Scenario 3: Making Smart Money Moves During COVID-19

This article contains breaking news and events related to the current state of politics and the economy. While we try our best to keep our articles as up-to-date as possible, the ongoing effects of COVID-19 are happening in real time and information is subject to change.

The effects of COVID-19 are still unfolding, and likely will be for some time, even after the virus has been controlled. Even now, the pandemic has changed daily life on a global scale and, on an individual level, it has impacted schedules, limited social gatherings, and impacted financial situations.

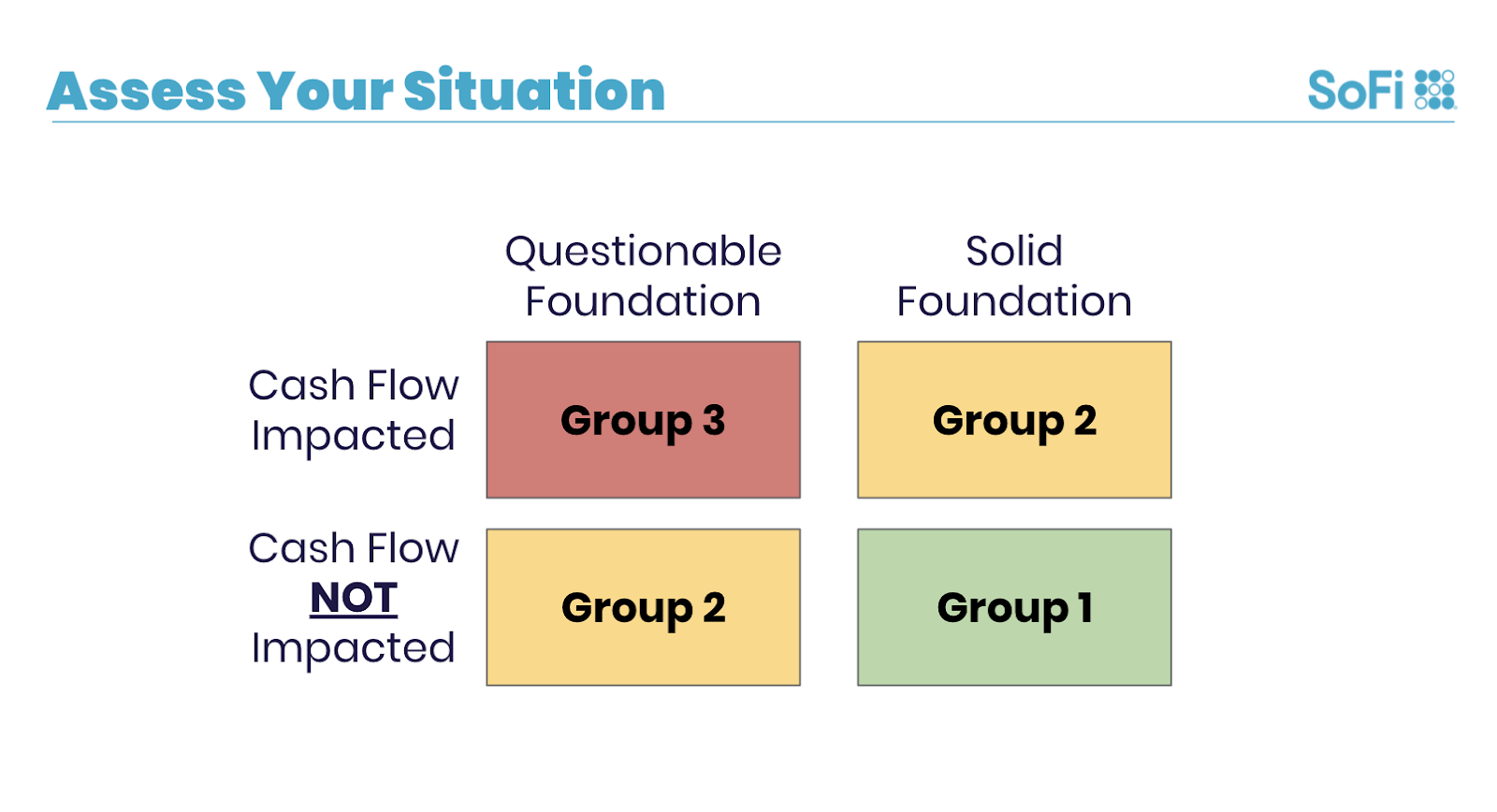

This post is the third in a series detailing different financial options available to those who’ve been impacted by changes in their finances as a result of COVID-19. In the first post, we covered some of the different categories people may find themselves in. You can take a look at it here. If you fall into Group 1 or Group 2, you can take a look at those respective posts.

For the rest of this article, we’ll review those who have classified themselves into Group 3—those who were in a questionable financial position and have experienced a direct impact to their income.

Developing a Financial Strategy

Individuals who’ve categorized themselves into Group 3 are experiencing a challenging financial situation, having had COVID-19 directly impact their income. In this case, people may want to focus on surviving the short-term impacts. As you develop a financial strategy, I suggest that people evaluate four major factors: income, expenses, debt, and investments.

Those in Group 3 have already seen their income directly impacted. For some this might have been a layoff, furlough, decrease in hours, or a mandatory pay cut. In some of these examples, individuals may want to explore the unemployment options available to them.

Now is the time to take a good, honest look at your expenses. How much of your spending is truly essential? Where can you make some cuts to discretionary spending?

Examine any debt. Do you have student loans? A mortgage? Credit card debt?

Take a look at your investments—how much do you have saved in a liquid account? Do you have any retirement savings?

Evaluating The Available Options

Group 3 may be faced with making some difficult decisions as a result of the changes spurred by COVID-19. While there may be challenging days ahead, these options could help individuals make ends meet while we collectively weather the crisis.

Receiving a Recovery Rebate Check. Some Americans can expect to receive up to $1,200 as part of the recently passed CARES Act. According to the IRS, tax filers whose gross adjusted incomes, or AGIs, are less than or equal to $75,000 for individuals or $150,000 for married couples are eligible for a one-time payment in the full amount of $1,200. Married couples filing jointly will receive a single check for $2,400. This amount is also increased by up to $500 for eligible dependents.

In this situation, consider using this money to cover essential expenses.

Filing for Unemployment Benefits. If you’ve not yet filed, explore what is available to you. At a high level, the CARES Act impacted unemployment in three major ways:

• Those who receive unemployment benefits during this time will get their normal state unemployment benefits plus $600 per week for up to four months, ending on July 31.

• The CARES Act provides an additional 13 weeks of unemployment benefits.

• The legislation provides funding to pay for the first week of unemployment benefits for those states that waive the one week waiting period.

Additionally, unemployment benefits may now impact self-employed or freelance individuals.

If you’ve lost your job and as a result, healthcare, look into ways to secure coverage .

Limiting Discretionary Spending. Reducing your expenses now can help you offset the loss in income.

Adjusting Essential Expenses. In some cases, limiting discretionary spending may not be enough. Explore ways to reduce essential expenses such as housing, food, and transportation.

Suspending payments on Federal Student Loans. The CARES Act suspended payments on federal student loans, interest free, through the end of September. Those with federal student loans should consider taking advantage of this suspension of payments to free up some cash flow.

Exploring Other Forbearance Options. It’s likely that those in Group 3 may need to explore forbearance options with their debt providers. Options will vary by lender so it’s important to understand specifically what options are available to you. In light of the current situation, institutions may be willing to work with their customers. If you anticipate having trouble, reach out to the servicer prior to missing any payments. It is important to use forbearance when necessary, since interest may still accrue during this period of time which can increase the long-term costs of your debt.

Reviewing Access to Capital. Take the time to understand and prioritize the various sources of capital that may be available to you. This could include home equity lines of credit, retirement plans, and individual investment accounts.

Changes enacted in the CARES Act could make it easier for some to access money in their retirement counts. For instance, The CARES Act expanded the loan limit for employer-sponsored retirement plans from $50,000 to $100,000. Double check with your benefits provider to understand the unique rules that apply to your plan.

The CARES Act also eliminated the 10% early withdrawal penalty for distributions prior to 59 ½ for those directly impacted by COVID-19. Additionally, the amount can be repaid or taxes can be paid over the course of three years rather than one year as it was prior to the CARES Act.

Getting Help If Needed

While the impact of COVID-19 continues to unfold, SoFi continues to work to help our members manage their financial needs.

If you have questions about your finances, consider making an appointment with one of SoFi’s Financial Planners. For more articles and resources, you can also check out the COVID-19 Financial Guide.

Schedule a complimentary call with one of SoFi’s Financial Planners for personalized financial recommendations.

SoFi Invest®

The information provided is not meant to provide investment or financial advice. Investment decisions should be based on an individual’s specific financial needs, goals and risk profile. SoFi can’t guarantee future financial performance. Advisory services offered through SoFi Wealth, LLC. SoFi Securities, LLC, member FINRA / SIPC .

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

SOCO20026