Mortgage Calculator With Interest

Mortgage Payment Calculator With Interest

Preparing to buy a house? Call us for a complimentary mortgage consultation or get prequalified online.

Mortgage Calculator With Interest

If you need to finance the purchase of a home with a mortgage, the sticker price of the home is not what you’ll end up paying. Banks charge interest on the money they lend, so when determining whether you can afford to buy a home, it’s critical to take this factor into account. A mortgage calculator with interest will help you figure out the true cost of a mortgage.

What Is a Mortgage Calculator with Interest?

A mortgage calculator with interest allows you to input the amount you’re borrowing, the term of the loan, and its interest rate. You can then see how much your monthly mortgage loan payment will be, what the total cost of the mortgage will be, and how much of the total cost is interest.

For the math curious out there, here’s a peek at the formula, with p being principal, the initial amount you are borrowing, and i being interest rate per repayment period. N is the number of payments over the life of the loan:

Monthly payment = p [ i (1+i) ^ n ] / [ (1+i) ^ n – 1 ]

While it is certainly possible to compute a mortgage payment by hand, a calculator does the work for you. It also allows you to easily tinker with the variables to see how changes to principal or interest rate, for instance, affect your monthly payment. Using a calculator will help ensure that your results are accurate, giving you a clear sense of what you might pay.

Recommended: 15-Year vs 30-Year Mortgage: Which Should You Choose?

Why Calculate Mortgage Payments with Interest?

By design, a mortgage includes interest payments. When a lender makes a loan, it takes on a certain amount of risk that the borrower may not pay the money back in full. Charging interest is one way lenders are compensated for that risk.

Charging interest is also one of the ways that banks make a profit. And it’s how they can afford to pay interest to customers who hold interest-bearing accounts, such as savings accounts.

Because lenders charge interest, when you borrow to buy a home, you’ll ultimately end up paying more than the sticker price. That’s why it’s critical to include interest in your calculation as you determine how much house you can afford and what monthly payments are possible for you to make.

Pros and Cons of Using a Mortgage Calculator With Interest

As noted above, there are a number of advantages to using a mortgage calculator with interest. The calculator does the math for you, ensuring accurate results. It allows you to easily tinker with the variables, which can help you determine how much you can afford to borrow and how large your monthly payment will be in different scenarios (a 15-year vs. a 30-year mortgage, for example). And it helps you understand the true cost of buying a home.

That said, there can be some limitations in using a mortgage calculator. For example, calculators may assume a fixed interest rate, which can lead to inaccurate results if you’re considering an adjustable-rate mortgage. Mortgage calculators may not capture all of the costs associated with a mortgage, such as private mortgage insurance (PMI), or homebuying closing costs. Not all mortgage calculators show taxes, which some buyers have rolled in to their monthly mortgage payment.

How Does a Down Payment Work?

When you take out a loan to buy a home, your lender will often require that you make a down payment equal to a percentage of the home purchase price. How much is a down payment? Some lenders require a down payment of as much as 20%, and putting that much down can often help a borrower qualify for a mortgage at a better interest rate than they would get with a lower down payment. But ultimately, the size of your down payment will depend on your lender and the type of loan you choose. The bigger your down payment, the smaller the principal amount of your mortgage loan will be.

The down payment serves a couple functions. First, it proves to the seller that a buyer is serious about purchasing the property. It also reduces the amount of money that the borrower needs to borrow, which reduces the lender’s risk.

This idea of risk reduction is key. The less risk a lender takes on, the more leeway it may have to reduce the amount of interest it charges. This, in turn, lowers the cost of the loan and increases the chances a borrower will get a good mortgage rate. As a result, it may be wise to put down as much money as you can afford upfront to save money later. A home loan help center can help you learn more about down payments and other basics of buying a home.

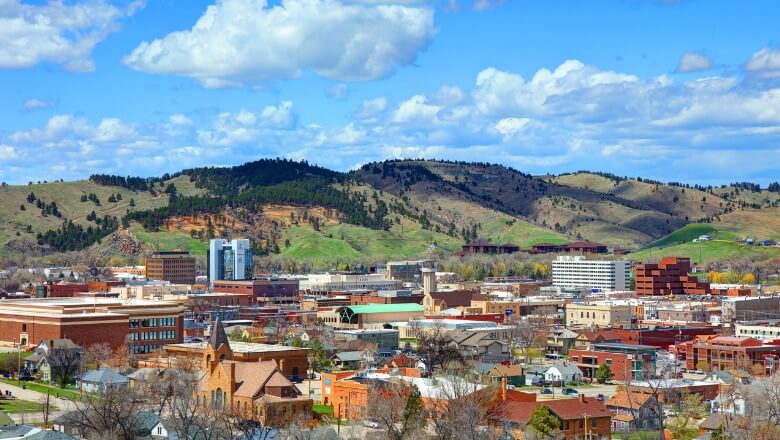

Moreover, did you know mortgage rates vary by state?

Current Mortgage Rates by State

How to Lower a Mortgage Down Payment

Putting down a large amount of money upfront may not always be possible. Borrowers have a couple courses of action to help them make lower down payments. Those making a down payment of less than 20% and who are borrowing using a conventional loan are typically required to pay for PMI until they build 20% equity in their home.

Some types of loans, such as Federal Housing Administration loans, may allow borrowers to put as little as 3.5% down, but these loans may require that borrowers pay both an upfront and a monthly mortgage insurance premium (MIP); the monthly MIP is often around .55%. Fortunately, the MIP is reduced as the loan is paid off.

Average Mortgage Down Payment in 2023

Housing prices fell in the first half of 2023 since their peak at the end of 2022, so down payments have fallen year-over year. The average median down payment in the second quarter of 2023 was $34,248, down 3.3% vs. the same time in 2022. Borrowers paid an average of 14.7% down in the third quarter of 2023, and median down payment amounts were about $30,000.

Down payments on second homes and investment properties tend to be higher at roughly 28%, about twice as much as a down payment on a primary residence. Wondering how much home you can afford based on your income, down and other variables? A home affordability calculator will do the math for you.

Recommended: Jumbo Mortgage Loans

Tips on Mortgage Down Payments

As you’re saving for a down payment on a home, consider the following tips.

First, remember that the larger your down payment, the lower your loan principal will be, which reduces the amount you pay in interest over the life of the loan. As a result, consider making as large a down payment as possible, while still reserving funds for closing costs and moving expenses.

Look into first-time homebuyer programs and loans. These may include different types of mortgages that require smaller down payments.

Consider setting aside a dedicated savings account for your down payment so you won’t be tempted to dip into your savings for other purposes. You may even consider automated deposits into the account to help keep you on track to meet your goals.

The Takeaway

As you shop for a new home, a mortgage calculator with interest is an important tool to help you understand what you can afford, both in terms of housing options and monthly mortgage payments. The size of your down payment also plays a critical role. The more you put down, the more you reduce the size of your principal, which in turn reduces the amount you pay in interest over time.

Armed with information about principal size and interest — and with a little help from a mortgage calculator — you can better determine what the true cost of financing a home will be.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.FAQ

How do I calculate how much interest I will pay on my mortgage?

A mortgage calculator with interest will show you how much the total cost of a mortgage will be, and how much of that cost comes from interest. It will also allow you to play with variables to see how changing, say, the term of the loan will impact payments and interest costs.

How much interest do you pay on a $500,000 house over 30 years?

The amount of interest you’ll pay will depend on your interest rate. For example, if you put down a 20% down payment and borrowed $400,000 with a 30-year mortgage at a fixed interest rate of 4.03% will cost you $689,971. In the end, you’ll have paid $289,971 in interest.

How much home can I afford with a $100,000 salary?

There’s a common rule of thumb that you shouldn’t pay more than 28% of your gross income (income before taxes) on housing. Using this rule, with a $100,000 salary, you’d have $28,000 a year to spend on a mortgage. With a 30-year loan at a 4.03% fixed interest rate, you could potentially afford a $500,000 house, provided you also had around $50,000 saved for a down payment. Use a home affordability calculator can help you determine how much house you can afford based on your specific circumstances.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOHL1023246More articles and resources

Get prequalified in minutes for a SoFi Home Loan.