Scenario 2: Making Smart Money Moves During COVID-19

This article contains breaking news and events related to the current state of politics and the economy. While we try our best to keep our articles as up-to-date as possible, the ongoing effects of COVID-19 are happening in real time and information is subject to change.

As news continues to break about the COVID-19 pandemic, it’s clear that Americans are being impacted by the crisis in different ways. And that’s true for finances, too. Some Americans continue to work, while others have felt the pinch of reduced salaries or layoffs as a result of the changing economic climate.

This is the third post in a series that will illuminate some of the financial strategies available to help individuals manage their finances during this unprecedented time. While these posts are intended to be informative, the goal is to provide a high-level overview of available options.

Those with specific questions about their finances could consider consulting with a qualified financial professional who can provide personalized advice after closely reviewing individual financial circumstances.

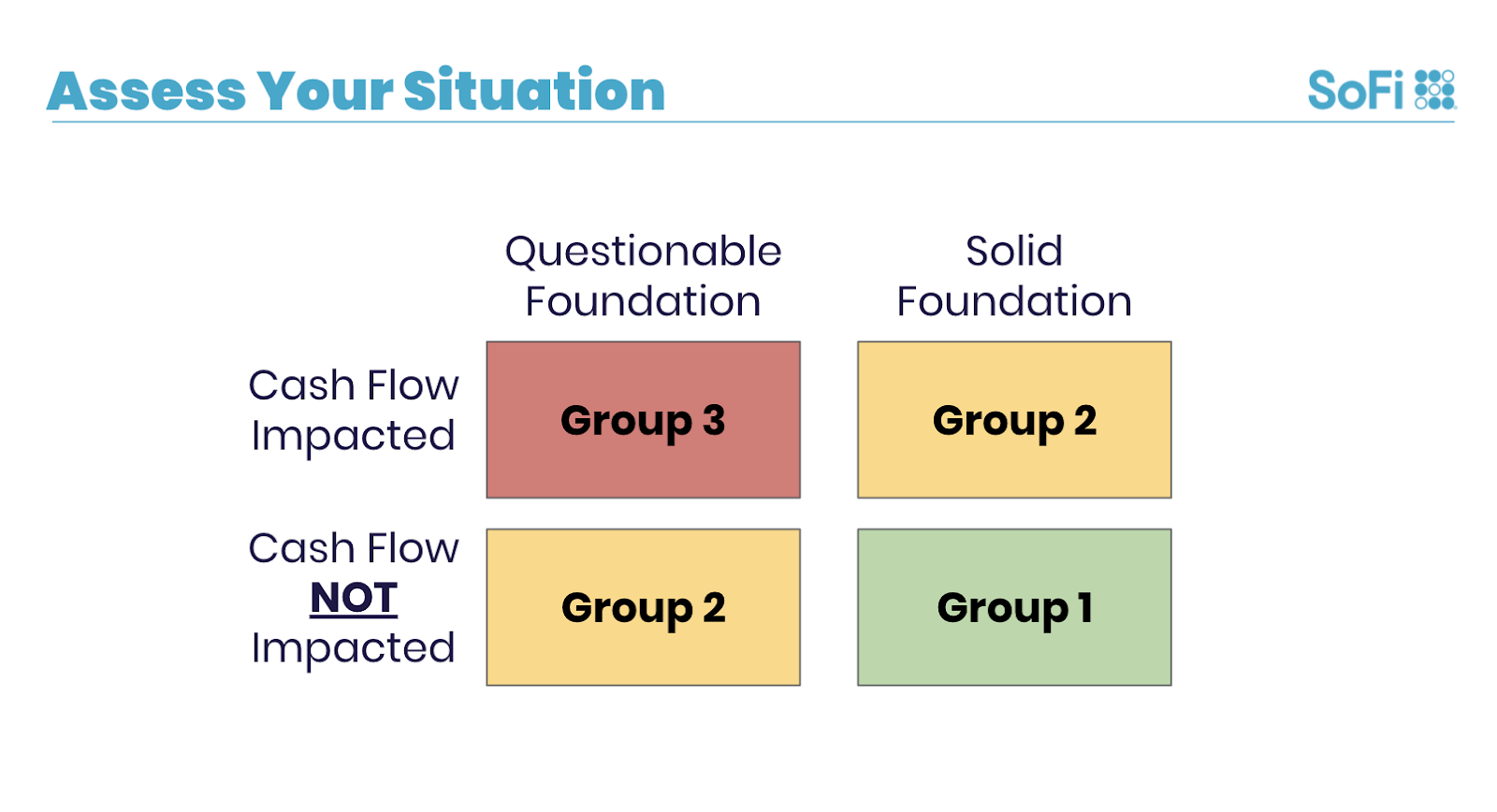

The first post of the series contained a detailed breakdown to help you determine which post-COVID-19 group you fall into—take a look at it here.

In other parts of the series, we’ll cover Group 1 and Group 3. But for the rest of this article, we’ll cover those that fall into Group 2.

This group includes those who were in a solid financial position and have experienced a direct impact on their finances. It also includes those who were in a questionable financial situation who have not experienced a direct impact on their income.

Developing a Financial Strategy

Those who fall into Group 2 are in the middle ground, where they’ve felt some impact of the changes caused by COVID-19. If you’re in this situation, you might want to consider taking proactive measures to respond to the changes, which could include options that may potentially help you strengthen your short-term financial position. As you develop a financial strategy, I suggest that people evaluate four major factors: income, expenses, debt, and investments.

Some in Group 2 are still working and earning an income. Even if you’re still earning money, it might not be wise to assume things will remain the same. Depending on the industry, there may be changes coming down the pipeline.

Are bonuses, commissions, and raises being postponed? Is there talk of potential pay cuts at your company? Asking yourself these questions now could be helpful should your earnings take a dip in the future.

Another portion of Group 2 may already have experienced pay cuts or layoffs. In this case, it might be time to take a look at your emergency fund and look into unemployment benefits.

It also might be wise to take a look at your expenses. Those in Group 2 might be feeling the effects of a slow or stagnant stream of income. Reviewing your expenses and considering changes to things formerly thought of as essential could be a good place to start when making cuts to your budget.

Taking a look at any debt you may have, such as high-interest credit card debt, is a good next step. Do you have student loans? A mortgage?

Then, taking the pulse on your investments will show you much cash is readily accessible in a liquid account. What types of accounts are your investments in?

Evaluating the Available Options

Once you’ve taken inventory of your new financial reality, reviewing the options available to you will probably be helpful in deciding how to use them to best make ends meet. Here are a few worth considering.

Receiving a Recovery Rebate Check

Also known as stimulus checks, some Americans can expect to receive up to $1,200 as part of the recently passed CARES Act.

According to the IRS , tax filers whose gross adjusted incomes, or AGIs, are less than or equal to $75,000 for individuals or $150,000 for married couples are eligible for a one-time payment in the full amount of $1,200. Married couples filing jointly will receive a single check for $2,400. This amount is also increased by up to $500 for eligible dependents.

Those in Group 2 who will be receiving a stimulus check could consider saving the money or using it to pay down high-interest debt, unless the money is needed to cover an essential expense.

Looking Into Unemployment Benefits

In the case of reduced or eliminated income, you might consider exploring the unemployment benefits available to you.

This could be an important component of your cash flow over the next few months, so understand what you may qualify for and the details of the unemployment programs in your state.

At a high level, the CARES Act impacted unemployment in three major ways:

• Those who receive unemployment benefits during this time will get their normal state unemployment benefits plus $600 per week for up to four months, ending on July 31.

• The CARES Act provides an additional 13 weeks of unemployment benefits.

• The legislation provides funding to pay for the first week of unemployment benefits for those states that waive the one-week waiting period.

Additionally, unemployment benefits may now impact self-employed or freelance individuals.

Ditching the Waste in Your Budget

Now’s the time to consider refining your budget as much as possible in order to reduce expenses.

This could help offset lower cash flow or allow you to use the surplus to fortify your financial foundation. This might mean tough cuts to discretionary spending.

Suspending Federal Loans & Saving Money

Those with federal student loans may want to consider taking advantage of the suspension of payments, which have been suspended through the end of September, without interest. This could be considered an opportunity to free up some much needed cash flow for essentials.

Understanding Forbearance Options

Those who’ve categorized themselves into this group are most likely not at a point right now where they need to leverage forbearance on other debts, but now’s the time to think about brushing up on the details in case the situation changes.

Every loan servicer is different, so check with yours to see what programs they might be offering to borrowers during this time.

Evaluating Access to Capital

Having an idea of how much cash you have on hand and knowing what options are available to access other assets—such as home equity, retirement plans, or individual investment accounts—could be helpful in the event things get worse.

One option that could potentially be useful? The CARES Act eliminated the 10% early withdrawal for retirement plan distributions prior to age 59½, for those directly impacted by COVID-19. Additionally, the amount can be repaid or taxes can be paid over the course of three years rather than one year as it was prior to the CARES Act.

Something to keep in mind if you’re considering this option, though, is that taking money out of your retirement plan could potentially impact your long-term retirement savings even if you do pay it back.

Want help preparing?

Handling finances can be overwhelming even when things are going smoothly. COVID-19 has changed the financial landscape in a lot of ways, and at SoFi we’re determined to help our members navigate the uncertainty.

For more information, take a look at SoFi’s COVID-19 Financial Guide, which has additional articles and resources.

Have your finances been impacted by COVID-19? Schedule a complimentary appointment with one of SoFi’s Financial Planners.

SoFi Invest®

The information provided is not meant to provide investment or financial advice. Investment decisions should be based on an individual’s specific financial needs, goals and risk profile. SoFi can’t guarantee future financial performance. Advisory services offered through SoFi Wealth, LLC. SoFi Securities, LLC, member FINRA / SIPC .

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

SOCO20024