What Is Gamma in Options Trading?

Gamma is one of the indicators that comprise the Greeks, a model for pricing options contracts and discerning their risks. Traders, analysts, portfolio managers, and other investment professionals use gamma — along with delta, theta, and vega — to quantify various factors in options markets. Gamma expresses the rate of change of an option’s delta, based on a $1 price movement — or, one-point movement — of the option’s underlying security. You might think of delta as an option’s speed, and gamma as its acceleration rate.

Understanding Gamma

In the Greeks, gamma is an important metric for pricing options contracts. Gamma can show traders how much the delta — another Greeks metric — will change concurrent with price changes in an option’s underlying security. An option’s delta is relevant for short amounts of time only. An option’s gamma offers a clearer picture of where the contract is headed going forward.

Expressed as a percentage, gamma measures an option’s, or another derivative’s, value relative to its underlying asset. As an options contract approaches its expiration date, the gamma of an at-the-money option increases; but the gamma of an in-the-money or out-of-the-money option decreases. Gamma can help traders gauge the rate of an option’s price movement relative to how close the underlying security’s price is to the option’s strike price. Put another way, when the price of the underlying asset is closest to the option’s strike price, then gamma is at its highest rate. The further out-of-the-money a security goes, the lower the gamma rate is — sometimes nearly to zero. As gamma decreases, alpha also decreases. Gamma is always changing, in concert with the price changes of an option’s underlying asset.

Gamma is the first derivative of delta and the second derivative of an option contract’s price. Some professional investors want even more precise calculations of options price movements, so they use a third-order derivative called “color” to measure gamma’s rate of change.

Recommended: What Is Options Trading? A Guide on How to Trade Options

Calculating Gamma

Calculating gamma precisely is complex and requires sophisticated spreadsheets or financial software. Analysts usually calculate gamma and the other Greeks in real-time and publish the results to traders at brokerage firms. Below is an example of how to calculate the approximate value of gamma. The equation is the difference in delta divided by the change in the underlying security’s price.

Gamma Formula

Gamma = Difference in delta / change in underlying security’s price

Gamma = (D1 – D2) / (P1 – P2)

Where D1 is the first delta, D2 is the second delta, P1 is the first price of the underlying security, and P2 is the second price of the security.

Example of Gamma

For example, suppose there is an options contract with a delta of 0.5 and a gamma of 0.1, or 10%. The underlying stock associated with the option is currently trading at $10 per share. If the stock increases to $11, the delta would increase to 0.6; and if the stock price decreases to $9, then the delta would decrease to 0.4. In other words, for every 10% that the stock moves up or down, the delta changes by 10%. If the delta is 0.5 and the stock price increases by $1, the option’s value would rise by $0.50. As the value of delta changes, analysts use the difference between two delta values to calculate the value of gamma.

Using Gamma in Options Trading

Gamma is a key risk-management tool. By figuring out the stability of delta, traders can use gamma to gauge the risk in trading options. Gamma can help investors discern what will happen to the value of delta as the underlying security’s price changes. Based on gamma’s calculated value, investors can see any potential risk involved in their current options holdings; then decide how they want to invest in options contracts. If gamma is positive when the underlying security increases in value in a long call, then delta will become more positive. When the security decreases in value, then delta will become less positive. In a long put, delta will decrease if the security decreases in value; and delta will increase if the security increases in value.

Traders use a delta hedge strategy to maintain a hedge over a wider security price range with a lower gamma.

Gamma as an Options Hedging Strategy

Hedging strategies can help professional investors reduce the risk of an asset’s adverse price movements. Gamma can help traders discern which securities to purchase by revealing the options with the most potential to offset loses in their existing portfolio. In gamma hedging, the goal is to keep delta constant throughout an investor’s entire portfolio of stocks and options. If any of their assets are at risk of making strong negative moves, investors could purchase other options to hedge against that risk, especially when close to options’ expiration dates.

In gamma hedging, investors generally purchase options that oppose the ones they already own in order to create a balanced portfolio. For example, if an investor already holds many call options, they might purchase some put options to hedge against the risk of price drops. Or, an investor might sell some call options at a strike price that’s different from that of their existing options.

Benefits of Gamma for Long Options

Gamma in options Greeks is popular among investors in long options. All long options, both calls and puts, have a positive gamma that is usually between 0 and 1, and all short options have a negative gamma between 0 and -1. A higher gamma value shows that delta might change significantly even if the underlying security only changes a small amount. Higher gamma means the option is sensitive to movements in the underlying security’s price. For every $1 that the underlying asset increases, the gamma rate increases profits. With every $1 that the asset increases, the investor’s returns increase more efficiently.

When delta is 0 at the contract’s expiration, gamma is also 0 because the option is worthless if the current market price is better than the option’s strike price. If delta is 1 or -1 then the strike price is better than the market price, so the option is valuable.

Risks of Gamma for Short Options

While gamma can potentially benefit long options buyers, for short options sellers it can potentially pose risks. The gamma rate can accelerate losses for options sellers just as it accelerates gains for options buyers.

Another risk of gamma for option sellers is expiration risk. The closer an option gets to its expiration date, the less probable it is that the underlying asset will reach a strike price that is very much in-the-money — or out-of-the-money for option sellers. This probability curve becomes narrower, as does the delta distribution. The more gamma increases, the more theta — the cost of owning an options contract over time — decreases. Theta is a Greek that shows an option’s predicted rate of decline in value over time, until its expiration date.

For options buyers, this can mean greater returns, but for options sellers it can mean greater losses. The closer the expiration date, the more gamma increases for at-the-money options; and the more gamma decreases for options that are in- or out-of-the-money.

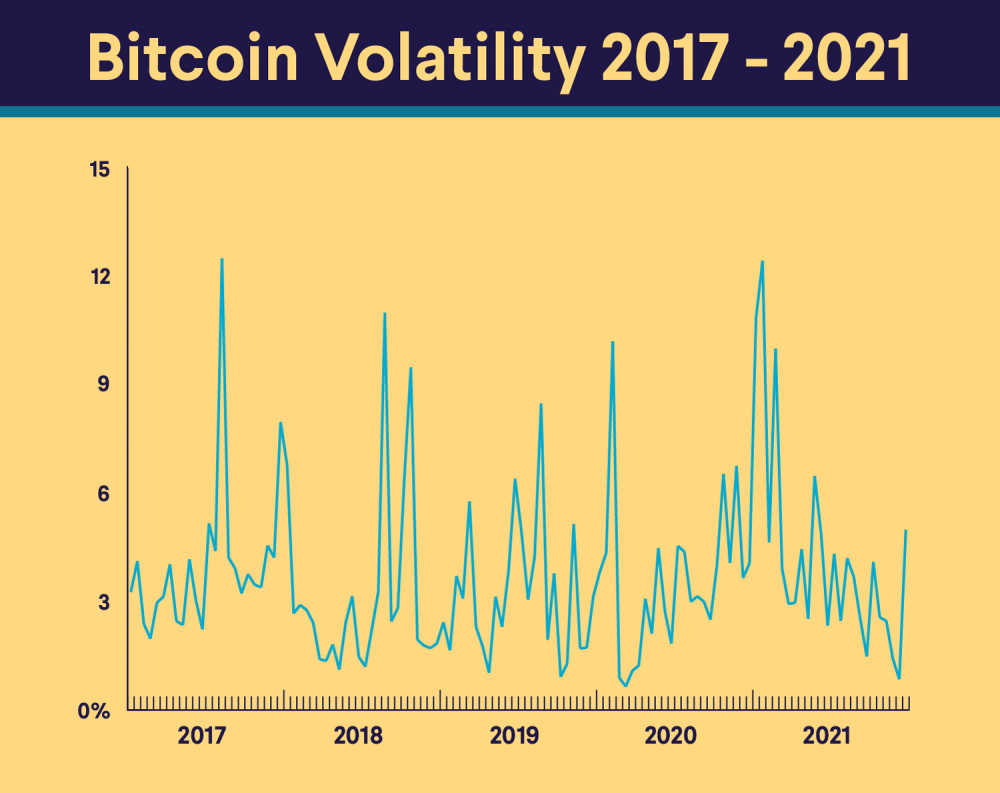

How Does Volatility Affect Gamma?

When a security has low volatility, options that are at-the-money have a high gamma and in- or out-of-the-money options have a very low gamma. This is because the options with low volatility have a low time value; their time value increases significantly when the underlying stock price gets closer to the strike price.

If a security has high volatility, gamma is generally similar and stable for all options, because the time value of the options is high. If the options get closer to the strike price, their time value doesn’t change very much, so gamma is low and stable.

Start Investing With SoFi

Gamma and the Greeks indicators are useful tools for understanding derivatives and creating options trading strategies. However, trading in derivatives, like options, is primarily for advanced or professional investors.

If you’re ready to invest, an options trading platform like SoFi’s is worth exploring. This user-friendly platform features an intuitive design, as well as the ability to trade options from either the mobile app or web platform. You can also access a library of educational resources to keep learning about options.

Photo credit: iStock/Prostock-Studio

SoFi Invest®

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

SoFi Invest encompasses two distinct companies, with various products and services offered to investors as described below:

Individual customer accounts may be subject to the terms applicable to one or more of these platforms.

1) Automated Investing and advisory services are provided by SoFi Wealth LLC, an SEC-registered investment adviser (“SoFi Wealth“). Brokerage services are provided to SoFi Wealth LLC by SoFi Securities LLC.

2) Active Investing and brokerage services are provided by SoFi Securities LLC, Member FINRA (www.finra.org)/SIPC(www.sipc.org). Clearing and custody of all securities are provided by APEX Clearing Corporation.

For additional disclosures related to the SoFi Invest platforms described above please visit SoFi.com/legal.

Neither the Investment Advisor Representatives of SoFi Wealth, nor the Registered Representatives of SoFi Securities are compensated for the sale of any product or service sold through any SoFi Invest platform.

Investment Risk: Diversification can help reduce some investment risk. It cannot guarantee profit, or fully protect in a down market.

Disclaimer: The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results.

Options involve risks, including substantial risk of loss and the possibility an investor may lose the entire amount invested in a short period of time. Before an investor begins trading options they should familiarize themselves with the Characteristics and Risks of Standardized Options . Tax considerations with options transactions are unique, investors should consult with their tax advisor to understand the impact to their taxes.

SoFi Relay offers users the ability to connect both SoFi accounts and external accounts using Plaid, Inc.’s service. When you use the service to connect an account, you authorize SoFi to obtain account information from any external accounts as set forth in SoFi’s Terms of Use. Based on your consent SoFi will also automatically provide some financial data received from the credit bureau for your visibility, without the need of you connecting additional accounts. SoFi assumes no responsibility for the timeliness, accuracy, deletion, non-delivery or failure to store any user data, loss of user data, communications, or personalization settings. You shall confirm the accuracy of Plaid data through sources independent of SoFi. The credit score is a VantageScore® based on TransUnion® (the “Processing Agent”) data.

*Borrow at 10%. Utilizing a margin loan is generally considered more appropriate for experienced investors as there are additional costs and risks associated. It is possible to lose more than your initial investment when using margin. Please see SoFi.com/wealth/assets/documents/brokerage-margin-disclosure-statement.pdf for detailed disclosure information.

Fund Fees

If you invest in Exchange Traded Funds (ETFs) through SoFi Invest (either by buying them yourself or via investing in SoFi Invest’s automated investments, formerly SoFi Wealth), these funds will have their own management fees. These fees are not paid directly by you, but rather by the fund itself. these fees do reduce the fund’s returns. Check out each fund’s prospectus for details. SoFi Invest does not receive sales commissions, 12b-1 fees, or other fees from ETFs for investing such funds on behalf of advisory clients, though if SoFi Invest creates its own funds, it could earn management fees there.

SoFi Invest may waive all, or part of any of these fees, permanently or for a period of time, at its sole discretion for any reason. Fees are subject to change at any time. The current fee schedule will always be available in your Account Documents section of SoFi Invest.

Exchange Traded Funds (ETFs): Investors should carefully consider the information contained in the prospectus, which contains the Fund’s investment objectives, risks, charges, expenses, and other relevant information. You may obtain a prospectus from the Fund company’s website or by email customer service at [email protected]. Please read the prospectus carefully prior to investing.

Shares of ETFs must be bought and sold at market price, which can vary significantly from the Fund’s net asset value (NAV). Investment returns are subject to market volatility and shares may be worth more or less their original value when redeemed. The diversification of an ETF will not protect against loss. An ETF may not achieve its stated investment objective. Rebalancing and other activities within the fund may be subject to tax consequences.

SOIN1021464