How to Avoid Overdraft Fees

Table of Contents

In your financial life, overdrafting your bank account is bad enough; no one likes to feel as if they’ve run out of money. But being charged an overdraft fee can dig you even deeper into the hole.

That’s why it can make sense to take some simple steps to avoid overdraft fees. You may be able to get a reprieve by contacting your bank or by linking accounts, among other moves.

In this guide, you’ll learn more about overdrafting and the charges involved, plus smart ideas for how to avoid overdraft fees.

Key Points

• Regularly monitor your account balance to track available funds and avoid spending more than you have to prevent an overdraft.

• Set up low balance alerts to receive notifications and take action before overdrafts occur.

• Manage overdraft coverage options to control when and how overdrafts are handled.

• Link your checking account to a savings account for automatic transfers to cover low balances.

• Use a modern mobile banking app for real-time account management and alerts.

What Is an Overdraft Fee?

If you pay out more than is in your bank account when writing a check, using your debit card, or making an electronic bill payment, your bank may go ahead and process the payment you’ve initiated, leaving you with a negative balance.

The bank will likely charge you for the privilege of letting you spend more than you have, and that is an overdraft fee.

How Much Do Overdraft Fees Cost?

Overdraft fees aren’t cheap. The cost can vary somewhat depending on the bank or financial institution, with the current average being $26.77 according to survey data. However, the fee can be as high as $30 to $35.

It’s important to note that the overdraft fee is generally per overdraft. So if you overdraft your account and don’t realize you overdrafted, you might make multiple purchases and incur a separate fee on each one.

And these fees can add up quickly. At almost $27 a pop, just three small purchases could set you back over $75. That’s why it’s helpful to learn how to get rid of overdraft fees.

Some banks may also charge extended overdraft fees (sometimes called continuous or sustained fees) if your account doesn’t go back into positive territory within a few days.

In 2024, Americans paid $12.1 billion in overdraft and related non-sufficient funds (NSF) fees each year. However, some banks are beginning to lower their overdraft fees. Other financial institutions don’t charge any fees for the first $50 of overdraft, which is the SoFi overdraft limit, for example.

8 Smart Ways to Avoid Overdraft Fees

If your bank does charge an overdraft fee, you’ll want to make sure there’s enough money in your account so that you don’t spend more than you have. These strategies can help you avoid overdraft fees.

1. Monitor Your Account Balance Regularly

How often do you monitor your balance? It’s a good idea to make a habit of checking your accounts weekly or even more frequently to make sure your balances aren’t too low.

This can be done quickly online, via mobile app, when you withdraw money from the ATM, and/or by calling the bank and getting an automated update on your account.

One simple way to avoid overdraft fees is to keep a cash cushion in your checking account. A cushion means you have a little more stashed in your account than you typically spend each month in order to cover unexpected or forgotten charges.

This cash cushion can help prevent overdraft. You might even add it as an item on your budget to make sure it gets replenished if you use it up.

Increase your savings

with a limited-time APY boost.*

2. Set up Low Balance Alerts

An easy way to help avoid unexpected overdrafts, plus possible overdraft fees, is to set up some automatic alerts.

• One that is particularly helpful is a low balance alert, which means you will be notified (by text, email, or cell phone notification) whenever your balance falls below a certain amount.

You could then immediately transfer money from savings, make a mobile deposit into your account, or hold off on making any purchases until another paycheck comes in.

• Another useful alert you may be able to set up is the overdraft alert. This means you would be notified whenever you overdraft your account.

This alert won’t help you avoid the initial overdraft fee, but it could stop you from continuing to make purchases and incurring more overdraft fees.

3. Understand and Manage Overdraft Coverage

Customers typically have to “opt-in” to a bank’s overdraft coverage program, which many do without thinking much about it when they open their accounts.

This gives the institution permission to clear a transaction even if there is not enough money to cover it in the account by essentially loaning you the money. They may then charge you a fee for this service. You can opt out of overdraft coverage. Once you do this, any purchase you make that you don’t have money in your account to pay for will be declined without a fee.

If you’re unsure about whether you’re enrolled in an overdraft program when you opened your account, you can contact your bank to find out whether you have this coverage or not.

Keep in mind, though, that opting out of overdraft coverage programs typically does not protect you from fees charged for bounced checks.

4. Link Your Checking to a Savings Account

Next on the list of how to avoid overdraft fees: Connect your accounts for overdraft protection.

Overdraft protection service is different from overdraft coverage. This service, which typically involves signing a contract to set up, will link your checking account to another account at the same institution.

Then, in the event that there’s not enough cash in your checking account to cover a transaction, the needed money would be transferred from the linked account to cover it. Some banks may charge a fee for the funds transfer, but these charges are typically lower than overdraft fees. Other banks offer overdraft protection transfers for free.

It’s important to remember, however, that some savings accounts have a limit of six withdrawals per month. If you go over the limit you could be charged an excessive transaction fee.

Recommended: How to Make Money From Home

5. Manage Your Autopay and Bill Pay Dates

It’s a good idea to check when monthly payments are due, and see how that dovetails (or doesn’t) with your paycheck schedule. For instance, you might be more likely to overdraft your account if your credit card payment is due a couple of days before your paycheck hits. If that’s the case, you might try contacting your credit card issuer and see if they could move your due date slightly to better accommodate your cash flow. Many companies will do that for you.

Check the autopay dates for all your bills to make sure you’ll have enough in your account to cover them.

6. Use a Modern Mobile Banking App

Another way to avoid overdraft fees is to use a mobile bank app, which can let you see your account balance, pending payments, and spending in one quick glance at your mobile device.

Mobile banking can make it easy to eyeball how your money looks so you can avoid overspending. You can check your balance on the app before you make purchases in stores or online to make sure you have sufficient funds in your account.

7. Use Direct Deposit to Your Advantage

When you enroll in direct deposit for your paychecks, you’ll generally get your money faster since it’s directly deposited into your account by your employer. You’ll also know exactly when the money will be deposited into the account — typically on every pay day, which might be bi-weekly. Otherwise, if you have an actual paper check to deposit, you have to take it to the bank, which can be inconvenient and time consuming. It also usually takes a few days for the check to clear and the money to be available to you.

Not only that, at some banks, if you have direct deposit, you can get paid up to two days early.

It’s possible to use direct deposit for other payments as well, such as tax refunds and Social Security payments.

8. Switch to a Bank With No Overdraft Fees

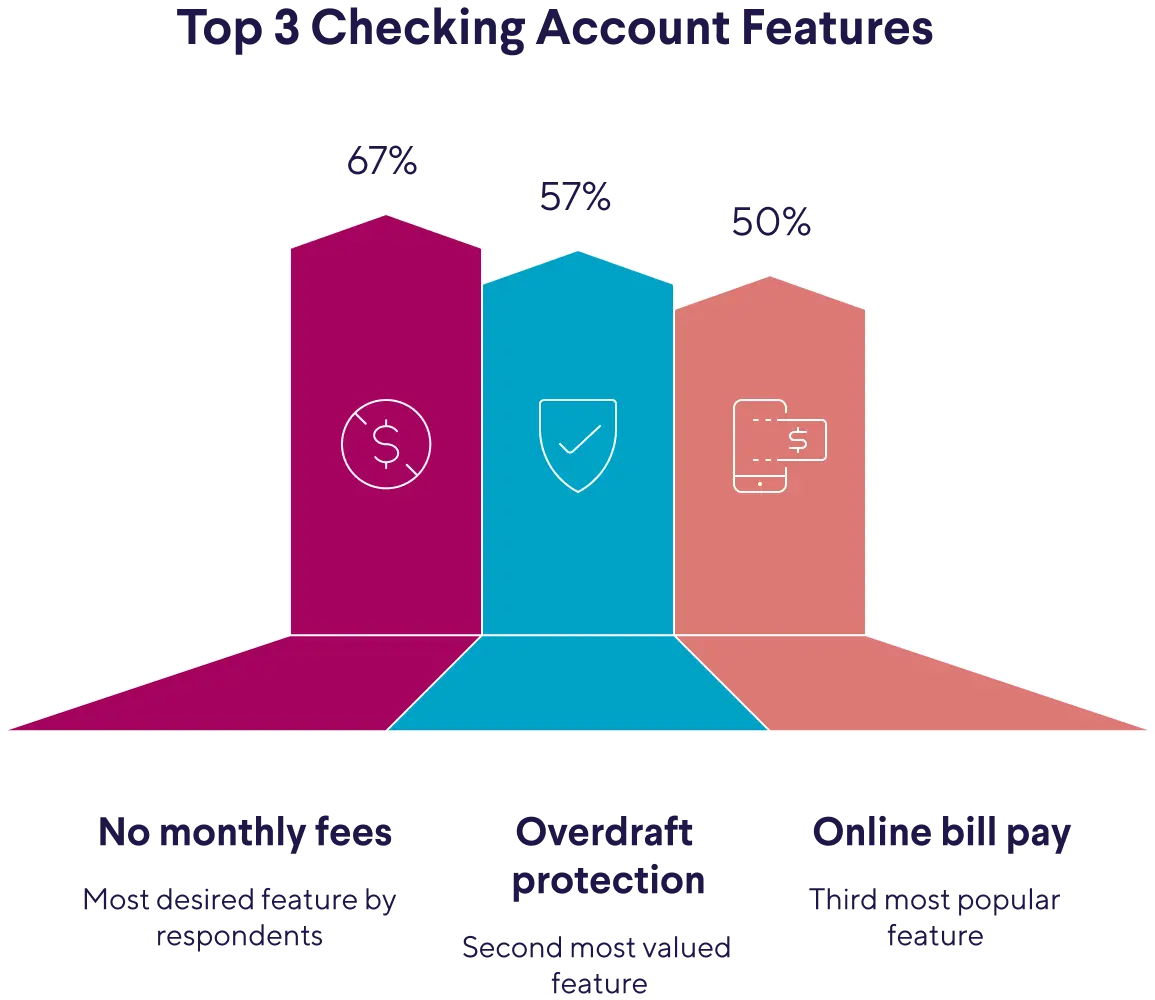

Banks are recognizing that overdraft fees can be a pain point for consumers. In fact, in a 2024 SoFi Banking survey, 57% of respondents said overdraft protection is an important feature in a bank account.

Source: SoFi’s 2024 Banking Survey

Some banks are now providing fee-free overdraft coverage. This may be limited to a certain amount, such as covering the first $50 of an overdraft, as mentioned earlier. It may also require the customer to get back to a positive balance within a certain period of time (say, until your next direct deposit hits).

It can be wise to shop around for this feature and check online vs. traditional banks for it.

What to Do If You’ve Already Been Charged an Overdraft Fee

If you’ve overdrawn your account, here are some steps to take to help avoid overdraft fees or limit them:

• The best first action is generally to transfer money into the account right away. You might still be able to prevent an overdraft fee.

You can check to see if your provider has a daily cutoff time or deadline for adding money to an account to correct a negative balance that same day to avoid fees.

Even if you miss the cutoff, transferring money into the account quickly can prevent other fees. That’s because leaving a balance negative for several days can sometimes result in an extended overdraft fee.

• If you are charged an overdraft fee, however, that doesn’t automatically mean you are stuck paying it. It doesn’t hurt to negotiate with the institution to try to have the fee reimbursed.

You can try to get overdraft fees waived by calling the bank and politely asking if they will remove the charge — if it’s your first offense, you might prevail. You may also want to ask your bank if it has a forgiveness program. Some institutions have policies to waive the first fee charged each year or if a customer is experiencing economic hardship.

How to Avoid an Overdraft Fee at the Checkout

One helpful habit to try: When you’re at the checkout about to make a purchase, first make sure you have enough money in your bank account before you proceed with the transaction. Here’s how.

• Use your mobile banking app to get an instant balance check on your account (many banking apps offer this feature). That way you can see at a glance if your purchase will be covered.

• Know your current balance vs. your available balance. There may be deposits or other transactions still pending in your current balance, which could affect what you have available to spend. Focus on the available balance of your account.

• When using a debit card to make a purchase online, an item may be on back order, and your card might not be charged until the item ships. It can be easy to forget about it and then not have enough funds in your account to cover it when the item does ship. To avoid an overdraft, make a note about delayed charge in your transaction register. You can also set a reminder on your phone to check on the item and the money in your account.

The Takeaway

There are a few simple ways to avoid overdraft fees, such as opting out of overdraft coverage, setting up an automatic low-balance alert, linking your accounts, keeping a little cash cushion in your account, or banking where you get a level of no-fee overdraft coverage.

Interested in opening an online bank account? When you sign up for a SoFi Checking and Savings account with eligible direct deposit, you’ll get a competitive annual percentage yield (APY), pay zero account fees, and enjoy an array of rewards, such as access to the Allpoint Network of 55,000+ fee-free ATMs globally. Qualifying accounts can even access their paycheck up to two days early.

FAQ

Can I get an overdraft fee refunded?

It may be possible to get an overdraft fee refunded. Call the bank and ask if they will refund the fee. If it’s the first time you’ve ever overdrafted your account, they might give you a refund. Some banks even have policies to waive the fee in certain situations — such as if a customer is facing economic hardship. So if there was an extenuating circumstance, be sure to explain it. But no matter what the circumstances, it doesn’t hurt to ask politely for a refund.

Is it better to turn off overdraft protection?

You may want to opt out of overdraft coverage, which is different from overdraft protection, which usually triggers a fee. Overdraft protection, on the other hand, typically links your checking account to another account at the same bank and if there’s not enough cash in your checking account to cover a transaction, the needed money would be transferred to cover it. Some banks charge a fee for these transfers, others don’t.

Do overdraft fees affect my credit score?

Overdraft fees generally don’t affect your credit score because your checking account activity is not typically reported to the credit bureaus. However, if you overdraft the account and don’t pay the overdraft and any fees incurred, the bank could send the debt you owe to collections. The collection agency can then report the debt to the credit bureaus which can negatively impact your credit score.

How long do I have to pay an overdraft?

How long you have to pay an overdraft is determined by your bank. Some institutions may give you just a day to cover the overdrawn amount plus any fees, others may give you one or two days. It’s important to find out what your bank’s specific policy is, and then follow it to avoid further negative consequences.

What’s the difference between overdraft protection and overdraft coverage?

Overdraft coverage is a service that gives your bank permission to clear a transaction even if there is not enough money in the account to cover it by essentially fronting you the money. They may then charge you a fee for doing so. Overdraft protection, on the other hand, usually links your checking account to another account at the same bank. If there’s not enough cash in your checking account to cover a transaction, the funds would be transferred to cover it. Some banks offer these transfers free of charge.

SoFi Checking and Savings is offered through SoFi Bank, N.A. Member FDIC. The SoFi® Bank Debit Mastercard® is issued by SoFi Bank, N.A., pursuant to license by Mastercard International Incorporated and can be used everywhere Mastercard is accepted. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Annual percentage yield (APY) is variable and subject to change at any time. Rates are current as of 12/23/25. There is no minimum balance requirement. Fees may reduce earnings. Additional rates and information can be found at https://www.sofi.com/legal/banking-rate-sheet

Eligible Direct Deposit means a recurring deposit of regular income to an account holder’s SoFi Checking or Savings account, including payroll, pension, or government benefit payments (e.g., Social Security), made by the account holder’s employer, payroll or benefits provider or government agency (“Eligible Direct Deposit”) via the Automated Clearing House (“ACH”) Network every 31 calendar days.

Although we do our best to recognize all Eligible Direct Deposits, a small number of employers, payroll providers, benefits providers, or government agencies do not designate payments as direct deposit. To ensure you're earning the APY for account holders with Eligible Direct Deposit, we encourage you to check your APY Details page the day after your Eligible Direct Deposit posts to your SoFi account. If your APY is not showing as the APY for account holders with Eligible Direct Deposit, contact us at 855-456-7634 with the details of your Eligible Direct Deposit. As long as SoFi Bank can validate those details, you will start earning the APY for account holders with Eligible Direct Deposit from the date you contact SoFi for the next 31 calendar days. You will also be eligible for the APY for account holders with Eligible Direct Deposit on future Eligible Direct Deposits, as long as SoFi Bank can validate them.

Deposits that are not from an employer, payroll, or benefits provider or government agency, including but not limited to check deposits, peer-to-peer transfers (e.g., transfers from PayPal, Venmo, Wise, etc.), merchant transactions (e.g., transactions from PayPal, Stripe, Square, etc.), and bank ACH funds transfers and wire transfers from external accounts, or are non-recurring in nature (e.g., IRS tax refunds), do not constitute Eligible Direct Deposit activity. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. SoFi Bank shall, in its sole discretion, assess each account holder's Eligible Direct Deposit activity to determine the applicability of rates and may request additional documentation for verification of eligibility.

See additional details at https://www.sofi.com/legal/banking-rate-sheet.

*Awards or rankings from NerdWallet are not indicative of future success or results. This award and its ratings are independently determined and awarded by their respective publications.

We do not charge any account, service or maintenance fees for SoFi Checking and Savings. We do charge a transaction fee to process each outgoing wire transfer. SoFi does not charge a fee for incoming wire transfers, however the sending bank may charge a fee. Our fee policy is subject to change at any time. See the SoFi Bank Fee Sheet for details at sofi.com/legal/banking-fees/.

^Early access to direct deposit funds is based on the timing in which we receive notice of impending payment from the Federal Reserve, which is typically up to two days before the scheduled payment date, but may vary.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

SOBNK-Q425-005

Read more