Expect the Unexpected

Hard to believe we’re already at the end of the first quarter, but perhaps less hard to believe that there have been some surprises since Jan 1st…isn’t that always the case? It’s also what makes markets so fun, they’re never too predictable. Here are some of the biggest surprises so far in 2023, and my thoughts on each.Nasdaq Bounceback

As of this writing (which is just a couple days shy of quarter-end), the Nasdaq is up 13.3% QTD with the ETF representing the 100 largest names in the index (the “QQQ”) up over 15%. Not many people saw that coming, myself included. Compared to the broader market indexes that reflect more of a cyclical influence, the divergence among them is meaningful. Given that the narrative entering 2023 was much about value and cyclicals rather than growth and tech, this bounceback from the rout of 2022 is a real head turner. The big question now is: Do we fade it or hold it in expectation of more upside? My answer to this is more nuanced than a simple fade/hold call, largely because although I do still expect the broader market and economy to hit the skids, it would likely be due to recession concerns, rather than the expectation of more monetary tightening. For that reason, I think it’s very possible that the QQQ-type stock doesn’t get hit as hard in a downturn as cyclical sectors such as Industrials, Financials, and even Consumer Discretionary. But the 15% quarterly return is unlikely to repeat itself all year. If we do see a recessionary drawback in markets, and the cyclicals take it on the chin, those bruised sectors are the ones that become the buys, and you’d likely hear me say: “Lean into the value plays and out of the QQQs.” But that’s not the case today. If we get a cool PCE print on Friday, and a cool CPI print on April 12, there certainly could be more upside in growth. But once earnings season begins in mid-April, many will be on the lookout for indications of faltering profits and it could turn out to be a tough month for markets. It’s not a bad idea to start trimming the growth gains from Q1, which can be done in a gradual and systematic way, in order to prevent your portfolio from being over-exposed.Terrible Twos

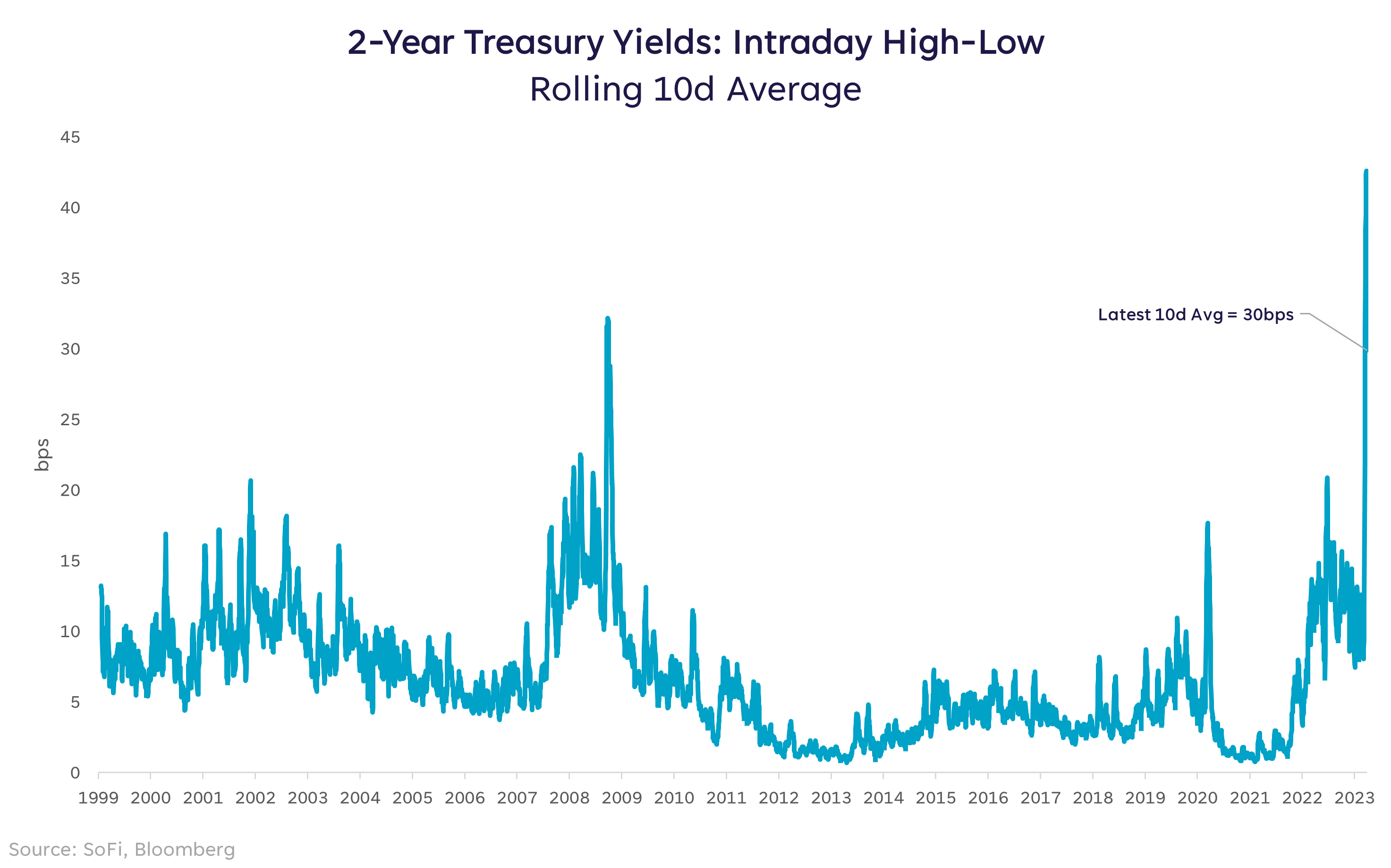

This could be a case of which came first, the 2-year Treasury yield or the QQQs? These are typically closely related (inversely), and from peak-to-trough the 2-year Treasury yield dropped 100 basis points during Q1. That’s a move of historic magnitude, and one that didn’t occur in a straight line. In fact, the spread between intraday highs and lows on the 2-year rose above those seen in the midst of the 2008-2009 crisis. The MOVE Index, which measures volatility on Treasury bonds, also hit cycle highs in the first quarter. So far, equities are holding up and economic data has not materially faltered, but I can say with confidence that moves of this magnitude in the Treasury market are not typically signals of smooth sailing ahead. At the very least, they’re indicating that the uncertainty around Fed policy has risen. Not only due to the recent fears in the banking system — but to the unclear end to the Fed’s hiking cycle (more on that below). Despite the big drop in yields, the 2-year Treasury is still sporting a number over 4%, which is attractive in most environments, especially one with twitchy volatility. Not to mention, the 6-month Treasury is still offering a 4.8% yield. For those reasons, if you already own something on the short-end of the Treasury curve I’d hang on to it. If you don’t, this remains an attractive entry point, in my opinion.Flip Flop

Last but certainly not least, perhaps the most notable surprise was the rapid shift in market expectations of rate hikes and cuts. In a matter of days, on the heels of the banking mess, the market went from pricing in four more hikes of 25 basis points, to pricing in at least three cuts before the end of the year. This change alone sent ripples across the Treasury market, the equity market, and investor sentiment in a flash. We had to quickly adjust our outlook on the whole year, and try to determine what that all meant for the direction of returns from here on out. Safe to say, the market still isn’t sure as the S&P sits in the same range it’s been in for months. Not above 4,200 and not below 3,800. My guess is we stay in this space until the next set of headlines comes around. I do expect another set of negative headlines, I’m just not sure what the subject will be. Until then, maybe we can enjoy the calm waters for a little bit…as long as we don’t mistake a calm stretch for an entirely smooth journey. We had our most recent rate hike only one week ago, the surprises are unlikely to be over yet.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content. Communication of SoFi Wealth LLC an SEC Registered Investment Advisor SoFi isn't recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv. SOSS23032303