Guide To Employee Stock Ownership Plans

You may have come across the term “ESOP” and wondered, what does ESOP stand for? An employee stock ownership plan (ESOP) is a type of defined contribution plan that allows workers to own shares of their company’s stock. While these plans are covered by many of the same rules and regulations that apply to 401(k) plans, an ESOP uses a different approach to help employees fund their retirement.

The National Center for Employee Ownership estimates that there are approximately 6,533 ESOPs covering nearly 15 million workers in the U.S. But what is an employee stock ownership plan exactly? How is an ESOP a defined contribution plan? And how does it work?

If you have access to this type of retirement plan through your company, it’s important to understand the ESOP meaning and where it might fit into your retirement strategy.

What Is an Employee Stock Ownership Plan (ESOP)?

An ESOP as defined by the IRS is “an IRC section 401(a) qualified defined contribution plan that is a stock bonus plan or a stock bonus/money purchase plan.” (IRC stands for Internal Revenue Code.) So what is ESOP in simpler terms? It’s a type of retirement plan that allows you to own shares of your company’s stock.

Though both ESOPs and 401(k)s are qualified retirement plans, the two are different in terms of how they are funded and what you’re investing in. For example, while employee contributions to an ESOP are allowed, they’re not required. Plus, you can have an ESOP and a 401(k) if your employer offers one. According to the ESOP Association, 93.6% of employers who offer an ESOP also offer a 401(k) plan for workers who are interested in investing for retirement.

How Employee Stock Ownership Plans Work

In creating an ESOP, the company establishes a trust fund for the purpose of holding new shares of stock or cash to buy existing shares of stock in the company. The company may also borrow money with which to purchase shares. Unlike employee stock options, with an ESOP employees don’t purchase shares themselves.

Shares held in the trust are divided among employee accounts. The percentage of shares held by each employee may be based on their pay or another formula, as decided by the employer. Employees assume ownership of these shares according to a vesting schedule. Once an employee is fully vested, which must happen within three to six years, they own 100% of the shares in their account.

ESOP Distributions and Upfront Costs

When an employee changes jobs, retires, or leaves the company for any other reason, the company has to buy back the shares in their account at fair market value (if a private company) or at the current sales price (if a publicly-traded company). Depending on how the ESOP is structured, the payout may take the form of a lump sum or be spread over several years.

For employees, there are typically no upfront costs for an ESOP.

Employee Stock Ownership Plan Examples

A number of companies use employee stock ownership plans alongside or in place of 401(k) plans to help employees save for retirement, and there are a variety of employee stock ownership plan examples. Some of the largest companies that are at least 50% employee-owned through an ESOP include:

• Publix Super Markets

• WinCo Foods

• Amsted Industries

• Brookshire Grocery Company

• Houchens Industries

• Performance Contracting, Inc.

• Parsons

• Davey Tree Expert

• W.L. Gore & Associates

• HDR, Inc.

Seven of the companies on this list are 100% employee-owned, meaning they offer no other retirement plan option. Employee stock ownership plans are popular among supermarkets but they’re also used in other industries, including engineering, manufacturing, and construction.

Pros & Cons of ESOP Plans

ESOPs are attractive to employees as part of a benefits package, and can also yield some tax benefits for employers. Whether this type of retirement savings plan is right for you, however, can depend on your investment goals, your long-term career plans, and your needs in terms of how long your savings will last. Here are some of the employee stock ownership plans pros and cons.

Pros of ESOP Plans

With an ESOP, employees get the benefit of:

• Shares of company stock purchased on their behalf, with no out-of-pocket investment

• Fair market value for those shares when they leave the company

• No taxes owed on contributions

• Dividend reinvestment, if that’s offered by the company

An ESOP can be an attractive savings option for employees who may not be able to make a regular payroll deduction to a 401(k) or similar plan. You can still grow wealth for retirement as you’re employed by the company, without having to pay anything from your own pocket.

Cons of ESOP Plans

In terms of downsides, there are a few things that might make employees think twice about using an ESOP for retirement savings. Here are some of the potential drawbacks to consider:

• Distributions can be complicated and may take time to process

• You’ll owe income tax on distributions

• If you change jobs means you’ll only be able to keep the portion of your ESOP that you’re vested in

• ESOPs only hold shares of company stocks so there’s no room for diversification

Pros and Cons of ESOP Plan Side-by-Side Comparison

| Pros | Cons |

|---|---|

|

• Shares of company stock purchased on employees’ behalf, with no out-of-pocket investment • Fair market value for those shares when they leave the company • No taxes owed on contributions • Dividend reinvestment, if that’s offered by the company |

• Distributions can be complicated and may take time to process • You’ll owe income tax on those distributions • Changing jobs means you’ll only be able to keep the portion of your ESOP that you’re vested in • ESOPs only hold shares of company stocks so there’s no room for diversification |

By comparison, a 401(k) could offer more flexibility in terms of what you invest in and how you access those funds when changing jobs or retiring. But it’s important to remember that the amount you’re able to walk away with in a 401(k) largely hinges on what you contribute during your working years, whereas an ESOP can be funded without you contributing a single penny.

💡 Quick Tip: Did you know that you must choose the investments in your IRA? Once you open a new IRA and start saving, you get to decide which mutual funds, ETFs, or other investments you want — it’s totally up to you.

ESOP Contribution Limits

The IRS sets contribution limits on other retirement plans, and ESOPs are no different. In particular, there are two limits to pay attention to:

• Limit for determining the lengthening of the five-year distribution period

• Limit for determining the maximum account balance subject to the five-year distribution period

Like other retirement plan limits, the IRS raises ESOP limits regularly through cost of living adjustments. Here’s how the ESOP compares for 2025 and 2026.

| ESOP Limits | 2025 | 2026 |

|---|---|---|

| Limit for determining the lengthening of the five-year distribution period | $280,000 | $290,000 |

| Limit for determining the maximum account balance subject to the five-year distribution period | $1,415,000 | $1,455,000 |

Cashing Out of an ESOP

In most cases, you can cash out of an ESOP only if you retire, leave the company, lose your job, become disabled, or pass away.

Check the specific rules for your plan to find out how the cashing-out process works.

Can You Roll ESOPs Into Other Retirement Plans?

You can roll an ESOP into other retirement plans such as IRAs. However, there are possible tax implications, so you’ll want to plan your rollover carefully.

ESOPs are tax-deferred plans. As long as you roll them over into another tax-deferred plan such as a traditional IRA, within 60 days, you generally won’t have to pay taxes.

However, a Roth IRA is not tax-deferred. In that case, if you roll over some or all of your ESOP into a Roth IRA, you will owe taxes on the amount your shares are worth.

Because rolling over an ESOP can be a complicated process and could involve tax implications, you may want to consult with a financial professional about the best way to do it for your particular situation.

ESOPs vs 401(k) Plans

Although ESOPs and 401(k)s are both retirement plans, the funding and distribution is different for each of them. Both plans have advantages and disadvantages. Here’s a side-by-side comparison of their pros and cons.

| ESOP | 401(k) | |

|---|---|---|

| Pros |

• Money is invested by the company, typically, and requires no contributions from employees. • Employees get fair market value for shares when they leave the company. • Company may offer dividend reinvestment. |

• Many employers offer matching funds. • Choice of options to invest in. • Generally easy to get distributions when an employee leaves the company. |

| Cons |

• ESOPs are invested in company stock only. • Value of shares may fall or rise based on the performance of the company. • Distribution may be complicated and take time. |

• Some employees may not be able to afford to contribute to the plan. • Employees must typically invest a certain amount to qualify for the employer match. • Employees are responsible for researching and choosing their investments. |

Recommended: Should You Open an IRA If You Already Have a 401(k)?

3 Other Forms of Employee Ownership

An ESOP is just one kind of employee ownership plan. These are some other examples of plans an employer might offer.

Stock options

Stock options allow employees to purchase shares of company stock at a certain price for a specific period of time.

Direct stock purchase plan

With these plans, employees can use their after-tax money to buy shares of the company’s stock. Some direct stock purchase plans may offer the stock at discounted prices.

Restricted stock

In the case of restricted stock, shares of stock may be awarded to employees who meet certain performance goals or metrics.

Investing for Retirement With SoFi

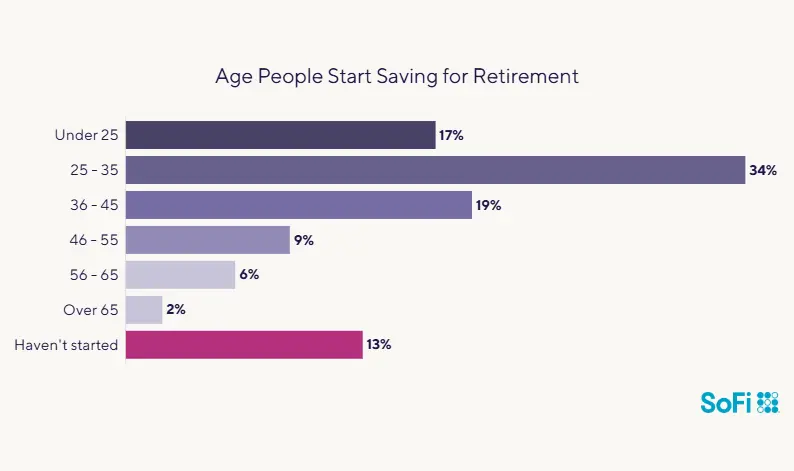

There are different things to consider when starting a retirement fund but it’s important to remember that time is on your side. No matter what type of plan you choose, the sooner you begin setting money aside for retirement, the more room it may have to grow.

Prepare for your retirement with an individual retirement account (IRA). It’s easy to get started when you open a traditional or Roth IRA with SoFi. Whether you prefer a hands-on self-directed IRA through SoFi Securities or an automated robo IRA with SoFi Wealth, you can build a portfolio to help support your long-term goals while gaining access to tax-advantaged savings strategies.

FAQ

Can employees contribute to an ESOP?

In most cases, the employer makes contributions to an ESOP on behalf of employees. Rarely, employers may allow for employee contributions to employee stock ownership plans.

What is the maximum contribution to an ESOP?

The maximum account balance allowed in an employee stock ownership plan is determined by the IRS. For 2025, this limit is $1,415,000, and for 2026, it’s $1,455,000, though amounts are increased periodically through cost of living adjustments.

What does ESOP stand for?

ESOP stands for employee stock ownership plan. This is a type of qualified defined contribution plan which allows employees to own shares of their company’s stock.

How does ESOP payout work?

When an employee changes jobs, retires, or leaves the company for any other reason, the company has to buy back the shares in their account at fair market value or at the current sales price, depending if the company is private or publicly-traded. The payout to the employee may take the form of a lump sum or be spread over several years. Check with your ESOP plan for specific information about the payout rules.

Is an ESOP better than a 401(k)?

An ESOP and a 401(k) are both retirement plans, and they each have pros and cons. For instance, the employer generally funds an ESOP while an employee contributes to a 401(k) and the employer may match a portion of those contributions. A 401(k) allows for more investment options, while an ESOP consists of shares of company stock.

It’s possible to have both an ESOP and a 401(k) if your employer gives you that option. Currently, almost 94% of companies that offer ESOPs also offer a 401(k), according to the ESOP Association.

About the author

Photo credit: iSTock/pixelfit

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Investment Risk: Diversification can help reduce some investment risk. It cannot guarantee profit, or fully protect in a down market.

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

¹Probability of Member receiving $1,000 is a probability of 0.026%; If you don’t make a selection in 45 days, you’ll no longer qualify for the promo. Customer must fund their account with a minimum of $50.00 to qualify. Probability percentage is subject to decrease. See full terms and conditions.

Exchange Traded Funds (ETFs): Investors should carefully consider the information contained in the prospectus, which contains the Fund’s investment objectives, risks, charges, expenses, and other relevant information. You may obtain a prospectus from the Fund company’s website or by emailing customer service at [email protected]. Please read the prospectus carefully prior to investing.

Options involve risks, including substantial risk of loss and the possibility an investor may lose the entire amount invested in a short period of time. Before an investor begins trading options they should familiarize themselves with the Characteristics and Risks of Standardized Options . Tax considerations with options transactions are unique, investors should consult with their tax advisor to understand the impact to their taxes.

Fund Fees

If you invest in Exchange Traded Funds (ETFs) through SoFi Invest (either by buying them yourself or via investing in SoFi Invest’s automated investments, formerly SoFi Wealth), these funds will have their own management fees. These fees are not paid directly by you, but rather by the fund itself. these fees do reduce the fund’s returns. Check out each fund’s prospectus for details. SoFi Invest does not receive sales commissions, 12b-1 fees, or other fees from ETFs for investing such funds on behalf of advisory clients, though if SoFi Invest creates its own funds, it could earn management fees there.

SoFi Invest may waive all, or part of any of these fees, permanently or for a period of time, at its sole discretion for any reason. Fees are subject to change at any time. The current fee schedule will always be available in your Account Documents section of SoFi Invest.

SOIN0224022

CN-Q425-3236452-128