It’s Beginning to Look a lot Like Contrast

Happy December, everyone. With the beginning of this merry month comes the time of year when I get to title all of my notes as Christmas songs and make no apologies for it. I can already hear the sleigh bells jing-a-ling, ring-ting-tingling, too. December also marks the month when we look back at the last 11 months for themes and try to predict which ones may emerge over the next 12. This year’s theme has felt something like, “everything goes down,” and that’s certainly been the case across most asset classes. Interestingly, another theme of 2022 has been that of divergence, or contrast, in performance patterns across categories. Some of these differences are wider than they’ve been in a very long time.Feliz Navi-Dow

It’s true that all major stock indices are down, but the old-fashioned Dow Jones Industrial Average (the “Dow”) is down considerably less than the S&P and Nasdaq. Specifically, the Dow is down only 4.8% YTD, while the S&P 500 is down 14.4% and the Nasdaq is down nearly 27%. Much of this historically large spread can be explained by sector weights. First, the Dow only includes 30 stocks so it’s a limited sample, not just of individual names, but also sector exposures. Second, the Dow only includes seven Technology stocks, none of which fall in the top five weights in the index. That makes a huge difference compared to the S&P, which has four of the top five stocks in either the Tech sector or closely adjacent (i.e., Amazon and Google). Although Tech falls in the top sector weights for both indices, some other big sectors in the Dow are Health Care, Financials, and Industrials, which together make up more than half of the total weight. In an environment where Tech continues to be scrutinized and under fundamental pressure, it’s no wonder the Dow has escaped a bit of the pain, and could continue to fare better.Jack Frost Nipping at The Lows

Another big gap in performance this year has been between low volatility and high volatility stocks. In a period fraught with fear, recession risk, and an unsympathetic Federal Reserve, this comes as no surprise. The question is whether it will persist. Since the S&P’s most recent low on Oct 12th, higher volatility stocks have done better. It’s no coincidence that this happened in tandem with a drop in the volatility index (the “VIX”) and accelerated with a cooler inflation print in mid-November. Beware these short-term reversals though; especially when they’re this powerful and contrasting with the longer-term trend. These tend to be emotional moves and can change course very quickly, which is something I expect to start seeing in December.Zat You, Small Caps?

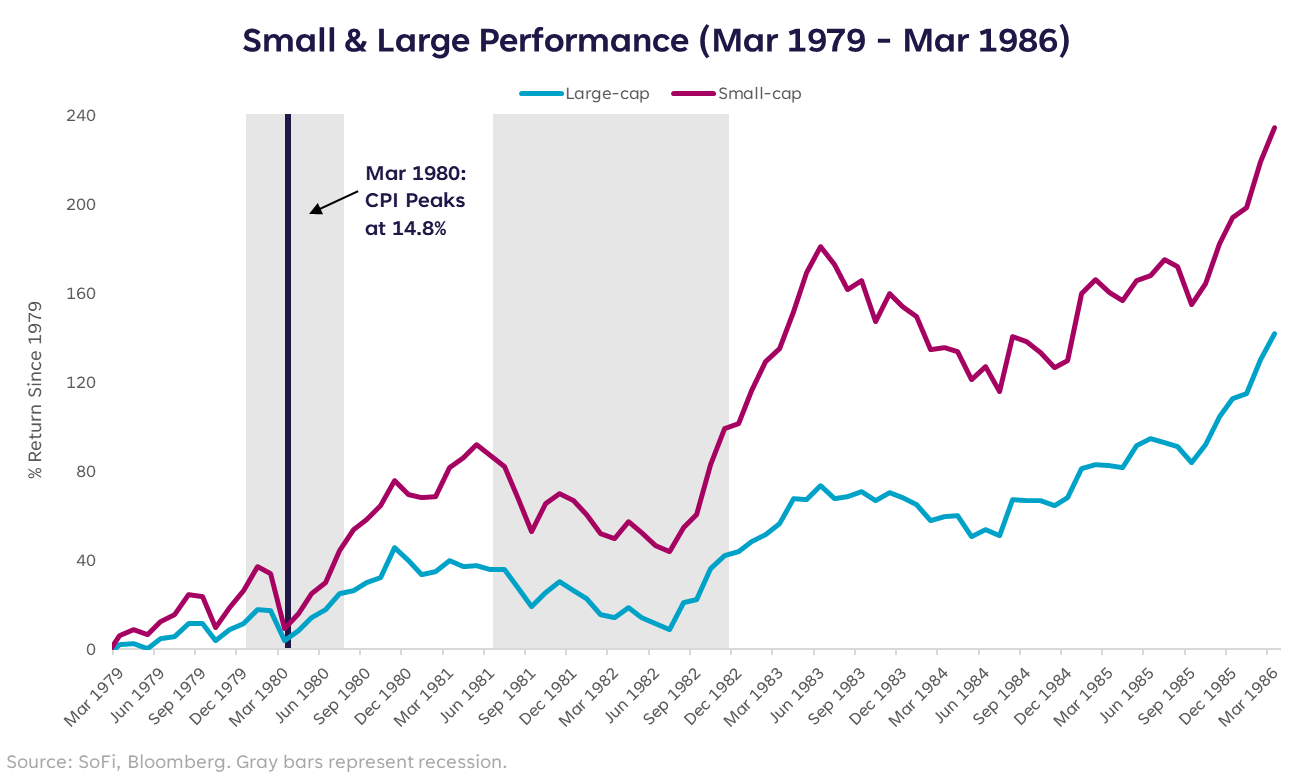

Back in the late 70s and early 80s, when we last had an inflation problem this large, the small-cap Russell 2000 index was a standout performer after CPI peaked in March 1980 at 14.8%. And when I say standout, I mean it outperformed large-caps by 42 percentage points, from March 1980 until March 1986, when CPI was back down to 2.8%. If history serves as a guide, and if CPI did in fact peak in June of this year at 9.1%, small-caps could have a nice 2023. Since the June 2022 CPI release, small-caps have outperformed large-caps by more than 200 basis points, which may mark the beginning of an outperformance trend. To close this out, as readers and market watchers, we’ve been warned many times about the “spread” not being our friend this year. Typically, we’re talking about yield spreads and the fact that their current inverted state spells ominous things for the months to come. That may be true, but they’re not the only spreads we should pay attention to. Some of the ones covered in this piece can offer insight and opportunities as we start a new year.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content. Communication of SoFi Wealth LLC an SEC Registered Investment Advisor SoFi isn't recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv. SOSS22120103