How Would You Like that Cooked?

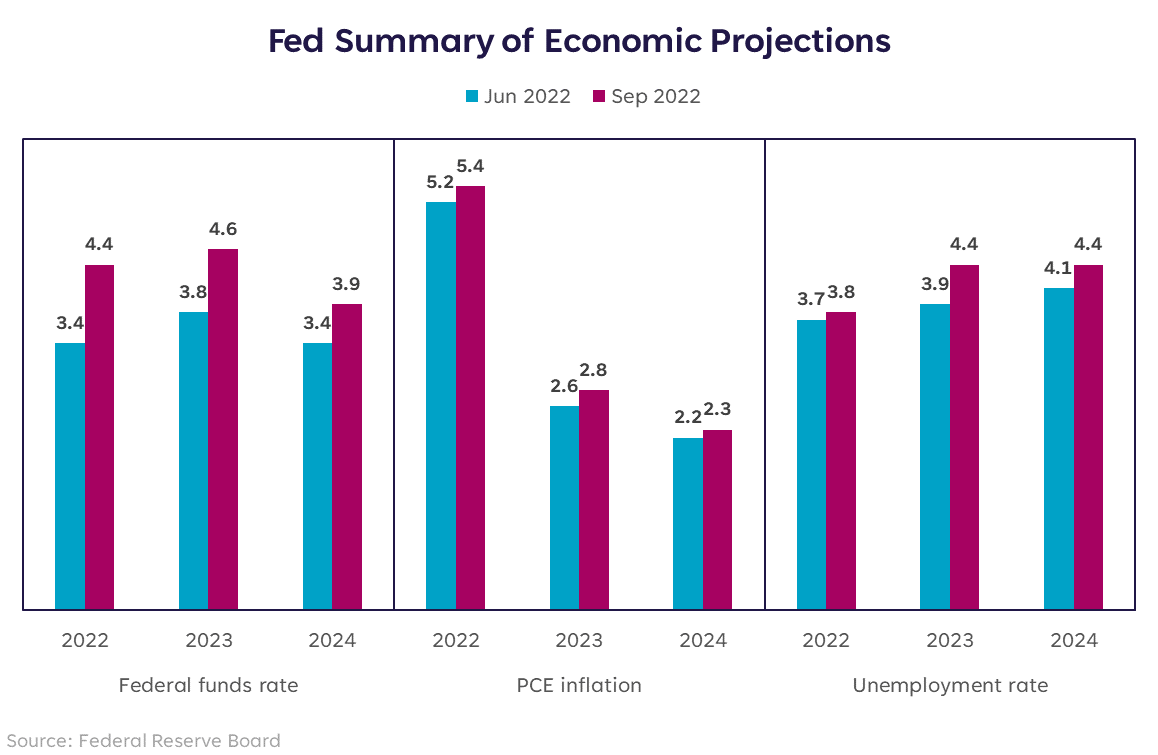

The Fed’s move to increase the Fed Funds Rate (FFR) by another 75 basis points to an upper bound of 3.25% was widely anticipated and what the chef (or market) suggested. Their quarterly summary of economic projections is what moved markets, due to the sharp increase in what the FOMC expects its policy rate to be at the end of this year and next year. Their estimate of the FFR went from 3.4% to 4.4% for the end of 2022, and from 3.9% to 4.6% for the end of 2023. The last time it was above 4% was December 2007. Below is a summary of how the other projections changed. Given that markets had only priced in a rate of roughly 4.2% by year-end, the immediate movement in equities and bonds after this decision was negative in response to a more hawkish stance. The inversion between 2-Yr and 10-Yr Treasurys deepened by 10 basis points to 52bps. As Chairman Powell spoke, markets flattened out upon hearing his continued commitment to containing inflation and creating an environment that allows for a sustainably healthy labor market, only to whipsaw back down by the end of the trading day and finish notably in the red.

If the Fed had previously ordered their economy cooked “medium,” this meeting’s projections moved their order to “medium well.” The primary fear of many investors remains that monetary policy will overshoot and push us into a painful recession at some point in the next 12 months.

Given that markets had only priced in a rate of roughly 4.2% by year-end, the immediate movement in equities and bonds after this decision was negative in response to a more hawkish stance. The inversion between 2-Yr and 10-Yr Treasurys deepened by 10 basis points to 52bps. As Chairman Powell spoke, markets flattened out upon hearing his continued commitment to containing inflation and creating an environment that allows for a sustainably healthy labor market, only to whipsaw back down by the end of the trading day and finish notably in the red.

If the Fed had previously ordered their economy cooked “medium,” this meeting’s projections moved their order to “medium well.” The primary fear of many investors remains that monetary policy will overshoot and push us into a painful recession at some point in the next 12 months.

No Knife on the Table

The statements that continued to be reiterated by Chairman Powell were, “strongly committed to bringing inflation back to our 2% goal” and “we think we’ll need to bring our funds rate to a restrictive level, and to keep it there for some time.” With headline CPI still sitting at 8.3% and headline PCE at 6.3%, it’s clear that the 2% target is quite a ways in the distance. As such, at this point, rate cuts seem to me a fantastical idea that is just as far off. Until inflation falls notably, equity markets could continue to suffer from volatile moves on each macro data point as investors attempt to discern the likelihood — and possible severity of — a looming recession.Chew Slowly

I’ve taken some flack lately for my commentary being too risk averse. But in an environment where further hikes are on the menu, inflation is still the centerpiece, and no one knows if the labor market will make it through dinner, a lower-than-usual risk tolerance in the short-term is an important consideration. But that does not mean keep it all in cash. It means choose carefully and keep in mind the hiking cycle isn’t over yet. Until we have a clearer idea of where the FFR will top out, I still view the classic growth sectors of Tech and Consumer Discretionary as too expensive at 20.0x and 24.5x forward P/E, respectively. The growth that can be found in Communication Services (14.3x) and Health Care (15.5x) is more attractive at this juncture, in my opinion. I also continue to find the Treasury market attractive at these levels, particularly shorter-term Treasurys with the 2-Yr yield hovering around 4% and roughly 50bps above the 10-Yr yield. If this Fed meeting didn’t cause a sustained rise in either yield (thus a sustained fall in prices), I have a hard time envisioning something that will, unless we lose control of inflation expectations. The fight against inflation is still on, and the outlook on the economy is still muddy. I don’t believe equities will find a smoother path upward until inflation comes down, whether because of tighter policy or because of a recession that restarts the business cycle. In either event, the road for markets remains an obstacle course.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser SoFi isn't recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv. SOSS22092203