The Most Important Components of a Successful Budget

Financial gurus, your money-savvy friend, and personal finance books and articles all say the same thing: You need a budget. Why? Because without any guardrails to guide your spending decisions, you can end up overspending (and, in turn, running up debt). You may also find it difficult to reach important financial goals, such as building an emergency fund, going on vacation, or buying a home.

The main characteristics of any budget are estimates of how much money you’ll make and how much you’ll spend over a certain period of time, typically a month. Trouble is, it can be hard to predict every expense that may come up in a given month. That can make it hard to know what to include in your budget. But don’t give up — read on. What follows are eight key components of a successful and realistic budget.

Key Points

• A successful budget includes estimates of income and expenses over a specific period, typically monthly.

• Emergency funds are crucial, ideally covering three to six months of expenses.

• Budgets should account for irregular and one-off expenses by setting aside funds monthly.

• Debt repayment is a key component, with strategies like the 50/30/20 rule guiding spending.

• Accurate tracking of monthly income is essential for effective budget allocation.

The Importance of Budgeting

While a budget may sound restrictive, it’s really nothing more than a plan for how you will spend your money. Why bother making one? Here’s a look at some of the benefits of putting together a basic budget:

• Lets you know if you’re spending more than, less than, or about the same as you’re earning each month.

• Gives you a birds-eye view at where exactly your money is going each month.

• Helps you avoid spending more than you have or want to spend.

• Alerts you to subscriptions or services you’re paying for but may no longer need.

• Ensures you stay on top of debt payments.

• Allows you to make adjustments in your spending and saving so you can align your financial habits to reach your goals.

• Can prevent you from going into debt should there be an unexpected, emergency expense or if you get laid off

• Helps you feel more secures and less stressed about money

Increase your savings

with a limited-time APY boost.*

Key Characteristics That Make a Budget Successful

While there are many ways you can approach managing your money, all budgeting styles share some of the same key elements. Let’s take a look at the main characteristics of a budget that can help you stay on track and boost your overall financial wellbeing.

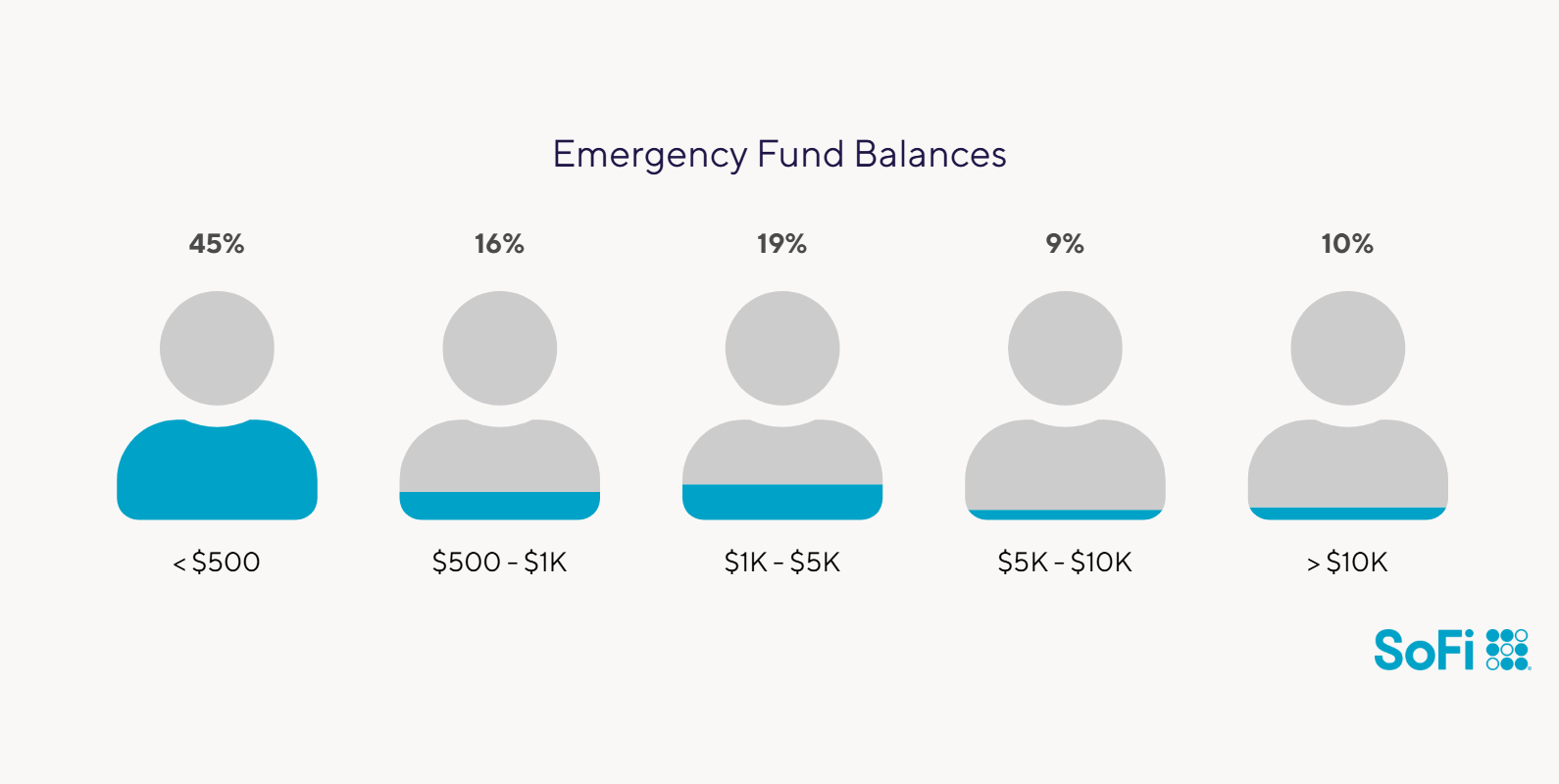

Emergency Funds

The bedrock of any type of budget is an emergency fund. Without a cash reserve set aside specifically for unplanned expenses or financial emergencies, any bump in the road — say a car repair, trip to the ER, or a loss of income — can force you to run up credit card debt. This can lead to a debt spiral that can take months, potentially years, to recover from.

A general rule of thumb is to keep three to six months’ worth of basic living expenses in a separate savings account earmarked for emergencies. If you’re self-employed or work seasonally, however, you might want to aim for six or 12 months of expenses to feel secure and protected.

Recommended: Where to Keep Emergency Funds

Irregular Expenses

When creating a budget, you likely won’t overlook your recurring monthly expenses, such as rent, utility bills, and food. What’s easy to forget about are your one-off and irregular expenses.

To set up an accurate budget, you’ll want to be sure to jot down any annual or seasonal expenses you anticipate, such as membership dues, holiday gifts, insurance payments, car and registration fees, or kid’s camp expenses. Scanning through your monthly checking account statements for a year should help you suss out your irregular expenses.

To adequately account for these expenses, determine the annual cost, divide by 12, and build that amount into your monthly budget. You may want to transfer that money into a separate account so you can pay those expenses when they’re due.

Recommended: What Are the Average Monthly Expenses for One Person?

Repaying Debt

For a budget to be successful, you want to make sure you’re accounting for debt repayment, including minimum monthly payments and (if you’re carrying high-interest debt) additional payments. The 50/30/20 budgeting rule, for example, recommends putting 50% of your money take-home income toward needs (including minimum debt payments), 30% toward wants, and 20% toward savings and debt repayment beyond the minimum.

Once you’ve paid off your balances, the money you were spending on debt/interest each month can now go towards other goals, such as a vacation, large-ticket purchase, or down payment on a house.

Recommended: See how your money is categorized using the 50/30/20 Budget Calculator.

Monthly Savings

Even if you tend to live paycheck to paycheck, a key element of a budget is putting at least something into savings each month. For example, with the “pay yourself first” approach to budgeting, you set up a recurring transfer from your checking account into your savings account on the same day each month, ideally right after you get paid.

Once you’ve fully funded your emergency saving account, you can funnel this extra money into a high-yield savings account to work towards your short-term savings goals.

And it’s fine to start small. If you save $20 a week, in a year you’ll have accumulated $1,040. If you commit to the 52-week savings challenge, where you save $1 the first week, $2 the second week, and so forth for an entire year, you’ll have stashed away $1,378 by week 52.

💡 Quick Tip: Most savings accounts only earn a fraction of a percentage in interest. Not at SoFi. Our high-yield savings account can help you make meaningful progress towards your financial goals.

Accurate Monthly Income

Without knowing exactly how much money hits your bank account each month, you won’t be able to allocate your funds accordingly and create an accurate budget. Besides your paycheck, you’ll want to factor in any other income streams, such as freelance work, government benefits, alimony, or child support.

If you’re self-employed and your income varies from month to month, determining your monthly income can be a bit trickier. One solution is to use your lowest monthly income over the past year as your baseline income (minus any taxes you will owe). This gives you a margin of safety, since you will likely make more than that.

Money for Vacations and Free Time

While it’s important to save for an emergency fund and pay off your debt, a key component of budgeting is money for fun and leisure. Without it, you likely won’t stick to your budget at all.

Think about what activities bring you the most joy and offer the most value in your life. What hobbies would you like to invest more time, energy, and resources in? Where would you like to vacation next? From there, you can set some “fun” savings goals. Consider how much you will need and when you want to reach your goal to determine how much to set aside for fun each month.

Recommended: 15 Creative Ways to Save Money

Retirement

Retirement might seem far off but failing to start saving early can put you in a tough predicament later on. Thanks to compound interest — the interest earned on your initial savings and the reinvested earnings — it’s much easier to amass a comfortable nest egg when you start early. Even if you’re still paying off your student loans, retirement is an important element of a budget that can make a huge difference in your future.

If you work for a traditional employer, you likely have a company 401(k) you are eligible to participate in. If your employer offers a company match, it’s wise to contribute at least up to match — otherwise you’re leaving free money on the table.

Realistic Goals

While many people don’t write down specific goals when creating a budget, this is actually an important element of budgeting. By setting realistic goals, such as building an emergency fund, saving for a downpayment on a car or a home, getting out of debt, or saving for retirement, you can begin to find ways to save for those goals and track your progress towards achieving them.

Having specific and realistic money goals can give you the motivation to take control of your spending. It also gives all the money that comes into your account a purpose.

Keep in mind, though, that goals and budgets are ever-evolving. When changes arise in your situation, you can tweak your goals accordingly. For instance, maybe you suffered a financial setback. In that case, you might want to put your foot off the pedal on aggressively paying off debt, and focus on replenishing your emergency fund.

Tips on Starting a Budget

If the idea of creating a budget feels overwhelming, here are some stimple steps that help jump start the process.

• Determine your after-tax income. If you get a regular paycheck, the amount you receive is probably just that, but if you have automatic deductions, such as 401(k) contributions or health and life insurance, you’ll want to add those back in to give yourself an accurate picture of your earnings.

• Tally your monthly expenses. You can scan your bank and credit card statements for the past three to six months to get an idea of what you typically spend each month and on what. You can then make a list of spending categories, how much (on average) you spend on each per month, and then break down those expenses into two main categories: “needs” and “wants.”

• Make adjustments. If your average monthly income is less than your average monthly spending (meaning you are going backwards) or is about the same (meaning you aren’t saving anything), you’ll want to look for places to cut back. You likely find it easier to cut back spending in your “wants” categories, such as cooking a few more times a week (and getting take-out less often) or cutting the cord on cable and opting for cheaper streaming services.

• Choose a budgeting plan. Once you’ve done the basics, you can take it a step further by selecting a budgeting plan. Any budget must cover all of your needs, some of your wants and — this is key — savings for emergencies and the future. The 50/30/20 budget (mentioned above) often works well for beginners. But there are many different types of budget — including the envelope system and zero-based budget. You might choose a budgeting app, such as YNAB or Goodbudget, to automate the process.

Banking With SoFi

Knowing exactly what elements go into a successful budget can help you create a spending plan that’s in step with your goals and help you do a lot more with the money you have.

Interested in opening an online bank account? When you sign up for a SoFi Checking and Savings account with eligible direct deposit, you’ll get a competitive annual percentage yield (APY), pay zero account fees, and enjoy an array of rewards, such as access to the Allpoint Network of 55,000+ fee-free ATMs globally. Qualifying accounts can even access their paycheck up to two days early.

FAQ

How do I stick to a budget?

The best way to stick to a budget is to never spend more than you have. Running up high-interest debt can be a vicious cycle that is tough to get out of. You also end up spending a lot more on your purchases than if you have held off and saved up.

If you can’t afford something you want right now, it’s generally a good idea to put it off until you can. If you want to go on vacation or buy new furniture, for example, plan for it and save regularly so it doesn’t throw off your budget.

What is the best budgeting method?

The best budgeting method is the one you’re most likely to stick with. If you prefer to not worry so much about where you’re spending each dollar, you might prefer the 50/30/20 budget. If you like to get granular with your spending, then a zero-sum budget might be a good choice.

What are the benefits of budgeting?

Budgeting is a tool that helps ensure you’re spending your money in a way that aligns with your priorities. If you simply spend here and there without any type of plan, you can end up spending on things you don’t care all that much about, and never saving up enough for the things that you do — such as buying a car, going on vacation, or putting a downpayment on home.

Budgeting also helps ensure you can pay all your bills, have a cushion for the unexpected, and avoid running up expensive debt.

Photo credit: iStock/AndreyPopov

Annual percentage yield (APY) is variable and subject to change at any time. Rates are current as of 12/23/25. There is no minimum balance requirement. Fees may reduce earnings. Additional rates and information can be found at https://www.sofi.com/legal/banking-rate-sheet

Eligible Direct Deposit means a recurring deposit of regular income to an account holder’s SoFi Checking or Savings account, including payroll, pension, or government benefit payments (e.g., Social Security), made by the account holder’s employer, payroll or benefits provider or government agency (“Eligible Direct Deposit”) via the Automated Clearing House (“ACH”) Network every 31 calendar days.

Although we do our best to recognize all Eligible Direct Deposits, a small number of employers, payroll providers, benefits providers, or government agencies do not designate payments as direct deposit. To ensure you're earning the APY for account holders with Eligible Direct Deposit, we encourage you to check your APY Details page the day after your Eligible Direct Deposit posts to your SoFi account. If your APY is not showing as the APY for account holders with Eligible Direct Deposit, contact us at 855-456-7634 with the details of your Eligible Direct Deposit. As long as SoFi Bank can validate those details, you will start earning the APY for account holders with Eligible Direct Deposit from the date you contact SoFi for the next 31 calendar days. You will also be eligible for the APY for account holders with Eligible Direct Deposit on future Eligible Direct Deposits, as long as SoFi Bank can validate them.

Deposits that are not from an employer, payroll, or benefits provider or government agency, including but not limited to check deposits, peer-to-peer transfers (e.g., transfers from PayPal, Venmo, Wise, etc.), merchant transactions (e.g., transactions from PayPal, Stripe, Square, etc.), and bank ACH funds transfers and wire transfers from external accounts, or are non-recurring in nature (e.g., IRS tax refunds), do not constitute Eligible Direct Deposit activity. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. SoFi Bank shall, in its sole discretion, assess each account holder's Eligible Direct Deposit activity to determine the applicability of rates and may request additional documentation for verification of eligibility.

See additional details at https://www.sofi.com/legal/banking-rate-sheet.

SoFi Checking and Savings is offered through SoFi Bank, N.A. Member FDIC. The SoFi® Bank Debit Mastercard® is issued by SoFi Bank, N.A., pursuant to license by Mastercard International Incorporated and can be used everywhere Mastercard is accepted. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

SOBK0124056

Read more