What Is the Average Retirement Savings by Age?

Table of Contents

- Average Retirement Savings By Age

- Average Retirement Savings Before Age 35

- Average Retirement Savings, Age 35 to 44

- Average Retirement Savings, Age 45 to 54

- Average Retirement Savings, Age 55 to 64

- Average Retirement Savings, Age 65 to 74

- Target Retirement Savings by Age

- Is Anyone Saving Enough for Retirement?

The average retirement savings by age depends on people’s income, expenses, and even where they live (with some states having higher retirement savings rates than others). The older you are, the more likely you are to prioritize retirement savings.

How much have Americans saved for retirement? While nearly half (46%) of households have no retirement savings, those that do have an average of about $334,000 saved, according to the Federal Reserve Board’s 2022 Survey of Consumer Finance, which is the most recent data available.

If you look at the median amount Americans have saved in retirement accounts such as IRAs, 401(k) and 403(b) plans, pensions, and so forth, that number is lower: about $87,000 per household.

Key Points

• Average retirement savings by age varies widely, with savings increasing as people get older.

• Though 46% of U.S. households show no retirement savings, those with retirement assets have an average of about $334,000.

• By age 30, it’s generally recommended to save an amount equal to your annual salary, and by age 40, three to four times annual salary.

• By age 50, it’s advised to have six times annual salary saved, and by age 60, eight times.

• Given that many Americans are not saving for retirement, it’s important to consider these broader benchmarks as a way to keep your own savings on track.

Average Retirement Savings By Age

Below is a breakdown of retirement savings by age group, ranging from people in their 20s to people in their 70s, according to the 2022 Survey of Consumer Finance.

| Age Group | Mean Retirement Savings |

|---|---|

| Under age 35 | $49,130 |

| 35 to 44 | $141,520 |

| 45 to 54 | $313,220 |

| 55 to 64 | $537,560 |

| 65 to 74 | $609,230 |

Source: 2022 Survey of Consumer Finance, Federal Reserve Board, latest data available.

Average Retirement Savings Before Age 35: $49,130

Most Americans in their 20s and early 30s haven’t reached their peak earning years, and many might be paying off student loans, and saving up to buy a house or have kids. Retirement isn’t always top of mind.

But the earlier people can figure out which retirement plan is right for them and commit to actually starting a retirement savings plan, the more they will benefit from compound growth over time.

Average Retirement Savings, Age 35 to 44: $141,520

With their careers and lives generally more established, many people are making more money at this age than they ever have. It can be tempting to spend more on lifestyle choices (e.g., vacations, cars, furniture). Many people also have mortgages, families, and other big-ticket expenses during this time in their lives.

But those who put that money towards retirement may be able to reach their retirement goal with greater confidence. Granted, it can be difficult to juggle competing priorities, but taking advantage of employer-provided retirement accounts, matching funds, and automatic transfers to savings can all help busy people make progress.

Recommended: How to Save for Retirement at 30

Average Retirement Savings, Age 45 to 54: $313,220

At this age, some Americans are on track to reach their retirement goals, while others are far off. There are still ways to catch up, such as cutting unnecessary expenses, moving to a smaller home, or putting any additional pay, income, or bonuses into retirement accounts.

In addition, many retirement accounts offer what’s known as a catch-up provision, which is a way to add more money to certain accounts, once you’re over age 50. Starting in 2025, there is also a new policy that allows people between 60 and 64 to save an extra amount in an employer-sponsored plan.

Average Retirement Savings, Age 55 to 64: $537,560

Although the goal for many is to retire at about age 65, many Americans have to keep working since they don’t have enough savings. In some cases, people plan on working at this stage of life anyway, although it’s not always easy to find work. Ideally, working in later years of life would be a choice and not a necessity.

Retirement contributions tend to increase as people age partly because they are earning more and partly because they are thinking about retirement more — and in some cases because other expenses are lower. For example: Your kids may be done with college, or you may have paid off your mortgage.

Average Retirement Savings, Age 65 to 74: $609,320

Many people in this age group have embarked on retirement, thanks to years of self-directed investing (although many retirees may have consulted a professional as well). This is a time when people need to evaluate the amount they have saved in light of how long they are likely to live — which is the most significant factor impacting retirees, in addition to the cost of living.

It may be possible to enjoy some years of travel, starting a business, helping raise grandchildren — or other adventures. Or it may be a time to adjust living expenses in order to make one’s savings last.

Target Retirement Savings by Age

Because the cost and standard of living varies so greatly, there aren’t clear dollar figure amounts that each age group should aim to have saved for retirement. But there are suggested guidelines, and numerous ways to save for retirement as well.

Retirement Savings Benchmarks

• By age 30: It’s generally recommended that people save an amount equal to their annual salary by the time they reach age 30. That may not be a realistic goal for many people, but it can be a general guideline or goal to aspire to.

One way to achieve this is to save 10-15% of one’s gross income starting in one’s 20s. Some employers will match 401(k) contributions if employees save a certain amount each month, so it’s a good idea to contribute at least that much to take advantage of what is essentially free money.

• By age 40: It’s recommended that investors have three to four times their annual salary saved by age 40.

• By age 50: Investors are typically advised to have six times their salary saved by age 50.

• By age 60: It’s recommended that investors have eight times their salary saved by age 60.

• By age 67: Investors are typically advised to have ten times their salary saved by age 67, which is considered full retirement age for Social Security for many Americans.

For example, if a 67-year-old makes $75,000 per year, ideally they would aim to have $750,000 saved, more or less, at the point at which they actually retire and start to claim Social Security.

Is Anyone Saving Enough for Retirement?

Despite the above recommendations, most Americans don’t have nearly these amounts in their retirement accounts. As noted, a significant percentage of Americans don’t have any retirement savings at all — and that includes Americans who are near retirement age.

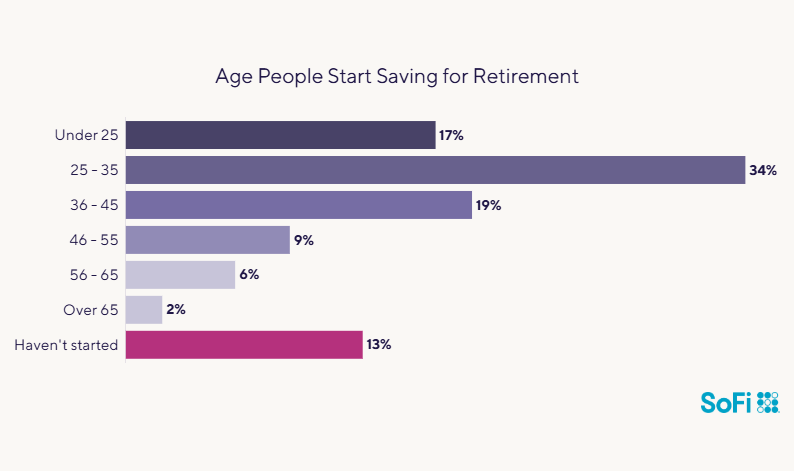

In a recent SoFi retirement survey of adults aged 18 and over, 59% had either no retirement savings or less than $49,000.

So, while some people are saving enough for retirement, many people aren’t. And relying on Social Security benefits isn’t likely to cover all of a retiree’s living expenses.

Social Security and Your Retirement

Social Security was designed to help people pay some of their expenses during retirement, but it was always assumed these benefits would be part of an individual’s larger income plan, which might include a pension and personal savings.

As a result, Social Security benefits are generally modest. As of January 2025, the estimated average Social Security payment for a retired worker was around $1,976 per month. But benefit amounts can be higher or lower, depending on your earning history, how old you are when you file, and other factors.

Perspectives on Social Security Vary Widely

In addition, people have different perspectives about Social Security. According to SoFi’s recent retirement survey, some adults think it will be their main source of income in retirement, while others see it as a supplement to other income sources. And some people aren’t counting on Social Security at all.

Perceptions of Social Security Perceptions in Retirement

• 41% Perceive SS as a supplementary source of income

• 31% Perceive SS as a their primary source of income

• 16% Aren’t relying on SS as a source of income

• 12% Aren’t sure how to perceive SS in their retirement plans

Source: SoFi Retirement Survey, April 2024

The fact that nearly a third of respondents believe Social Security could be their primary source of income reveals a lack of awareness of these benefits and how they work. And it points to a need for greater education around the need for personal savings and careful financial planning.

Strategies to Maximize Retirement Savings

It can be stressful to feel behind on saving for retirement, but it’s never too late to start.

There are several ways to save for retirement — but a good place to start, if you haven’t already, is by creating a budget to track expenses. This allows you to see where your money is going and identify categories of spending that could be reduced. It’s then possible to direct some of those savings to a retirement account, such as a traditional IRA, or a work-sponsored plan such as a 401(k) or 403(b).

Some retirement plans also have catch up options for those who start late — typically, individuals older than 50 can contribute extra funds to their retirement accounts.

No matter how much you put aside for retirement, or whether you contribute to a traditional IRA or a Roth IRA, a 401(k) or an after-tax investment account, a good strategy is to automate savings. With automated savings, the money is deducted from your paycheck or your bank account automatically — making it easy to forget that the money was ever in the account in the first place.

Recommended: Comparing the SIMPLE IRA vs. Traditional IRA

Retirement Account Options

Whether you’re employed full-time, working part-time, or you’re self-employed, there are many types of retirement account options available. Following is a selection of common retirement accounts, but there are others as well.

Bear in mind: Most retirement accounts offer different tax advantages, as well as strict rules about annual contribution limits, withdrawals and early withdrawals, loans, and required minimum distributions (RMDs). Be sure to understand the terms, to ensure a the plan you choose can help you reach your goals before funding a retirement account.

Individual Retirement Accounts, or IRAs

With an IRA, you open and fund a tax-advantaged IRA account yourself or for a custodian (e.g., a minor child). IRAs are for individuals, and are not offered by employers. That said, small businesses may offer a special type of IRA.

IRAs come in two flavors: traditional and Roth IRAs. When considering a Roth IRA vs traditional it’s important to understand the tax implications of each type of account. Traditional IRAs take tax-deferred contributions. This means your contributions are pre-tax, and can reduce your taxable income. You owe ordinary income tax on withdrawals.

Roth IRAs are considered after tax, because you deposit funds that have been taxed already. Qualified withdrawals are tax free.

Recommended: Roth IRA vs Traditional IRA: Key Differences

Employer-Sponsored Plans

A 401(k) plan is a tax-advantaged plan typically offered to the employees of a company. A 403(b) and 457(b) are similar, but offered by governments, schools, churches, or non-profit organizations that are tax exempt.

Traditional accounts allow employees to contribute pre-tax dollars, but withdrawals are taxed as income in retirement. Roth versions of these accounts (you may be able to set up a Roth 401(k) or Roth 403(b) account) allow after-tax contributions, and qualified tax-free withdrawals.

Self-Employed and Small Business Accounts

• A Saving Incentive Match Plan for Employees, or SIMPLE IRA plan, is also a tax-deferred account, similar to a traditional IRA. But these accounts are designed for small businesses with 100 employees or less (including sole proprietors, and people who are self-employed).

As a result, the contribution limits for SIMPLE IRAs are higher, and the tax treatment of these plans is slightly different.

• A SEP IRA is a Simplified Employee Pension Plan that small businesses and self-employed individuals can fund. Here, the employer makes the contributions. Employees do not. Like a SIMPLE IRA, the annual contribution limits are generally higher than for standard IRAs.

The Takeaway

The average American household has about $334,000 in retirement accounts, e.g., IRAs, 401(k) and 403(b) plans, pensions, and so forth. The number varies depending on age groups and other factors. Knowing how much others in your age group are saving for retirement can help provide a benchmark for evaluating whether you’re making the progress you envision.

There are a number of different formulas, calculations, and rules of thumb to help individuals figure out how much money they’ll need in retirement. While these figures can be helpful, it’s also important to take personal goals, financial responsibilities, and lifestyle into consideration.

Prepare for your retirement with an individual retirement account (IRA). It’s easy to get started when you open a traditional or Roth IRA with SoFi. Whether you prefer a hands-on self-directed IRA through SoFi Securities or an automated robo IRA with SoFi Wealth, you can build a portfolio to help support your long-term goals while gaining access to tax-advantaged savings strategies.

FAQ

How much money do I need to retire comfortably?

Calculating the amount you need to retire comfortably is highly personal. It depends on how long you’re likely to live, how healthy you are, as well as the lifestyle you envision. It may be worth consulting with a professional to lay out different options, and what the financial implications may be, as this can influence how much you save as well as your investment strategy.

What percentage of my income should I save for retirement?

The general rule of thumb is to save between 10% and 20% of your income for retirement. The exact amount will depend on many factors, including whether you’re saving for yourself or also for a spouse; what your likely longevity will be; whether you might have other financial sources of income (e.g., from a trust or an inheritance); and the retirement lifestyle you hope to have.

When should I start saving for retirement?

Given that you could live as many years in retirement as you did while you were working, the odds are that you might need more savings than you anticipated. In that light, it’s wise to start as soon as you can, and maximize the savings opportunities available to you.

What happens if I start saving for retirement late?

If you get a late start on retirement, it’s even more important to maximize your savings and your investing strategy. As an older saver, it can be hard to recover from market volatility, so you want to be cautious. It may make sense to work with a professional.

How do I catch up on retirement savings?

Catching up on retirement savings can mean boosting the percentage you save, pairing another retirement account, such as an IRA, with your employer plan, making sure you get your employer match, and — for those 50 and up — being sure to take advantage of catch-up provisions that allow you to save more in most retirement accounts. For those between the ages of 60 and 64, a “super catch-up” amount is now allowed in most employer plans.

About the author

You may also be interested in:

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Disclaimer: The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results.

SOIN-Q125-059

Read more