Much Ado About China

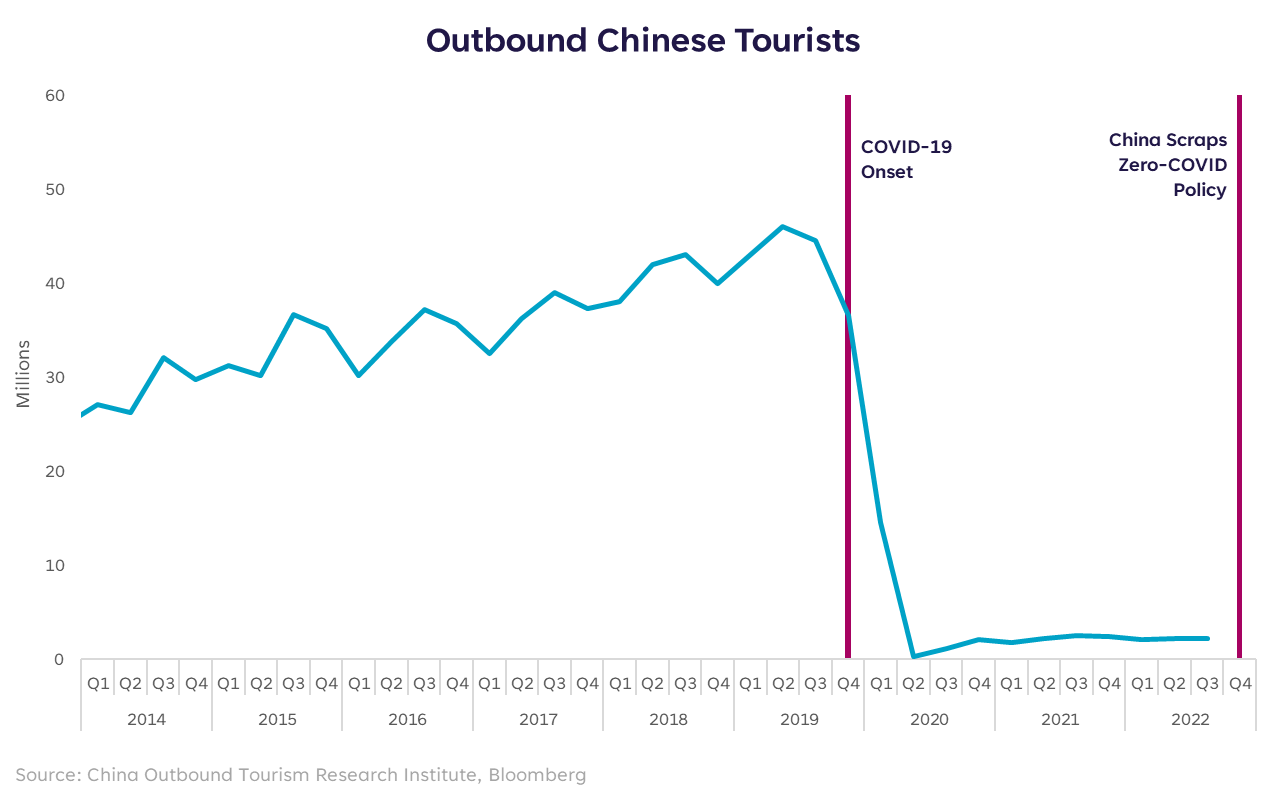

Although China is rarely noticeably absent from headlines, its return to being top of mind has been feverishly fierce in recent weeks. And although Shakespeare has nothing to do with this topic, I’ve chosen it as the heading theme. Not everything makes sense. China is a hot topic after its government reopened the borders and scrapped its zero-COVID policy that citizens have lived under since 2020. A simple Google search for “China reopening” returns endless articles, opinions, pontifications, and predictions on what this could mean for the rest of the globe. Questions that now arise are: Is this good or bad? Does it prevent a global recession or make it more likely? Will China actually stay open or reverse course? (“To be, or not to be, that is the question.”) For starters, let’s take a look at what it could mean for the travel industry. Pre-COVID, outbound Chinese tourists amounted to 150-200 million people per year. The onset of COVID stopped that for all countries, but China’s restrictions have kept it suppressed. Granted, not all of those tourists came to the U.S., and it will likely take time to get back to 2019 levels. That said, even if half this many people traveled in 2023, it could present a notable demand tailwind for hospitality, retail, airlines, and service industries around the globe. In a very straightforward sense, this is positive for global consumption. In reality, it’s complicated.What’s Past is Prologue

Luckily, the rest of the world has already completed this reopening mission, and we have our experience to draw upon. There was indeed a lot of pent up demand, but there was also a shortage of supply, a shortage of materials, and resulting inflation acceleration. Cue the present day global fight against inflation. China's reopening is smaller in scale than the combination of most developed nations doing it at the same time. Still, given that China is the world’s second largest economy, it deserves consideration, or at the very least a double-check of our growth and inflation assumptions. The delights and consequences of the rest of the world reopening were many, and I’d expect this experience to be similar, although at an accelerated pace for China. We’re already seeing some consequences as COVID cases have surged and some countries have placed restrictions on traveling to and from the People’s Republic of China. I’ve seen this movie before…we, too, experienced a spike in COVID cases as everyone began traveling again and went through a seemingly endless process of lifting and then reinstating certain restrictions, with uneven adoption across the country and around the globe. This announcement of a reopening isn’t a magic bullet for growth in the short-term as China goes through its own re-entry to Earth, but in the long-run, it is positive for demand.Wisely, and Slow. They Stumble That Run Fast.

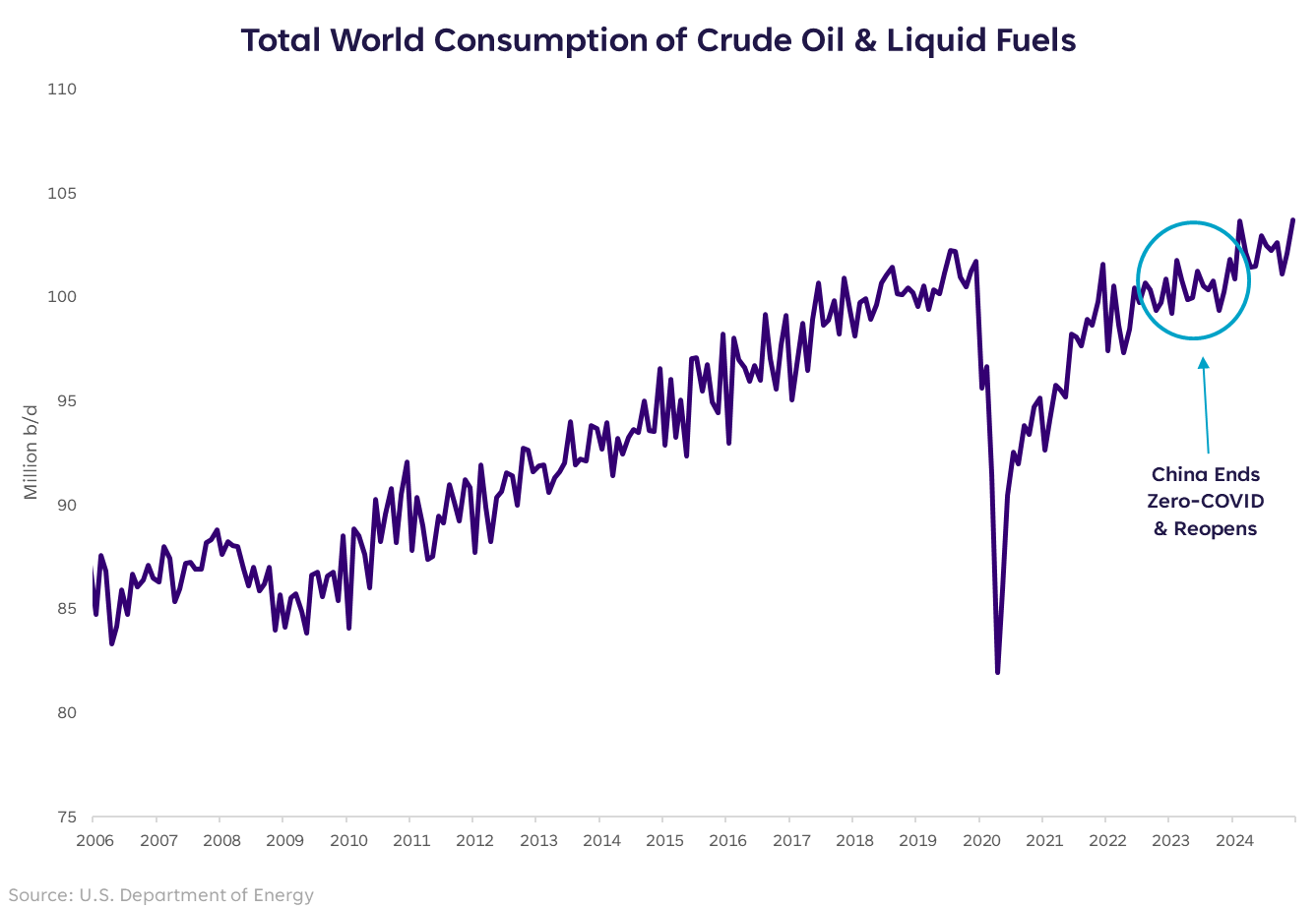

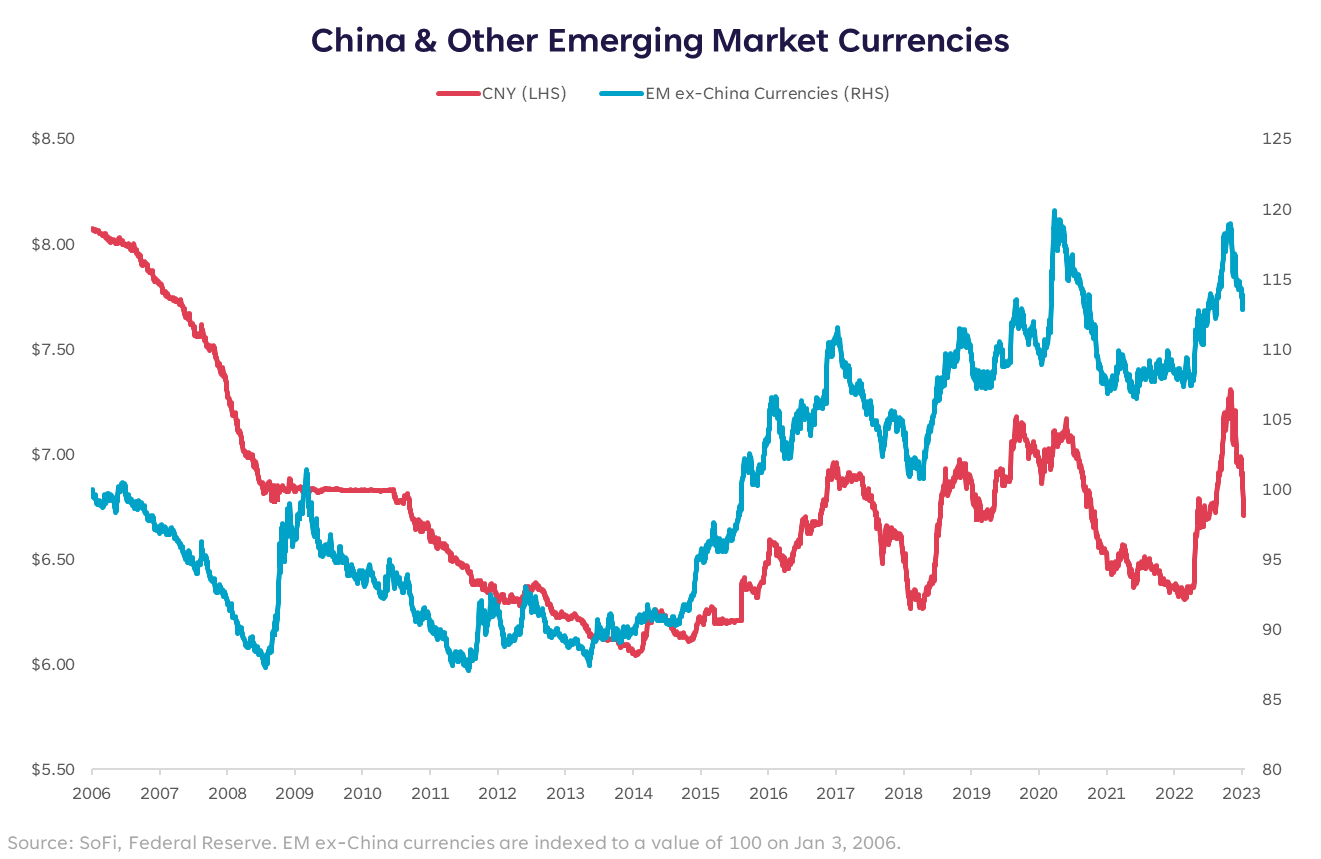

However, the current concern is that much of the rest of the world is trying to control inflation which requires some forced reduction in demand. The most vulnerable spots to this increased demand are likely commodity markets, and particularly oil. Brent crude is down markedly from its 2022 peak of $128/barrel (to $85/barrel today), but since the move by China to scrap zero-COVID it’s up 9% — and that was less than two weeks ago. Needless to say, this could present a problem for global central banks as they battle headline inflation. While investors continue to over-index to what the Fed is or isn’t going to do, this could be a curve ball in inflation readings while the world absorbs the increase in activity. Turning the discussion to what it means for China domestically, and for the rest of Emerging Markets (EM), so far the currency moves have been quite large. After a recent depreciation vs. the U.S. Dollar, both the Chinese Yuan and a basket of EM currencies have strengthened on the news (lower values = strengthening vs. the USD). As investors, this is another data point to note. Emerging markets certainly carry higher risk than developed markets and they’ve remained unattractive due to geopolitical risks (which remain), currency weakness and volatility (monitoring closely), and their dependence on China (reopening reduces this headwind). In the name of global consumption, I welcome this reopening news. In the name of investing, I submit that it does present an interesting bull case for international markets. But in the name of prudent investing, I point to the heading of this section: “wisely, and slow.” I think it’s a bit too soon right now. I still want to let some of the initial boom simmer down so that we have a better idea of just how “open” China will stay. But given that my main focus in 2023 markets is valuation, international developed and emerging markets pose a much more affordable bargain than the U.S. The next two to three months will be very telling for the Fed, global markets, and corporate earnings. Let’s get through a bit more of that journey before we revisit this opportunity, after all, “Modest doubt is called the beacon of the wise.”

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content. Communication of SoFi Wealth LLC an SEC Registered Investment Advisor SoFi isn't recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv. SOSS23011903