Austin Housing Market: Trends & Prices (2025)

Austin Real Estate Market Overview

(Last Updated – 4/2025)

Chances are you’ve heard a lot about Austin. This Southwestern hot spot has been all the rage in recent years thanks to its hip art, music, and food scenes. And the tech industry in Austin has attracted high earners to the city.

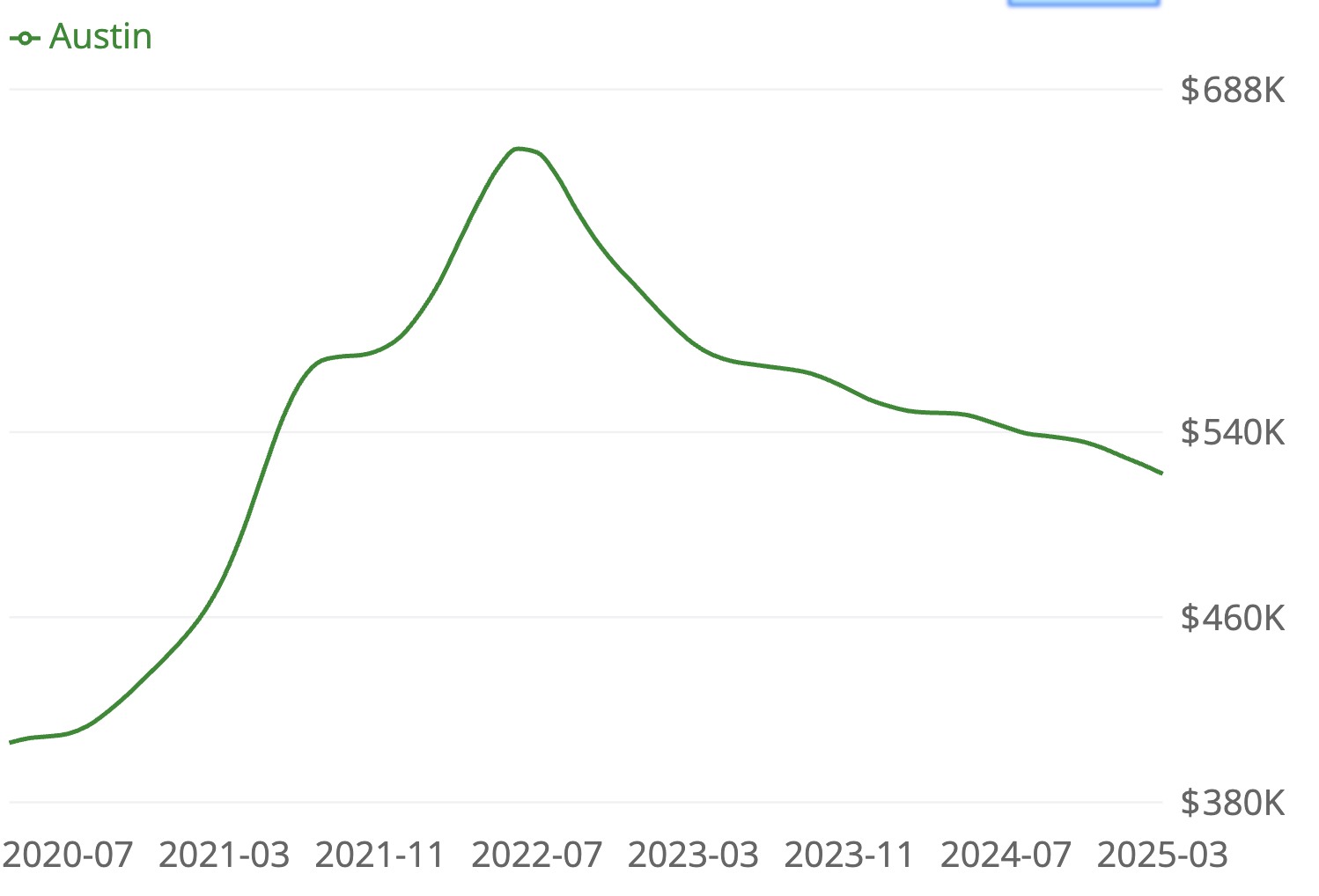

Is the market still overheated? Home values were rising steadily since 2015, and the pandemic surge elevated Austin to the second-most-overvalued market in the country in 2021. However, since mid-2022, the popular Austin housing market has slowly been returning to a post-pandemic normal. Austin home prices in early 2025 were down only marginally compared with the year before, but the median home value in the city is back to where it was in mid-2021, according to Zillow.

Frothy or not, the City of the Violet Crown (so named because of the color of the sky at sunset) holds appeal. For 12 years running, ending in 2023, Austin was America’s fastest-growing city, according to the U.S. Census Bureau. In 2024, it slipped to second place. With just shy of 1 million residents, Austin is the country’s 26th most-populous metro area.

Austin, with lower home prices than, say, San Francisco or Los Angeles, lures not only techies and music lovers but also foodies. If health is top of mind, Whole Foods is headquartered downtown.

Recommended: Local Housing Market Trends by CityOverall Austin Market Trends

Welcome to Austin, where sellers should have no problem offloading their homes, but buyers need to be ready to compete.

According to Redfin, some homes for sale in Austin receive multiple offers. Typical homes sell for 3% below list price and go pending in 70 days. Hot homes sell for around list price and go pending in around 33 days.

Recommended: Price-to-Rent Ratio in 50 Cities$513,000

Median Sale Price

$319

Median Sale Price Per Square Foot

89 days

Median Time on Market

Austin Housing Market Forecast

There is no denying that house prices in Austin have seen a significant increase in recent years. The chart below illustrates the upswing that began in 2015, with a steady decline since summer 2022.

As Tesla made its home in Gigafactory Texas, Austin has attracted more wealthy investors and more people looking to start or advance their careers to this booming tech hub.

Demographics of the Austin City Market

Some consider Austin to be one of the best places to live in the United States (the city took ninth place in a U.S. News analysis), and it’s pretty obvious why. Not only does the city offer music festivals, art exhibits, and food fairs, but nature lovers will find what they need too.

The nearby Zilker Nature Preserve and Lady Bird Lake offer amazing views and a chance to escape the city for an hour or two. Families and active singles will have plenty of ways to fill their weekends and make memories in Austin.

Before making a move and buying a home, though, consider some of the key demographics of the Austin real estate market.

Recommended: Home Ownership ResourcesMedian Household Income: $91,501

Median Age: 34.9

College Educated: 61.7%

Homeowners: 44.4%

Married: 42%

Popular Austin Neighborhoods

Austin has many great neighborhoods to choose from, but let’s shine a spotlight on five of the biggest.

North Austin

If you like to walk to work or run errands, North Austin may be a good fit for you. This neighborhood isn’t the most pedestrian-friendly neighborhood in the city, but you’ll definitely have the option of walking to some of your favorite spots.

There are almost 100 restaurants, bars, and coffee shops to choose from, and most residents can walk to one of these establishments in just five minutes.

Quick Facts

Population:

175,955

Median Age:

32

Housing Units:

82,059

Bike Score:

61/100

Walk Score:

54/100

Transit Score:

45/100

Median Household Income:

$71,534

North Austin Housing Market

The North Austin housing market is somewhat competitive. Since last year, average home prices have dropped by 3.7%. On average, North Austin homes go to pending in around 69 days; some receive multiple offers but sale prices average 2% below asking price. If you want to be prepared to compete for a hot home (or if you want to get a solid sense of your borrowing power), it’s smart to seek preapproval for a mortgage loan before you start your search.

Median Sale Price

$405,000

Median Price Per Square Ft.

$295

Franklin Park

This is a primarily residential neighborhood known for having affordable housing options and some commercial buildings. The close proximity to downtown and the University of Texas will surely be appealing to students. The neighborhood has added more than a thousand new housing units in recent years.

A large state park borders the eastern side of this neighborhood and offers hiking, camping, fishing, and other outdoor activities.

Quick Facts

Population:

51,069

Median Age:

32

Housing Units:

20,035

Bike Score:

41/100

Walk Score:

40/100

Transit Score:

41/100

Median Household Income:

$78,474

Franklin Park Housing Market

Though the market in Franklin Park is somewhat competitive, the median home sale price is relatively stable year over year, as of March 2025. Homes tend to sit on the market for 68 days, though in-demand properties can sell in a little more than half that time. Some homes get multiple offers.

Median Sale Price

$305,000

Median Price Per Square Ft.

$215

West University

West University may be a college town, but anyone can enjoy the lively feel of this neighborhood. While the home of the University of Texas at Austin won’t be the most quiet neighborhood, there will be no shortage of fun events, great food, and school pride. Not surprisingly, this is a good place to be if you want to live the car-free life — getting around by bike and on foot is easy here.

Quick Facts

Population:

32,937

Median Age:

21

Housing Units:

12,519

Bike Score:

94/100

Walk Score:

92/100

Transit Score:

65/100

Median Household Income:

$30,336

West University Housing Market

The real estate market in West University is considered somewhat competitive, as the median sale price rose 4.6% since last year.

Typically, homes have been selling for 3% under list price in this neighborhood and stay on the market for around 72 days.

Median Sale Price

$359,000

Median Price Per Square Ft.

$388

Windsor Park

This neighborhood is home to charming ranch-style homes that provide a classic Texas feel. The family-friendly neighborhood has access to lots of parks and playgrounds. For parents who need to commute, downtown is just 15 minutes away.

Quick Facts

Population:

36,307

Median Age:

35

Housing Units:

17,065

Bike Score:

66/100

Walk Score:

55/100

Transit Score:

45/100

Median Household Income:

$87,978

Windsor Park Housing Market

The Windsor Park housing market is considered only somewhat competitive by Redfin, so you have a good shot at finding a home here amid the family-friendly vibes. The median sale price was down 14% in March 2025 compared with that month the prior year.

Houses in Windsor Park sell for around 3% below list price, with some receiving multiple offers. The typical home goes pending in 50 days.

Median Sale Price

$475,000

Median Price Per Square Ft.

$344

Garrison Park

This quiet neighborhood is conveniently located near both major highways that serve the area, making commuting a breeze.

When you want to stay closer to home, there are tons of stores and restaurants to choose from, including charming cafes.

Quick Facts

Population:

61,122

Median Age:

37

Housing Units:

31,246

Bike Score:

65/100

Walk Score:

53/100

Transit Score:

42/100

Median Household Income:

$84,529

Garrison Park Housing Market

In this moderately competitive real estate market, some sellers can look forward to receiving multiple offers; however, they can expect their house to stay on the market for around 111 days. In March 2025, prices were relatively flat year-over-year.

Buyers should expect typical homes to go for around 4% below list price and popular homes to go for about list price.

Median Sale Price

$450,000

Median Price Per Square Ft.

$330

SoFi Home Loans

It’s easy to see why Austin has become such a popular market to buy a home in. There are some really amazing neighborhoods to choose from whether you’re young and single or have a family to look after.

If you think Austin could be your home sweet home, then you may need to consider your mortgage loan options.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

FAQ

Is the Austin housing market crashing?

While home values in Austin have declined from their peak numbers in 2021, the market as a whole is still somewhat competitive and some homes in many well-regarded neighborhoods receive multiple offers. Popular homes tend to sell for list price. Some might describe this as a crash, but calmer heads would call it a return to normal after a fever-pitch period in the market.

Is now a good time to buy in Austin?

Median sale prices in the Austin market have declined in recent years, but whether it is the right time to buy depends as much on your personal financial situation as on home prices. If you have a solid credit score and can cover the cost of a home in your price range, including a down payment (which could be as low as 3% for some first-time homebuyers), then the time may be right for you. Have a look at the cost of renting vs. owning before making a decision.

Do many people in Austin rent?

A little more than half of Austin’s households, 56%, are renters, not unusual for a university town. But this is still far less than the proportion of renters you would find in an East Coast city such as Hartford or Newark.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Qualifying for the reward requires using a real estate agent that participates in HomeStory’s broker to broker agreement to complete the real estate buy and/or sell transaction. You retain the right to negotiate buyer and or seller representation agreements. Upon successful close of the transaction, the Real Estate Agent pays a fee to HomeStory Real Estate Services. All Agents have been independently vetted by HomeStory to meet performance expectations required to participate in the program. If you are currently working with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®. A reward is not available where prohibited by state law, including Alaska, Iowa, Louisiana and Missouri. A reduced agent commission may be available for sellers in lieu of the reward in Mississippi, New Jersey, Oklahoma, and Oregon and should be discussed with the agent upon enrollment. No reward will be available for buyers in Mississippi, Oklahoma, and Oregon. A commission credit may be available for buyers in lieu of the reward in New Jersey and must be discussed with the agent upon enrollment and included in a Buyer Agency Agreement with Rebate Provision. Rewards in Kansas and Tennessee are required to be delivered by gift card.

HomeStory will issue the reward using the payment option you select and will be sent to the client enrolled in the program within 45 days of HomeStory Real Estate Services receipt of settlement statements and any other documentation reasonably required to calculate the applicable reward amount. Real estate agent fees and commissions still apply. Short sale transactions do not qualify for the reward. Depending on state regulations highlighted above, reward amount is based on sale price of the home purchased and/or sold and cannot exceed $9,500 per buy or sell transaction. Employer-sponsored relocations may preclude participation in the reward program offering. SoFi is not responsible for the reward.

SoFi Bank, N.A. (NMLS #696891) does not perform any activity that is or could be construed as unlicensed real estate activity, and SoFi is not licensed as a real estate broker. Agents of SoFi are not authorized to perform real estate activity.

If your property is currently listed with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®.

Reward is valid for 18 months from date of enrollment. After 18 months, you must re-enroll to be eligible for a reward.

SoFi loans subject to credit approval. Offer subject to change or cancellation without notice.

The trademarks, logos and names of other companies, products and services are the property of their respective owners.

SOHL-Q125-236