Tough Love

This week’s CPI report served up tough love for both bulls and hopeful doves. The rally that took us back above 4,000 on the S&P 500 was put to a painful end on Tuesday, when the S&P fell 4.3% and the Nasdaq tumbled 5.2% on the heels of hotter-than-expected inflation. The problem is that it wasn’t just hotter on one metric — it was hotter on the headline number, the core number, and when measured month-over-month and year-over-year. The real star of the “tough love” show was the month-over-month (m/m) change. According to estimates, this month was expected to be the first where CPI would post a negative m/m reading since May 2020. Instead, we got a positive 0.1%.It’s Not Me, It’s You

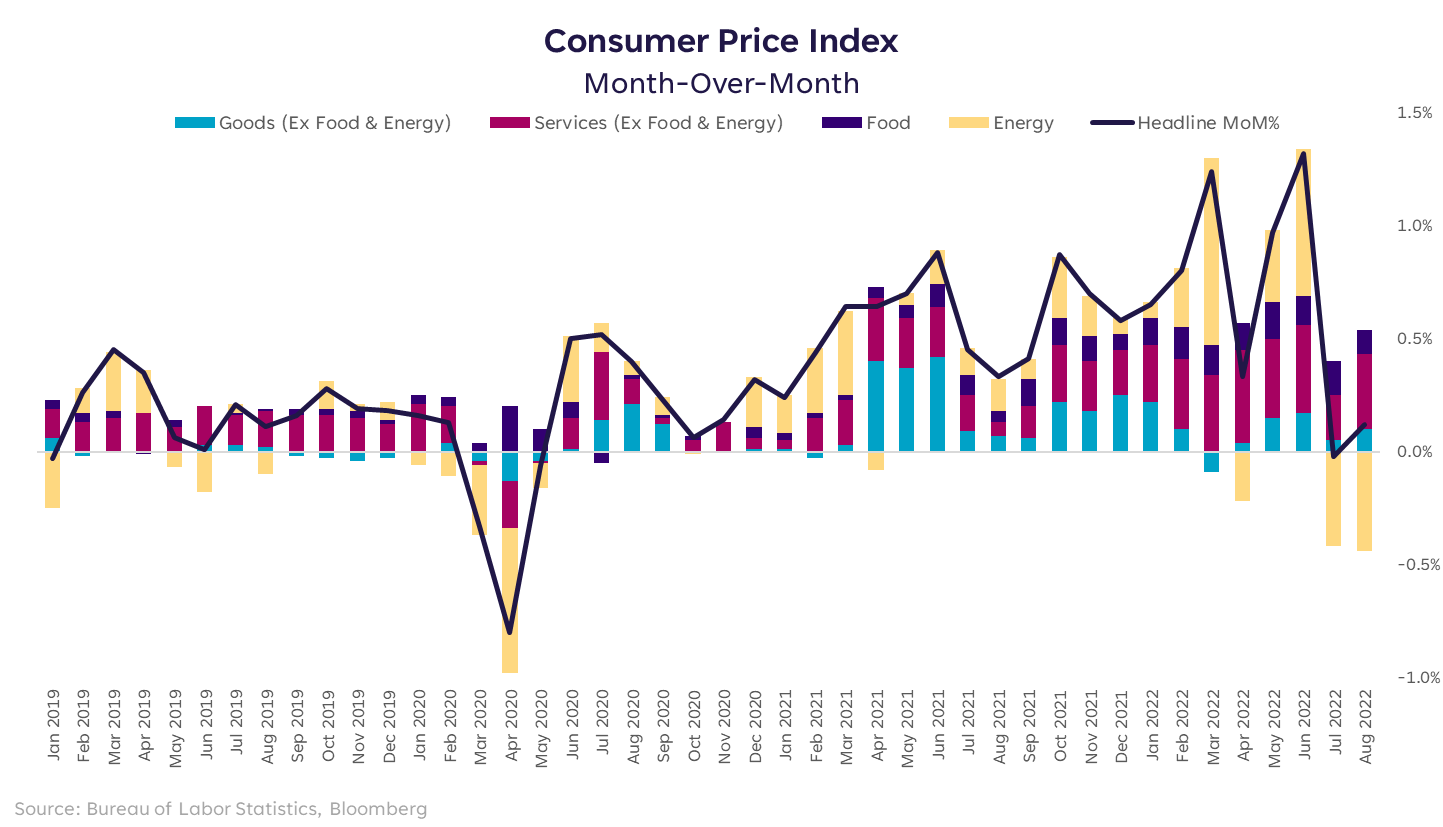

It’s not energy, it’s services. The optimism about a cooler inflation report was driven by the fact that energy and gas prices have fallen substantially in the last three months. WTI Crude Oil is down 28% over that period and the average cost of gas in the U.S. is down over 26%. The chart above depicts the energy (yellow) component pulling the overall reading down. But an increase in services inflation won the fight this time. In particular, the problem spot that is finally emerging in the data is housing, which falls under services in this methodology. We’ve known for some time that housing affordability is low and that home prices and rent levels have skyrocketed. We also know that they haven’t started to come down in a meaningful way, and that it takes longer for housing market indicators to make their way into these headline numbers. And here we are.Everybody Hurts

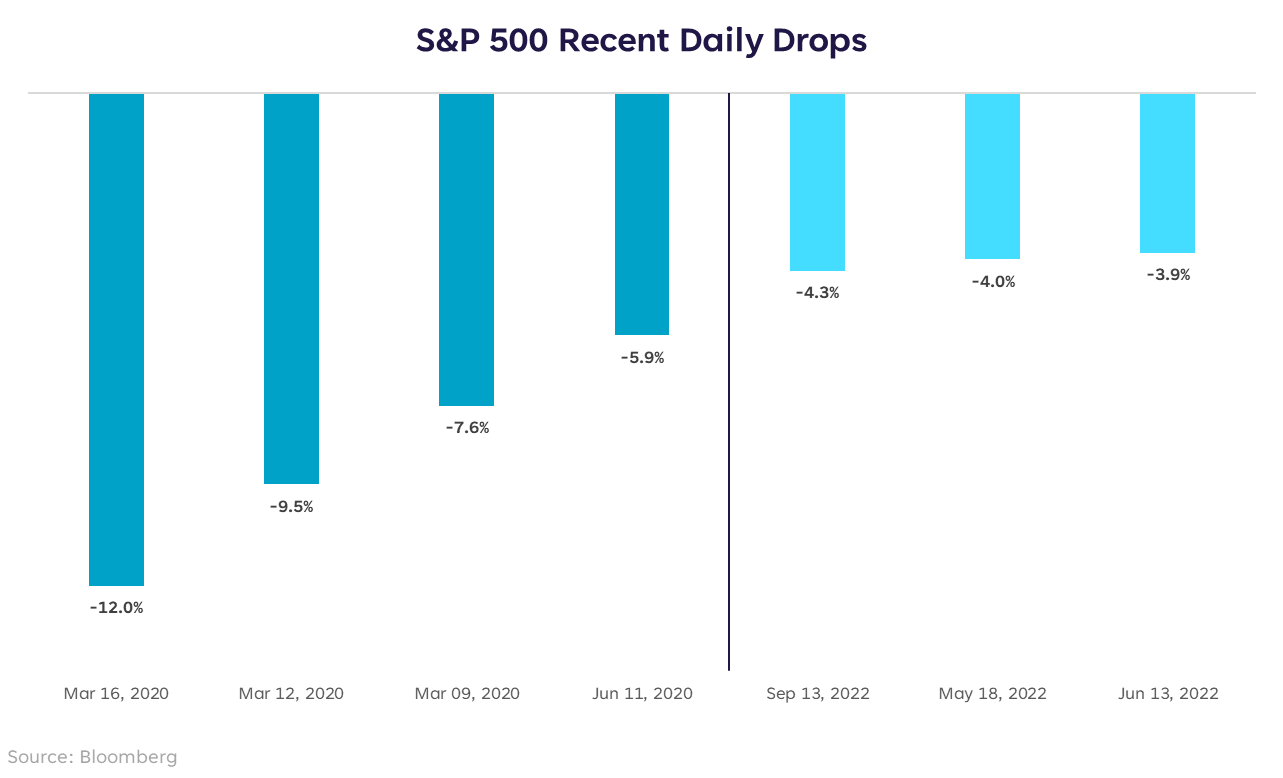

For those of you who are younger than I am, “Everybody Hurts” is a 90s song by a band called R.E.M., and it’s not short on sad lyrics. On Tuesday, we saw the worst one-day drop in the S&P since June 2020. I can’t help but think it was a pivotal day, whether it was the realization that sticky inflation will require more pain to fix, or simply the beginning of another valuation flush that could take us down to prior lows. There’s also the possibility it will look like an overreaction in a couple months. In any event, I think we’ll talk about that day for a while, but it’s important to put it in perspective. A 4.3% daily drop was large by any standards, but still not nearly as large as what we saw in the depths of Covid when uncertainty was at its peak and the market literally wasn’t functioning as it should. I don’t want to minimize it though. September and October can be tough months for markets and this year feels like no exception. Given that we have a Fed meeting looming in the next week, and it will be one where they publish a new dot plot and summary of economic projections, there could be more one-day flushes to come. These pesky high inflation prints could be foreshadowing a more hawkish dot plot, and higher projections for inflation, unemployment, and the Fed Funds Rate. The persistently hawkish stance and messaging by the Fed leads me to believe that markets may see a few more daily stabs downward that proves to be a final big flush. This may sound odd, but if that happens swiftly, meaning within the next couple months, that actually becomes the bull case in my view. It could be a quick and painful drop, resulting in a renewed move higher later in the year that’s more durable, as inflation falls more notably. Of course, no one knows exactly what will happen or when, but on days when everybody hurts, I tend to believe that the end of pain comes closer into view.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv. SOSS22091504