How Much Money Should I Save a Month?

How much of your paycheck should you save each month? Financial professionals often recommend putting at least 20% of your monthly take-home income into savings for future financial goals, such as buying a home and funding your retirement.

Exactly how much you should save each month, however, will depend on your income, current living expenses and financial obligations, as well as your goals. Here are some guidelines to help you decide how much of your income to stash in savings, plus tips on helping reach your goal.

Table of Contents

Key Points

• Financial advisors often suggest saving at least 20% of your monthly take-home income for future goals.

• A common budgeting technique is using the 50/30/20 rule: putting 50% of income toward essentials, 30% toward non-essentials, and 20% toward savings.

• One easy way to increase savings is to automate recurring transfers from checking to savings accounts.

• Funneling windfalls into savings and using roundups — a tool that saves the difference between a purchase price and the nearest higher dollar — can also boost savings.

• One of the most effective ways to save money is to determine your near-term and long-term financial goals and to track spending and progress in a budget.

How Much Should You Actually Be Saving Each Month?

There’s no one answer to “How much should I save each month?” Each person’s financial situation is different. Factors impacting how much you should save each month include income, expenses, debt, family size, and cost of living, among others. A commonly quoted bit of advice is to aim to save at least 20% of every paycheck.

The 50/30/20 Rule Is a Popular Starting Point

That 20% figure is part of the popular 50/30/20 budget rule. This technique says to put 50% of your take-home pay toward necessities (housing, utilities, minimum debt payments), 30% toward wants (travel, dining out, entertainment, and other fun purchases), and 20% toward savings and/or additional debt payments.

This budget can help you get on track for regular savings and is flexible enough to accommodate the fact that you may be dealing with debt. You might try a 50/30/20 savings calculator to help you do the math or work with a monthly budget template.

The “Pay Yourself First” Method Ensures You Always Save

Another strategy for saving is to use what’s known as the “pay yourself” method. This involves automatically transferring a sum of money into your savings account. This means the cash goes into savings before you use it to pay bills or go shopping.

In this way, you are prioritizing future goals (such as building an emergency fund, saving for a down payment, or funding a child’s education). Saving money becomes non-negotiable. You might schedule this kind of transfer from checking into savings just after your direct deposit paycheck hits. Online banking can make this a snap.

What Are Some Common Savings Goals You Should Plan For?

It can be difficult to know how much money you should save each month without having a sense of what you are saving for. Setting a few financial goals can also help motivate you to save, rather than spend all of your income.

Building an Emergency Fund for Unexpected Expenses Is Crucial

A major dental or car repair bill, the need for a new hot water heater, the unexpected loss of a job: These are fairly common occurrences that many people aren’t financially prepared for.

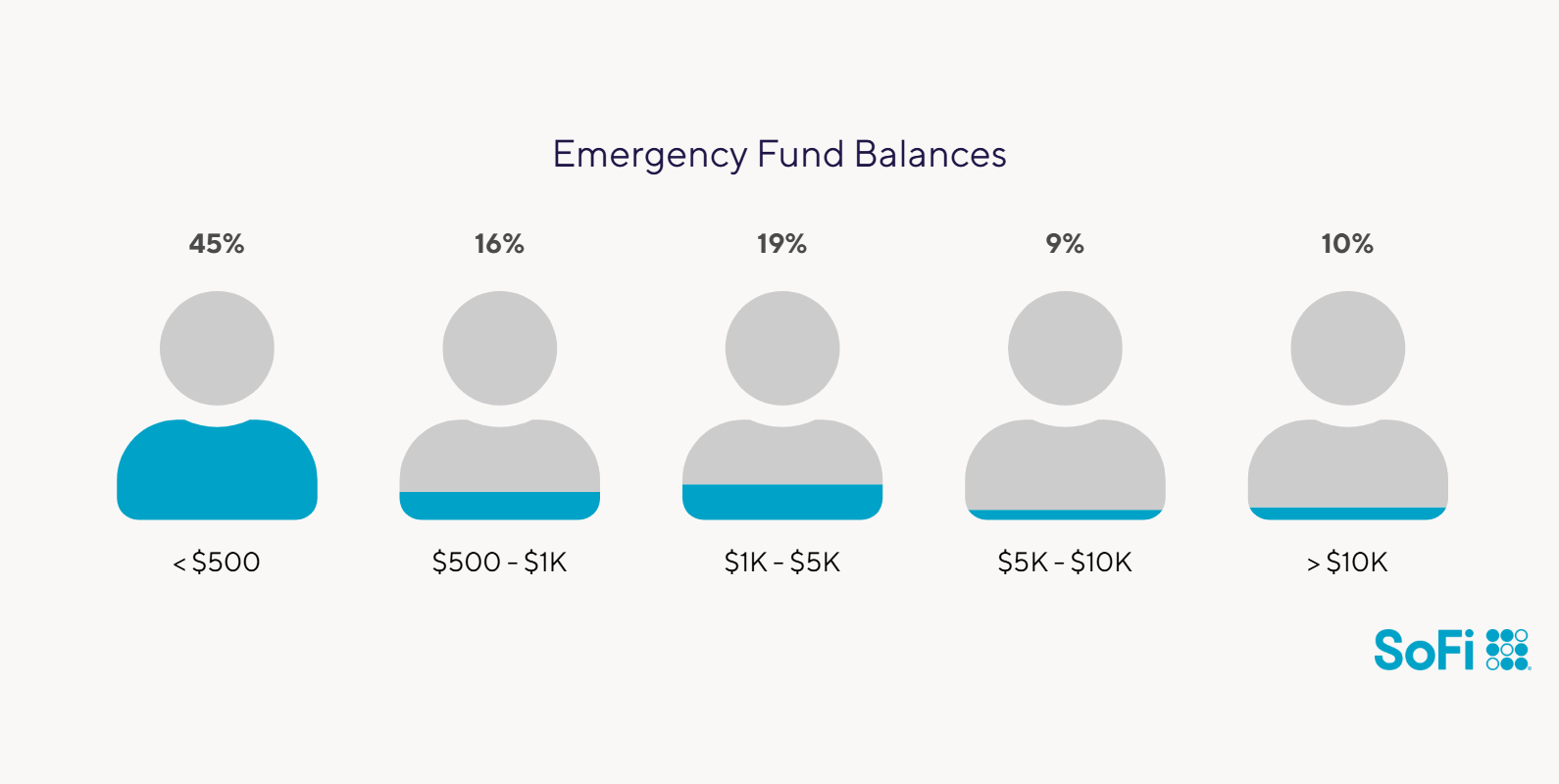

Experts advise that you have at least three to six months’ worth of living expenses stashed in an emergency fund for just these types of scenarios. By this measure, many Americans don’t have enough emergency savings, according to SoFi’s most recent “How People Bank Today” survey of 500 U.S. adults.

| Amount in emergency savings | People who have saved that amount |

| Less than $500 | 45% |

| $500 to $1,000 | 16% |

| $1,000 to $5,000 | 19% |

| $5,000 to $10,000 | 9% |

| More $10,000 | 10% |

To start building an emergency fund, it’s wise to keep the money in a liquid form (a high-yield savings account can be a good option). For those who are the sole earner in a family or who have fluctuating incomes, a higher figure may be advisable. You might use an emergency fund calculator to help determine how much money to save to reach your goal. As you build your fund, this money can sit, earning interest, until a safety net of cash is needed. Then, if an emergency does occur, you can dip into the fund instead of relying on high-interest credit cards.

Saving for a Down Payment on a House Requires a Long-Term Plan

Building up cash for a down payment on a house can be part of the American dream for many. Steady savings over the long-term can be a wise move, and it typically takes discipline: This could be the largest sum you’ll ever save.

You might open up a dedicated savings account and automatically funnel funds into it. Many people aim for a 20% down payment to avoid private mortgage insurance (PMI), but there are loans available with as little as, say, 3% to 5% down. It can be wise to calculate how much you’ll need and how long you have to save that amount and then determine how much you need to sock away every month (a savings goal calculator or down payment calculator can help). Then you can budget appropriately and also deposit any windfalls into your savings.

Planning for Retirement Is One of the Most Important Financial Goals

Planning for retirement is typically another major financial undertaking. According to a recent Gallup poll, about six out of 10 Americans say they have a retirement savings plan. It’s a wise move to start planning and saving as soon as possible to allow time for your money to grow. There are various online calculators and other tools you can use to assess how much you will need for retirement, or you might choose to meet with a financial planner.

When you set out to save for retirement, you may want to take advantage of company matches offered in your workplace retirement plan by contributing the maximum amount the company matches.

After emergency savings, a down payment, and retirement, goals may start to look different from person to person. may want to save up to start a business, and yet another may be interested in college savings. Fifty-two percent of the respondents to SoFi’s survey said they are using their savings accounts to save for a specific goal.

|

Goals People Save For in a Savings Account |

|

|---|---|

| Short-term and long-term goals | 40% |

| Short-term goals like a vacation or holiday spending | 35% |

| Long-term goals like a child’s college education or a house | 26% |

Where Is the Best Place to Keep Your Monthly Savings?

The best account for building savings will depend on what you are saving for.

A High-Yield Savings Account Helps Your Money Grow Faster

If you are saving up for retirement, for example, you’ll likely want to use a designated retirement account, like a 401(k) or IRA, since they allow you to contribute pretax dollars (which can help lower your annual tax bill).

You may want to keep in mind, however, that the IRS (Internal Revenue Service) sets annual contribution limits to retirement funds.

For an emergency fund or other short-term savings goals (within three to five years), you may want to open a separate savings account, such as a high-yield savings account, money market account, or a checking and savings account. These savings vehicles typically offer more interest than a traditional savings account, yet allow you to easily access your money when you need it.

What Are Some Easy Ways You Can Boost Your Savings?

Below are some strategies that can help make it easier to start — and build — your monthly savings.

Automating Savings

One great way to make sure you stick to a money-saving plan is to automate savings, as referenced above. You may want to set up a recurring transfer from your checking into your savings account on the same day each month, perhaps the day after your paycheck clears. Even setting aside just a small amount of money each month now can, little by little, add up to a significant sum in the future.

Putting Spare Change to Work

There are apps that will automatically use roundups on any amount paid on a credit or debit card. They round your charge up to the next whole dollar amount and put that little bit of extra money into savings accounts or even invest it. This “pocket change” can add up over time.

Using Windfalls Wisely

If a lump sum of cash, such as a bonus or monetary gift, comes your way, you may want to consider funneling all or part of it right into savings.

Or, if you get a percentage raise on your salary, you might want to boost your automatic monthly transfer from your checking account to your savings account by the same percentage.

Reviewing Your Budget

If you feel like your budget is too tight to save anything at the end of the month, you may want to review your monthly and habitual expenses. You can do this by combing through your checking and credit card statements for the past few months. Or you may want to track your spending for a month or two. You can then come up with a list of spending categories and determine how much you are spending on average for each.

There are online tools that can help make this process easier — in fact, 23% of people use budgeting tools offered by their bank, SoFi’s survey found. And of the 20% of respondents who have used AI to help manage their finances, 31% have used automated budgeting suggestions.

Once you can see exactly where your money is going each month, you may find places where you can fairly easily cut back, such as getting rid of streaming subscriptions you rarely watch, quitting the gym and working out at home, or cooking more and getting take-out less often.

The Takeaway

The right amount to save each month will be unique to you and reflect such factors as your financial goals, how much you earn, and how much you spend each month on essential expenses.

One of the most important keys to saving is consistency. No matter how much of your income you choose to set aside each month, depositing small amounts regularly can build to a large sum over time to achieve your goals. Finding the right banking partner can also help you actualize your money aspirations.

Interested in opening an online bank account? When you sign up for a SoFi Checking and Savings account with eligible direct deposit, you’ll get a competitive annual percentage yield (APY), pay zero account fees, and enjoy an array of rewards, such as access to the Allpoint Network of 55,000+ fee-free ATMs globally. Qualifying accounts can even access their paycheck up to two days early.

FAQ

How much savings should I have by age 30?

A common guideline is to have your annual salary saved for retirement by age 30, with some sources suggesting a slightly lower target like 0.5x or 1x your salary for overall savings, which would include an emergency fund.

Is saving $500 a month considered good?

There’s no single amount of money saved every month that qualifies as good. Each person’s financial situation is unique. That said, consider the rule of saving 20% of your take-home pay. With this formula, saving $500 a month would equal $6,000 a year, which is 20% of a $30,000 annual take-home pay.

What should I do if I have debt and want to save?

It can be challenging to both save and pay off debt. Strategies can include budgeting wisely, paying the minimum on your debt while building an emergency fund, and then focusing on such debt payoff alternatives as the snowball and avalanche techniques or debt consolidation. Automating savings (aka paying yourself first) is another valuable method.

How is saving for retirement different from other savings goals?

Saving for retirement differs from other savings goals (such as for an emergency fund) since it’s a very long-term endeavor, can involve large sums of money, offers tax advantages, and carries legal protections.

What if I can’t afford to save 20% of my income right now?

It may not be possible to save 20% of your income due to such factors as high cost of living or high levels of debt. What is important is to start saving consistently, even if it’s a small amount, so that your money can grow over time and help you build long-term wealth.

SoFi Checking and Savings is offered through SoFi Bank, N.A. Member FDIC. The SoFi® Bank Debit Mastercard® is issued by SoFi Bank, N.A., pursuant to license by Mastercard International Incorporated and can be used everywhere Mastercard is accepted. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Annual percentage yield (APY) is variable and subject to change at any time. Rates are current as of 12/23/25. There is no minimum balance requirement. Fees may reduce earnings. Additional rates and information can be found at https://www.sofi.com/legal/banking-rate-sheet

Eligible Direct Deposit means a recurring deposit of regular income to an account holder’s SoFi Checking or Savings account, including payroll, pension, or government benefit payments (e.g., Social Security), made by the account holder’s employer, payroll or benefits provider or government agency (“Eligible Direct Deposit”) via the Automated Clearing House (“ACH”) Network every 31 calendar days.

Although we do our best to recognize all Eligible Direct Deposits, a small number of employers, payroll providers, benefits providers, or government agencies do not designate payments as direct deposit. To ensure you're earning the APY for account holders with Eligible Direct Deposit, we encourage you to check your APY Details page the day after your Eligible Direct Deposit posts to your SoFi account. If your APY is not showing as the APY for account holders with Eligible Direct Deposit, contact us at 855-456-7634 with the details of your Eligible Direct Deposit. As long as SoFi Bank can validate those details, you will start earning the APY for account holders with Eligible Direct Deposit from the date you contact SoFi for the next 31 calendar days. You will also be eligible for the APY for account holders with Eligible Direct Deposit on future Eligible Direct Deposits, as long as SoFi Bank can validate them.

Deposits that are not from an employer, payroll, or benefits provider or government agency, including but not limited to check deposits, peer-to-peer transfers (e.g., transfers from PayPal, Venmo, Wise, etc.), merchant transactions (e.g., transactions from PayPal, Stripe, Square, etc.), and bank ACH funds transfers and wire transfers from external accounts, or are non-recurring in nature (e.g., IRS tax refunds), do not constitute Eligible Direct Deposit activity. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. SoFi Bank shall, in its sole discretion, assess each account holder's Eligible Direct Deposit activity to determine the applicability of rates and may request additional documentation for verification of eligibility.

See additional details at https://www.sofi.com/legal/banking-rate-sheet.

*Awards or rankings from NerdWallet are not indicative of future success or results. This award and its ratings are independently determined and awarded by their respective publications.

We do not charge any account, service or maintenance fees for SoFi Checking and Savings. We do charge a transaction fee to process each outgoing wire transfer. SoFi does not charge a fee for incoming wire transfers, however the sending bank may charge a fee. Our fee policy is subject to change at any time. See the SoFi Bank Fee Sheet for details at sofi.com/legal/banking-fees/.

^Early access to direct deposit funds is based on the timing in which we receive notice of impending payment from the Federal Reserve, which is typically up to two days before the scheduled payment date, but may vary.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

SOBNK-Q425-036

Read more