Your bank accounts are the hub of your financial life, where much of your money comes in and goes out. So of course, you want enough in there to feed all of your obligations. But, according to financial experts, you can have too much cash sitting in your checking and savings accounts.

For some, seeing extra dollars in their checking accounts can be a great source of comfort. Others may simply find it impossible not to draw down their account by month’s end.

There isn’t a magic number that defines “too much” cash. That’s determined by your unique financial situation. One rule of thumb suggests maintaining enough to cover three months’ worth of living expenses. But if you have significant expenses on the horizon, you may have good reason to keep your account more flush.

That noted, if you consistently have more than that in your checking account, or hold much of your savings in a low-yield savings account, there may be more productive ways to use your money – and achieve your financial goals.

What to Do With Excess Cash

There are many ways to use a little extra cash, from investing to saving up for a dream vacation. The following list of priorities may help you decide while keeping your financial wellness front and center. And the order is meaningful: Financial experts commonly recommend you take care of more pressing needs, such as repaying debt, before turning to investing. So here we go:

1. Boost or establish your emergency fund: Financial planners recommend holding three to six months’ worth of living expenses in an easily accessible but separate account.

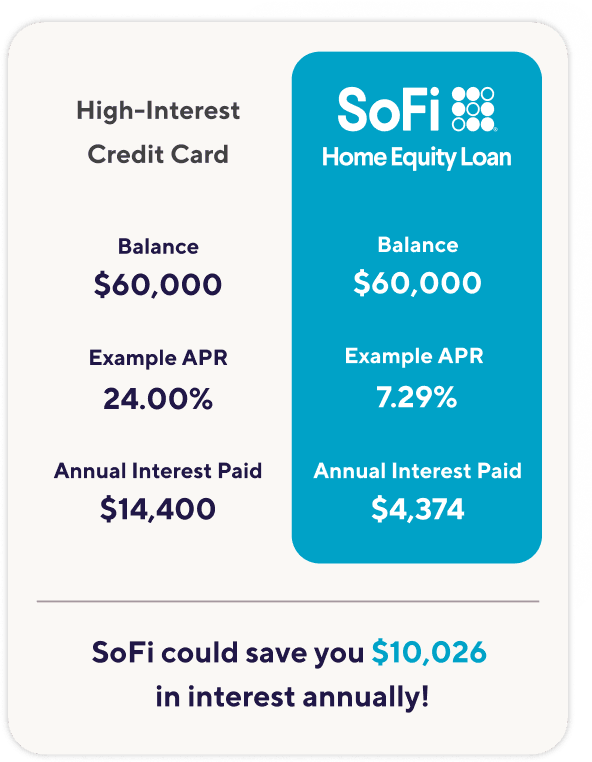

2. Pay off high-interest debts: Not all debt is created equal, and focusing on paying down high-interest obligations can leave you better off in the long-term. (A high interest rate is commonly considered 7% or higher.)

3. Contribute to your retirement savings: An individual retirement account (IRA) can help you work towards your retirement goals, plus contributions may reduce your taxable income for the year and your investments can grow tax-deferred. If you already have an IRA and haven’t funded it for 2024 yet, there’s good news: You still have until tax day (April 15, 2025). If you’re all set for 2024, you could make your contribution for this year too. And note that if you’re 55 or older, additional catch up contributions can help you get to your savings goal. Plus, SoFi is offering members a 1% match on any contributions to a SoFi IRA.

4. Boost your personal investment account: If points 1-3 are taken care of, you may consider transferring any excess cash into your personal investment account. What you do with it next is a question of your individual goals and risk tolerance, but we’ve got some pointers.

The Interest Rate Environment and Your Investments

Interest rates can play a major role in determining where you put your extra cash to work. Over the past few years, the Federal Reserve’s interest rate policy has affected everything from the rate you may get on a savings account to how attractive certain investments are.

In 2022 and 2023, the Fed raised rates to combat high inflation, boosting the appeal of certain investment options such as high-yield savings accounts. But inflation has cooled and last year the Fed cut rates three times and said more cuts may be coming.

Lower interest rates typically reduce the returns on savings accounts and other lower-risk investments, potentially making them less attractive compared with other investment options. Understanding these changes is essential for making informed decisions about how to manage and grow your excess funds effectively.

(Note: A high-yield savings account may still be an appropriate place to keep an emergency fund. Learn more about the SoFi high-yield account here.)

Investing Your Excess Cash

Though the broader investing environment may be complex, investing your money doesn’t have to be complicated. You can use a robo-advisor to make specific investment decisions, or work with a financial advisor if you want more personalized guidance.

Investing is inherently riskier than holding all your money in cash because investments can lose value. But diversifying your portfolio – rather than putting all your eggs in one basket – is a proven way to reduce risk and, potentially, improve returns. You may spread picks across different sectors and asset classes, such as stocks, bonds, and alternative investments, for example.

Always do your research and assess the risk profile of any investments you’re considering, but know that there are relatively lower-risk and lower-cost strategies that still offer attractive yields. Examples include exchange-traded funds (ETFs) focusing on Treasury securities (Treasury yields rose at the end of 2024) and tracking the performance of the broader stock market.

If you’re looking to move extra cash from your checking account into your investing account and level up how your money can work for you, check out SoFi’s investing content collection to learn more about your options.

Image: Bernie Pesko/SoFi Source iStock

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

SoFi isn't recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

Read more