Getting Private Student Loans Without a Cosigner

With the average cost of tuition at a private college close to $40,000 per year, it’s no surprise that many students will take out student loans to pay for their education. These student loans come in all shapes and sizes: federal or private, subsidized or unsubsidized, cosigned or not.

Most federal student loans do not require a credit check and can be borrowed without a cosigner. While the majority of students who take out private loans have a cosigner to guarantee the loan, that’s not an option for everyone. A cosigner — generally a family member or close friend — is someone who guarantees they will pay back your student loan if, for some reason, you can’t.

If you don’t have enough established credit to qualify for a private student loan on your own, turning to a cosigner may help you get approved at a better interest rate. However, not everyone has someone to cosign their student loans. Luckily, there are plenty of ways to potentially qualify for both private and federal student loans without a cosigner. Here’s what you need to know.

Key Points

• Many students need to take out loans due to rising tuition costs, with options including federal loans that do not require a cosigner.

• Obtaining a private student loan without a cosigner is possible, but typically requires a solid credit history and may result in higher interest rates.

• Federal student loans offer various funding options without the need for a cosigner, although loan limits may restrict the total amount available.

• Students unable to secure a loan without a cosigner can consider alternatives such as attending a community college or exploring grants and scholarships.

• Building credit early and checking eligibility through soft credit inquiries can help increase the chances of qualifying for loans without a cosigner.

Purpose of Adding a Cosigner

There are two main reasons why adding a cosigner to a private student loan may make sense — one is to improve your chances of being approved for a loan and the other is to potentially help secure a more competitive interest rate.

If you’re applying for student loans, you may not have a long credit history yet. To lenders, a lack of credit history can be seen as risky because you haven’t proved how well you can manage your financial obligations. You might need a cosigner to convince a lender to give you a student loan, since having a cosigner with more financial security or a better credit history reduces risk to the lender.

A cosigner with a strong credit history may also help you get approved for a loan with a lower interest rate, which could help reduce the amount of money you pay in interest over the life of the loan.

A cosigner will need to share their financial information with the lender, so it’s a good idea to make sure that your cosigner has plenty of time to get their documents in order and discuss loan applications with you.

Recommended: A Complete Guide to Private Student Loans

Named a Best Private Student Loans

Company by U.S. News & World Report.

Can You Get a Federal Student Loan Without a Cosigner?

Yes, you can get a federal student loan without a cosigner. The first step in qualifying for a federal financial aid package is to fill out the Free Application for Federal Student Aid (FAFSA) .

You’ll submit your financial information and, if you’re a dependent student, your parents’ information, too. Depending on your financial need, you’ll then be offered a combination of federal student loans — including Subsidized and Unsubsidized Direct or PLUS Loans — and work-study programs.

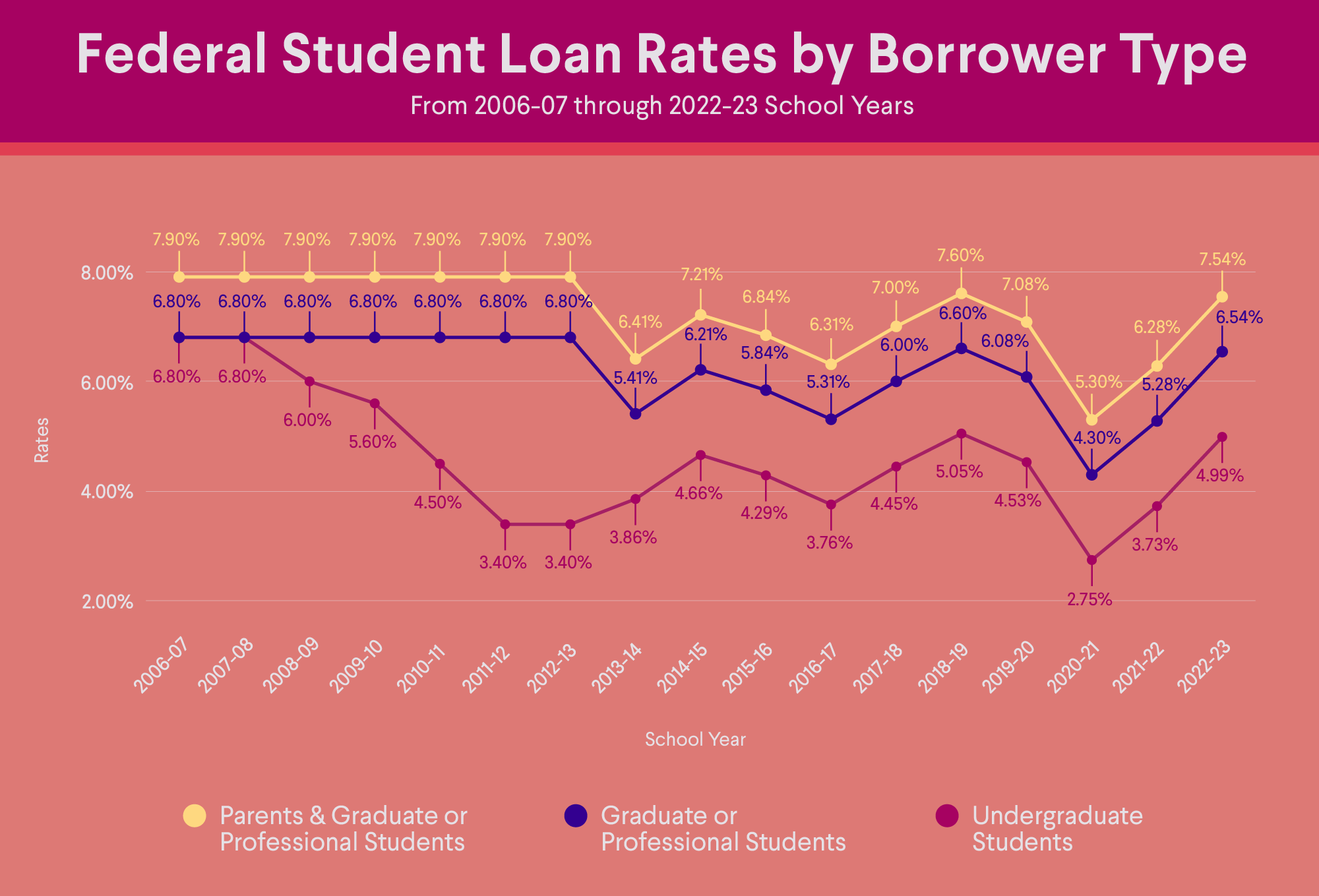

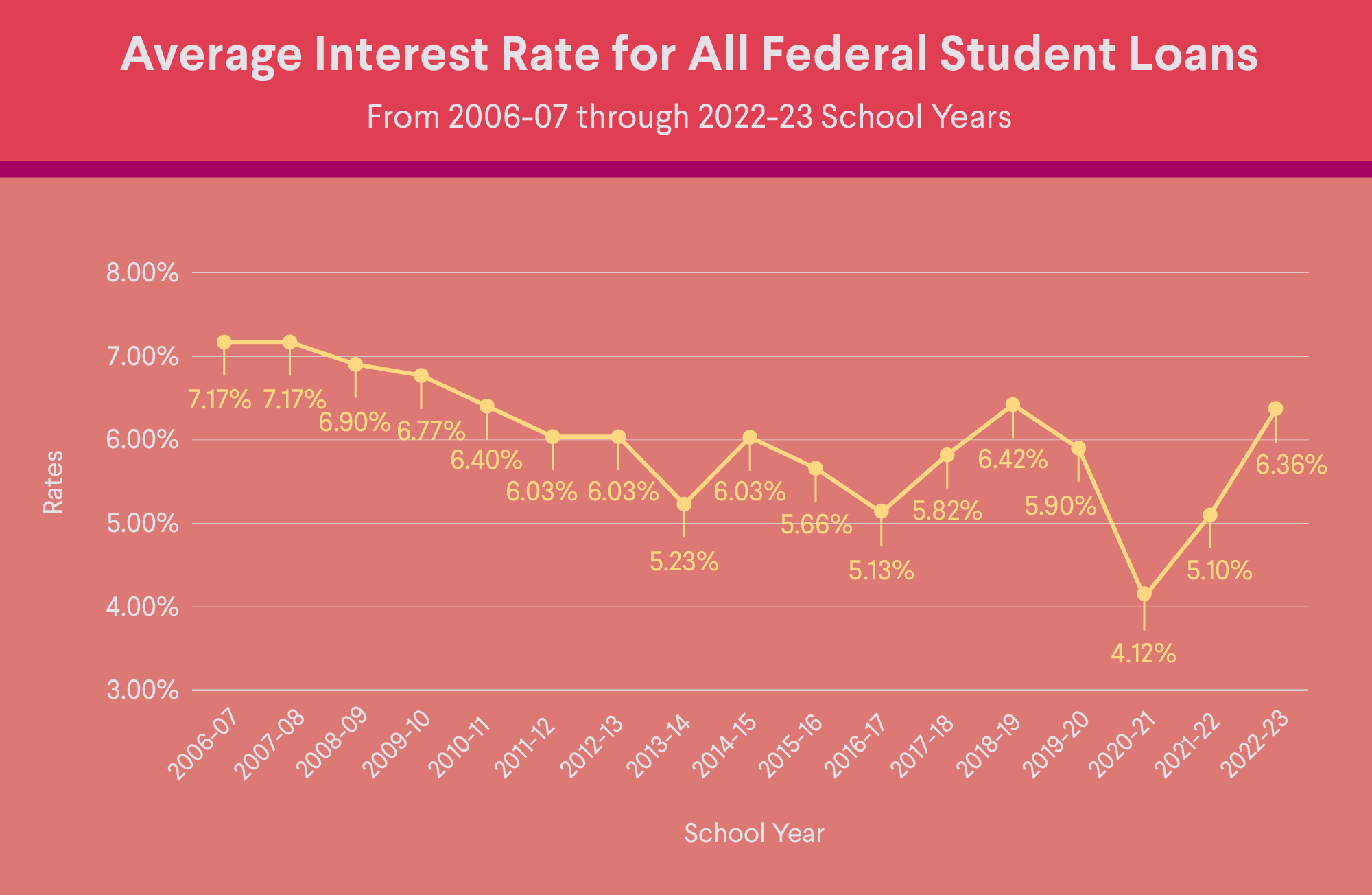

Federal student loans typically do not require a cosigner, nor a credit check, and they often have competitive interest rates. Direct PLUS Loans , which are primarily offered to parents and graduate or professional students, however, do require a credit check.

You’ll want to keep in mind that there are limits on how much you can take out in federal loans. For example, dependent students whose parents are unable to obtain PLUS Loans cannot take out more than $9,500 as a first-year undergrad. And, no more than $3,500 of this amount may be in subsidized loans. Because of these limits, students may look for additional sources of funding.

Can You Get a Private Student Loan Without a Cosigner?

Yes, it is possible to get a private student loan without a cosigner, but you will likely need to have an established credit history or be willing to pay a higher interest rate.

To qualify for a private student loan, which are available from banks, credit unions, and online lenders, you generally have to be age 18 or older, a U.S. resident, and enrolled in school at least part time. Additionally, certain lenders may only approve loans if you are enrolled at schools that meet their criteria, which can vary from lender to lender.

You also typically must meet certain credit requirements. This often includes at least two years of established credit history, a good credit score (670-739), and a certain minimum amount of income.

Some private lenders will provide student loans without a cosigner even if you have a limited credit history or income. However, you will almost definitely pay a higher interest rate.

💡 Quick Tip: It’s a good idea to understand the pros and cons of private student loans and federal student loans before committing to them.

Pros of Having a Cosigner on a Private Student Loan

Having a cosigner on a private student loan can help you qualify for a loan you might not otherwise be able to get. In addition, it can help you get approved for a larger loan amount, as well as lower rates and fees.

You’ll also want to keep in mind that having a cosigner is not necessarily a permanent situation. Some lenders will release a cosigner from a loan after the primary borrower meets certain requirements, like a certain number of payments and a credit check.

You also may consider refinancing your loan once you’re out of school, which will then be a way to have the loan in your own name. It can be a good idea to talk through what your cosigner expects and anticipates for the life of the loan, so that you’re both on the same page.

Recommended: Should I Refinance Federal Student Loans?

What is the Minimum Credit Score for a Student Loan?

If you apply for a federal student loan, your credit score won’t be a factor, since a credit check is not even part of the application process. However, private student loans often require a credit score of at least 670 to get a loan without a cosigner.

The exact qualification criteria will vary from lender to lender but, generally, the higher your credit score, the more likely you are to qualify and obtain a competitive interest rate for a private student loan.

Before you apply for a private student loan, you may want to get copies of your credit reports (available free at AnnualCreditReport.com) and check your credit score to get a sense of where you may stand in the eyes of a lender. You also can check your credit report for any errors, which could bring down your score.

Who Is Eligible for Student Loans That Don’t Require Cosigners?

Federal student loans don’t require a cosigner. There are also some private student loans that don’t require a cosigner, though you typically need to meet certain credit and income requirements.

You may be able to check your private student loan eligibility before you apply for a loan without a cosigner. This triggers a soft credit check. A soft credit check does not affect your credit score, but can give you an approximate idea of whether or not you’ll be approved for a loan and what the interest rate on the loan may be.

Keep in mind, though, that your loan won’t be finalized until you apply for the loan. At this point, a hard credit check will be performed and final approval decisions will come through. But checking loan eligibility is one way to know whether or not a lender may consider your application without a cosigner.

Options If You Can’t Get a Student Loan Without a Cosigner?

If you can’t get a student loan without a cosigner and you don’t have someone who can be your cosigner, don’t panic. There are other potential paths forward depending on your goals and your circumstances:

• Take a gap year. Some students take a year off to build credit, grow their income, and reapply once they feel their finances are on more secure footing.

• Consider a less expensive school. Some students who can’t get a cosigner decide to go to a community college and take core credit courses. Once they feel their finances are more secure, they transfer to their intended school to finish their degree.

• Rethink your education priorities. If you can’t get a cosigner and are having trouble shouldering loans on your loan, you may recalibrate your educational goals and consider different degree programs or institutions that may have a less expensive price tag. It can be helpful to talk to people who work in your future career field — they may have thoughts on how you can save money on education or may have tips for alternate paths toward the job you want.

• Talk with your financial aid office. Chances are, your financial aid office has seen similar situations and may have ideas. They may also be able to connect you with other funding opportunities, as well as students who have independently financed their education.

Other Ways to Help Finance Your Education

Besides taking out federal student loans or private student loans without a cosigner, there are a few other options to help finance your education.

Grants and Scholarships

There are many grants and scholarships available, including need-based grants and merit-based grants (grants available for students who reach a certain level of academic excellence) that you do not need to repay.

You can search for scholarships online to see if there are any you might qualify for. You might also ask your high school’s college counselor or selected college’s financial aid office for information on any scholarships or grants you may be eligible for.

Working While in School

You might also consider working while you’re in school. Some students find they can manage a job alongside their studies, while others find that it’s challenging to find a balance.

There is no “right” way to pay for your education. Some students may take a year or more off to save up for school, and then focus full-time on school. Talking to graduates can help you see different pathways and that there is no “one size fits all” when it comes to financing an education.

The Takeaway

Applying for a private student loan with a cosigner can help a potential borrower secure a more competitive interest rate or preferable loan terms. This is because the cosigner provides additional security for the lender — if the primary borrower runs into any issues repaying the loan, the cosigner is responsible.

Federal student loans, aside from Direct PLUS Loans, do not require a credit check or cosigner. If you find that your federal loans aren’t going to cover your education, a private student loan may help. And, some private lenders will offer student loans without a cosigner. Just keep in mind that private student loans lack the borrower protections offered by federal student loans.

If you’ve exhausted all federal student aid options, no-fee private student loans from SoFi can help you pay for school. The online application process is easy, and you can see rates and terms in just minutes. Repayment plans are flexible, so you can find an option that works for your financial plan and budget.

FAQ

Is it possible to get a private student loan without a cosigner?

Yes, it is possible, but it can be more difficult. Lenders typically require proof of good credit and sufficient income. Students without a strong financial profile may have trouble qualifying or may face higher interest rates.

How can students improve their chances of qualifying for a private student loan without a cosigner?

Students can build credit by paying bills on time, maintaining low credit card balances, and possibly working part-time to show income. A higher credit score and steady income improve the odds of loan approval.

Are there alternatives to private loans if you can’t get one without a cosigner?

Yes. Students should first maximize federal student aid, including grants, scholarships, and federal loans, which don’t require a cosigner. Some schools also offer institutional loans or payment plans that can help bridge funding gaps.

SoFi Private Student Loans

Terms and conditions apply. SOFI RESERVES THE RIGHT TO MODIFY OR DISCONTINUE PRODUCTS AND BENEFITS AT ANY TIME WITHOUT NOTICE. SoFi Private Student loans are subject to program terms and restrictions, such as completion of a loan application and self-certification form, verification of application information, the student's at least half-time enrollment in a degree program at a SoFi-participating school, and, if applicable, a co-signer. In addition, borrowers must be U.S. citizens or other eligible status, be residing in the U.S., Puerto Rico, U.S. Virgin Islands, or American Samoa, and must meet SoFi’s underwriting requirements, including verification of sufficient income to support your ability to repay. Minimum loan amount is $1,000. See SoFi.com/eligibility for more information. Lowest rates reserved for the most creditworthy borrowers. SoFi reserves the right to modify eligibility criteria at any time. This information is subject to change. This information is current as of 4/22/2025 and is subject to change. SoFi Private Student loans are originated by SoFi Bank, N.A. Member FDIC. NMLS #696891 (www.nmlsconsumeraccess.org).

SoFi Loan Products

Please borrow responsibly. SoFi Private Student loans are not a substitute for federal loans, grants, and work-study programs. We encourage you to evaluate all your federal student aid options before you consider any private loans, including ours. Read our FAQs.

SoFi Student Loan Refinance

Terms and conditions apply. SoFi Refinance Student Loans are private loans. When you refinance federal loans with a SoFi loan, YOU FORFEIT YOUR ELIGIBILITY FOR ALL FEDERAL LOAN BENEFITS, including all flexible federal repayment and forgiveness options that are or may become available to federal student loan borrowers including, but not limited to: Public Service Loan Forgiveness (PSLF), Income-Based Repayment, Income-Contingent Repayment, extended repayment plans, PAYE or SAVE. Lowest rates reserved for the most creditworthy borrowers. Learn more at SoFi.com/eligibility. SoFi Refinance Student Loans are originated by SoFi Bank, N.A. Member FDIC. NMLS #696891 (www.nmlsconsumeraccess.org).

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

SOISL-Q225-017

Read more