to a savings plan. If you don’t know how much money hits the bank account each month and how much you spend, how do you know what’s a realistic amount to save? Before creating savings strategies, many people find it helpful to track their spending and expenses, organized by week, month, or year.”

Brian Walsh, CFP® at SoFi