How the UltraFICO Credit Score Works

UltraFICO® is a scoring model that includes banking activity not normally factored into your credit score. By incorporating information from your savings and checking accounts, you may be able to build your FICO credit score and, in turn, your chances of getting approved for credit, as well as qualifying for better rates.

The most widely used credit scoring model is the FICO® score which tells lenders how much risk you represent as a borrower. Your score is important because it can determine what financial products and services, as well as interest rates, you can qualify for. If you have a low (or no) score, however, you may be able to positively impact it using the UltraFICO® Score.

Here’s what you need to know about UltraFICO.

Key Points

• UltraFICO is a credit score that includes banking activity to potentially positively impact a person’s score.

• UltraFICO can help individuals with poor or minimal credit history, provided they manage their banking well.

• UltraFICO could help those with borderline scores build their score and qualify for credit or more favorable interest rates.

• Experian is the only provider of UltraFICO.

• Positive bank balances and behavior can help build an UltraFICO score.

How Does UltraFICO Work?

UltraFICO is a tool that allows you to voluntarily include banking activity not normally considered by the credit bureaus in your credit score calculation.

To understand how UltaFICO works, it helps to understand how your FICO credit score is calculated. While FICO keeps their exact methodology under wraps, your score, which can range from 300 to 850, is primarily based on the following criteria:

• Debt payment history (35% of your score) This looks at whether you make your debt payments on time. Late payments can negatively impact your score. So can accounts in collections or a bankruptcy.

• Credit utilization (30%) Also known as amounts owed, this is how much of your available revolving credit you’re currently using. Utilizing less of your available credit at any one given time is generally better than using more. Ideally, you want to aim to use 30% or less of your available credit.

• Length of credit history (15%) Having a longer history with creditors is better than being new to credit.

• New credit (10%) Applying for new credit cards or loans (and initiating a hard credit pull) can temporarily lower your score. For this reason, it’s a good idea to research credit card offerings and eligibility requirements before applying for one.

• Credit mix (10%) Having a mix of different types of credit (such as a credit card and an installment loan like a mortgage) can positively influence your score.

The UltraFICO scoring model expands the information included in your credit score by considering such factors as:

• Length of time you’ve had your bank accounts open (checking, savings and money market)

• Your activity in those bank accounts

• Proof that you have cash in those accounts (ideally, at least $400)

• Whether your overdraft often

• If you have direct deposit of your paycheck

How Do You Get an UltraFICO Score?

If you apply for new debt, such as a credit card or personal loan, and are denied because your score is low or you don’t have enough credit history to generate a FICO Score, you can ask the lender to pull your UltraFICO score. You might also ask a lender to pull your UltraFICO score if you are offered a credit card or loan with a high interest rate in the hopes of getting a better offer.

In some cases, a lender might invite you to participate in the UltraFICO scoring process after you submit an application for a credit card or loan. This is most likely to happen if your score is on the edge of acceptance or there simply isn’t enough information in your credit report to generate a FICO score.

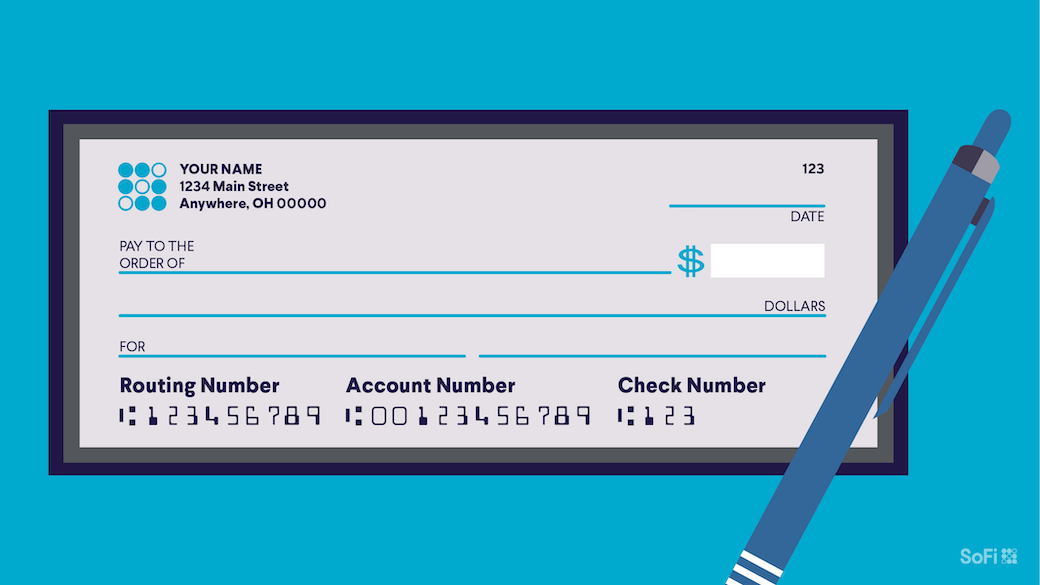

If a lender offers UltraFICO, you will be directed to a secure site to answer questions about your banking relationships. By doing this, you’re allowing the credit bureau to look at your checking, savings, and money market accounts in order to try to get the boost you need to qualify for credit.

Recommended: How to Apply for a Personal Loan

Who Will UltraFICO Benefit?

The UltraFICO score was designed to broaden access to credit for those who are just starting to build their credit profile, as well as those who are those who are trying to reestablish their credit after financial challenges. They also say that the new scoring model will be able to help borrowers who are near score cut-offs, giving them access to credit they wouldn’t otherwise qualify for.

While UltraFICO isn’t likely to dramatically change the outcome of your credit card or loan application, it might be enough to build your score into the next higher range which may make a difference if you were on the borderline of acceptance.

You’ll want to keep in mind, however, that UltraFICO is only available through some lenders. In addition, only Experian® offers UltraFICO. Your credit reports with the other two consumer credit bureaus — Equifax® and TransUnion® — won’t be affected by this service.

You can, of course, look into other ways to build your credit score, such as reducing your credit utilization ratio and always making debt payments on time.

Recommended: Typical Personal Loan Requirements

The Takeaway

Your credit score can make or break your ability to get a credit card, mortgage, or any type of personal loan. It can also determine the interest rate you’re offered, which can make a big difference in the total cost of a loan. The scoring model UltraFICO could help build your FICO score if you have consistently maintained positive bank account balances. However, it’s not offered by all lenders and creditors, so it isn’t always an option. Fortunately, there are other ways to positively impact your credit profile, such as keeping your credit utilization low, and always paying debt (such as your credit card bill or personal loan installment) on time.

Think twice before turning to high-interest credit cards. Consider a SoFi personal loan instead. SoFi offers competitive fixed rates and same-day funding. See your rate in minutes.

FAQ

What is an UltraFICO score?

An UltraFICO score is a type of credit score that incorporates data from your bank accounts (checking, savings, and money market) to possibly positively impact your standard FICO score. It may benefit individuals who don’t have much of a credit history or have scores in the lower ranges.

Is UltraFICO from Experian or TransUnion?

UltraFICO is only available through Experian, not through TransUnion or Equifax.

How rare is it to have an 800 credit score?

Perhaps surprisingly, an 800 credit score is not extremely rare, but it’s still considered exceptional. Almost one out of four Americans have credit scores in the 800-850 range, which is considered excellent.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

*Awards or rankings from NerdWallet are not indicative of future success or results. This award and its ratings are independently determined and awarded by their respective publications.

Disclaimer: Many factors affect your credit scores and the interest rates you may receive. SoFi is not a Credit Repair Organization as defined under federal or state law, including the Credit Repair Organizations Act. SoFi does not provide “credit repair” services or advice or assistance regarding “rebuilding” or “improving” your credit record, credit history, or credit rating. For details, see the FTC’s website .

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

SOPL-Q225-100

Read more