Seeping Out of the Balloon

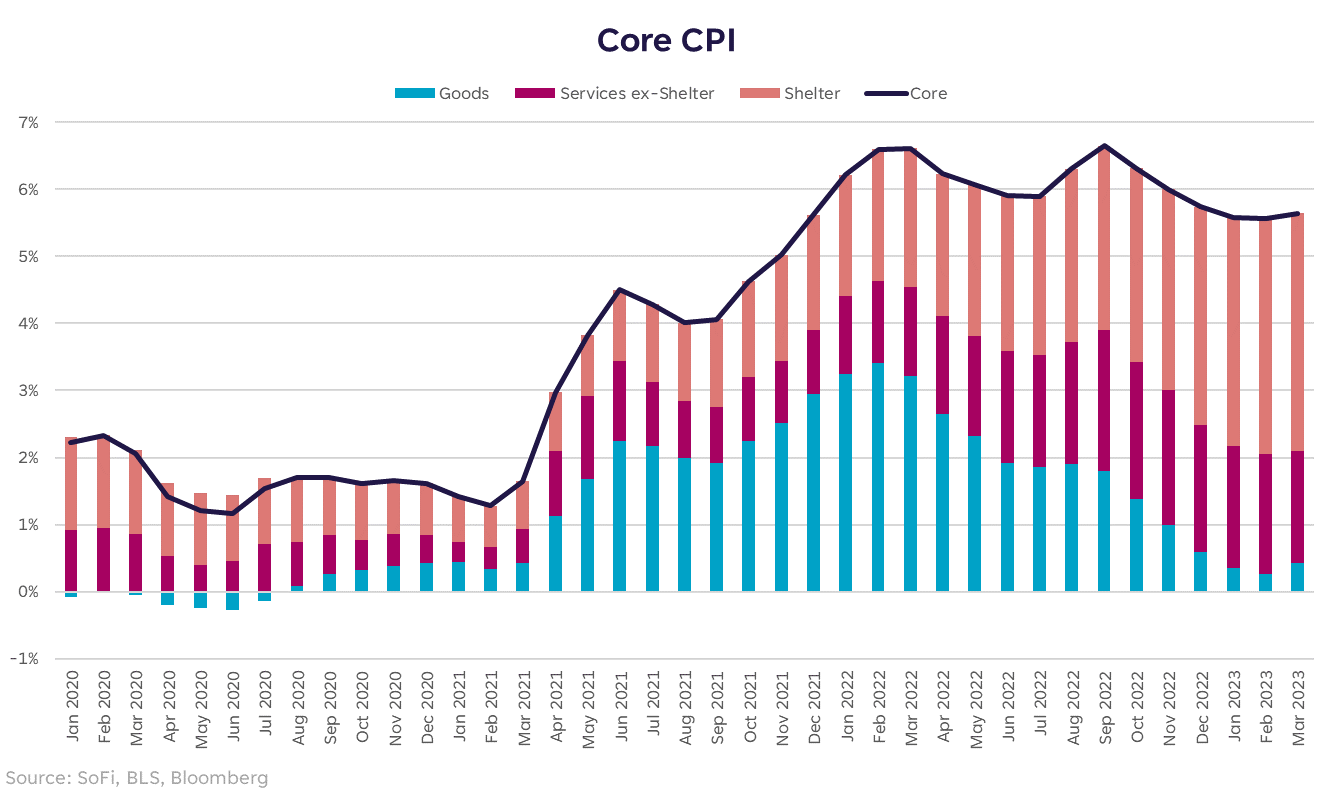

The latest Consumer Price Index (CPI) data showed a cooling in the headline number to 5.0% y/y from last month’s 6.0% reading. That’s a good sign inflation is moderating by this measure, but as with most headlines, the important takeaways are in the finer details. As a reminder, headline CPI includes all items, while core CPI removes food and energy from the calculation. One of the most interesting elements of this month’s report was that core inflation came in above headline inflation for the first time since January 2021. Clearly, the food and energy components were notably cooler in March, which is a welcome relief for consumers. Food prices finally stopped showing increases m/m, while energy was down 6.4% y/y and 3.5% m/m. However, the fact that core CPI was above headline also means there are components under the surface that may not be cooling as quickly as we hoped. Those components are mainly services, which tend to be more stubborn in general, and I worry that this time is no exception. Bottom line: inflation is cooling in many areas, but with core at 5.6% y/y it remains far from “problem solved,” and still shows potential to stick around longer than we (and the Fed) would like.Trickery

As I write this midday on Wednesday, the stock market’s initial reaction to CPI was reasonably positive — perhaps reflecting relief that the data wasn’t more troubling. However, as we’ve seen many times before, as markets digest the news things can change quite a bit in just a few hours. In any event, we are still in an environment where intraday swings in stocks and bonds have the potential (and precedent) to be very, very large. Subdued volatility in stocks (VIX index below) can play a good game of trickery on investors, and is worth a skeptical eye when other signals are sending different messages. The bond market volatility gauge (MOVE Index) continues to throw flares of caution that investors shouldn’t ignore. The gap between the two, and the persistently higher volatility in bonds, is worrisome. Although both stocks and bonds react to macro data and Fed moves, the way each interprets the news as either “good” or “bad” can be very different. The relationship between stocks and bonds right now fits cleanly into my theme so far in 2023…somebody’s wrong.Powell’s Predicament

The next Federal Open Market Committee (FOMC) meeting begins on May 2nd, with a rate announcement and press conference from Jerome Powell on May 3rd. It’s likely to be a hot topic until that day, but with all the data and earnings commentary we’re set to receive in the meantime, it still feels pretty far out. As of now, the market is placing a 70-75% probability on a 25 basis point hike in May. According to the Fed’s own predictions, they’ve got one more hike in them this year. The predicament they could face in May is if earnings and econ data comes in soft over the next few weeks, is another hike worth the risk? Will 25 basis points really make that much of a difference? Again, Powell doesn’t call me for my opinion, so take this with a grain of salt. But at this point, with the fed funds rate handily above both the 2-year and 10-year Treasury yields, and at or above some measures of inflation…a pause could be justified.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content. Communication of SoFi Wealth LLC an SEC Registered Investment Advisor SoFi isn't recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv. SOSS23041304