Knowing when to sell a stock is a complex enterprise, even for the most sophisticated investors. In a perfect world you’d sell a stock when you’d made a profit and wanted to capture the gains. But even that scenario raises questions of your target amount (have you made enough?) and timing (would it be better to hold the stock longer?).

Similar questions arise when the stock is losing value. Is it a true loser or is the company just underperforming? Should you sell and cut your losses — or would you be locking in losses just before a rebound?

Adding to the above there are questions of personal need, opportunity costs, tax considerations, and more that investors must keep in mind as they decide when to sell their stocks. Fortunately there is a fairly finite list of considerations, as well as different order types like market sell, stop-loss, stop-limit, and others that give investors some control over the decision of when to sell a stock.

Key Points

• Knowing when to sell a stock is complex, considering factors like profit, timing, personal needs, taxes, and investment style.

• Factors to consider when deciding to sell a stock include goals, company fundamentals, economic trends, volatility, and taxes.

• Some investors rarely sell stocks, while others sell more frequently based on their investment goals and desired returns.

• Reasons to sell a stock include loss of faith in the company, opportunity cost, high valuation, personal reasons, and tax considerations.

• Reasons to hold onto a stock include potential growth, belief in long-term performance, economic forecasts, and avoiding emotional decision-making.

When Is a Good Time to Sell Stocks?

There are a few ways to approach the question of when to sell stocks. Risk, style, investing goals, and how much time you have are all critical variables. Perhaps the most relevant answer is “when you need to,” as that criterion alone requires specific calculations that depend on your overall plan, the type of investor you are, your risk tolerance, market conditions (i.e. stock market fluctuations), and of course the stock itself.

When deciding when to sell a stock, you might weigh:

• How the stock fits into your goals

• Company fundamentals

• Economic trends

• Your hoped-for profit

• Volatility and/or losses

• Taxes

In addition, whether you sell your stocks will boil down to your investment style — are you day trading or employing a buy-and-hold strategy? — how much risk you’re willing to assume, and your overall time horizon and other goals (i.e. tax considerations).

Many investors who are simply investing for retirement may rarely sell stocks. After all, over time the average stock market return has been about 10% (not taking inflation into account).

And while there are no guarantees, in general the old saying that “time in the market is better than timing the market” tends to hold true.

Others, who are looking to turn a profit on a weekly or monthly basis, may sell much more frequently. It’s more a matter of looking at what you’re hoping to generate from your investments, and how fast you’re hoping to generate it.

Get up to $1,000 in stock when you fund a new Active Invest account.*

Access stock trading, options, alternative investments, IRAs, and more. Get started in just a few minutes.

*Customer must fund their Active Invest account with at least $50 within 45 days of opening the account. Probability of customer receiving $1,000 is 0.026%. See full terms and conditions.

8 Reasons You Might Sell a Stock

There are several reasons that could prompt you to think about selling your stock.

1. When You No Longer Believe in the Company

When you bought shares of a certain company, you presumably did so because you believed that the company was promising and you wanted to invest in its stock, and/or that the share price was reasonable. But if you start to believe that the underlying fundamentals of the business are in decline, it might be time to sell the stock and reinvest those funds in a company with a better outlook.

There are many reasons you may lose faith in a stock’s underlying fundamentals. For example, the company may have declining profit margins or decreasing revenue, increased competition, new leadership taking the company in a different direction, or legal problems.

Part of the task here is differentiating what might be a short-term blip in the stock price due to a bad quarter or even a bad year, and what feels like it could be the start of a more sustained change within the business.

Recommended: Tips on Evaluating Stock Performance

2. Due to Opportunity Cost

Every investment decision you make comes at the cost of some other decision you can’t make. When you invest your money in one thing, the tradeoff is that you cannot invest that money in something else.

So, for each stock you buy you are doing so at the cost of not buying some other asset.

Given the performance of the stock you’re currently holding, it might be worth evaluating it to see if there could be a more profitable way to deploy those same dollars. Exchange-traded funds (ETFs) that provide easy access to other asset classes — like bonds or commodities — have also created competition to simply holding company stocks.

This is easier said than done, however, because we are often emotionally invested in the stocks that we’ve already purchased. Nonetheless, it’s important to include an evaluation of opportunity costs as part of your overall decision about when to sell a stock.

3. Because the Valuation Is High

Often, stocks are evaluated in terms of their price-to-earnings (P/E) ratios. The market price per share is on the top of the equation, and on the bottom of the equation is the earnings per share. This ratio allows investors to make an apples-to-apples comparison of the relative earnings at different companies.

The higher the number, the higher the price as compared to the earnings of that company. A P/E ratio alone might not tell you whether a stock is going to do well or poorly in the future. But when paired with other data, such as historical ratios for that same stock, or the earnings multiples of their competitors or a benchmark market, like the S&P 500 Index, it may be an indicator that the stock is currently overpriced and that it may be time to sell the stock.

A P/E ratio could increase due to one of two reasons: Because the price has increased without a corresponding increase in the expected earnings for that company, or because the earnings expectations have been lowered without a corresponding decrease in the price of the stock. Either of these scenarios tells us that there could be trouble for the stock on the horizon, though nothing’s a sure bet.

4. For Personal Reasons

It’s also possible that you may need to sell a stock for personal reasons, such as:

• You need the cash (owing to a job loss, emergency, etc.)

• You no longer believe in the mission of the company

• Your risk tolerance has changed and you’re moving away from equities

• You want to try another strategy other than active investing, for example automated investing, where your investment choices are largely guided by the input of a sophisticated algorithm.

Since personal reasons may also have emotions attached to them, it’s wise to balance out your personal feelings with an evaluation of other reasons to sell the stock.

5. Because of Taxes

Employing a tax-efficient investing strategy shouldn’t outweigh making decisions based on other priorities. Still, it’s important to take taxes into account when making decisions about which stocks to keep and which stocks to sell.

When purchased outside of a retirement account, gains on the sale of an investment are subject to capital gains tax rules. It may be possible to offset some capital gains with capital losses, which are triggered by selling stocks at a loss.

This strategy is known as tax-loss harvesting.

For example, if an investor sells a security for a $25,000 gain, and sells another security at a $10,000 loss, the loss could be applied so that the investor would only see a capital gain of $15,000 ($25,000 – $10,000).

If you’re considering this as part of a self-directed trading strategy, you may want to consult a tax professional, as the rules can be complicated in terms of short-term vs. long-term gains, replacing a stock you sell with one that’s substantially different, as well as how to carryover losses.

• Understanding how a tax loss can be carried forward

The difference between capital gains and capital losses is called a net capital gain. If losses exceed gains, that’s a net capital loss.

• If an investor has an overall net capital loss for the year, they can deduct up to $3,000 against other kinds of income — including their salary and interest income.

• Any excess net capital loss can be carried over to subsequent years (known as a tax-loss carryover or carry forward) and deducted against capital gains and up to $3,000 of other kinds of income — depending on the circumstances.

• For those who are married filing separately, the annual net capital loss deduction limit is only $1,500.

Recommended: Unrealized Gains and Losses Explained

6. To Rebalance a Portfolio

If you’re looking to make some tweaks to your investment strategy for one reason or another, you may want to sell some stocks as a part of a strategy to rebalance your portfolio. The reason for rebalancing is to keep your portfolio anchored on the asset allocation that you prefer.

As some investments rise and fall over time, your asset allocation naturally shifts. Some asset classes might exceed the percentage you originally chose, based on your risk tolerance.

Investors are encouraged to rebalance their portfolios regularly — but not too often — as market and economic conditions can and do change. An annual rebalancing strategy is common.

This typically involves taking a look at your desired asset allocation, thinking about your risk tolerance (and how it may have changed), and deciding how you may want to change the different asset classes that comprise your portfolio, if at all.

7. Because You Made a Mistake

You may want to sell stocks if you simply made a mistake. Perhaps the company or sector is not a priority for you, or not a good bet in your eye. Maybe a stock is too risk or volatile. Maybe you bought into a company because it was in the news, or friends were raving about it (a.k.a. FOMO trading).

All of these conditions can happen to investors, and knowing when to sell a stock sometimes means owning up to a mistake.

Recommended: Guide to Financially Preparing for Retirement

8. You’ve Met Your Goals

In the best case, of course, you might want to sell a stock once you’ve met your goals. Perhaps the price is right, or you’re ready to retire, or you’ve crossed some other threshold where you no longer need to hold onto the stock.

In that case, the decision to sell will likely come down to timing and taxes. Or, if you’re preparing to retire, you may also want to consider whether you’re holding the stock in a tax-deferred account or not.

💡 Quick Tip: When you’re actively investing in stocks it’s important to ask what types of fees you might have to pay. For example, brokers may charge a flat fee for trading stocks, or require some commission for every trade. Taking the time to manage investment costs can be beneficial over the long term.

4 Reasons You Might Not Want to Sell a Stock

In addition to weighing possible reasons for selling a stock, there are counter arguments for holding onto your shares.

1. Because a Stock Went Up

As mentioned, most stock prices will go up at some point, and you may want to hold onto your stock in the hope that it will continue to grow. That’s a valid reason, especially if you’re thinking long term.

Just bear in mind that there are no guarantees, and past performance is no guarantee of future results, as the industry mantra goes. So even if a stock’s price is rising, you may want to have a few other reasons for not selling the stock.

2. Because a Stock Went Down

Just as a stock may go up, the price will also go down at some point. At those moments it may be tempting to cut your losses before you accrue even bigger ones — especially if you believe that the stock’s value will continue to drop.

But, again, it may be helpful to think longer term rather than what’s happening today. The stock price might rebound, and you may only lock your losses in by selling. Analyzing the company fundamentals as well as the economic climate can help you make this decision.

Recommended: What Happens If a Stock Goes to Zero?

3. Because of an Economic Forecast

Economic forecasting uses a range of economic indicators — such as interest rates, consumer confidence, the rate of inflation, unemployment rates — to predict or anticipate economic growth. But economic forecasting is not an exact science, and it’s wise to consider other factors.

In addition, economic forecasts come and go. This is especially the case in the short term. Therefore, changes in stock prices may have as much to do with investor sentiment or outside forces (such as political or economic events or announcements) as they do with the health of the underlying company.

4. Because Everyone Else Is Selling

Understanding the impact of other investors on your own decisions is equally important. While you may think you’re capable of remaining calm in the face of media hype and headlines, as numerous behavioral finance studies have shown it’s surprisingly easy to get caught up in what other investors are doing.

If you find yourself questioning your own investment plan or your own logic, think twice to make sure the impulse to sell isn’t brought on by strong emotions or by the opinions of others.

Selling a Stock 101

These are the basic steps required to cash out and sell stocks:

1. Whether by phone or via an online brokerage account platform, let your broker know which of your stock holdings you’d like to sell.

2. Specify which order type (more on that below). This can determine at what price level your stock is sold.

3. Fill out any other information your broker requires in order to initiate the sale. For instance, some accounts may have a “time in force” option, or when the order expires. Keep in mind, the trade date is different from the settlement date. It usually takes a couple of days for a trade to settle.

4. Click “Sell” or “Submit Order.”

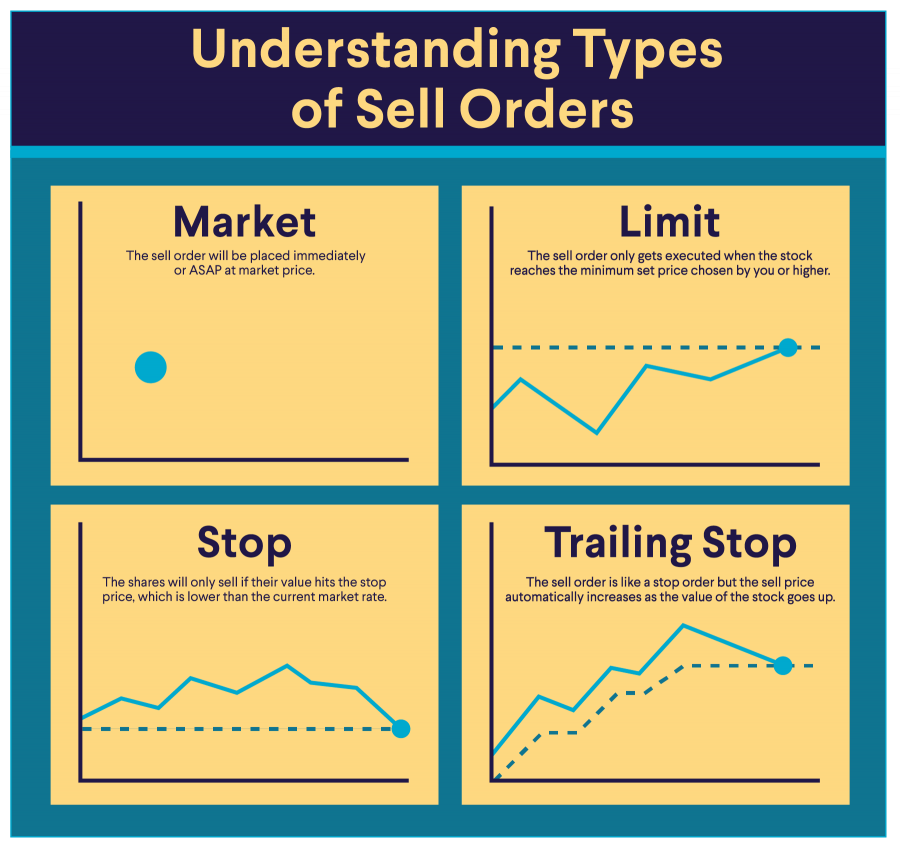

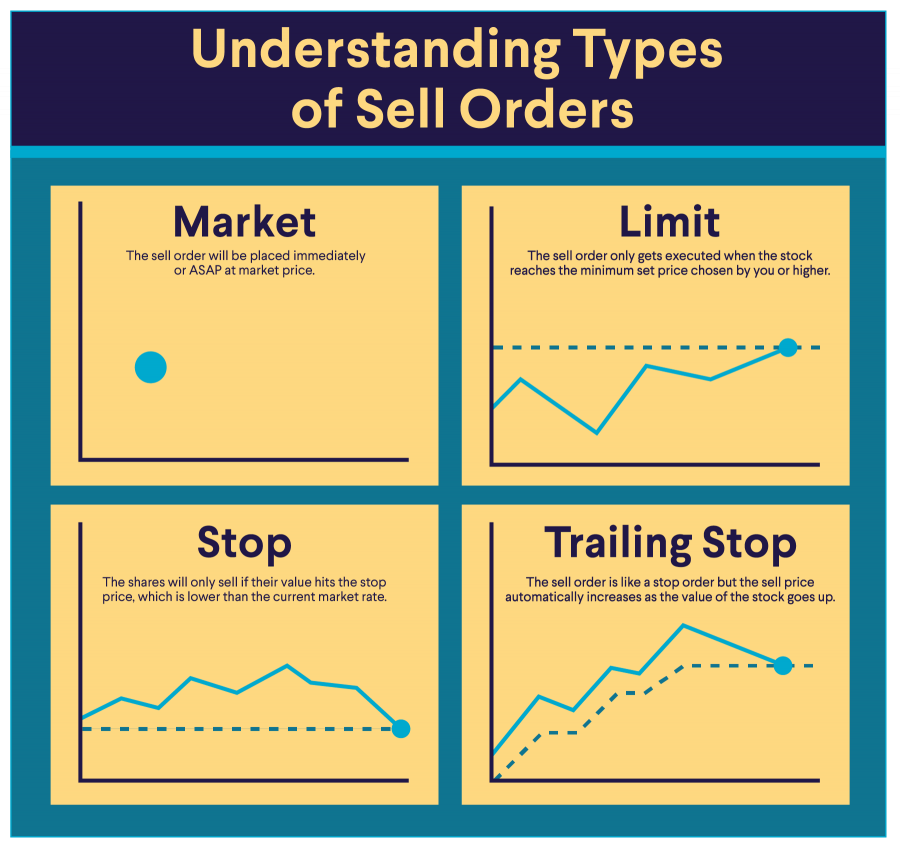

Different Sell Order Types

There are several different stock order types that can be useful in different situations.

Market Sell Order

This order type involves selling a stock immediately. The order will be executed without the investor specifying any price level to sell at. It’s important for investors to know however that because share prices are constantly shifting, they might not get the exact price they see on their stock-data feed. There may also be a difference due to delayed versus real-time stock quotes to consider as well.

Generally speaking, the advantage of using a market order is that your trade is likely to be executed quickly. That’s especially true for bigger or more popular stocks, which tend to be more liquid. But again: the biggest potential drawback is that you might not get the exact price you thought you were due to market volatility.

Limit Sell Order

Limit orders involve selling a stock at a specific price. For example, if you’re buying stocks, you can specify a price that you’re willing to pay — the trade will then be executed at that price, or lower.

If you’re selling stocks, the inverse is true — your stock will be sold at the specified price, or higher.

The upside to using limit orders is that they give investors some semblance of control by allowing them to name their price. The investor can then walk away, and let their brokerage handle the execution for them.

The downsides, though, include the fact that the trade may never execute if the specified price isn’t reached, and that using limit orders may take some practice and experience to properly execute.

Stop-Loss Sell Order

A stop-loss order is a level at which an automatic sell order kicks in. In other words, an investor specifies a price at which the broker should start selling, should the stock hit that level. This can also be referred to as a “sell-stop order.” But note that there are other types of stop-loss orders, such as buy-stop orders, and trailing stop-loss orders.

Stop-loss orders can be useful in that they can prevent investors from losing more than they’re comfortable with, or that they can afford to lose. They, as the name implies, are a very useful tool to prevent losses. But depending on overall market conditions, they can also work against an investor. If there’s a short-term drop in share prices, for instance, it’s possible that an investor could miss out on gains if share prices rebound in the medium or long term.

Stop-Limit Sell Order

A stop-limit sell order is an order that’s executed if your stock’s price drops to a certain price, but only if the shares can be sold at or above the limit price specified. They are, in effect, a sort of bridge between stop and limit orders. These types of orders can help investors dodge the risk that a stop order executed at an unexpected price, giving them more control over the price at which a sell order will execute.

Different Ways to Sell Stocks

There are desktop platforms and mobile phone apps that offer brokerage services. These are likely the most common platforms individual or retail investors use to currently buy or sell stocks. However, another option is through a financial advisor.

Financial advisors are professionals who have been entrusted to handle certain financial responsibilities and you can send them a stock sale order to execute. They can do a number of other things for you, too, including proffer advice and help you formulate an investing strategy. But there are costs to using financial advisors, so it may not be worth it, depending on how involved in the markets you are.

The Takeaway

There are times when it may be a good idea to sell your stocks, and others when it’s not. For example, if you’ve lost faith in a company, need a cash infusion, or are doing some portfolio rebalancing, it may be a good time to sell shares of a certain stock.

On the other hand, if you’re unnerved that your stock’s price fell after a bad earnings report, you may want to hold on and let things play out. It’s difficult, and is a true test of your risk tolerance. But over time, it should become easier and more natural as you gain experience as an investor.

Invest in what matters most to you with SoFi Active Invest. In a self-directed account provided by SoFi Securities, you can trade stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, options, and more — all while paying $0 commission on every trade. Other fees may apply. Whether you want to trade after-hours or manage your portfolio using real-time stock insights and analyst ratings, you can invest your way in SoFi's easy-to-use mobile app.

Invest with as little as $5 with a SoFi Active Investing account.

FAQ

How can you tell when to sell a stock?

There’s no exact science, and determining whether it’s a good time to sell a stock will come down to the individual investor’s strategy, risk tolerance, and time horizon. However, you can also keep an eye on a stock’s valuation, consider your opportunity costs, and weigh other factors in order to make the decision.

Should you ever sell stocks when they’re down?

You can sell stocks when they lose value for any number of reasons, but it’s wise to make sure you’re doing so as a part of an overall investing strategy, e.g. tax-loss harvesting, and not simply because you’re making an emotional or impulsive decision based on current market conditions.

How much profit do I need before I sell a stock?

There’s no exact science or answer to determine how much of a return you’d need to see before you sell a stock. That’s up to the specific investor, and there may be times when selling a stock at a loss is preferable for tax purposes or other reasons.

Photo credit: iStock/FotoDuets

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

SoFi Invest is a trade name used by SoFi Wealth LLC and SoFi Securities LLC offering investment products and services. Robo investing and advisory services are provided by SoFi Wealth LLC, an SEC-registered investment adviser. Brokerage and self-directed investing products offered through SoFi Securities LLC, Member FINRA/SIPC.

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Exchange Traded Funds (ETFs): Investors should carefully consider the information contained in the prospectus, which contains the Fund’s investment objectives, risks, charges, expenses, and other relevant information. You may obtain a prospectus from the Fund company’s website or by emailing customer service at [email protected]. Please read the prospectus carefully prior to investing.

Investment Risk: Diversification can help reduce some investment risk. It cannot guarantee profit, or fully protect in a down market.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Disclaimer: The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results.

SOIN0224005

Read more