39 Passive Income Ideas to Help You Make Money in 2026

Table of Contents

With inflation and interest rates rising, many people are looking for ways to generate additional income these days — and finding reliable sources of passive income, which require less effort than most jobs — has become particularly desirable.

Creating and managing passive income streams isn’t a truly passive activity, however. Generating passive income usually requires upfront work, or sometimes a substantial investment to get the ball rolling. And depending on what your passive income ideas are, whether you’re renting out property or selling a product via online platforms, you’ll likely have ongoing tasks to keep the money coming in. That said, passive income can in some cases deliver more income with less effort than a traditional job that requires a fixed number of hours per week.

Key Points

• Passive income is money earned without regular, active involvement.

• Investing in businesses, P2P lending, and rental properties are some ways to generate passive income.

• Benefits of passive income include extra money with less effort, freedom, and flexibility.

• Initial work and investments are often needed to set up a stream of passive income.

• The opposite of passive income is active income, which usually involves a job and is also known as earned income.

What Is Passive Income?

Passive income is money that you earn without active involvement. In other words, it is income that isn’t attached to an hourly wage or annual salary. Passive income ideas could include things like cash flow from rental properties, dividend stocks, sales of a product (that requires little or no effort), royalties, and more.

Essentially, these side hustles can help you earn money without contributing much, if any, active effort. If you are paid for a service you perform, that’s active income — you have to put in time and energy in order to get paid. If you can continue making money while staying mostly hands-off, that can be a form of passive income. That doesn’t mean you won’t have to put work in up front to get started — you probably will. But besides some maintenance, passive income shouldn’t require your active involvement.

There are obvious benefits to these low-effort side hustles over traditional active income. Earning more money without putting in more hours offers the opportunity to make extra cash without burning yourself out. If you’re successful enough, it might even give you the freedom and flexibility to quit your day job and do whatever you want instead, whether that’s going to school, traveling, writing, or making art.

39 Passive Income Ideas to Help You Make Money

There are a number of ways to earn passive income. Some options, like the following types of passive income, take relatively little active supervision.

- Invest in Bonds (and Earn Interest)

- Invest in a Business

- Become a Peer-to-Peer (P2P) Lender

- Buy a Rental Property

- Invest in Crowdfunded Real Estate

- Invest in Index Funds or Dividend Stocks

- Invest with an Automated Advisor

- Start a Retirement Account

- Join an Affiliate Program

- Rent Out Your Car

- Advertise on Your Car

- Rent Your Parking Space

- Rent Storage Space

- Invest in Real Estate Investment Trusts (REITs)

- Rent Your Bike

- Rent Out a Room or Property

- Pet Sit in Your Home

- House Sit for Someone

- Buy and Sell Domain Names

- Rent Your Tools

- Invest in Royalties

- Purchase a Billboard

- Purchase a Blog

- Create an Online Course

- Sell Digital Products

- License Your Photos

- Create a Mobile App

- Sell a Product

- License Your Music

- Self-Publish a Book

- Sell Blank Books

- Create Greeting Cards

- Sign Up for Dropshipping

- Start a Blog

- Start a YouTube Channel

- Publish an Ebook

- Create a Podcast

- Start an ATM Business

- Start a Vending Machine Business

1. Invest in Bonds (and Earn Interest)

A fairly simple way to earn passive income through your investment portfolio is to invest in bonds with high yields. That is, you’ll receive regular payments from the bond-issuer, generating income and return on your investment.

Similar to a CD, a bond is a way of locking up a certain amount of money for a fixed period of time. In short, bonds are purchased for a fixed period of time (the duration), investors receive interest payments over that time, and when the bond matures, the investor receives their initial investment back.

Generally, investors earn higher interest payments when bond issuers are riskier. An example may be a company that’s struggling to stay in business. But interest payments may be lower when the borrower is trustworthy, like the U.S. government.

2. Invest in a Business

Although this may take an up-front investment, buying into a business and becoming a silent partner can be another passive income source.

Even if the company you are thinking of investing in seems solid, it’s important to have an understanding of the challenges the organization may face. There are some red flags to look out for, such as a company whose revenue is earned from just a couple of clients — or just one client — as opposed to several.

It’s also important to lay out the exact terms of your investment and compensation.

3. Become a Peer-to-Peer (P2P) Lender

Peer-to-peer (P2P) lending platforms are another type of crowdfunding that allows people to borrow money from individual investors. Through these sites, you can be matched with an individual seeking a loan, and lend your money at a rate that could be higher than the usual bank rates.

That’s because investors taking part in peer-to-peer lending tend to bear the bulk of any risk. It is possible that borrowers will default on their loans, leading to a higher risk if an investor were to lend money with a lower credit rating, for example. Returns are never guaranteed and while investors will receive a return on the money they invest, they could also lose some or all of it in the long run.

4. Buy a Rental Property

Another popular passive income source is rental property. You might want to purchase a home to rent out to an ongoing tenant or list a property on a short-term rental site. Hiring a property management company lessens your day-to-day involvement, thereby making this venture a more passive income strategy than active.

Obviously, setting up this type of income requires a pretty big outlay, and it may be a while before your investment property generates a profit over and above the many expenses required to run it, if it ever does. In addition, there are always risks in the rental markets to keep in mind.

5. Invest in Crowdfunded Real Estate

If you don’t have thousands of dollars to spend on a piece of property, you can always check out your options on crowdfunded real estate sites. These may require a smaller initial investment, and likewise the costs are also shared.

Crowdfunded real estate investments can be complex, however, and you’ll want to balance the risks and rewards.

6. Invest in Dividend Stocks

When companies choose to share a portion of their profits with the investors who own shares of the firm, those payments are called dividends, and they work generally the same way from company to company.

Typically, dividends are paid in cash (though some might be paid in stock), on a regular schedule. Dividends are usually paid quarterly, though there are variations.

Investors might receive dividends from companies they’re invested in, or from mutual funds they’re invested in that hold shares of dividend-paying companies.

There is no guarantee that investing in dividend stocks will continue to earn you passive income. As Liz Young Thomas, Head of Investment Strategy at SoFi, points out, “A stock’s dividend yield will fluctuate because it’s based on the stock’s price and prices can be volatile. You should also consider other factors like a company’s track record of increasing the dividend, the dividend payout ratio, debt load, and cash on hand when determining the overall health of an investment.”

💡 Learn more: What Is Dividend Income? Can You Live Off It?

7. Invest with an Automated Advisor

If you’re just getting started with investing, you may want to use automated investing tools to help you choose the appropriate allocation of assets for your goals.

Typically, an automated platform — also called a robo-advisor — is a digital investing service that provides you with a questionnaire so you can establish your financial goals, risk preferences, and time horizon.

On the backend, a sophisticated algorithm then recommends a pre-set, automated portfolio that aligns with your responses. These portfolios often have lower account minimums compared with traditional brokers, and the portfolios themselves are typically comprised of low-cost exchange-traded funds (ETFs) — which adds to the cost efficiency of some robo products.

You can use a robo investing as you would any account — for retirement, as a taxable investment account, or even for your emergency fund — and you typically invest using automatic deposits or contributions. The allocation in each portfolio is usually pre-determined, and investors cannot change the investments.

8. Start a Retirement Account

When you open your retirement account, you can choose to invest it however you want. For example, you could open an individual retirement account (IRA) online.

One way to earn income in a retirement account is by investing in mutual funds. You can choose the level of risk you want to take with your money by finding a mutual fund that is higher or lower risk.

💡 Learn more: 4 Easy Steps to Starting a Retirement Plan

9. Join an Affiliate Program

When you join a company’s affiliate program, you earn a commission from every product that someone purchases from that company. In many cases, all you have to do is post the link on your blog, website, or social media pages.

10. Rent Out Your Car

Another one of the best passive income opportunities is renting out your car on a site like Turo. It’s basically the Airbnb of cars, and could generate thousands of dollars per year, in some cases.

11. Advertise on Your Car

If you have a clean driving record as well as a newer car, consider getting in touch with a car advertising agency. You simply drive around town with ads on your car and easily generate passive income.

12. Rent Your Parking Space

Do you have space in your driveway that you aren’t using? Then rent it out on platforms like Stow It, where you can find people who will pay to rent out the space.

13. Rent Storage Space

If you have extra space in your garage, shed, or storage unit, then you could start earning passive income by using a peer-to-peer storage site like Stashii to find people who need your space.

14. Invest in Real Estate Investment Trusts (REITs)

An alternative to becoming a property owner or landlord are real estate investment trusts, or REITs. REITs are publicly traded companies on the stock market that own income-producing real estate, such as apartment complexes, office buildings, retail centers, storage units, and more. They give you the chance to invest in real estate portfolios without having to manage the properties yourself. REITs sometimes come at a higher risk than other types of funds, so it’s important to research potential REITs or REIT funds, and consider how they may play a role in a diversified portfolio.

💡 For more alternative investment options, check out: Alternative Investments: Definition and Types

15. Rent Your Bike

Perhaps you don’t have a car, but you do have a bike that’s just sitting around. Your bike could be a lucrative passive income source, especially if you live in a high-traffic area. List your bike on Spinlister to get started.

16. Rent Out a Room or Property

Even if you don’t own an investment property, with your landlord’s permission, you may be able to rent out a room in your apartment or list it on Airbnb.

17. Pet Sit in Your Home

If you love pets, you can earn passive income by welcoming pets into your home while their owners are on vacation. For instance, you could charge $30 to $80 per day just for running a doggy daycare. You can gain clients through word of mouth or use a site like Rover to find customers.

18. House Sit for Someone

When your friends go out of town, they may need someone to stay in their home and do simple things like water their plants and collect their mail. You can easily make money and have somewhere new to stay for a little bit. Along with making yourself available to friends, you can sign up to be a house sitter on HouseSitter.com.

19. Buy and Sell Domain Names

Some domain names are cheap, while others cost a lot of money because they are in high demand. One thing you could do to start another passive income stream is to purchase domain names you think will be popular. Purchase low for around $10 to $100 and then sell them for a much higher price later on.

20. Rent Your Tools

Have you ever done a home improvement project that required you to purchase tools? You may never need to use those tools again. Thankfully, now you can rent tools, and rent out your tools, on peer-to-peer platforms such as Sparetoolz to earn passive income.

21. Invest in Royalties

Let’s say you don’t have any songwriting ability, but you would like to make money on other artists’ work. You can invest in royalties through Royalty Exchange and earn passive income on the intellectual property.

22. Purchase a Billboard

You can make thousands of dollars per month if you own a billboard where companies can advertise their products and services. Do your research and make sure you get the right permits before committing to a billboard.

23. Purchase a Blog

If you don’t have the time or energy to create content for your own blog, then look into ones that are already successful and see if the owners are willing to sell. You could also hire someone to manage your blog so that you’re truly earning in a passive way.

24. Create an Online Course

If you have a special skill or knowledge about a certain topic, you may be able to create a video course where you teach people about that topic and charge them to take the course.

25. Sell Digital Products

You may want to research online platforms where you can sell everything from digital art to e-books. Whether you’re an artist, graphic designer, or writer, you can create digital products to sell online.

26. License Your Photos

Many companies, bloggers, and individuals use stock photos on a regular basis. You may be able to upload your best photos to stock media platforms and earn passive income on them.

27. Create a Mobile App

If you’ve been dreaming about an amazing phone app that you think a lot of other people would use, you may want to look into hiring a development team to create it.

28. Sell a Product

You may be able to earn passive income through sales of a product that you create. This could be a book that you write or a physical product that you design and make. You might also list items you already own on sites like eBay and earn extra income through those sales.

29. License Your Music

Do you love to write songs? Then you could license your music and start earning passive income. You’ll just have to team up with a music licensing company to get started.

30. Self-Publish a Book

Through platforms like Amazon’s KDP, you can self-publish a book and earn a royalty on it every time someone makes a purchase. You will be able to set the price of your book and be in full control of your book’s Amazon page, where you can list pictures of the book, reviews, and videos promoting it.

31. Sell Blank Books

You can start selling books online without having to write anything. How? By focusing on blank books, such as journals, sketchbooks, and planners. Simply find a design you believe will appeal to people and begin collecting royalties when people buy your books.

32. Create Greeting Cards

Another artistic endeavor that could be a good passive income stream is creating greeting cards that you sell to a wholesale or retail stationery company that accepts independent artist submissions.

33. Sign Up for Dropshipping

If you want to sell products and make money online but don’t want to store any of the goods, you could always look into dropshipping to create passive income. With dropshipping, you don’t have to have much money to start since you don’t need inventory to fulfill orders for customers.

34. Start a Blog

Blogging seems like a pretty cool space to operate in and gives you a lot of creative freedom. You can make your blog all about crafts, share tutorials, ideas, and more. It’s up to you how your space operates.

Blogging might seem like too much work to many people, but it doesn’t have to be a full-time job for everyone. For some people, blogging can be fun after a day at the office — and, with time and effort, it could turn into something more lucrative.

Here are a few ideas on how you can make passive income from blogging:

• Affiliate marketing

• Google AdSense: Cost Per Click and Cost Per Impression

• Sponsored posts

• Selling products

35. Start a YouTube Channel

If you enjoy creating videos more than writing, then consider starting your own YouTube channel. Once you get enough viewers, you can begin to generate passive income through YouTube advertising.

36. Publish an Ebook

Like an online course, an ebook is a way to share your expertise with the world. Anyone can self-publish a book online through services like Amazon’s Kindle Direct Publishing, iBooks Author, or Kobo Writing Life.

The percentage of royalties you earn varies depending on the publisher. Of course, the more marketing you do, the more copies you’re likely to sell — and there’s no shortage of online marketing strategies to investigate. But once you write and publish the e-book, it’s out there ready to generate passive income for you.

37. Create a Podcast

Podcasts are still popular, and they can generate some passive income for you. If you start a podcast that resonates with people, then you can grow your audience and monetize your show by sponsoring with ad partners. If you get enough listeners, you may be able to sign up for podcast advertising networks.

38. Start an ATM Business

When people are out at a bar or nightclub or they’re frequenting a cash-only business, they may need cash right away. If you own an ATM business and you place your ATM in high-traffic locations, you could start to generate passive income through surcharge fees. Typically, you could earn around $3 per withdrawal.

39. Start a Vending Machine Business

Similar to an ATM business, a vending machine business allows you to use your creativity and determine high-traffic areas where you could make a lot of money. If you buy in bulk, you’ll be able to save on the snacks and drinks you purchase for your machines.

Potential Benefits of Earning Passive Income

There are only 24 hours in a day. If you go to a job each day that pays you a set amount of money, that is the maximum amount that you’ll ever make in a 24-hour period. That is called earned income.

By investing some of that earned income into different passive income ideas, you may be able to increase your earnings. Diversifying your income stream may also improve your financial security. Some benefits of passive income are:

• More Free Time: By earning money through passive income sources, you might be able to free time in your schedule. You may choose to spend more time with your family, pursue a creative project or new business idea, or travel the world.

• Financial Security: Even if you still plan to keep your 9-to-5 job, having multiple sources of income could help increase your financial security. If you lose your job, become sick, or get injured, you may still have money coming in to cover expenses. This is especially important if you are supporting a family.

• Tax Benefits: You may want certain legal protections for your personal assets or to qualify for tax breaks. Consulting with an attorney and/or tax advisor to explore setting up a formal business structure like a sole proprietorship, a limited liability company (LLC), or a corporation, for example, might help you decide if this is a good route for your particular situation.

• Location Flexibility: If you don’t have to go into an office each day, you’ll be free to move around and, possibly, live anywhere in the world. Many streams of passive income can be managed from your phone or laptop.

• Achieve Financial Independence: The definition of financial independence is having enough income to cover your expenses without having to actively work in order to cover living expenses. This could allow you to retire early and have more freedom to live your life the way you choose. Whether you’re interested in retiring early or not, passive income can be one way to help you reach financial independence.

• Pay Off Debt: Passive income may help you to supplement your income so that you will have the opportunity to pay off any debts more quickly.

Potential Downsides of Earning Passive Income

Although it might sound like a dream come true to quit your job and travel the world, earning through passive income is not quite that simple.

• Earning Passive Income Is Not a Passive Activity: Whether you’re generating passive income through a rental income, running a blog, or in another way, you will still need to put in some time and effort. It takes upfront investment to get these income sources up and running, and they don’t always work out as planned.

If, for example, you run an Airbnb, you have to maintain the property, ensure a high-quality experience for guests, and address any issues or concerns guests may have to secure positive reviews.

• Passive Income Requires Diversity: In order to earn enough passive income to quit your job and cover all your expenses, you would most likely need more than one source of income. Although you may no longer need to clock into a 9-to-5 job, you will likely still need to spend time managing multiple income streams.

• It’s Lonely at the Top: It might sound great to never have to go to the office again and to have the freedom to travel, but earning money through passive income can become lonely.

Not having anyone to talk to during the day might make you feel lonely, and if you aren’t self-motivated, you may find it difficult to stay on task if you need to manage your passive income streams.

• Getting Started May Require Investment: Depending on how you plan to create passive income, it may require an initial financial investment. You may need money for a down payment on an investment property, the development of a product you plan to sell, or for investment into dividend stocks.

Managing Passive Income Streams

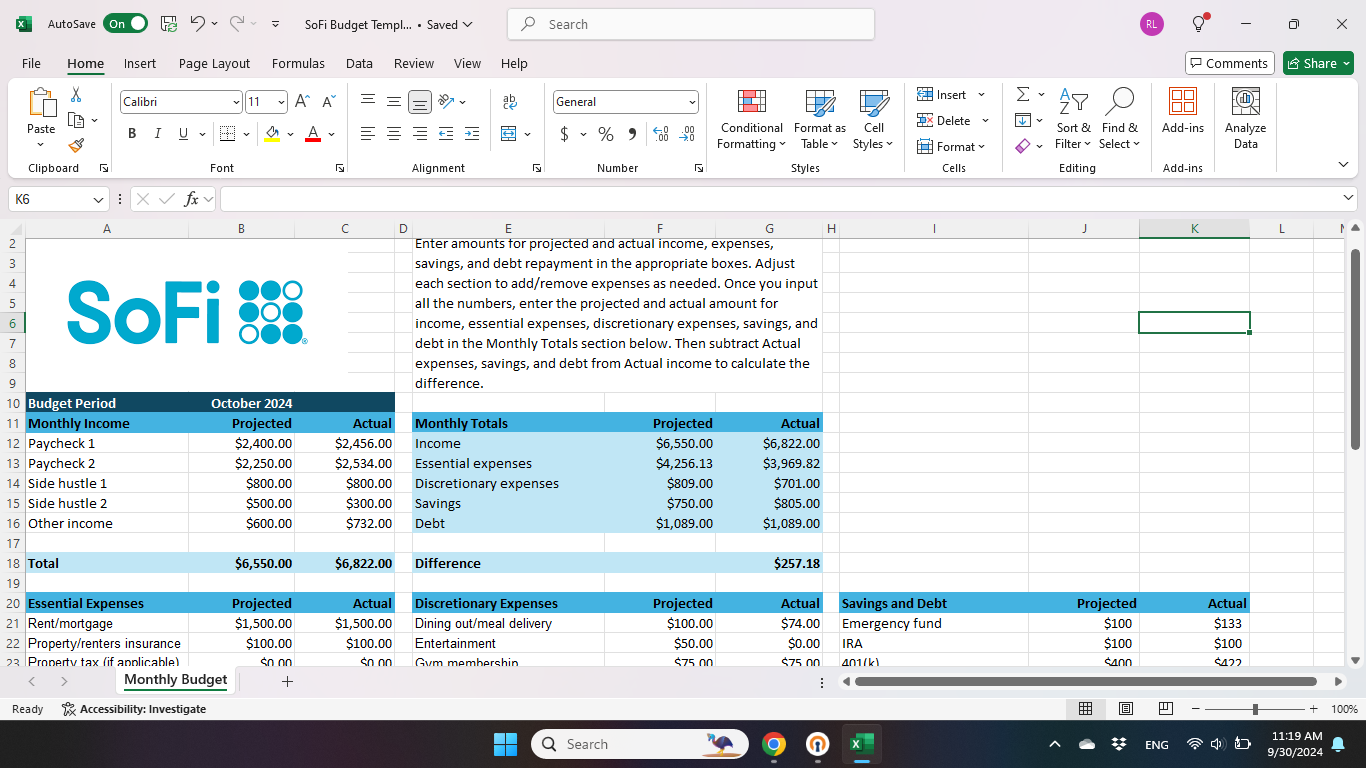

No matter which type of passive income you choose to pursue, it’s important to keep track of your personal finances and both your short-term and long-term financial goals.

Tracking multiple sources of income in a monthly budget can be a complex task. To be profitable, it’s important to pay attention to how much money you put into the maintenance of your passive income stream(s), such as property upkeep or monthly online services.

The Takeaway

Establishing passive income streams is one way to diversify your income and can help you build wealth and achieve financial freedom in the long term. There are a variety of ways to earn passive income, such as through investing, rental properties, and automated investing.

Some passive income sources require a financial commitment or upfront investment, such as purchasing a rental property, and others may require a time commitment. And passive income, of course, is rarely 100% passive. Often there is considerable time and effort that goes into setting up a passive income stream. And some sources of passive income (from investing, real estate, running a business or creative endeavor) require ongoing maintenance.

Invest in what matters most to you with SoFi Active Invest. In a self-directed account provided by SoFi Securities, you can trade stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, options, and more — all while paying $0 commission on every trade. Other fees may apply. Whether you want to trade after-hours or manage your portfolio using real-time stock insights and analyst ratings, you can invest your way in SoFi's easy-to-use mobile app.

Opening and funding an Active Invest account gives you the opportunity to get up to $1,000 in the stock of your choice.¹

FAQ

Do you need to pay taxes on passive income?

In most cases, yes, you’ll need to pay income taxes (or any other applicable taxes) on the income generated by passive income streams.

What are some advantages of creating passive income streams?

Generating passive income may help you reach your financial goals sooner, pay off debt, or even achieve financial independence, though there may be some drawbacks and extra responsibilities that come along with it.

Why might it be a good idea to try and develop passive income streams?

Creating passive income streams may help diversify your income and can help you build wealth and achieve financial freedom in the long term. There are a variety of ways to earn passive income, such as through investing, rental properties, and automated investing.

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Mutual Funds (MFs): Investors should carefully consider the information contained in the prospectus, which contains the Fund’s investment objectives, risks, charges, expenses, and other relevant information. You may obtain a prospectus from the Fund company’s website or clicking the prospectus link on the fund's respective page at sofi.com. You may also contact customer service at: 1.855.456.7634. Please read the prospectus carefully prior to investing.Mutual Funds must be bought and sold at NAV (Net Asset Value); unless otherwise noted in the prospectus, trades are only done once per day after the markets close. Investment returns are subject to risk, include the risk of loss. Shares may be worth more or less their original value when redeemed. The diversification of a mutual fund will not protect against loss. A mutual fund may not achieve its stated investment objective. Rebalancing and other activities within the fund may be subject to tax consequences.

Exchange Traded Funds (ETFs): Investors should carefully consider the information contained in the prospectus, which contains the Fund’s investment objectives, risks, charges, expenses, and other relevant information. You may obtain a prospectus from the Fund company’s website or by emailing customer service at [email protected]. Please read the prospectus carefully prior to investing.

Investment Risk: Diversification can help reduce some investment risk. It cannot guarantee profit, or fully protect in a down market.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

¹Probability of Member receiving $1,000 is a probability of 0.026%; If you don’t make a selection in 45 days, you’ll no longer qualify for the promo. Customer must fund their account with a minimum of $50.00 to qualify. Probability percentage is subject to decrease. See full terms and conditions.

An investor should consider the investment objectives, risks, charges, and expenses of the Fund carefully before investing. This and other important information are contained in the Fund’s prospectus. For a current prospectus, please click the Prospectus link on the Fund’s respective page. The prospectus should be read carefully prior to investing.

Alternative investments, including funds that invest in alternative investments, are risky and may not be suitable for all investors. Alternative investments often employ leveraging and other speculative practices that increase an investor's risk of loss to include complete loss of investment, often charge high fees, and can be highly illiquid and volatile. Alternative investments may lack diversification, involve complex tax structures and have delays in reporting important tax information. Registered and unregistered alternative investments are not subject to the same regulatory requirements as mutual funds.

Please note that Interval Funds are illiquid instruments, hence the ability to trade on your timeline may be restricted. Investors should review the fee schedule for Interval Funds via the prospectus.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

This article is not intended to be legal advice. Please consult an attorney for advice.

SOIN-Q325-011

Read more