Bond valuation is a way of determining the fair value of a bond. Bond valuation involves calculating the present value of the bond’s future coupon payments, its cash flow, and the bond’s value at maturity (or par value), to determine its current fair value or price. The price of a bond is what investors are willing to pay for it on the secondary market.

When an investor buys a bond from the issuing company or institution, they typically buy it at its face value. But when an investor purchases a bond on the open market, they need to know its current value. Because a bond’s face value and interest payments are fixed, the valuation process helps investors decide what rate of return would make that bond worth the cost.

Key Points

• Bond valuation is the process of determining a bond’s fair value by calculating the present value of future coupon payments and its value at maturity.

• Investors must consider the bond’s current price, which may differ from its face value, as it reflects market conditions and the issuing company’s creditworthiness.

• The valuation involves discounting the bond’s future cash flows using a realistic discount rate, which is essential due to the time value of money.

• Changes in interest rates significantly affect bond pricing; rising rates usually decrease bond prices, while falling rates can increase them.

• Investing in bonds can diversify a portfolio, as they tend to be less risky than stocks and provide a predictable income stream through fixed payments.

How Bond Valuation Works

First, it’s important to remember that bonds are generally long-term investments, where the par value or face value is fixed and so are the coupon payments (the bond’s rate of return over time) — but interest rates are not, and that impacts the present or fair value of a bond at any given moment.

To determine the present or fair value of a bond, the investor must calculate the current value of the bond’s future payments using a discount rate, as well as the bond’s value at maturity to make sure the bond you’re buying is worth it.

Some terms to know when calculating bond valuation:

• Coupon rate/Cash flow: The coupon rate refers to the interest payments the investor receives; usually it’s a fixed percentage of the bond’s face value and typically investors get annual or semi-annual payments. For example, a $1,000 bond with a 10-year term and a 3% annual coupon would pay the investor $30 per year for 10 years ($1,000 x 0.03 = $30 per year).

• Maturity: This is when the bond’s principal is scheduled to be repaid to the bondholder (i.e. in one year, five years, 10 years, and so on). When a bond reaches maturity, the corporation or government that issued the bond must repay the full amount of the face value (in this example, $1,000).

• Current price: The current price is different from the bond’s face value or par value, which is fixed: i.e. a $1,000 bond is a $1,000 bond. The current price is what people mean when they talk about bond valuation: What is the bond currently worth, today?

The face value is not necessarily the amount you pay to purchase the bond, since you might buy a bond at a price above or below par value. A bond that trades at a price below its face value is called a discount bond. A bond price above par value is called a premium bond.

💡 Quick Tip: Are self-directed brokerage accounts cost efficient? They can be, because they offer the convenience of being able to buy stocks online without using a traditional full-service broker (and the typical broker fees).

Get up to $1,000 in stock when you fund a new Active Invest account.*

Access stock trading, options, alternative investments, IRAs, and more. Get started in just a few minutes.

How to Calculate Bond Valuation

Bond valuation can seem like a daunting task to new investors, but it is not that onerous once you break it down into steps. This process helps investors know how to calculate bond valuation.

Bond Valuation Formula

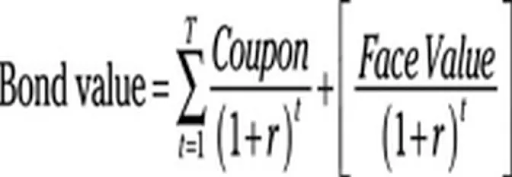

The bond valuation formula uses a discounting process for all future cash flows to determine the present fair value of the bond, sometimes called the theoretical fair value of the bond (since it’s calculated using certain assumptions).

The following steps explain each part of the formula and how to calculate a bond’s price.

Step 1: Determine the cash flow and remaining payments.

A bond’s cash flow is determined by calculating the coupon rate multiplied by the face value. A $1,000 corporate bond with a 3.0% coupon has an annual cash flow of $30. If it’s a 10-year bond that has five years left until maturity, there would be five coupon payments remaining.

Payment 1 = $30; Payment 2 = $30; and so on.

The final payment would include the face value: $1,000 + $30 = $1,030.

This is important because the closer the bond is to maturity, the higher its value may be.

Step 2: Determine a realistic discount rate.

The coupon payments are based on future values and thus the bond’s cash flow must be discounted back to the present (thanks to the time value of money theory, a future dollar is worth less than a dollar in the present).

To determine a discount rate, you can check the current rates for 10-year corporate bonds. For this example, let’s go with 2.5% (or 0.025, when expressed as a decimal).

Step 3: Calculate the present value of the remaining payments.

Calculate the present value of future cash flows including the principal repayment at maturity. In other words, divide the yearly coupon payment by (1 + r)t, where r equals the discount rate and t is the remaining payment number.

$30 / (1 + .025)1 = $29.26

$30 / (1 + .025)2 = 28.55

$30 / (1 + .025)3 = 27.85

$30 / (1 + .025)4 = 27.17

$1030 / (1 + .025)5 = 1,004.87

Step 4: Sum all future cash flows.

Sum all future cash flows to arrive at the present market value of the bond : $1,117.70

Understanding Bond Pricing

In this example, the price of the bond is $1,117.70, or $117.70 above par. A bond’s face or par value will often differ from its market value — and in this case its current fair value (market value) is higher. There are a number of factors that come into play, including the company’s credit rating, the time to maturity (the closer the bond is to maturity the closer the price comes to its face value), and of course changes to interest rates.

Remember that a bond’s price tends to move in the opposite direction of interest rates. If prevailing interest rates are higher than when the bond was issued, its price will generally fall. That’s because, as interest rates rise, new bonds are likely to be issued with higher coupon rates, making the new bonds more attractive. So bonds with lower coupon payments would be less attractive, and likely sell for a lower price. So, higher rates generally mean lower prices for existing bonds.

The same logic applies when interest rates are lower; the price of existing bonds tends to increase, because their higher coupons are now more attractive and investors may be willing to pay a premium for bonds with those higher interest payments.

Is Investing in Bonds Right for You?

Investing in bonds can help diversify a stock portfolio since stocks and bonds trade differently. In general, bonds are seen as less risky than equities since they often provide a predictable stream of income. Investors can consider bonds as an investment, and those with a lower risk tolerance might be better served with a portfolio weighted highly in bonds.

Performing proper bond valuation can be part of a solid research and due diligence process when attempting to find securities for your portfolio. Moreover, different bonds have different risk and return profiles. Some bonds — such as junk bonds and fixed-income securities offered in emerging markets — feature higher potential rates of return with greater risk. “Junk” is a term used to describe high-yield bonds. You can take on higher risk with long-duration bonds and convertible bonds. Some of the safest bonds are short-term Treasury securities.

You can also purchase bond exchange-traded funds (ETFs) and bond mutual funds that own a diversified basket of fixed-income securities.

The Takeaway

Bond valuation is the process of determining the fair value of a bond after it’s been issued. In order to price a bond, you must calculate the present value of a bond’s future interest payments using a reasonable discount rate. By adding the discounted coupon payments, and the bond’s face value, you can arrive at the theoretical fair value of the bond.

A bond can be priced at a discount to its par value or at a premium depending on market conditions and how traders view the issuing company’s prospects. Owning bonds can help diversify your portfolio. Many investors also find bonds appealing because of their steady payments (one reason that bonds are considered fixed-income assets).

Invest in what matters most to you with SoFi Active Invest. In a self-directed account provided by SoFi Securities, you can trade stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, options, and more — all while paying $0 commission on every trade. Other fees may apply. Whether you want to trade after-hours or manage your portfolio using real-time stock insights and analyst ratings, you can invest your way in SoFi's easy-to-use mobile app.

Opening and funding an Active Invest account gives you the opportunity to get up to $1,000 in the stock of your choice.¹

Photo credit: iStock/Tempura

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Exchange Traded Funds (ETFs): Investors should carefully consider the information contained in the prospectus, which contains the Fund’s investment objectives, risks, charges, expenses, and other relevant information. You may obtain a prospectus from the Fund company’s website or by emailing customer service at [email protected]. Please read the prospectus carefully prior to investing.

Fund Fees

If you invest in Exchange Traded Funds (ETFs) through SoFi Invest (either by buying them yourself or via investing in SoFi Invest’s automated investments, formerly SoFi Wealth), these funds will have their own management fees. These fees are not paid directly by you, but rather by the fund itself. these fees do reduce the fund’s returns. Check out each fund’s prospectus for details. SoFi Invest does not receive sales commissions, 12b-1 fees, or other fees from ETFs for investing such funds on behalf of advisory clients, though if SoFi Invest creates its own funds, it could earn management fees there.

SoFi Invest may waive all, or part of any of these fees, permanently or for a period of time, at its sole discretion for any reason. Fees are subject to change at any time. The current fee schedule will always be available in your Account Documents section of SoFi Invest.

Investment Risk: Diversification can help reduce some investment risk. It cannot guarantee profit, or fully protect in a down market.

¹Probability of Member receiving $1,000 is a probability of 0.026%; If you don’t make a selection in 45 days, you’ll no longer qualify for the promo. Customer must fund their account with a minimum of $50.00 to qualify. Probability percentage is subject to decrease. See full terms and conditions.

SOIN-Q224-1862302-V1