SoFi Blog

Tips and news—

for your financial moves.

Graduate Student Loans

You could unlock a

lower rate than the

federal grad PLUS loan.

Borrow for grad school with SoFi and you could

unlock a lower rate than the federal grad PLUS

loan. Yes, you heard us right.

Apply today and you could also unlock no

origination fees and more.

View your rate

Lowest rates reserved for the most creditworthy borrowers.

New! Cash bonus for good grades.

Up to $2501 with GPAs 3.0 or higher.

Learn more

Received a mailer from us?

Tailored to your ambitions.

Pay for grad school with the confidence that your future plans are being considered.

Competitive rates

Flexible term options that work for you.

No fees required

Skip the origination fees that come with federal student loans.

View your rate in minutes

See all of your options without any impact to your credit score.†

Six-month grace period

Give yourself some time to get a job before you start paying back your loans.

Graduate Student loan rates.

Not sure which to choose?

Learn more.→

PRIVATE STUDENT LOANS

Earn and redeem points to pay down your SoFi graduate student loan.

Now you can redeem your rewards points to pay down your SoFi graduate student loan. Earning rewards points is as easy as setting up bill pay, checking your credit score, and more.

Learn more

For complete Member Rewards details, read our Terms of Service.

STUDENT LOAN CALCULATOR

Estimate your student loan payments

Simulate your potential monthly payments and interest by choosing loan preferences that meet your needs.

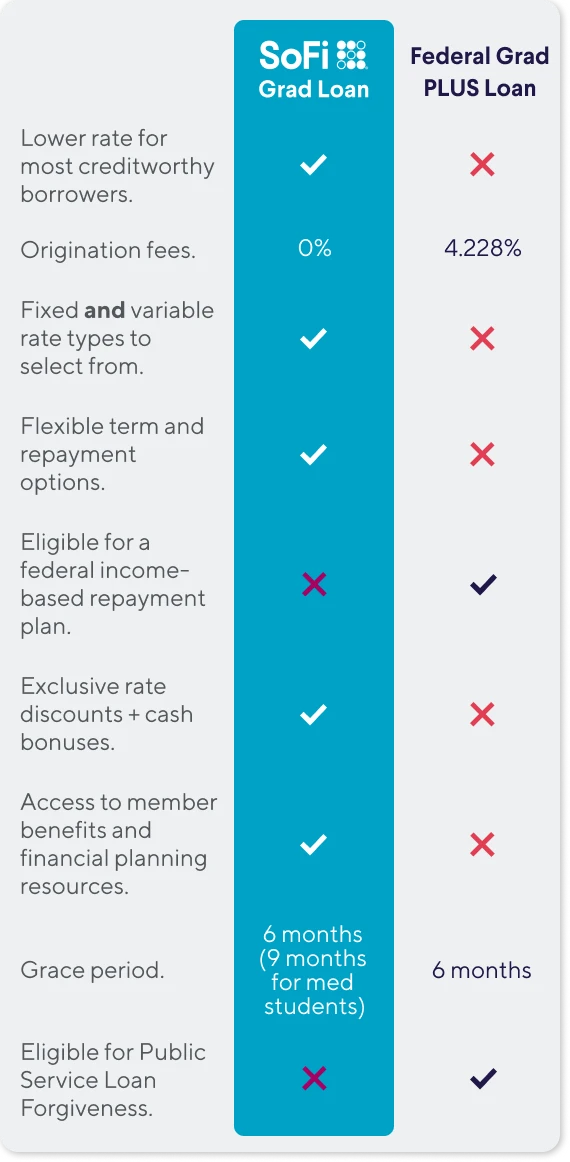

See how SoFi stacks up.

Comparison based on information obtained on the Federal Student Aid website as of July 8, 2025.

Repay the graduate student way.

Pick the repayment option that works for you and your budget.

Deferred

Start paying principal and interest payments six months after you leave school.

- No payments while in grad school

- Highest overall cost option

Interest only

Pay only interest payments while you’re in school.

- Moderate payment while in grad school

- Reduces overall cost

Partial

Pay a $25 fixed monthly payment while you’re in grad school.

- Lowest payment option while in graduate school

- Reduces some of the overall cost

Immediate

Start paying principal and interest payments right away.

- Highest payment option while in grad school

- Lowest overall cost option

View repayment examples

On your terms.

We now offer four different term options so you can choose a repayment timetable that works for you.

5-year

7-year

10-year

15-year

View repayment examples

Start your application

What about grad-level certificate programs?

Yep—covered.

Gaining a new skill through a graduate-level certificate program? Our loan for grad students can help you pay for it—so learning has even fewer limits.

View your rate

Check program eligibility

How do I apply for a graduate student loan?

-

1

Apply online in just minutes.

Get your rate fast and find out if you’re pre-qualified

before you even finish the full application. Seamlessly add

a cosigner in just a few clicks. -

2

Select your rate and repayment option.

Choose from fixed or variable rates.

Then, pick from four repayment options. -

3

Sign and accept your loan.

Upload screenshots of your info, sign your paperwork

electronically, and voilà—your work is done!

We’ll handle it from here.

View your rate

Tools, tips, resources, and more.

Our online resource center is filled with helpful articles on private student loans for graduate school, budgeting tools, guides, and more.

Visit SoFi Learn

Graduate Student Loan FAQs

SoFi’s graduate student loan application is entirely online. Borrowers can

apply in just minutes. In order to apply, borrowers will need the following

information:

- Social Security number or Tax Identification Number (TIN) are required from all borrowers all the time

- Proof of income: You may be required to provide proof of income if SoFi is not able to validate it automatically. We could use something similar for gov’t ID.

- Government-issued ID

- Student’s school information (student’s estimated graduation date and academic term)

- Loan amount (how much you’d like to borrow)

- Financial aid you expect to receive

- Do you already have a private student loan with SoFi? We’ll use your past application to pre-fill as much information as possible in your new application

After completing the online application, approved borrowers will

receive their rate (with no impact to their credit score). Borrowers can then

review and select their rate and repayment options. From there, borrowers

would simply sign and accept their loan.

There are a number of different types of graduate student loans. Federal student loans are offered through the US Department of Education. Federal Direct Unsubsidized Loans for graduate school are one of the student loans available to students. Graduate borrowers are also eligible for Grad PLUS Student loans through the federal government. There are also private graduate student loans, like SoFi offers. These loans are offered through a private institution. Private loans may allow you to borrow beyond the federal limits imposed on federal loans, or help you pick up the excess if you don’t qualify for enough federal funding. Each type of loan has its own advantages and disadvantages, so it is important for graduate students to choose the type of loan that is right for their individual needs. If you want to learn more about the graduate student loan types, check out this article.

Private student loans can offer higher borrowing limits and more flexible repayment options than federal loans. They may also be a good option for students who do not qualify for federal loans or who need to borrow more money than the federal loan limits allow. SoFi Private Student Loans offer competitive rates and flexible terms with no fees, an easy all-online application, flexible repayment plans including an option to make no payments until after graduation, and U.S. based support when you need it. And you can check your rate in just 3 minutes. Our online application is simple–and for those who already have a private student loan with us, we make taking out additional private student loans even simpler with the Fast Track application that pre-populates information to make completing the application a breeze. SoFi members also get access to meaningful benefits.

SoFi’s offers both fixed and variable options for graduate student loans.

To be eligible for a SoFi Graduate Loan, a borrower must have an undergraduate degree, be enrolled at an approved, degree-granting institution, and be attending the school at least half time. Eligible borrowers may be in graduate-level certificate programs as well as programs for advanced degrees. Borrowers can add a cosigner to their application to increase their likelihood or approval. Cosigners must be the age of majority in their state of residents and be US citizens, permanent residents, or non-permanent residents. You can find more information on SoFi’s eligibility criteria here.

For federal unsubsidized loans, graduate or professional students can borrow up to $20,500 per year (with a lifetime cap of $138,500 including all undergraduate federal loans). For SoFi private student loans, the minimum amount that grad students can borrow is $1,000. Grad students can borrow up to the certified cost of attendance (including expenses like tuition, technology, transportation, books, and lab fees) less any financial aid they received from the school.

SoFi offers four different term options to choose a repayment timetable that works for you. SoFi offers 5-, 7-, 10-, 15-year term options. Borrowers can find more information about SoFi’s graduate student terms here.

See more FAQs

Get started in minutes.

Find your graduate student loan rate in just a few clicks.

View your rate

Terms and Conditions Apply. SOFI RESERVES THE RIGHT TO MODIFY OR DISCONTINUE PRODUCTS AND BENEFITS AT ANY TIME WITHOUT NOTICE. SoFi Private Student loans are subject to program terms and restrictions, such as completion of a loan application and self-certification form, verification of application information, the student’s at least half-time enrollment in a degree program at a SoFi-participating school and, if applicable, a co-signer. In addition, borrowers must be U.S. citizens or other eligible status, be residing in the U.S., and must meet SoFi’s underwriting requirements, including verification of sufficient income to support your ability to repay. Minimum loan amount is $1,000. See SoFi.com/eligibility for more information. View payment examples. Lowest rates reserved for the most creditworthy borrowers. SoFi reserves the right to modify eligibility criteria at any time. This information is subject to change. This information is current as of 7/8/22 and is subject to change.

* Interest Rates: Eligibility and Important Details. Fixed rates range from 3.43% APR to 14.83% APR with all discounts. Variable rates range from 4.64% APR to 15.86% APR with all discounts. Unless required to be lower to comply with applicable law, Variable Interest rates are capped at 17.95%. SoFi rate ranges are current as of 6/1/23 and are subject to change at any time. Your actual rate will be within the range of rates listed above and will depend on the term and type of repayment option you select, evaluation of your creditworthiness, income, presence of a co-signer (if applicable) and a variety of other factors. Lowest rates reserved for the most creditworthy borrowers. Check out our eligibility criteria at https://www.sofi.com/eligibility-criteria/. For the SoFi variable-rate product, the variable interest rate for a given month is derived by adding a margin to the 30-day average SOFR index, published two business days preceding such calendar month, rounded up to the nearest one hundredth of one percent (0.01% or 0.0001). APRs for variable-rate loans may increase after origination if the SOFR index increases. The SoFi 0.25% autopay interest rate reduction requires you to agree to make monthly principal and interest payments by an automatic monthly deduction from a savings or checking account. This benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. The benefit lowers your interest rate but does not change the amount of your monthly payment. This benefit is suspended during periods of deferment and forbearance. Autopay is not required to receive a loan from SoFi.

Decoding Markets: June Inflation

Tariff Bite Incoming

The stakes are high. Tariffs are the highest they’ve been in 100 years, President Trump is clamoring for rate cuts, and Federal Reserve officials are in wait-and-see mode until they get more clarity. Fed officials have said that they expect tariff impacts to become increasingly apparent as summer moves along, and investors will be scrutinizing every data point anxiously.

Which brings us to this week’s major inflation data. The Consumer Price Index (CPI) increased by a seasonally adjusted 0.3% month-over-month, a step up from the more benign 0.1% rise recorded in May. This monthly acceleration pushed the year-over-year inflation rate to 2.7%, up from the prior month’s 2.4%.

While core CPI, which excludes the volatile food and energy components, came in below consensus estimates at 0.2% month-over-month, things were less rosy under the hood.

For example, the core goods component rose 0.2% in June. That might not sound like a big deal, but it’s noteworthy because it occurred despite new and used cars falling 0.3% and 0.7%, respectively. Those items represent 35% of the entire core goods basket, which suggests that inflation in core goods minus cars was hot.

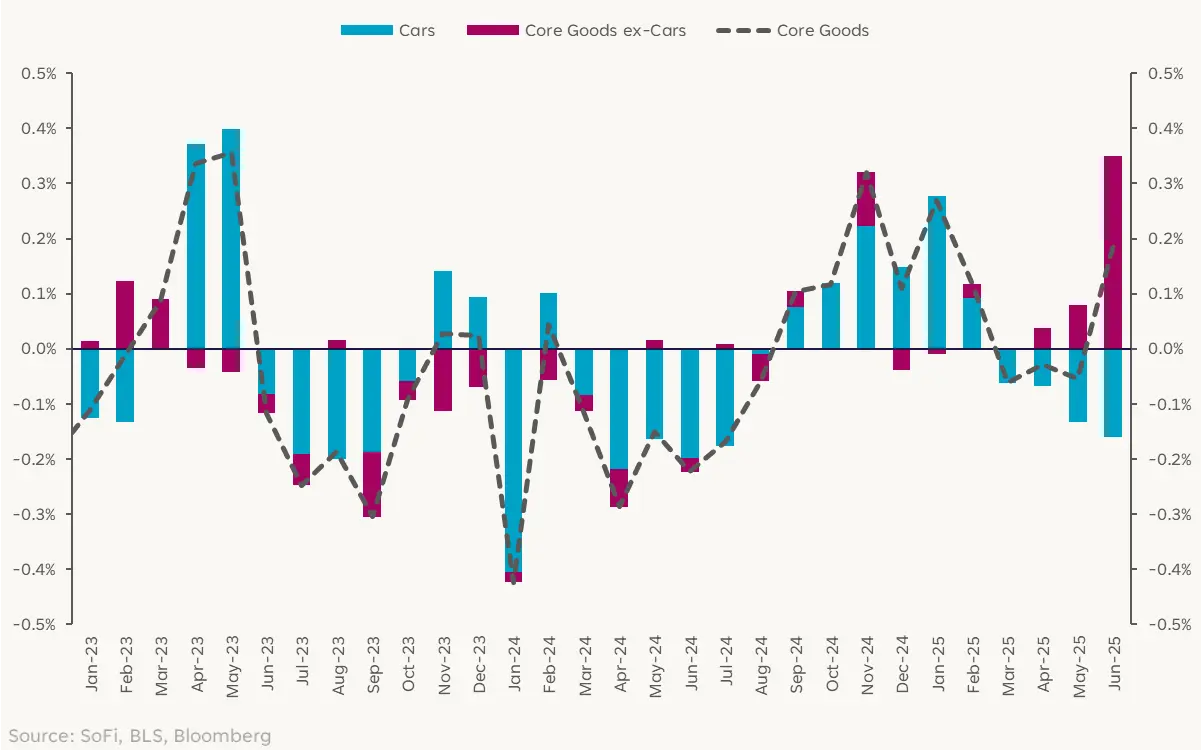

Core Goods CPI Month-over-Month

Spoiler alert: That’s exactly what it was, as apparel, recreation, and household furnishings inflation all accelerated meaningfully. Overall, core goods (excluding cars) inflation was nearly 0.6% month-over-month, the highest since November 2021. And it’s not like the distribution of these price increases were random — they align pretty closely with recent tariffs. For the last few months, the tariff bark had been louder than its bite, but that might be changing now.

Looking Upstream for Clues

Consumer inflation isn’t the only data we got, however, as the Producer Price Index (PPI) dropped a day after CPI. In simple terms, the PPI measures the prices companies receive for their goods and services at the wholesale level, while the CPI measures the prices consumers ultimately pay at the retail level. Importantly, PPI also tends to reflect the input costs businesses face further up the supply chain.

Headline PPI, often called the Final Demand figure, was flat month-over-month versus expectations for a 0.2% increase. On its face that is a downside surprise, but the prior month was actually revised up by 0.2 percentage points, so net-net it’s a bit of a wash.

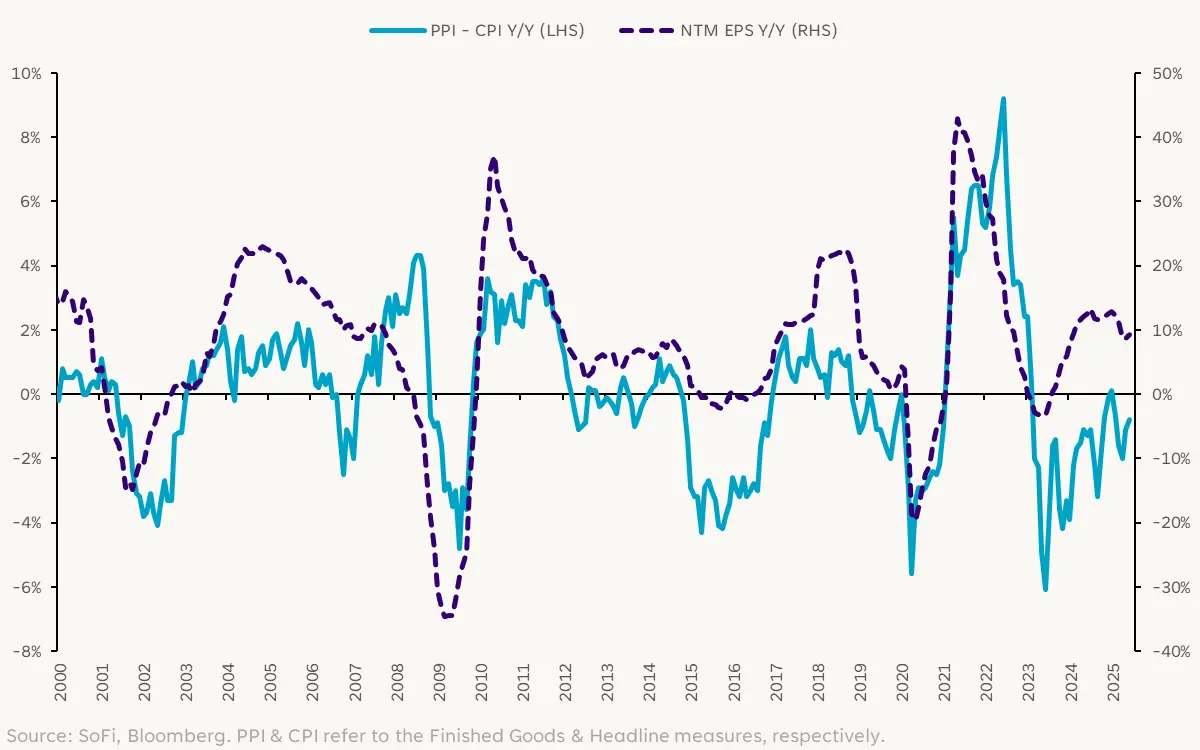

An investor’s first instinct might be to look at PPI Final Demand being lower than CPI and assume that this would help corporate profit margins (and possibly stocks as a result), but the historical relationship isn’t straightforward.

The back story: The Final Demand figure wasn’t always what was interpreted as the headline PPI figure. In fact, we only have data for it going back to 2009. Up until recently, the headline figure was the PPI Finished Goods series (which actually dates back to the 19th century!). The reasons for the switch are convoluted, but the idea is Final Demand more thoroughly measures all aspects of wholesale inflation.

A larger sample size is advantageous when analyzing relationships, however, so let’s look at the PPI Finished Goods series when looking at CPI and corporate profit margins. In June 2025, the PPI measure was up 0.4% month-over-month and 1.9% year-over-year. While it l might seem that a lower PPI should be good for margins, history actually tells us the exact opposite.

PPI-CPI Tracks Forward Earnings Growth

A possible explanation is that periods of higher wholesale inflation reflect strong corporate pricing power that will be passed through to consumers, boosting the bottom line. However, this time may be different, given that the nature of the cost shock isn’t just shifting supply and demand but the introduction of a new tax. So, if PPI moves higher relative to CPI in coming months, that might not suggest profit expansion like it otherwise would have.

Testing the Rotation

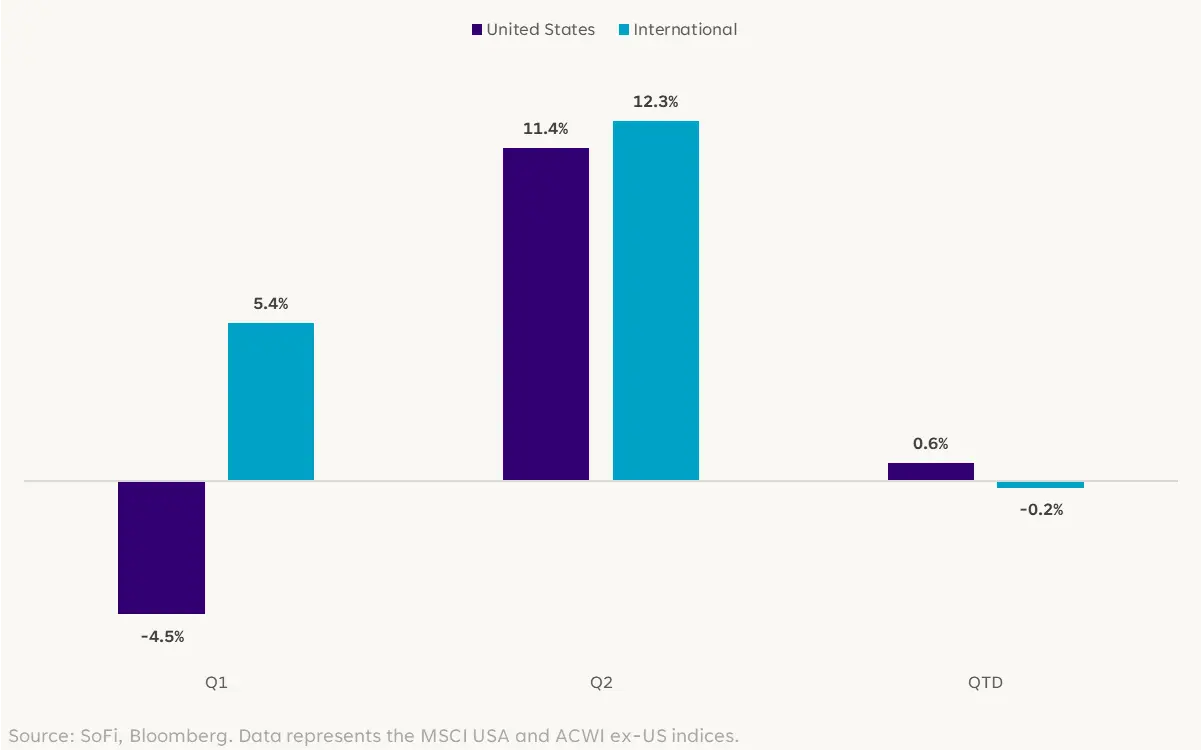

After a first half of 2025 where international equities dramatically outperformed their U.S. counterparts, July has ushered in a more complex and volatile environment. That’s testing the durability of the nascent idea that international markets may outperform after a decade plus of U.S. dominance.

The S&P 500 is +0.6% month-to-date, mostly due to mega-cap tech stocks — the Magnificent Seven is +1.8%, while the equal-weight S&P 500 is flat. Meanwhile, the powerful outperformance of international stocks that defined the first half of the year has also stalled in July. Through July 16, the MSCI ACWI ex-US Index was down 0.3% after returning 18.1% in H1, a notable reversal of the H1 trend.

2025 Total Returns

This pause has been driven by a confluence of factors, including a potential short-term bounce in the U.S. dollar or some profit taking after the strong start to the year.

Of course, fundamental differences between the U.S. and international markets remain. The big one is the valuation disparity between domestic and international stocks, as the S&P 500 trades at a forward P/E ratio of 22.1x while the MSCI ACWI ex-US trades at a 14.4x P/E. For U.S. investors, investing in international stocks also introduces a currency component. That boosted international stock returns by 10-15 percentage points in H1, as the dollar had its worst first half of a year since 1973, but could turn into a drag if the dollar rebounds.

The choppy start to the second half serves as a crucial reminder that major market shifts are rarely linear. For investors, this reinforces the importance of a truly diversified portfolio, not just geographically, but also in terms of style and sector. You never really know how things are going to go, but you can be prepared.

Want more insights from SoFi’s Investment Strategy team? The Important Part: Investing With Liz Thomas, a podcast from SoFi, takes listeners through today’s top-of-mind themes in investing and breaks them down into digestible and actionable pieces.

SoFi can’t guarantee future financial performance, and past performance is no indication of future success. This information isn’t financial advice. Investment decisions should be based on specific financial needs, goals and risk appetite.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Mario Ismailanji is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Form ADV 2A is available at www.sofi.com/legal/adv.

Read moreCurrent Home Equity Loan Rates in Austin, TX Today

AUSTIN HOME EQUITY LOAN RATES TODAY

Current home equity loan

rates in Austin, TX.

Disclaimer: The prime rate directly influences the rates on HELOCs and home equity loans.

Turn your home equity into cash. Call us for a complimentary consultation or get prequalified online.

Compare home equity loan rates in Austin.

Key Points

• Your credit score, debt-to-income ratio, and market conditions all play a part in the interest rate you’re offered.

• Fixed interest rates result in predictable monthly payments, while adjustable rates tend to start a bit lower.

• To be eligible for a home equity loan, you’ll need to maintain at least 20% equity in your home.

• The interest on home equity loans may be tax-deductible if you use it for home improvements.

• Alternatives to home equity loans include home equity lines of credit (HELOC) and cash-out mortgage refinances.

Introduction to Home Equity Loan Rates

Home equity loans are a popular way to access cash for a variety of big expenses. Getting the best available home equity loan rates in Austin, Texas, starts with understanding how rates are influenced by economic and personal factors. We’ll also discuss how a home equity loan works — along with alternatives like the home equity line of credit (HELOC) and the cash-out mortgage refinance.

Whichever financing tool you choose, your prep work will be similar, and we’ll explain the steps to present yourself as a stellar candidate. The payoff could be thousands of dollars saved on interest and fees.

How Do Home Equity Loans Work?

What is a home equity loan? In short, it’s a second mortgage that uses your home as collateral. The loan is disbursed in one lump sum and repaid in equal monthly installments over five to 30 years. Because the loan is secured by your home equity, it typically offers lower interest rates than unsecured personal loans. Most home equity loans have fixed interest rates, which can provide peace of mind if you like predictable payments. To qualify, you’ll generally need to have at least 20% equity in your home.

How Are Home Equity Loan Interest Rates Determined?

The interest rates on all kinds of home loans are influenced by a multitude of factors, from the economy to your own financial standing. The Federal Reserve’s policies, particularly the federal funds rate, have a significant impact on lending. Lenders typically peg their rates to the prime rate, which in turn is influenced by the Fed. Keeping an eye on the prime rate can give you a good view of where home equity loan rates are headed.

Your credit score and debt-to-income ratio also factor in, with higher scores and lower ratios often translating to better rates. Loan size and repayment term come into play, with larger loans and longer terms carrying increased risk and, consequently, higher rates.

How Interest Rates Impact Affordability

Your interest rate helps determine the affordability of different types of home equity loans. Even a seemingly small difference in interest rate can add up to significant savings or costs over the life of your loan. For example, a $100,000 home equity loan with a 15-year term would have a monthly payment of $985 at 8.50% interest, and $1,044 at 9.50% interest.

But the real story is in the total interest paid: The 8.50% rate adds up to $77,253 in interest over the life of the loan. Compare that to $87,960 with the 9.50% rate. That means securing the lower rate would save you $10,700 — well worth the time and effort you spend shopping around.

The chart below gives you a broader view of how small changes in interest rate alter your monthly payment and total interest for a $100K loan repaid over 15 years.

| Interest Rate | Monthly Payment | Total Interest Paid |

|---|---|---|

| 9.00% | $1,014 | $82,568 |

| 8.875% | $1,007 | $81,232 |

| 8.75% | $999 | $79,901 |

| 8.625% | $992 | $78,574 |

| 8.50% | $985 | $77,253 |

| 8.375% | $977 | $75,937 |

| 8.25% | $970 | $74,625 |

| 8.125% | $963 | $73,319 |

| 8.00% | $956 | $72,017 |

Home Equity Loan Rate Trends

The trends in home equity loan rates can be a bit like the weather—unpredictable. Interest rates on home equity loans are influenced by a number of factors, including the prime rate, which is closely related to the federal funds rate set by the Federal Reserve. The prime rate has fluctuated significantly in recent years, ranging from 3.25% in 2020 to 8.50% in 2023. These changes can have a direct impact on the rates offered to you.

While it’s impossible to predict future movements with certainty, staying informed about economic conditions and what the prime rate is up to can help you time your application for the best possible rate. Comparing rates from multiple lenders and considering the broader market context can also provide valuable insights.

Source: TradingView.com

| Date | Prime Rate |

|---|---|

| 9/19/2024 | 8.00% |

| 7/27/2023 | 8.50% |

| 5/4/2023 | 8.25% |

| 3/23/2023 | 8.00% |

| 2/2/2023 | 7.75% |

| 12/15/2022 | 7.50% |

| 11/3/2022 | 7.00% |

| 9/22/2022 | 6.25% |

| 7/28/2022 | 5.50% |

| 6/16/2022 | 4.75% |

| 5/5/2022 | 4.00% |

| 3/17/2022 | 3.50% |

| 3/16/2020 | 3.25% |

| 3/4/2020 | 4.25% |

| 10/31/2019 | 4.75% |

| 9/19/2019 | 5.00% |

| 8/1/2019 | 5.25% |

| 12/20/2018 | 5.50% |

| 9/27/2018 | 5.25% |

Source: St. Louis Fed

How to Qualify for the Lowest Rates

Most of us can’t wait around long for interest rates to drop. All we can do is set ourselves up for success. Lenders will scrutinize your credit score, debt-to-income (DTI) ratio, and the equity in your home. You can bolster your chances of qualifying for a lower rate by enhancing your credit score, reducing your debt, and ensuring your home’s value is accurately appraised.

Maintain Sufficient Home Equity

To be eligible for a home equity loan, you need to maintain at least 20% equity in your home. Calculating your equity is straightforward: Just subtract your mortgage balance from your current home value. For instance, if you owe $400,000 on your mortgage and your home is valued at $550,000, your equity is $150,000, or 27%. Lenders typically allow you to borrow up to 85% of your equity, which means in this example, you could potentially access $127,500.

Keeping a healthy amount of equity in your home is not only a smart financial move, but it also ensures you can secure favorable loan rates and manage the loan effectively, even in the face of financial challenges. A home equity loan calculator can help you calculate your equity level.

Build a Strong Credit Score

To get the most competitive home equity loan rates, set your sights on a credit score of 700 or higher. A robust credit score is a testament to your financial acumen and can lead to more favorable loan terms. Lenders scrutinize your payment track record, credit utilization, and the length of your credit history. By paying your bills on time and keeping credit card balances in check, you can give your score a boost. Steer clear of opening new accounts or closing old ones before applying, as this can dent your score.

Manage Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is a big deal when it comes to qualifying for a home equity loan and getting lower rates. Lenders typically look for a DTI ratio below 50%, and ideally below 36%. To calculate your DTI, divide your total monthly debt payments (student loans, auto loan, mortgage payment) by your gross monthly income. Let’s say your student loan payment is $300 a month, your auto loan is $400, your mortgage is $1,600, and your monthly income before taxes is $7,000. Your DTI ratio is 33%. ($300 + $400 + $1,600 = $2,300 / $7,000 = 33%)

A lower DTI can help you qualify for a loan and show lenders that you have a manageable debt load, which can reduce the risk of default. To improve your DTI, consider paying down existing debts, increasing your income, or both. Keeping your DTI in check can help you qualify for better loan terms and lower interest rates, which can make your home equity loan more affordable.

Obtain Adequate Property Insurance

Property insurance is a must-have for home equity loans, especially in flood-prone areas. This insurance is a safety net for both you and the lender. It’s a smart move to review your current policy and consider beefing it up if needed. Getting the right coverage not only meets your lender’s requirements but also safeguards your investment, making the road to your home equity loan smoother and more secure.

Tools & Calculators

Using these resources can be a game-changer. They can help you get a handle on the numbers, compare rates, and find the loan that fits your financial situation like a glove.

Run the numbers on your home equity loan.

-

Home Equity Loan

CalculatorEnter a few details about your home loan and we’ll provide you your maximum home equity loan amount.

-

HELOC Payment

CalculatorPunch in your HELOC amount and we’ll estimate your monthly payment amount for your HELOC.

-

HELOC Interest Only Calculator

Use SoFI’s HELOC interest calculator to estimate how much monthly interest you’ll pay .

Using the free calculators is for informational purposes only, does not constitute an offer to receive a loan, and will not solicit a loan offer. Any payments shown depend on the accuracy of the information provided.

Closing Costs and Fees

Closing costs for home equity loans generally range from 2% to 5% of the loan amount. Here’s a quick breakdown: There’s the appraisal, which can set you back $300 to $500, and the credit report, which typically costs $50 to $100. Title insurance (0.5% to 1% of the loan) and the title search ($100 to $250) make sure everything’s shipshape with your property title. Origination fees (0.5% to 1% or a flat fee) cover the lender’s costs for getting you set up. And don’t forget about the document preparation/attorney fees, which can range from $500 to $2,000.

Tax Deductibility of Home Equity Loan Interest

The interest on home equity loans may be tax-deductible if the funds are used to improve your home. If you’re married and filing jointly, you can deduct the interest on up to $750,000 of qualified home equity loans. If you’re single, the limit is $375,000. To claim the deduction, you’ll need to itemize your tax return. A tax advisor can help you understand how this deduction applies to your specific financial situation and how you can maximize your potential tax savings.

Alternatives to Home Equity Loans

Home equity loans are just one of the many financial tools at your disposal. You might also consider a home equity line of credit (HELOC) or a cash-out mortgage refinance. Both options allow you to tap into the equity in your home, but they work a little differently. Both options can be helpful for big expenses or debt consolidation, but it’s important to compare the terms and fees to find the best fit for your financial goals.

First, let’s get into what is a home equity line of credit..

Home Equity Line of Credit (HELOC)

A HELOC is akin to a credit card, granting you the flexibility to borrow up to a set limit and pay interest solely on what you use. While the interest rates for HELOCs are variable, they can be a cost-effective solution. Typically, a 680 credit score (700 is even better) and a debt-to-income ratio under 50% (ideally under 36%) are what lenders look for. HELOCs are particularly handy if you’re uncertain about the total amount you need to borrow or anticipate expenses over time.

During the initial draw period, which often lasts 10 years, you typically make interest-only payments. (Use a HELOC interest-only calculator to estimate your monthly bills.) After that, the repayment period lasts 10-20 years; that’s when you’ll start repaying both the principal and interest. (A HELOC repayment calculator can help you determine how much you’ll owe.)

If you’re debating a HELOC vs. a home equity loan, this chart shows you their main differences at a glance.

| HELOC | Home Equity Loan | |

|---|---|---|

| Type | Revolving line of credit | Installment loan |

| Interest Rate | Usually variable-rate | Usually fixed-rate |

| Repayment | Repay only what you borrow plus interest; you may have the option to make interest-only payments during the draw period. | Starts immediately at a set monthly payment |

| Disbursement | Charge only the amount you need | Lump sum |

Cash-Out Refinance

This option replaces your current mortgage with a larger one, giving you a lump sum to work with. The amount you can borrow is tied to your home’s equity, with most lenders allowing borrowing up to 80% of your property’s value. To qualify, you need a credit score of 620 or above and a debt-to-income ratio under 43%. You can choose between fixed or variable interest rates, with the latter potentially offering more financial flexibility.

If you’re on the fence about a cash-out refinance vs. a hoem equity line of credit, consider that a cash-out refinance consolidates your debts into a single monthly payment, streamlining your financial landscape.

The Takeaway

When you’re ready to take the next step, keep in mind that a strong credit score, a manageable debt-to-income ratio, and the right property insurance can all play a part in securing favorable terms for your home equity loan. Leverage the tools and calculators at your disposal to estimate monthly payments and compare lenders. And don’t forget to account for closing costs and fees, which typically range from 2% to 5% of the loan amount. We hope this information makes your decision a bit easier — and maybe saves you some serious money.

SoFi now offers home equity loans. Access up to 85%, or $750,000, of your home’s equity. Enjoy lower interest rates than most other types of loans. Cover big purchases, fund home renovations, or consolidate high-interest debt. You can complete an application in minutes.

Unlock your home’s value with a home equity loan from SoFi.

FAQ

What can a home equity loan help you with?

Home equity loans are a great way to finance big expenses or consolidate high-interest debt. They can also be a smart option for home improvements since they can be tax-deductible. Just be sure to use the money wisely and make sure you can afford the monthly payments.

What’s the monthly payment on a $50,000 home equity loan?

The monthly payment for a $50,000 home equity loan depends on the loan term and interest rate. For instance, with a 7.00% rate across a 20-year term, your monthly payment would be around $388. Shorten the term to 10 years, and your payment rises to $581. The longer term eases your monthly budget, but remember you’ll pay more in interest over a longer repayment term. Before you decide, compare rates and terms from different lenders to find the best fit for your financial situation.

What’s the monthly payment on a $100,000 HELOC?

The payment on a $100,000 HELOC depends on the interest rate and the payment period you’re in. There are two phases to a HELOC: the draw period and the repayment period. During the draw period, which is typically 10 years, you usually can make interest-only payments on the amount you’re using. If you draw $50,000 and your rate is 8.00%, your interest-only payment would be $333 per month. Once the draw period ends, the repayment period begins, and you’ll start paying both principal and interest. If you draw the full $100,000 at the same 8.00% rate over a 20-year repayment period, the monthly payment would increase to around $1,503. Keep in mind that HELOCs have variable interest rates, and your actual payment could be higher or lower depending on the rate and how much you borrow.

What might prevent you from securing a home equity loan?

There are a few things that might prevent you from qualifying for a home equity loan, such as not having enough equity in your home, a low credit score, and a high debt-to-income (DTI) ratio. Lenders usually require at least 20% equity in your home and a credit score of 680 or higher, although some prefer a score over 700. A DTI ratio of 43% or less is also typically required. Additionally, not having adequate property insurance, particularly in flood-prone areas, can also disqualify you. To improve your chances, consider increasing your credit score, paying down your current debts, and making sure your property is well-insured.

What are the benefits of a home equity loan?

Home equity loans are a smart choice for many reasons. They come with fixed interest rates and predictable monthly payments, which makes budgeting easier. If you’re thinking about a major expense like home renovations, college tuition, or consolidating debt, a home equity loan could be just what you need. The best part? The interest rates are usually lower than unsecured loans because your home is the collateral. And there’s a potential tax perk: The interest you pay on home equity loans used for home improvements might be tax-deductible (up to certain limits). Just remember to consider the risks, like the potential for foreclosure, before you take the leap.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

²SoFi Bank, N.A. NMLS #696891 (Member FDIC), offers loans directly or we may assist you in obtaining a loan from SpringEQ, a state licensed lender, NMLS #1464945.

All loan terms, fees, and rates may vary based upon your individual financial and personal circumstances and state.You should consider and discuss with your loan officer whether a Cash Out Refinance, Home Equity Loan or a Home Equity Line of Credit is appropriate. Please note that the SoFi member discount does not apply to Home Equity Loans or Lines of Credit not originated by SoFi Bank. Terms and conditions will apply. Before you apply, please note that not all products are offered in all states, and all loans are subject to eligibility restrictions and limitations, including requirements related to loan applicant’s credit, income, property, and a minimum loan amount. Lowest rates are reserved for the most creditworthy borrowers. Products, rates, benefits, terms, and conditions are subject to change without notice. Learn more at SoFi.com/eligibility-criteria. Information current as of 06/27/24.In the event SoFi serves as broker to Spring EQ for your loan, SoFi will be paid a fee.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Checking Your Rates: To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

Disclaimer: Many factors affect your credit scores and the interest rates you may receive. SoFi is not a Credit Repair Organization as defined under federal or state law, including the Credit Repair Organizations Act. SoFi does not provide “credit repair” services or advice or assistance regarding “rebuilding” or “improving” your credit record, credit history, or credit rating. For details, see the FTC’s website .

Non affiliation: SoFi isn’t affiliated with any of the companies highlighted in this article.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOHL-Q324-283

More home equity resources.

-

What is a Home Equity Line of Credit

-

Different Types of Home Equity Loans

-

HELOC vs Home Equity Loan: How They Compare