Liz Looks at: The First Rate Hike

Wheels Up

It’s official, we have liftoff. In a much anticipated move, the Federal Reserve raised its benchmark policy rate by 25 basis points to a range of 0.25-0.5%. This is the first rate hike since Dec 2018, and is a meaningful step toward tighter monetary policy as the Fed attempts to tackle the highest inflation reading we’ve seen in almost 40 years.

The Plot Thickens

Although the actual news of a 25 basis point rate hike was widely expected, as usual the devil is in the details.

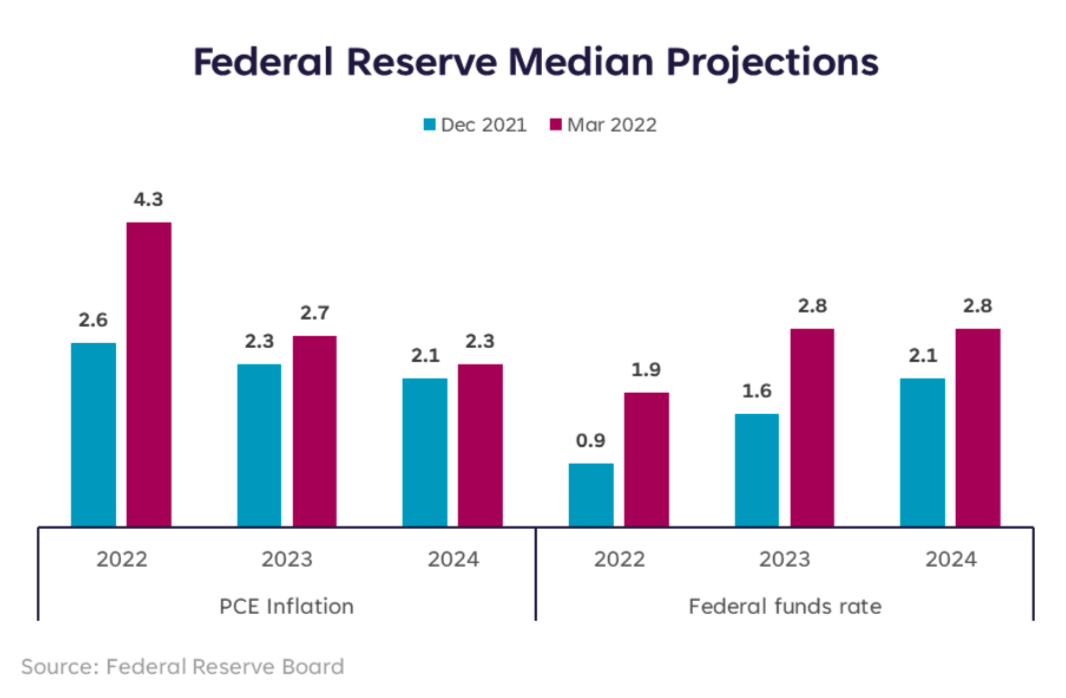

One of the notable details we heard from this meeting is that the Fed’s economic projections indicated that the Federal Open Market Committee expects the Fed Funds rate to be 2.8% in 2023 and 2024 — up from 1.6% and 2.1%, respectively. That’s a meaningful increase that shows they expect inflation to be uncomfortably high beyond the end of this year, and that we will be in need of tighter policy for longer. The end goal is to bring inflation down to a level closer to the Fed’s long-run target of 2% — this meeting confirmed that is a much bigger challenge than before.

Why does this all matter? Because raising the Fed Funds rate moves the stock and bond markets (generally, markets don’t like rate hikes) and always brings with it the risk of going too far and causing a recession.

Simply put, we are walking a tightrope.

Pick Your Poison

Let’s set aside the debate about whether the Fed was behind the curve and already made a mistake by waiting too long to tighten policy. Instead, let’s focus on the problems in front of us.

Inflation has been a problem for almost a year and became a bigger problem as a result of the war between Russia and Ukraine. That remains the Fed’s main concern. Unfortunately, what they need to do to control inflation tends to have a negative effect on economic growth and financial markets.

We can’t have it all. And there’s a chance we have to go through some more pain either via sustained higher inflation, or slower economic growth and/or continued market volatility. Although this is a difficult problem to solve no matter what, I’d prefer slower economic growth and continued market volatility in the near-term if it solves the inflation problem and sets us up for longer-term success.

Said another way, I think the Fed is right to focus on inflation even if their actions cause near-term negative effects.

Can we Stick the Landing?

If the definition of “stick the landing” means tightening monetary policy without causing a recession, yes. However, the probability of recession over the next 12-18 months has increased, both in my opinion and according to consensus expectations. That probability still remains well below 50% and is not an imminent threat — demand remains strong in the U.S. economy.

I will actually define “stick the landing” as getting inflation under control even if that includes a brief and shallow recession. It could turn out to be a reset, and although it may not be what we want to see happen, I don’t think we should view recessions as kryptonite for markets or the economy. Inflation, however, could be.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv.

SOSS22031702