Should You Pay Off Debt or Save Money First?

Table of Contents

Paying off debt vs. saving money is a tough financial choice. Prioritizing debt repayment can help you repay what you owe faster, freeing up more money in your budget for saving. It can also help you spend less on interest charges.

But paying off debt and delaying saving might backfire. If you don’t have savings and you get hit with an unplanned expense, you could end up with even more high-interest debt.

Whether it makes sense to pay off debt or save depends largely on your financial situation. The right decision might be to try to do both.

Key Points

• It’s important to establish an emergency savings fund with three to six months’ living expenses to avoid additional debt.

• Compare interest rates on debts to prioritize high-interest debt repayment.

• Use the debt snowball method to pay off debts from the lowest to the highest, or use the debt avalanche method to minimize interest by paying the highest-interest debt first.

• Putting savings in a high-yield savings account can maximize interest your savings may earn.

• Contribute enough to a 401(k) to secure the employer match, then balance saving and debt repayment.

The First Priority for Everyone: Build a Starter Emergency Fund

Without an emergency fund, an unplanned expense or loss of income could result in racking up even more debt, putting you further in the hole.

Financial professionals generally recommend building an emergency fund of three to six months’ worth of expenses. If you’re self-employed or work seasonally, you may want to aim closer to eight or even 12 months’ worth of expenses. An emergency fund calculator can help you figure out how much to save.

You could stash your emergency savings in a high-yield savings account. These accounts are designed to earn more interest than traditional savings accounts, which could potentially help your savings earn even more.

To figure out how quickly the balance in your savings account might grow, you can look at how frequently the interest compounds. (Compounding is when the interest is added to the principal in the account and then the total amount earns interest.) By plugging your information into an APY calculator, you can see the power of compound interest at work.

💡 Quick Tip: Are you paying pointless bank fees? Open a checking account with no account fees and avoid monthly charges (and likely earn a higher rate, too).

How to Decide What Comes Next: Compare Interest Rates

Once you’ve got your emergency fund in shape, you can focus on your debt. What’s important here is the kind of interest your debt has. Analyze all the debt you have — car loans, student loans, credit cards, and so on — and determine whether it’s high-interest debt or low-interest debt.

When to Aggressively Pay Down Debt (High-Interest Debt)

High-interest debt, such as credit card debt, can quickly accumulate and become overwhelming. The longer it takes to pay off, the more interest you’ll accrue, making it harder to escape the debt cycle. When you have high-interest debt, it makes sense to focus on paying off your debt first.

When to Prioritize Saving and Investing (Low-Interest Debt)

On the other hand, if you have debts with relatively low annual percentage rates (APRs) and you don’t feel unduly burdened by them, you could prioritize saving, while paying off your loans and other debts according to their payment schedules.

Recommended: Why Your Debt to Income Ratio Matters

The Best of Both Worlds: How to Pay Off Debt and Save Simultaneously

If you have high-interest debt under control and you also have an emergency fund, consider saving and paying down debt at the same time. Here are some tips to help you manage both.

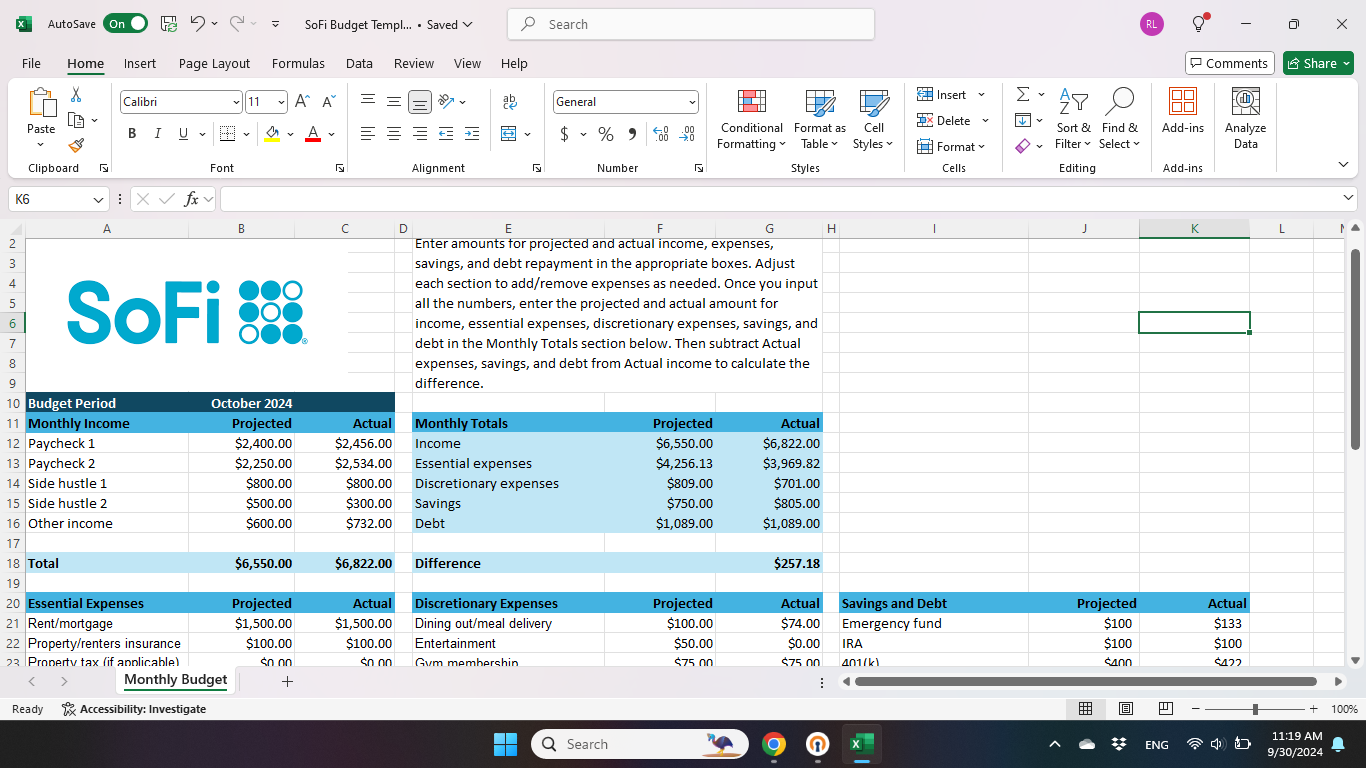

• Create a budget: A budget can help you track your income, expenses, and savings. The key is to allocate specific amounts for debt repayment and savings to ensure both are addressed every month.

• Cut unnecessary expenses: Review your expenses and identify areas where you can cut back. Redirect these funds toward debt repayment and saving.

• Automate saving: Once you have target monthly savings amounts, it’s a good idea to set up automatic transfers to your savings accounts. This ensures consistent saving without the temptation to spend the money.

While you’re at it, make sure you’re happy with your banking experience. You can compare bank accounts to get the best interest rates and customer service, for example.

• Take advantage of your employer’s 401(k) match: If your employer offers a 401(k) plan with a company match, it’s a good idea to try to contribute at least enough to get the maximum employer match. This is essentially free money and it could help add to your retirement savings.

• Increase income: You might also want to explore ways to boost your income, such as taking on a side gig, freelancing, or asking for a raise. You can then use the additional income to pay down debt faster and boost your savings.

• Use windfalls wisely: If you receive a bonus, tax refund, or any unexpected sum of money, consider using it to pay down debt or boost your savings rather than going on a shopping spree.

Increase your savings

with a limited-time APY boost.*

Strategies to Pay Down Debt

Once you commit to paying down your debt, you’ll want to come up with a plan for how to do it. Here are some strategies to consider.

The Debt Snowball Method

With the snowball method, you list your debts in order of size. You then funnel extra money towards the smallest debt, while paying the minimum on the rest. When the smallest balance is paid off, you move on the next-smallest debt, and so on. This can provide psychological benefits by giving you quick wins and motivating you to continue.

As you’re paying down debt, be sure to monitor your checking account regularly to make sure you have enough money in it to cover your bill payments.

The Debt Avalanche Method

Another approach is the avalanche method. With this strategy, you list your debts in order of interest rate. You then direct any extra money toward the balance with the highest rate, while paying the minimums on the other debts. Once the highest-interest debt is paid off, you move to the next highest, and so on. The debt avalanche minimizes the amount of interest you pay over time.

Recommended: How to Set and Reach Your Savings Goals

The Takeaway

Saving and paying down debt is a balancing act. Which is more important? There’s no one-size-fits all answer. Generally speaking, you’ll want to fund your emergency savings account before you aggressively focus on debt payoff. After that, you can focus on saving and knocking down debt at the same time.

Interested in opening an online bank account? When you sign up for a SoFi Checking and Savings account with eligible direct deposit, you’ll get a competitive annual percentage yield (APY), pay zero account fees, and enjoy an array of rewards, such as access to the Allpoint Network of 55,000+ fee-free ATMs globally. Qualifying accounts can even access their paycheck up to two days early.

FAQ

What is considered high-interest debt?

While there is no one definition of high-interest debt, it is typically considered to be debt with a high interest rate, often in the double digits. For example, the average credit card interest rate as of August 2025 was 24.35%. Credit cards are considered high-interest debt, as are certain types of loans (such as personal loans) for borrowers whose credit is poor.

How much should I have in my emergency fund before aggressively paying down debt?

Before aggressively paying down debt, it’s a good idea to save three to six months’ worth of living expenses in an emergency fund. Otherwise, if you don’t have any savings to draw on to cover an unexpected expense or event, you might have to use high-interest credit cards to get by, which would compound your debt.

Should I use my savings to pay off my car loan or student loans early?

Whether you should use your savings to pay off your car loan or student loans early depends on your specific financial situation. Generally speaking, if you have additional savings beyond the recommended three to six months’ worth of money in an emergency savings fund, you might consider using some of that extra savings to pay off your car loan or student loans early. But it’s best not to use the money in your emergency fund for this, so that you’ll be covered if a surprise expense pops up.

Should I stop contributing to my 401(k) to pay off debt?

If your employer offers a 401(k) plan with matching employer funds, it’s wise to contribute at least enough to get the full employer match, if possible. This is essentially free money you would otherwise miss out on. Once you’ve received the 401(k) employer match, you could work on paying off your high-interest debt.

Does paying off debt or saving have a bigger impact on my credit score?

Paying off debt generally has a bigger impact on your credit score than saving does.That’s because paying off debt can reduce your credit utilization, which is the amount of credit you’re using compared to the amount of credit you have available. The lower your credit utilization, the better. A low credit utilization can have a significant positive impact on your credit score. In fact, credit utilization accounts for 30% of your FICO® Score.

About the author

Photo credit: iStock/malerapaso

SoFi Checking and Savings is offered through SoFi Bank, N.A. Member FDIC. The SoFi® Bank Debit Mastercard® is issued by SoFi Bank, N.A., pursuant to license by Mastercard International Incorporated and can be used everywhere Mastercard is accepted. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Annual percentage yield (APY) is variable and subject to change at any time. Rates are current as of 12/23/25. There is no minimum balance requirement. Fees may reduce earnings. Additional rates and information can be found at https://www.sofi.com/legal/banking-rate-sheet

Eligible Direct Deposit means a recurring deposit of regular income to an account holder’s SoFi Checking or Savings account, including payroll, pension, or government benefit payments (e.g., Social Security), made by the account holder’s employer, payroll or benefits provider or government agency (“Eligible Direct Deposit”) via the Automated Clearing House (“ACH”) Network every 31 calendar days.

Although we do our best to recognize all Eligible Direct Deposits, a small number of employers, payroll providers, benefits providers, or government agencies do not designate payments as direct deposit. To ensure you're earning the APY for account holders with Eligible Direct Deposit, we encourage you to check your APY Details page the day after your Eligible Direct Deposit posts to your SoFi account. If your APY is not showing as the APY for account holders with Eligible Direct Deposit, contact us at 855-456-7634 with the details of your Eligible Direct Deposit. As long as SoFi Bank can validate those details, you will start earning the APY for account holders with Eligible Direct Deposit from the date you contact SoFi for the next 31 calendar days. You will also be eligible for the APY for account holders with Eligible Direct Deposit on future Eligible Direct Deposits, as long as SoFi Bank can validate them.

Deposits that are not from an employer, payroll, or benefits provider or government agency, including but not limited to check deposits, peer-to-peer transfers (e.g., transfers from PayPal, Venmo, Wise, etc.), merchant transactions (e.g., transactions from PayPal, Stripe, Square, etc.), and bank ACH funds transfers and wire transfers from external accounts, or are non-recurring in nature (e.g., IRS tax refunds), do not constitute Eligible Direct Deposit activity. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. SoFi Bank shall, in its sole discretion, assess each account holder's Eligible Direct Deposit activity to determine the applicability of rates and may request additional documentation for verification of eligibility.

See additional details at https://www.sofi.com/legal/banking-rate-sheet.

We do not charge any account, service or maintenance fees for SoFi Checking and Savings. We do charge a transaction fee to process each outgoing wire transfer. SoFi does not charge a fee for incoming wire transfers, however the sending bank may charge a fee. Our fee policy is subject to change at any time. See the SoFi Bank Fee Sheet for details at sofi.com/legal/banking-fees/.

*Awards or rankings from NerdWallet are not indicative of future success or results. This award and its ratings are independently determined and awarded by their respective publications.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

SOBNK-Q325-106

Read more