Top Story

The Week Ahead on Wall Street

Economic Data

Today, November Chicago PMI is due along with the October Pending Home Sales Index. In September, this metric, which tracks signed contracts on existing homes, fell by 2.2%. Though interest rates remain low, home prices are climbing, which may be curbing the home-buying frenzy to some extent.

Tomorrow, look for November Markit manufacturing PMI, the November ISM Manufacturing Index, October construction spending, and November motor vehicle sales. In October, motor vehicle sales continued to show steady recovery. Sales of SUVs and trucks have been particularly strong.

On Wednesday, the November ADP employment report is released. This monthly metric tracks private employment in the US. In October, payroll growth was slower than expected as rising COVID-19 cases caused parts of the country to implement restrictions on businesses.

On Thursday, look for November market services PMI, the November ISM Services Index, and initial jobless claims. Last week another 778,000 workers filed for unemployment insurance, which was higher than economist estimates of 730,000.

On Friday, October factory orders and October trade deficit figures are released. Also look for November nonfarm payrolls, the November unemployment rate, and November average hourly earnings. These three related metrics paint a picture of the country’s job market. In October, nonfarm payroll employment climbed by 638,000 and the unemployment rate fell to 6.9%.

Earnings Reports

Today, Zoom (ZM) reports its earnings. The video conference software provider’s shares have dipped as a result of positive vaccine news, along with other “stay-at-home” stocks like Netflix (NFLX), Peloton (PTON), and Slack (WORK). However, Zoom’s shares have still climbed about sixfold this year. The company also received some good publicity last week as it lifted its 40-minute time limit for calls on Thanksgiving Day.

Tomorrow, Salesforce (CRM) reports its earnings. The customer relationship management software provider services clients from banks to retailers to healthcare companies. Though the rise of remote work has led some companies to lean on Salesforce more, the overall economic downturn has caused a decline in demand for Salesforce’s services. Analysts expect to see a year-over-year decline in revenue for the company.

On Wednesday, Snowflake (SNOW) will hand in its report card. This will be the data warehousing company’s first earnings report since it went public in September. Its IPO was one of the hottest of the year. The company initially priced its shares at $80, then bumped its pre-trading price up to $120 because demand was so high. Shares are currently trading at about $280. Investors will be eager to gain more insight into how Snowflake is performing.

On Thursday, look for an earnings report from Kroger (KR). Consumers are hunkering down for another period of social distancing and cooking at home to curb the spread of COVID-19. As a result, grocery store sales are climbing, as they did when the pandemic first set in. Now, however, companies like Kroger are better able to handle demand for delivery and curbside pickup.

To round out the week, on Friday, Big Lots (BIG) will report earnings. The Ohio-based discount retailer operates 1,411 stores in 47 states. The chain specializes in furniture and electronics, both of which have been popular as consumers spend more time at home.

The Week Ahead at SoFi

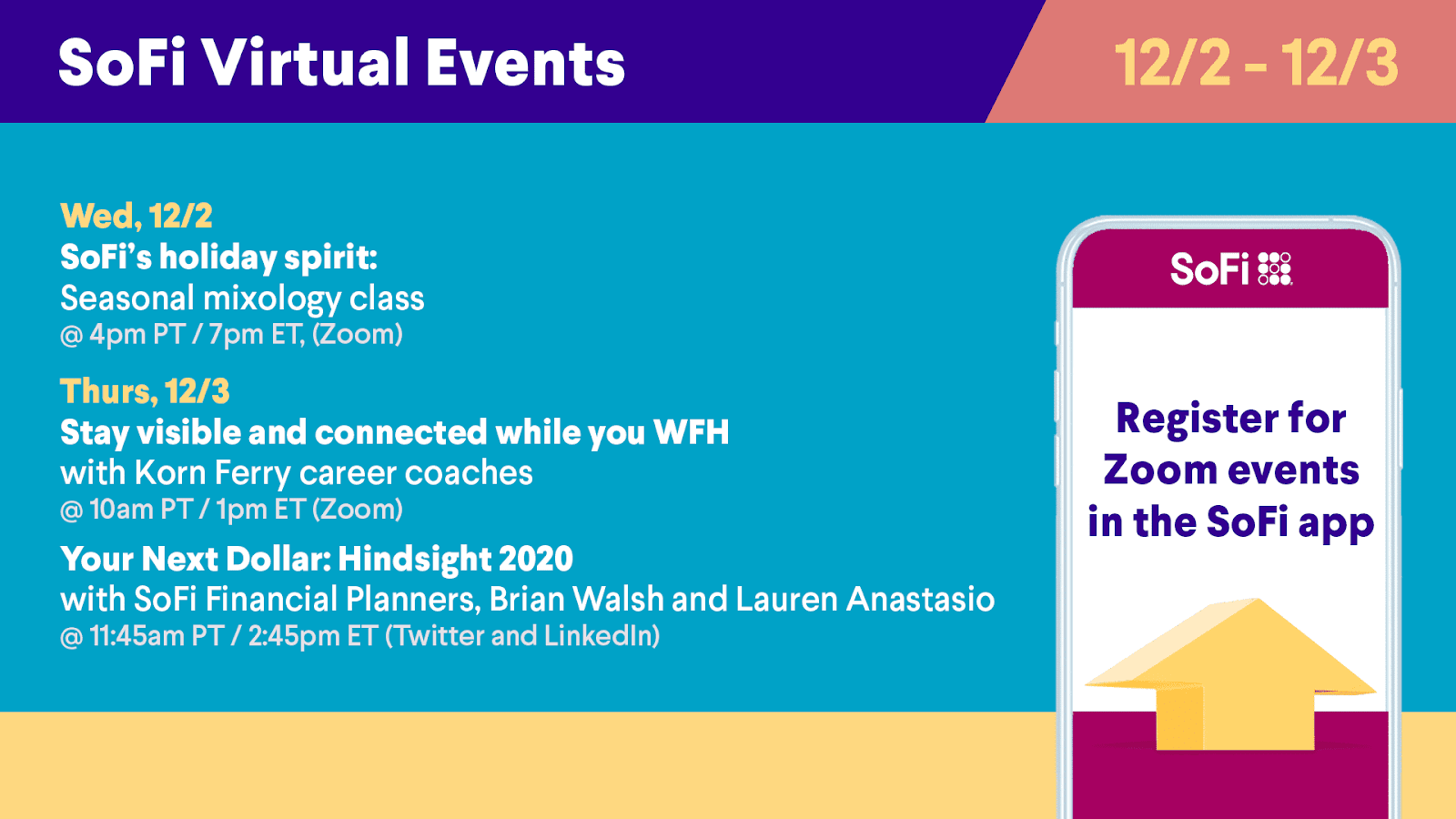

It’s almost officially December—and we officially have three events for you to enjoy. Learn to make holiday cocktails, take a financial look back at 2020, and more. Register for this week's events in the SoFi app! Want to enjoy a previous event that you missed? Watch past events on our YouTube channel.

Small Business Saturday Spotlight

Innovating and Adapting

Over the weekend, on Small Business Saturday, customers gave businesses in their communities some much-needed support. The pandemic has been challenging for the US’ 30.7 million small business. By the end of the summer, nearly 2 million of these small businesses had shuttered permanently, and that number has climbed since. As COVID-19 cases rise and certain parts of the country implement new lockdown measures to curb the spread of the virus, some businesses are struggling more than ever.

However, innovating and adapting is nothing new for small business owners. During the pandemic, distilleries have manufactured hand sanitizer, restaurants have built outdoor eating spaces, gyms have offered online classes. On Small Business Saturday this year, business owners found creative, safe ways to help customers do their holiday shopping locally.

The History of Small Business Saturday

Small Business Saturday is a relatively new holiday. It was created in 2010 by American Express (AXP) as a way to encourage people to patronize small, local businesses during the holiday shopping season. Since then, it has gained popularity. In 2019, 110 million people shopped on Small Business Saturday.

This year, because of the pandemic-induced difficulties small businesses have faced, the day was more important than ever. In a recent survey, 75% of small business owners said that in order to keep their doors open in 2021, they will need to hit their normal holiday shopping numbers. Though this year Small Business Saturday looked different than usual with many customers opting for delivery or curbside pickup instead of in-store shopping, many small businesses across the country did receive a helpful boost.

Other Ways to Help Local Businesses

According to a study by American Express, 67 cents out of every dollar spent at a small business stays within the local economy, so shopping locally does not only benefit one business, but an entire community.

Though companies like Walmart (WMT) and Target (TGT) have gained attention for growing their ecommerce operations during the pandemic, many small businesses have also built impressive online offerings, which make it easy and safe to support them this holiday season. In addition to doing holiday shopping locally, buying gift cards, leaving positive reviews, posting on social media, and tipping a little extra, are other easy ways to make a big difference for small businesses.

A Black Friday for the History Books

Thanksgiving Weekend Shopping Was Moving Online Even Before the Pandemic

Black Friday, the unofficial start to the holiday shopping season, looked a little different this year. In years past, Black Friday has been a day of lining up outside stores early in the morning and crowding into aisles hunting for bargains. This year, many retailers moved the excitement online to keep workers and shoppers safe.

Though COVID-19 has accelerated the trend, online Black Friday sales have been steadily ticking up since 2016. In fact, even last year, more consumers did Thanksgiving weekend shopping online than at brick-and-mortar stores. As anticipated, that progression continued this year. According to preliminary data from Sensormatic Solutions, in-store Black Friday traffic plunged over 52% compared with 2019. Some of that activity then moved online. According to data from Adobe Analytics, internet spending on Black Friday spiked 21.6%, hitting a new record. Across the country, roughly $9 billion was spent online the day after Thanksgiving this year, making Black Friday 2020 the second-largest internet spending day in the US behind Cyber Monday 2019.

The “Cyber 5”

In recent years, retailers have been working to spread the Black Friday hype across multiple days. Prior to the pandemic, companies were finding ways to get shoppers excited about the holidays during a period known as the “Cyber 5”—Thanksgiving, Black Friday, Small Business Saturday, Cyber Sunday, and Cyber Monday.

This year, companies like Target (TGT) Macy’s (M), and Amazon (AMZN) have been rolling out holiday deals since October. This strategy serves several purposes. Businesses expect in-person holiday shopping sales to be sluggish in mid- to late-December, therefore they want to bulk up their sales early. Additionally, this is expected to be the busiest holiday season for ecommerce ever, and companies want to spread out orders to avoid supply chain issues and delivery delays closer to the holidays.

The History of Black Friday

The Friday after Thanksgiving has marked the unofficial start of the winter holiday season since President Abraham Lincoln officially designated the last Thursday in November as Thanksgiving Day. Some accounts say the name "Black Friday" dates back to the early 1960s in Philadelphia, where it was used by police to describe the heavy traffic jams that would occur on the Friday after Thanksgiving. Another popular explanation is that the day earned its name because accountants use black ink to record profits and red ink to record losses. When holiday shopping starts and stores see profits, they are recorded in black ink, thus the name “Black Friday”.

This year will likely be another important chapter in the history of Black Friday. Many analysts expect that ecommerce habits which consumers formed during the pandemic will stay in place for years to come. If shoppers have a positive experience with online Black Friday this year, they may decide to hunt for deals from their couches instead of lining up in the cold in future years.

Not-So-Breaking News

-

BertelsmanSE (BTG4.FF) is close to reaching a deal to acquire publisher Simon & Schuster from ViacomCBS (VIAC) for over $2 billion. BertelsmanSE already owns Penguin Random House, and if the deal is completed, the German media company will account for about one third of all books sold in the US.

-

Gap (GPS) missed Wall Street expectations with its latest earnings report. The retailer has invested heavily in ecommerce and its online sales rose by 61% during the third quarter, but its marketing and shipping costs have also spiked.

-

France’s finance ministry announced that it will impose a “digital tax” on tech companies’ 2020 earnings even though the US has threatened to retaliate with tariffs on French imports. This will impact US companies including Amazon (AMZN), Facebook (FB), and Apple (AAPL).

-

Shares of Nikola (NKLA) slid after the electric truck maker’s CEO said that talks with General Motors (GM) are in progress, but did not confirm that Nikola’s $2 billion deal with the auto industry giant will go through. Nikoka has been accused of misrepresenting its technology and investors are concerned that this will hurt its chances of inking the deal with GM.

-

Deere & Co (DE) reported stronger-than-expected Q4 earnings and predicted gains in 2021. Global demand for construction and forestry equipment is rising after a slump during the early stages of the pandemic.

-

Can the president cancel student debt? Here’s an overview of some ways the next president might tackle the question of student loan forgiveness.

Financial Planner Tip of the Day

Save for retirement or pay down student loans: where should you focus? While most people want to pay student loans off as quickly as possible, it can actually be smart to take a little longer to do so and start saving for retirement sooner.

Brian Walsh, CFP® at SoFi