Whistle While You Wait

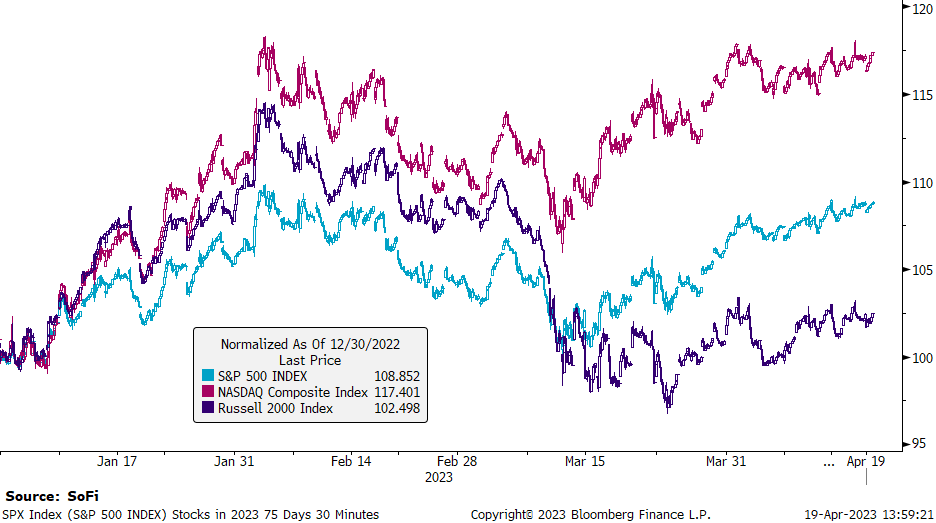

Stop me if you’ve heard this before: Sentiment is bearish. Even some of the most bullish voices have turned down the volume. Positioning on speculative S&P 500 futures contracts is the most bearish in over a decade. If the market went down, it seems as if it would come as a surprise to absolutely no one. Yet with unimpressive breadth, stocks have continued to fight their way higher this year, and the volatility index (VIX) trotted its way lower. What gives? Is this the calm before the storm, or durable momentum to the upside? The reality is, no one truly knows the answer. The best we can do is use the information we have about the current environment and our knowledge of previous cycles. Unfortunately, that doesn’t make this much easier, nor does it stop the constant, “is this time different?” chatter. It’s always a little bit different. The catalysts that take us into downturns are of a new flavor each time, and the sectors that suffer most tend to differ. So what might the catalyst be, if one materializes?Looking for the Poison Apple

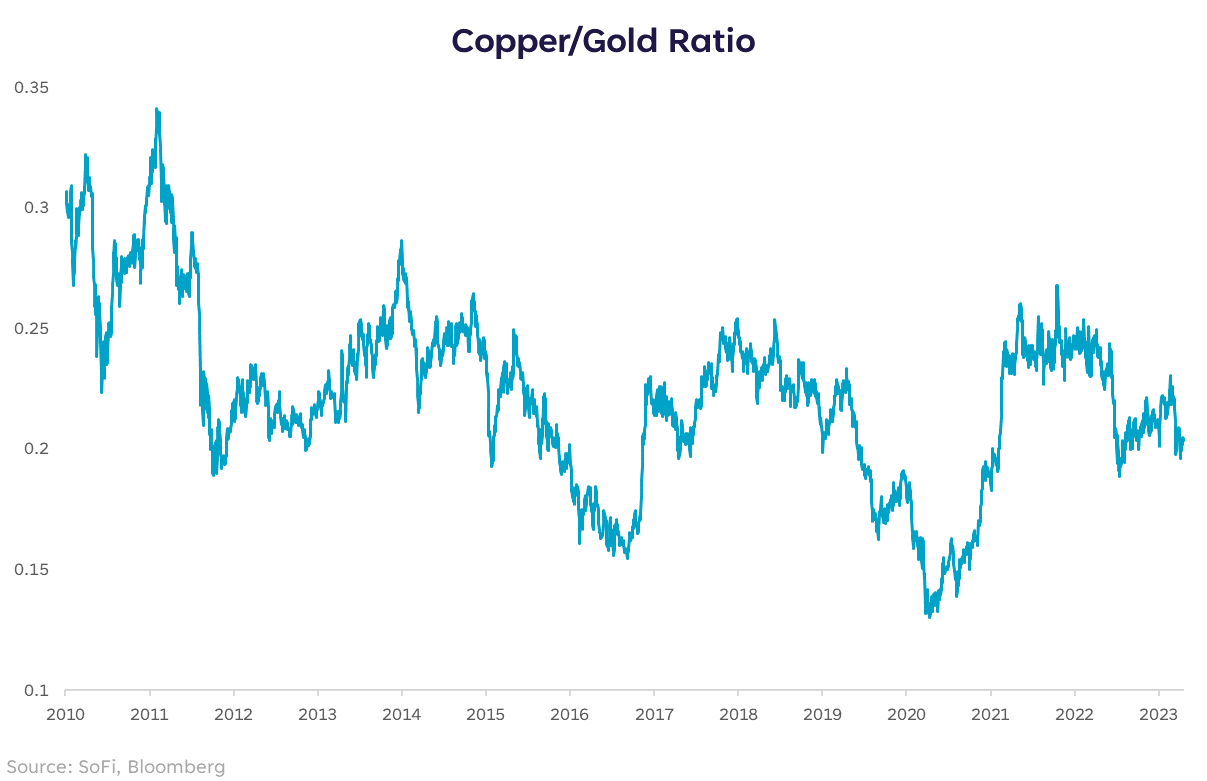

As we know, the culprit is rarely found in the places we expect. Right now, the most obvious possibilities would be further stress in the banking system, disappointing earnings results, or upside surprises to inflation. So far, none of these have concretely materialized. Nor has any new unforeseen shock, but the sense in markets is that something is lurking out there. If this were the beginning of a new bull market and a new economic expansion, there are certain signals we’d expect to see. One of which is small caps at least participating in the rally, if not leading other indices. No such luck. Another signal of cyclical strength could be found in the copper to gold ratio. In times of expansion, copper tends to handily outperform gold (which is seen as a safe haven store of value). As such, if this were the beginning of an expansion in concert with an increase in stock prices, we would expect this ratio to be moving up. Again, no such luck. Despite a sleepy VIX index and resilient stock valuations, it’s contradictory signals like these that keep myself, and likely others, consistent in our cautious tone. If I have to try too hard to find the fundamental reasons that support a technical market move, I don’t trust the move.Mirror, Mirror, on the Wall

Nevertheless, extended periods of sanguine markets that make bearish sentiment look misguided can feel as if we’re staring into a magic mirror that’s telling us lies. A frustrating time at best, downright inexplicable at worst. But such is life in the land of markets. What to do in the meantime? Many assume that the most bearish investors are simply not invested in anything at the moment, and I think that’s quite untrue. I’ll speak for myself in saying that over the course of the past few months, the places I’ve suggested rotating money into are ones that I don’t typically tout as big upside opportunities, but this is a unique environment. The message — while we watch earnings data, economic data, and headlines roll in — is to be invested, but at these valuations, not overly exposed to rate-sensitive or economically sensitive sectors. Instead, take the benefits of yield and stores of value in instruments such as short-term Treasuries, gold, utilities, and money market funds. I’d think of these investments as things I’m in “for a good time, not a long time.” Although they don’t seem incredibly interesting, I’d call a 4% yield in cash-like instruments, and a 9% YTD return in gold a decent way to bide our time until equities offer a more compelling risk/reward tradeoff.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content. Communication of SoFi Wealth LLC an SEC Registered Investment Advisor SoFi isn't recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv. SOSS23042004