Table of Contents

Class A, Class B, and Class C shares are different categories of company shares that have different voting rights and different levels of access to distributions and dividends. Companies may use these tiers so that certain key shareholders, such as founders or executives, have more voting power than ordinary shareholders. These shareholders also may have priority on the company’s profits and assets, and may have different access to dividends.

Not all companies have alternate stock classes. And what can make share categories even more complicated is that while the classifications are common, each company can define their stock classes, meaning that they can vary from company to company. That makes it even more important for investors to know exactly what they’re getting when they purchase a certain type of stock.

Key Points

• Class A, Class B, and Class C shares are different categories of company stock with varying voting rights and access to dividends.

• Companies may use different share classes to give certain shareholders more voting power and priority on profits.

• Share classes can vary from company to company, making it important for investors to understand the specific terms and differences.

• Class A shares generally have more voting power and higher priority for dividends, while Class B shares are common shares with no preferential treatment.

• Class C shares can refer to shares given to employees or alternate share classes available to public investors, with varying restrictions and voting rights.

Why Companies Have Different Types of Stock Shares

When a company goes public, it sells portions of itself, known as stocks or shares, to shareholders.

Shareholders own a portion of the company’s assets and profits and have a say in how the company is governed. To help mitigate risk and retain majority control of the company, a company can restrict the amount of stock they sell and retain majority ownership in the company. Or, it can create different shareholder classes with different rights.

By creating multiple shareholder classes when they go public, a company can ensure that executives maintain control of the company and have more influence over business decisions. For example, while ordinary shareholders, or Class B shareholders, may have one vote per share owned, individuals with executive shares, or Class A shares, may have 100 votes per share owned. Executives also may get first priority of profits, which can be important in the case of an acquisition or closure, where there is only a finite amount of profit.

Different stock classes can also reward early investors. For example, some companies may designate Class A investors as those who invested with the company prior to a certain time period, such as a merger. These investors may have more votes per share and rights to dividends than Class B investors. A company’s charter, perspective, and bylaws should outline the differences between the classes.

Class differentiation has become more critical in creating a portfolio in recent years because investors have access to different classes in a way they may not have had access in the past. For example, mutual funds frequently divide their shares into A, B, and C class shares based on the type of investor they want to attract.

The Different Types of Shares

Just like there are different types of stock, there are different types of shareholders. Because different stock classes have such different terms, depending on the company, investors may use additional terminology to describe the stock they hold. This can include:

Preferred Shares

Investors who buy preferred shares may not have voting rights, but may have access to a regular dividend that may not be available to shareholders of common stock.

Common Shares

Sometimes called “ordinary shares,” common shares are stocks bought and measured on the market. Owners have voting rights. They may have dividends and access to profits, though they may come after other investors, such as executive shareholders and preferred shareholders have been paid.

Nonvoting Shares

These are typically offered by private companies or as part of a compensation package to employees. Companies may use non voting shares so employees and former employees don’t have an outsize influence in company decision-making, or so that power remains consolidated with the executive board and outside shareholders. Some companies create a separate class of stock, Class C stock, that comes without voting rights and that may be less expensive than other classes.

Executive Shares

Typically, these shares are held by founders or company executives. Their stock may have outsize voting rights and may also have restrictions on the ability to sell the shares. Executive shares usually do not trade on the public markets.

Advisory Shares

Often offered to advisors or large investors of a company, these shares may have preferred rights and do not trade on public markets.

Restricted Shares

Restricted shares are called so because they come with strings attached, typically having to do with whether they can be sold or transferred. For instance, an employee of a company may earn restricted shares as a part of their compensation package, and aren’t able to sell them until after a certain period of time.

Treasury Shares

Treasury shares are shares that a company purchases back from the open market from shareholders. When you hear of stock “buybacks,” this is typically what that term is referring to. In effect, a company is reabsorbing its shares, and reducing the total outstanding stock on the market.

Recommended: Shares vs. Stocks: Differences to Know

Get up to $1,000 in stock when you fund a new Active Invest account.*

Access stock trading, options, alternative investments, IRAs, and more. Get started in just a few minutes.

What Are Class A Shares?

While the specific attributes of Class A shares depend on the company, they generally come with more voting power and a higher priority for dividends and profit in the event of liquidation. Class A shares may be more expensive than Class B shares, or may not be available to the general public.

Advantages and Disadvantages of Class A Shares

Class A shares have some advantages and disadvantages over other types of shares. But again, it all comes down to the specifics.

Many companies can have different stock tiers that trade at different prices. For instance, Company X may have Class A stock that regularly trades at hundreds of thousands of dollars while its Class B stock may trade for hundreds of dollars per share.

Class B stockholders may also only have a small percentage of the vote that a Class A stockholder has. And while Class A stockholders might be able to convert their shares into Class B shares, a Class B shareholder may not be able to convert their shares into Class A shares.

Many of the tech companies that have gone public in recent years have also used a dual-share class system.

In some cases, shareholders are not allowed to trade their Class A shares, so they have a conversion that allows the owner to convert them into Class B, which they can sell or trade. Executives may also be able to sell their shares in a secondary offering, following the IPO.

💡 Quick Tip: Distributing your money across a range of assets — also known as diversification — can be beneficial for long-term investors. When you put your eggs in many baskets, it may be beneficial if a single asset class goes down.

What Are Class B Shares?

Often companies refer to their Class B shares as “common shares” or “ordinary shares,” (But occasionally, companies flip the definition and have Class A shares designated as common shares and Class B shares as founder and executive shares).

Advantages and Disadvantages of Class B Shares

Class B shares are generally liquid, meaning that investors can buy and sell common shares on a public stock exchange, where, typically, one share equals one vote. However, Class B shares carry no preferential treatment when it comes to dividing profits or dividends.

What Are Class C Shares?

Some companies also offer Class C shares, which they may give to employees as part of their compensation package. The difference between Class C and common stock shares can be subtle.

It’s important to note that these stock classes vary depending on the company. So doing research and understanding exactly which type of shares you’re buying is key before you commit to purchasing a certain class of stock.

Advantages and Disadvantages of Class C Shares

Class C shares may have specific restrictions, such as an inability to trade the shares.

Class C shares also may also refer to alternate share classes available to public investors. Often priced lower than Class A shares and with restrictions on voting rights, these shares may be more accessible to larger groups of investors. But this is not always the case. For example, Alphabet has Class A and Class C shares. Both tend to trade at similar prices.

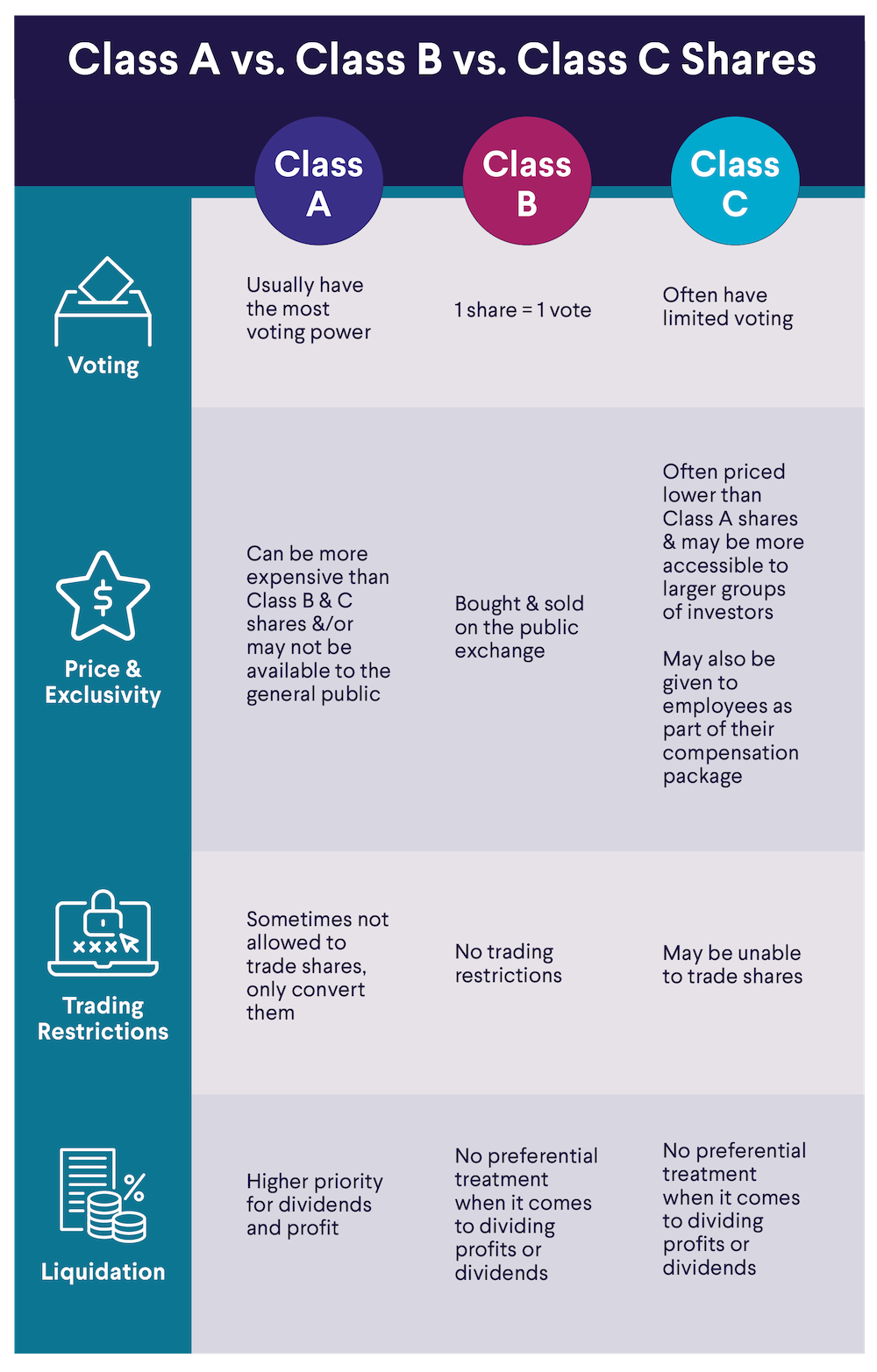

Note that the chart below represents common definitions of Class A, B, and C shares, but that companies may structure their own stock classes differently.

What Are Dual Class Shares?

Companies that offer more than one class of shares have “dual class shares.” This is a fairly common practice, and some companies offer dual class shares that automatically convert to a common share with voting privilege at a set period of time.

Why Some Companies Use Dual Class Shares

Some companies may use dual class shares if they hope to IPO, and do not want public investors to have a say in the company’s decision-making. There has been controversy about companies offering two share classes of stock to the public, with detractors concerned that multiple share classes may lead to governance issues, such as reduced accountability. But others argue that multiple share classes can be an asset for a public company, leading to improved performance.

Examples of Companies With Dual Class Shares

There are numerous companies that use dual class share systems. Here are some examples of some of most recognizable:

• Alphabet (Google)

• Berkshire Hathaway

• Meta

• Ford

• Nike

The Takeaway

Class A, Class B, and Class C shares have different voting rights and different levels of access to distributions and dividends. It can be difficult to determine which investment class is the best option for you if you’re deciding to invest in a public company that offers multiple share classes. Beyond market price, understanding how the stock will function in your overall portfolio as well as your personal investing philosophy can help guide you choose the best share class for you.

For example, investors who may be looking for shorter-term investments may choose a stock class without voting privileges. Other investors who want to be active in corporate governance may prefer share classes that come with voting rights. And some investors may be looking for stocks that provide guaranteed dividends, which may guide their decision toward one class of shares.

Invest in what matters most to you with SoFi Active Invest. In a self-directed account provided by SoFi Securities, you can trade stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, options, and more — all while paying $0 commission on every trade. Other fees may apply. Whether you want to trade after-hours or manage your portfolio using real-time stock insights and analyst ratings, you can invest your way in SoFi's easy-to-use mobile app.

Opening and funding an Active Invest account gives you the opportunity to get up to $1,000 in the stock of your choice.¹

FAQ

Are there specific types of businesses that prefer Class A, Class B, or Class C shares?

Not necessarily, as how each share class is structured is typically done for different strategic reasons. As such, some companies in certain industries may operate in similar manners, but it doesn’t mean their share structures would necessarily follow suit.

Do Class B shares always have fewer voting rights than Class A shares?

Class B shares often, or commonly have fewer voting rights than Class A shares, but it’s not always the case. Some companies structure their shares such that Class B shares actually have more voting rights than Class A shares.

Can investors convert Class B or C shares into Class A shares?

Some investors are able to convert their Class B or C shares into Class A shares, depending on the specific stock.

Why do some companies prefer dual class share structures?

Some companies might use dual class share structures in order to concentrate voting power among a select group of investors, rather than leave it to the whims of public or retail investors.

How do different share classes impact dividend payments?

Broadly speaking, different share classes often have different dividend payments, and that can depend on numerous factors.

You may also be interested in:

Photo credit: iStock/g-stockstudio

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

¹Probability of Member receiving $1,000 is a probability of 0.026%; If you don’t make a selection in 45 days, you’ll no longer qualify for the promo. Customer must fund their account with a minimum of $50.00 to qualify. Probability percentage is subject to decrease. See full terms and conditions.

Disclaimer: The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results.

Mutual Funds (MFs): Investors should carefully consider the information contained in the prospectus, which contains the Fund’s investment objectives, risks, charges, expenses, and other relevant information. You may obtain a prospectus from the Fund company’s website or clicking the prospectus link on the fund's respective page at sofi.com. You may also contact customer service at: 1.855.456.7634. Please read the prospectus carefully prior to investing.Mutual Funds must be bought and sold at NAV (Net Asset Value); unless otherwise noted in the prospectus, trades are only done once per day after the markets close. Investment returns are subject to risk, include the risk of loss. Shares may be worth more or less their original value when redeemed. The diversification of a mutual fund will not protect against loss. A mutual fund may not achieve its stated investment objective. Rebalancing and other activities within the fund may be subject to tax consequences.

Investment Risk: Diversification can help reduce some investment risk. It cannot guarantee profit, or fully protect in a down market.

Investing in an Initial Public Offering (IPO) involves substantial risk, including the risk of loss. Further, there are a variety of risk factors to consider when investing in an IPO, including but not limited to, unproven management, significant debt, and lack of operating history. For a comprehensive discussion of these risks please refer to SoFi Securities’ IPO Risk Disclosure Statement. This should not be considered a recommendation to participate in IPOs and investors should carefully read the offering prospectus to determine whether an offering is consistent with their investment objectives, risk tolerance, and financial situation. New offerings generally have high demand and there are a limited number of shares available for distribution to participants. Many customers may not be allocated shares and share allocations may be significantly smaller than the shares requested in the customer’s initial offer (Indication of Interest). For more information on the allocation process please visit IPO Allocation Procedures.

SOIN-Q225-154