An ACH routing number is a nine-digit code that identifies a financial institution during an electronic financial transaction. It ensures that money transferred using the ACH (Automated Clearing House) network is taken from and sent to the right place. ACH transfers are usually faster than paper checks and are used for various transactions like autopay and direct deposits.

Since ACH routing numbers play a vital role in everyday banking, let’s take a closer look.

Key Points

• An ACH routing number is a nine-digit code essential for identifying financial institutions during electronic transactions, facilitating faster money transfers compared to traditional checks.

• This number is crucial for various financial activities, including setting up direct deposits, authorizing online payments, and managing automatic bill payments.

• To locate an ACH routing number, individuals can check their checks, access their online banking account, search the bank’s website, or contact customer service.

• ACH routing numbers differ from ABA routing numbers, which are used for paper checks and wire transfers, although many banks now use the same number for both.

• Understanding and knowing the ACH routing number is vital for conducting secure and efficient electronic transactions in today’s banking environment.

What Is an ACH Routing Number?

An ACH routing number is essentially a digital address for your bank. It’s used specifically for transfers made using the Automated Clearing House (ACH) network, a system that facilitates electronic payments and direct deposits between financial institutions in the U.S.

Smaller banks and credit unions may have only one ACH routing number, while big banks may use several different ACH routing numbers based on region.

You’ll need your bank’s ACH routing number for a number of financial transactions. This includes setting up direct deposit at work, getting a tax refund directly deposited into your bank account, authorizing a one-time online payment, setting up autopay, and using a P2P payment app.

To set up an ACH transaction, you also need to provide your account number, which (unlike an ACH number) is unique to you. Your account number identifies the specific account, such as a traditional or online checking account, within the bank you want to use for the ACH credit or debit.

Increase your savings

with a limited-time APY boost.*

How Do I Find My ACH Routing Number?

Let’s say you want to sign up to pay your homeowner’s insurance automatically every month or you need to enroll in a P2P app to send someone money. To find your bank’s ACH routing number, you have a few options.

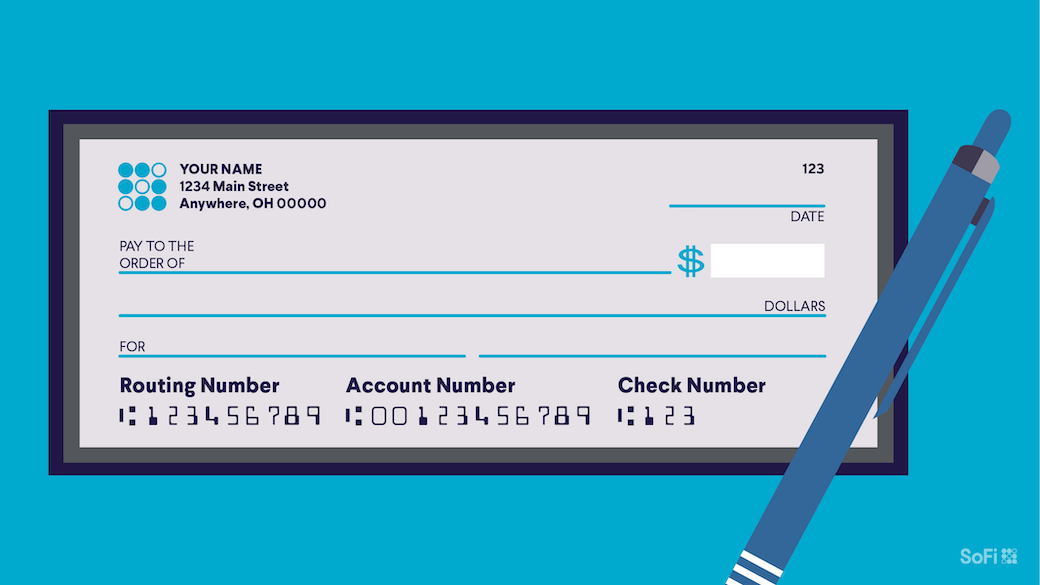

Using Your Checkbook

If you have paper checks, you can find your routing number by looking at the string of numbers printed along the bottom of a check. Your bank’s routing number is the first set of nine digits on the bottom left. It is usually followed by your account number and then the check number.

Using Your Online or Mobile Bank Account

Another way to get your ACH routing number is to go to your bank’s website and sign into your account. Methods vary by bank but, typically, here’s how you do it: Click on the last four digits of your account number (which appears above your account information) and choose “see full account number” next to your account name. A box will then open to display your bank account number and routing number.

You can also find your ACH routing number by signing into your bank’s mobile app. Typically, you just need to choose your account title and then tap “show details,” and your bank account and routing number will appear.

Using the Internet

If you don’t have access to online banking, you can also find your ACH routing number by going to your bank’s official website. You can then use the search function to look for “ACH routing number” or check the “Help” or “FAQ” sections.

Another option is to do a simple internet search. Put “ACH number” and the name of your bank into a search engine and you should be able to find it. Keep in mind that some large banks may have multiple regional ACH numbers. You want to make sure you are getting the one associated with your location.

Contacting Customer Service

If you can’t get online, you can always contact your bank’s customer service department by phone. They can provide you with the correct ACH routing number.

What Are ACH Routing Numbers Used For?

ACH routing numbers serve several essential functions in the banking system. Here are some of the main uses for ACH routing numbers:

• Direct deposit Employers use ACH routing numbers to deposit salaries directly into employees’ bank accounts. This method is fast, secure, and convenient for both employers and employees.

• Bill payments Many people use ACH routing numbers to pay bills electronically. This includes payments for utilities, mortgages, and other recurring expenses.

• Tax refunds The IRS and state tax agencies use ACH routing numbers to deposit tax refunds directly into taxpayers’ bank accounts.

• Transfers between accounts ACH routing numbers are used to transfer money between different bank accounts, whether within the same bank or between different banks. This is common for personal transactions, such as moving funds from a checking account to a savings account.

ACH vs ABA Routing Numbers: The Differences

An ABA (American Bankers Association) routing number is similar to an ACH routing number in that it identifies your bank. However, these numbers are used in different contexts.

ACH routing numbers are specifically used for electronic transactions processed through the Automated Clearing House network. This includes direct deposits, bill payments, and other electronic funds transfers. ABA routing numbers (also known as check routing numbers) are used for processing paper checks and for wire transfers. ABA and ACH simply refer to the method in which the money is moved.

These days, the same nine-digit number can serve as both an ACH routing number and an ABA routing number, which means that the ABA and ACH routing number for your bank is likely the same. If that’s the case, your bank will simply refer to its ABA/ACH routing number simply as its “routing number.”

Some banks, however, may provide separate ACH numbers (for electronic transfers) and ABA numbers (for checks and wire transfers).

ACH vs ABA Routing Numbers: History

ABA numbers were created in 1910 by the American Bankers Association (ABA) to help facilitate the sorting, bundling, and shipping of paper checks. They are still used for the processing of paper checks (and also for wire transfers).

More than a half century later, in the late 1960s, a group of California banks banded together to find a speedier alternative to check payments. They launched the first ACH in the U.S. in 1972; that was a key milestone in the evolution of electronic banking.

ACH vs ABA Routing Number: Numerical Differences

In the past, ABA and ACH numbers were slightly different, specifically the first two digits. Today, though, they are typically identical. Your bank’s ABA routing number and ACH routing number are likely to be one and the same. The reason is that both ABA and ACH numbers are used for the same purpose — transferring funds to the correct destination.

Test your understanding of what you just read.

The Takeaway

An ACH routing number is a nine-digit code that identifies a bank during an electronic financial transaction. The ACH system has been used for decades and makes life easier by keeping transactions quick and secure. While ACH numbers used to be different from ABA routing codes, today these two numbers are typically the same.

Whether you are setting up direct deposits, paying bills, or transferring money between accounts, it’s essential to know your bank’s ACH routing number. You can find it by looking at your checks, logging into your account, or doing a simple online search. It’s that easy.

Interested in opening an online bank account? When you sign up for a SoFi Checking and Savings account with eligible direct deposit, you’ll get a competitive annual percentage yield (APY), pay zero account fees, and enjoy an array of rewards, such as access to the Allpoint Network of 55,000+ fee-free ATMs globally. Qualifying accounts can even access their paycheck up to two days early.

FAQ

Is the routing number different for ACH and wire transfers?

In some cases, the routing number for ACH transactions may be different from the routing number used for wire transfers. ACH routing numbers are used for electronic transactions processed through the Automated Clearing House network, such as direct deposits and bill payments.

Wire transfers, which are often faster and more direct, require an ABA or wire transfer routing number. It’s a good idea to confirm with your bank to ensure you use the correct routing number for the type of transaction you are making.

For SoFi wire transfers, the routing number is the same for ACH and wire transfers: 031101334.

Do all banks have an ACH routing number?

All banks and credit unions that process ACH transactions have an ACH routing number. This nine-digit number is your bank’s digital address, and is essential for facilitating electronic transactions such as direct deposits and bill payments. Each financial institution has its own specific ACH routing number to ensure that transactions are routed correctly.

Is your ACH number your account number?

No, your ACH routing number is not the same as your account number. The ACH routing number is a nine-digit code that identifies your bank or financial institution. Your account number, on the other hand, is a unique identifier for your specific bank account within that institution.

Both numbers are required for electronic transactions, but they serve different purposes. The routing number directs the transaction to the correct bank, while the account number specifies the particular account to be credited or debited within that bank.

Photo credit: iStock/fizkes

Annual percentage yield (APY) is variable and subject to change at any time. Rates are current as of 12/23/25. There is no minimum balance requirement. Fees may reduce earnings. Additional rates and information can be found at https://www.sofi.com/legal/banking-rate-sheet

Eligible Direct Deposit means a recurring deposit of regular income to an account holder’s SoFi Checking or Savings account, including payroll, pension, or government benefit payments (e.g., Social Security), made by the account holder’s employer, payroll or benefits provider or government agency (“Eligible Direct Deposit”) via the Automated Clearing House (“ACH”) Network every 31 calendar days.

Although we do our best to recognize all Eligible Direct Deposits, a small number of employers, payroll providers, benefits providers, or government agencies do not designate payments as direct deposit. To ensure you're earning the APY for account holders with Eligible Direct Deposit, we encourage you to check your APY Details page the day after your Eligible Direct Deposit posts to your SoFi account. If your APY is not showing as the APY for account holders with Eligible Direct Deposit, contact us at 855-456-7634 with the details of your Eligible Direct Deposit. As long as SoFi Bank can validate those details, you will start earning the APY for account holders with Eligible Direct Deposit from the date you contact SoFi for the next 31 calendar days. You will also be eligible for the APY for account holders with Eligible Direct Deposit on future Eligible Direct Deposits, as long as SoFi Bank can validate them.

Deposits that are not from an employer, payroll, or benefits provider or government agency, including but not limited to check deposits, peer-to-peer transfers (e.g., transfers from PayPal, Venmo, Wise, etc.), merchant transactions (e.g., transactions from PayPal, Stripe, Square, etc.), and bank ACH funds transfers and wire transfers from external accounts, or are non-recurring in nature (e.g., IRS tax refunds), do not constitute Eligible Direct Deposit activity. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. SoFi Bank shall, in its sole discretion, assess each account holder's Eligible Direct Deposit activity to determine the applicability of rates and may request additional documentation for verification of eligibility.

See additional details at https://www.sofi.com/legal/banking-rate-sheet.

SoFi Checking and Savings is offered through SoFi Bank, N.A. Member FDIC. The SoFi® Bank Debit Mastercard® is issued by SoFi Bank, N.A., pursuant to license by Mastercard International Incorporated and can be used everywhere Mastercard is accepted. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

SOBK-Q224-1885644-V1