If you’re thinking about buying a home in the not-too-distant future, you may be wondering what kind of property to purchase. Would a single-family house be better, or perhaps a condo unit?

Some important factors: Do you prefer being in a city, perhaps in an apartment or townhome, or are you all about a house with a picket fence? Do you like handling your own gardening and picking your own front-door paint colors, or would you like to delegate that? Do you like neighbors close by or prefer privacy? Does your household include furbabies?

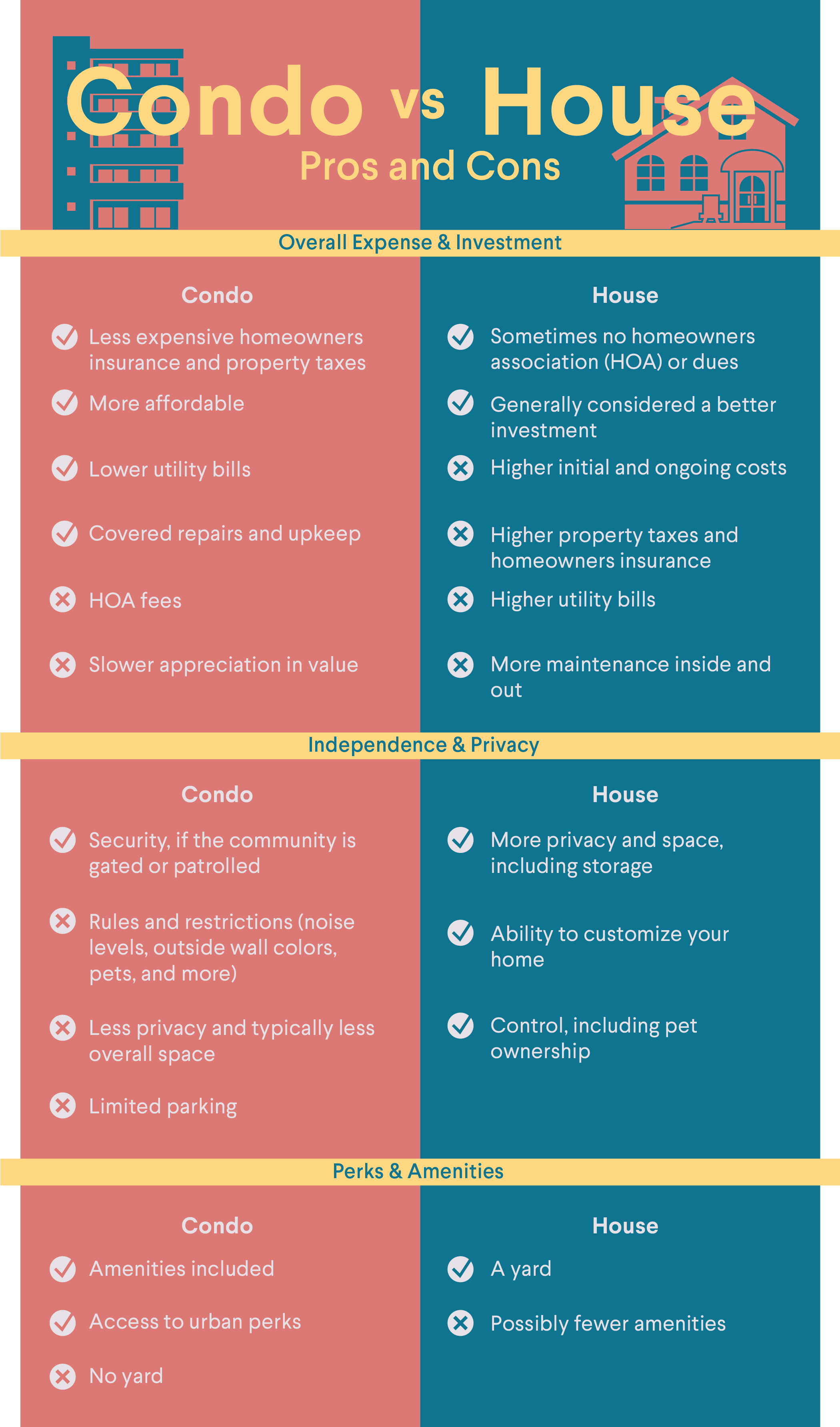

These are some of the considerations that may impact whether a house or a condo is right for you. Each option has its pros and cons, and of course, finances will play a role too.

Key Points

• Houses typically cost more but are considered better long-term investments.

• Condos reduce maintenance and utility costs, but fees apply.

• Houses offer more privacy and living space.

• Condos often include shared amenities, and many offer urban perks.

• Condo values appreciate more slowly than those of houses.

To decide which might suit you best, take this house vs. condo quiz, and then learn more about some key factors.

House or Condo Quiz

Next, you might want to take these pros and cons into consideration as well.

Pros and Cons of Buying a House

A top-of-mind question for many people is, “Isn’t a house more expensive than a condo?” Cost is a factor, especially when buying in a hot market, and there can typically be a significant difference between a house and a condo when you are home shopping.

The median sales price of existing single-family homes was $404,400 in the fourth quarter of 2024, according to St. Louis Fed data, compared with a median existing condo price of $359,000 in December 2024, according to the National Association of Realtors®.

Now that you know that price info, look at these pros and cons when buying a house vs. a condo.

Pros of Buying a House

Among the benefits of buying a house are the following:

• More privacy and space, including storage

• A yard

• Ability to customize your home as you see fit

• Room to garden and create an outdoor space, just as you want it to be

• Control of your property

• Pet ownership unlikely to be an issue

• Sometimes no homeowners association (HOA) or dues

• Generally considered a better investment

Cons of Buying a House

However, you may have to contend with these downsides:

• Potentially higher initial and ongoing costs

• More maintenance inside and out

• Typically higher utility bills

• Potentially higher property taxes and homeowners insurance

• Possibly fewer amenities (such as common areas, a gym, etc.)

If, after taking the quiz and weighing the pros and cons, buying a house feels like the right choice, you can start brainstorming about size, style, location, and price; attending open houses; and looking online.

Learning how to win a bidding war might also come in handy, depending on the temperature of the market.

First-time homebuyers can

prequalify for a SoFi mortgage loan,

with as little as 3% down.

Questions? Call (888)-541-0398.

Pros and Cons of Buying a Condo

A quick look at how condos work before diving in: Condominium owners share an interest in common areas, like the grounds and parking structures, and hold title to their individual units. They are members of an HOA that enforces community rules. Being a member of a community in this way is a key difference between a condo and a house.

Pros of Buying a Condo

Here are some of the upsides of purchasing a condo:

• More affordable

• Amenities included (this might include common rooms, a fitness center, and other features)

• Potentially less expensive homeowners insurance and property taxes

• Repairs and upkeep of the property typically taken care of

• Typically lower utility bills

• Security, if the community is gated or patrolled

• Access to urban perks

Cons of Buying a Condo

Next, consider the drawbacks of condo living:

• Less privacy

• Typically no private yard

• Rules and restrictions (about noise levels, outside wall colors, pets, and more)

• Typically less overall space

• HOA fees

• Limited parking

• Slower appreciation in value

Plus, the mortgage interest rate and down payment are often higher on a condo vs. a house of the same value, though that isn’t always the case, especially for a first-time buyer of an owner-occupied condo.

Conventional home loan mortgage lenders sometimes charge more for loans on condo units; they take into consideration the strength of the condo association financials and vacancy rate when weighing risk.

Mortgages backed by the Federal Housing Administration (FHA) are available for condos, even if they are not part of an FHA-approved condominium project, with a process called the Single Unit Approval Program.

An FHA loan is easier to qualify for and requires as little as 3.5% down, but you’ll pay upfront and ongoing mortgage insurance premiums.

What Are the Costs of a House or Condo?

As mentioned above, houses tend to cost more than condos. But here are a few other ways to look at the financials when comparing a condo vs. a house:

• Condos tend to have lower list prices than houses which may mean a smaller mortgage. However, you also need to factor in monthly maintenance fees and HOAs so you get the full picture.

• Condos may have assessments from time to time. These are additional charges to fund projects for the unexpected expenses, such as a capital improvement to the entire dwelling.

• Homeowner fees are growing along with inflation, so when you make your purchase, understand that these charges are not static.

• Before buying into an HOA community, it’s imperative to vet the board’s finances, including its reserve fund, how often it has raised rates in recent years, whether it has collected any special assessments or plans, and whether it’s facing any lawsuits.

• If you are buying a house, keep in mind that maintenance and upkeep are your responsibility. This can mean everything from replacing a hot-water heater that’s reaching the end of its lifespan to dealing with roof repairs.

• Down payments will vary due to several factors. For a condo, a down payment is typically around 10% but can vary considerably from, say, 3% to 20%.

• With a house, a down payment could be from 3.5% with an FHA loan to the conventional 20% needed to avoid private mortgage insurance, or PMI. Those who qualify for VA loans may be able to buy a house without a down payment.

• If you are buying a house, make sure to scrutinize property taxes and factor those into your budget. Those are not fixed and can rise over time.

Another smart move: Check out this home affordability calculator to get a better feel for the bottom line.

When Is a Good Time to Buy?

You may know what you’d like to buy (condo vs. a house) and where (in what neighborhood), but do you feel as though now is the right time? If so, fantastic.

You might decide, though, that you want to rent for a while longer under certain circumstances, which can include:

• Hoping to wait out an overheated market and looking at price-to-rent ratios

• Wanting to save more money for the down payment and closing costs (the bigger your down payment, the lower your monthlies will likely be)

• Needing to boost your credit score first

• Wanting to pay down credit card debt or other debt, which improves your debt-to-income ratio or DTI

• Needing more time to look at houses and condos before deciding which path to take

Get matched with a local

real estate agent and earn up to

$9,500‡ cash back when you close.

Pair up with a local real estate agent through HomeStory and unlock up to

$9,500 cash back at closing.‡ Average cash back received is $1,700.

The Takeaway

The condo vs. house decision depends on a multitude of factors. Reviewing the pros and cons of buying a condo vs. a house can at least give you a direction to start your search. And so can such givens as knowing that you want to be in a certain location (downtown in a condo instead of in a house on a couple of acres), or that you have lots of dogs and therefore want your own yard, and so forth.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Qualifying for the reward requires using a real estate agent that participates in HomeStory’s broker to broker agreement to complete the real estate buy and/or sell transaction. You retain the right to negotiate buyer and or seller representation agreements. Upon successful close of the transaction, the Real Estate Agent pays a fee to HomeStory Real Estate Services. All Agents have been independently vetted by HomeStory to meet performance expectations required to participate in the program. If you are currently working with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®. A reward is not available where prohibited by state law, including Alaska, Iowa, Louisiana and Missouri. A reduced agent commission may be available for sellers in lieu of the reward in Mississippi, New Jersey, Oklahoma, and Oregon and should be discussed with the agent upon enrollment. No reward will be available for buyers in Mississippi, Oklahoma, and Oregon. A commission credit may be available for buyers in lieu of the reward in New Jersey and must be discussed with the agent upon enrollment and included in a Buyer Agency Agreement with Rebate Provision. Rewards in Kansas and Tennessee are required to be delivered by gift card.

HomeStory will issue the reward using the payment option you select and will be sent to the client enrolled in the program within 45 days of HomeStory Real Estate Services receipt of settlement statements and any other documentation reasonably required to calculate the applicable reward amount. Real estate agent fees and commissions still apply. Short sale transactions do not qualify for the reward. Depending on state regulations highlighted above, reward amount is based on sale price of the home purchased and/or sold and cannot exceed $9,500 per buy or sell transaction. Employer-sponsored relocations may preclude participation in the reward program offering. SoFi is not responsible for the reward.

SoFi Bank, N.A. (NMLS #696891) does not perform any activity that is or could be construed as unlicensed real estate activity, and SoFi is not licensed as a real estate broker. Agents of SoFi are not authorized to perform real estate activity.

If your property is currently listed with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®.

Reward is valid for 18 months from date of enrollment. After 18 months, you must re-enroll to be eligible for a reward.

SoFi loans subject to credit approval. Offer subject to change or cancellation without notice.

The trademarks, logos and names of other companies, products and services are the property of their respective owners.

SOHL-Q125-045