Scenario 1: Making Smart Money Moves During COVID-19

This article contains breaking news and events related to the current state of politics and the economy. While we try our best to keep our articles as up-to-date as possible, the ongoing effects of COVID-19 are happening in real time and information is subject to change.

COVID-19 has changed the way many of us operate on a daily basis. It’s impacts aren’t limited to our schedules. Americans are feeling the financial impacts of the pandemic in a variety of different ways.

This is the second post in a series designed to shed light on some financial strategies and available tools to help individuals manage their finances through the changing landscape. These posts are designed to be informative and provide a high level overview of available options. If you have questions specific to your financial situation, consider consulting with a financial professional who can take a deeper look at your finances and provide comprehensive, personalized advice.

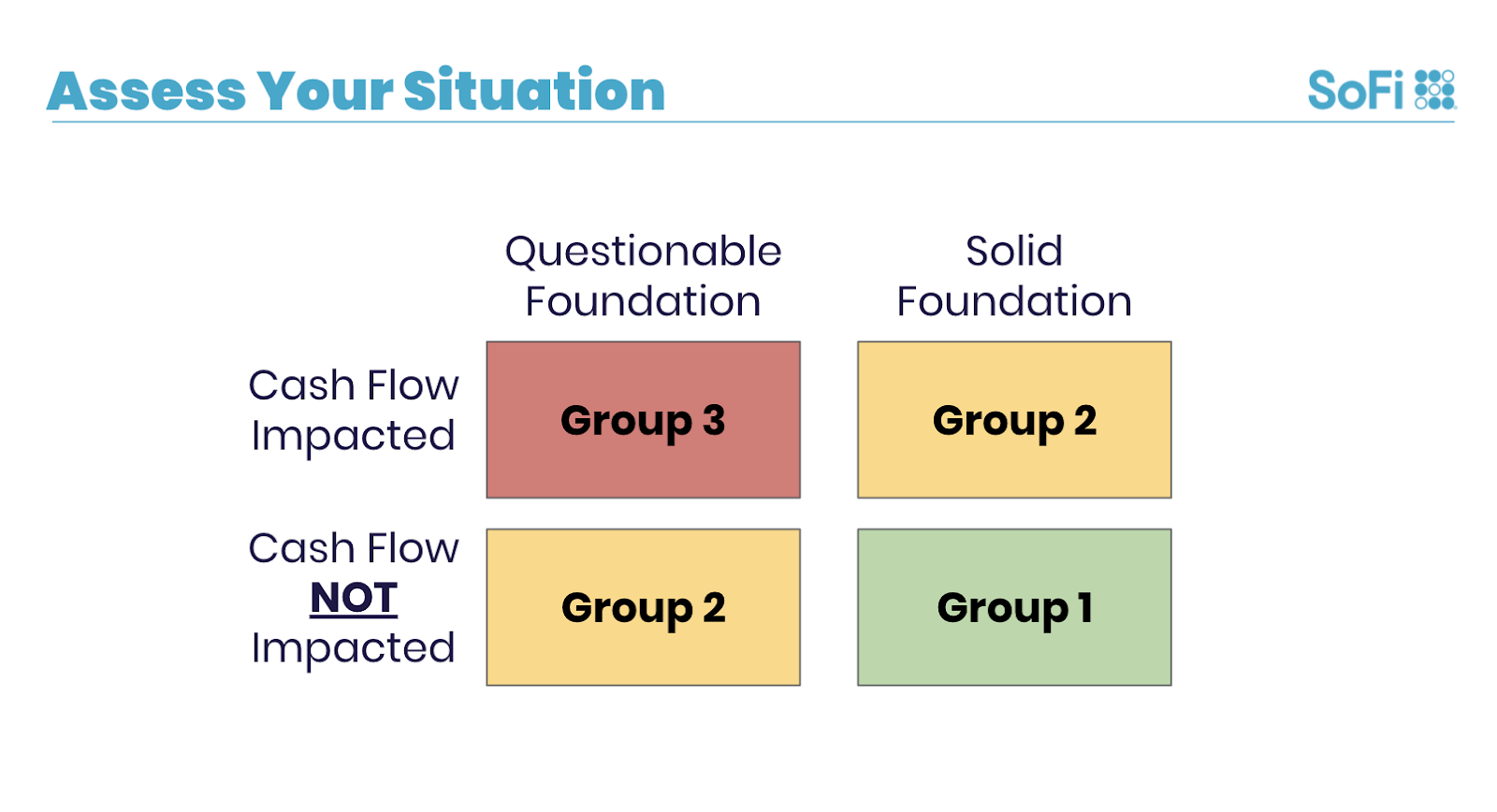

The previous post provides details to help you determine which post-COVID-19 group you fall into financially. If you missed it, you can read it here.

In other parts of this series, we cover Group 2 and Group 3. But for the rest of this article we will review those who fall into Group 1—those who were in a solid financial position before this crisis, and have not yet experienced an impact on their income.

Developing a Financial Strategy

Those people who fall into this first group are well-positioned to weather the financial storm caused by COVID-19. Since their income has not been impacted, they may be able to proactively take steps that could strengthen their financial future. As you develop a financial strategy, I suggest that people evaluate four major factors: income, expenses, debt, and investments.

Those who fall into Group 1 are fortunate enough to still be earning income. But, depending on their job or industry, there may be other factors to consider. Will the current situation impact bonuses, commissions, or any potential raises? Avoid assuming things will continue as usual. Think through some possible options and contingency plans for some of the most likely “what ifs?”

Then, take a look at your expenses. Now could be a good time to take a close look at your spending habits and trim some of the excess. What do your expenses look like? What is essential? What could be cut out of your budget? Understanding where you have room to make adjustments to your spending can be helpful should your income be reduced. While you can’t always control how much money you have coming in, you’re in a better position to control how much money is going out and where it is being spent.

Next, take a look at any debt you may have. While those in this scenario don’t have any high interest debts, do you have student loans? A mortgage?

Then, take the pulse on your investments. How much cash is readily accessible in a liquid account? What types of accounts are your investments in?

Evaluating The Available Options

Based on your assessment, evaluate which options you may have available to you. Here are a few considerations that may be most applicable to those who fall into this scenario:

Receiving a Recovery Rebate Check. Also known as stimulus checks, some Americans can expect to receive up to $1,200 as part of the recently passed CARES Act. According to the IRS , tax filers whose gross adjusted incomes, or AGIs, are less than or equal to $75,000 for individuals or $150,000 for married couples are eligible for a one-time payment in the full amount of $1,200. Married couples filing jointly will receive a single check for $2,400. This amount is also increased by up to $500 for eligible dependents.

If you will receive a check, people who fall into Group 1 have the flexibility to use it as they see fit—save, invest, or spend.

Trimming the Budget. Even though those in Scenario 1 are in a good financial spot in the present, reducing waste could help free up additional cash flow to take advantage of other opportunities.

Reviewing Student Loan Payments. Also in the CARES Act, there was language that suspended payments for federal student loans , without interest, through the end of September. Those with federal student loans could take advantage of this. Consider saving those suspended payments and applying them to the principal before interest kicks back in. Check with the loan servicer to confirm payments have been suspended.

Refinancing Debt. Those with debt like private student loans or a mortgage may want to explore how the current interest rate environment could help them reduce their interest through refinancing, leading to long-term savings.

Exploring Investment Options. Depending on your financial situation, this could present an opportunity to review some of your investments. A few options worth exploring are:

• Roth Conversions. Interested in converting a Traditional IRA to a Roth IRA? Roth conversions are taxed on a percentage of the converted value, so with the recent decline in the market, now could be the time to make the conversion. For example, if the account value has dropped 25% from one month ago, that would mean lower taxes. For more information, take a look at this conversion calculator .

• Tax Loss Harvesting. This relatively complex strategy is the practice of realizing losses to offset future gains. This means selling investments at a loss, to offset gains in other investments.

• Asset Allocation. Have cash sitting on the sidelines? Now that the markets are lower than they were even just a month ago, it could be time to explore investing. Reassess your financial goals and resources to determine how to best allocate your money.

• Maximizing Contributions. Those that haven’t hit contribution limits for 2019 still have time. The deadline for making contributions to an IRA for 2019 has been extended by three months assuming you have not filed your 2019 taxes yet.

Staying Nimble During Uncertainty

The coronavirus pandemic has illustrated how quickly things can change. The same is true for finance, especially in today’s climate. While no one can predict the future, taking steps to prepare yourself financially could be beneficial in the long run.

Financial planning in the time of COVID-19? Consider making a complimentary appointment with one of our financial advisors.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

SOCO20023