Wealth Market Commentary (Week of July 17, 2017)

Monetary Policy and the Phillips Curve: Global edition.

We’ve seen a moderate increase in stock price volatility this June and early July as comments by European Central Bank president Mario Draghi about rolling back stimulus sent interest rates higher and equities lower globally. More recently, mixed data and comments by Federal Reserve Chair Janet Yellen sent U.S. interest rates back down slightly. A lot has happened in the markets, but looking at events in terms of how central bankers view the relationship between unemployment and inflation can help us make sense of this activity and what may happen going forward.

Last month (see here: June Market Commentary), we discussed an organizing principle for how to think about the market in the post-crisis world. This framework simplifies the many possible outcomes for markets by focusing on two scenarios: There either is a relationship between lowering unemployment and increasing inflation (the so-called Phillips curve), or there isn’t; and the Fed is either right about the state of this relationship, or it isn’t. We can break down what these scenarios might mean for equities and fixed income into a matrix of four outcomes as follows:

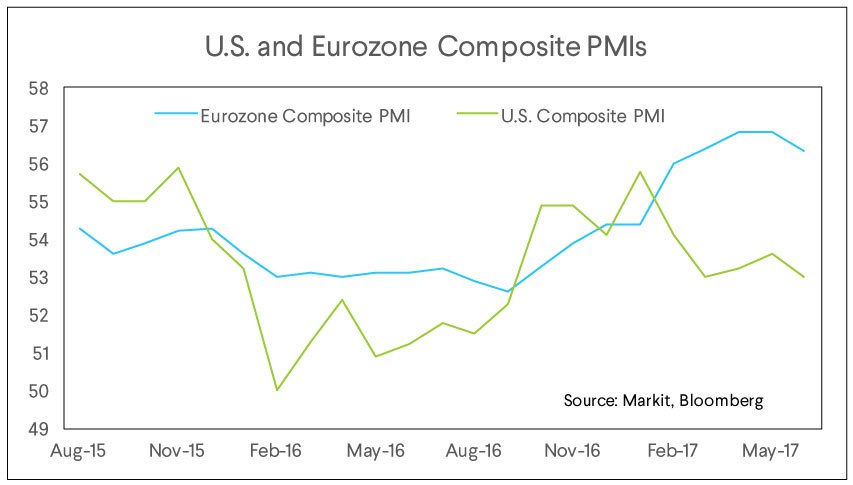

Events over the past several weeks have shown us that this same framework can also be applied to other developed markets, particularly Europe. At the end of June, European Central Bank president Mario Draghi gave a speech at the ECB forum in Sintra, Portugal in which he revealed a more positive outlook on the Europe economy than he has had in years—and for good reason. We can see in the chart below that economic activity in the Eurozone has been accelerating even as measures in the U.S. have tapered off.

This would seem like a positive for equities, however Draghi’s comments also came with a tentative plan to start reducing the ECB’s monetary stimulus. This caught many market participants by surprise. Like the Fed, the ECB is tasked with trying to limit inflation, however the Eurozone has yet to see much inflation as a result of the improving economic situation. To some his statements seemed premature and, as a result, interest rates jumped higher worldwide while equities dropped.

In terms of our matrix, Draghi’s speech put his views firmly in the top left box: the relationship between declining unemployment and increasing inflation remains strong and we should soon see a rise in prices. However, since the market is not seeing inflation on the horizon, the price action reflected the top right box: the relationship between unemployment and inflation isn’t strong, yet the central bank thinks it is. If the ECB raises interest rates when it is not needed, it would likely push Europe into recession. This would hurt corporate profits and, thus, equity prices. The rise in rates would also send bond prices lower, since the market would have to adjust to higher risk-free interest rates.

In light of the market’s dramatic response, Draghi and the ECB tried to walk back their comments to reassure participants that they would make monetary policy decisions based on incoming data and not just theory. We’ve seen this scenario play out with many central bankers who prepare the market for a hawkish scenario, and then try to quell anxieties about making moves too soon.

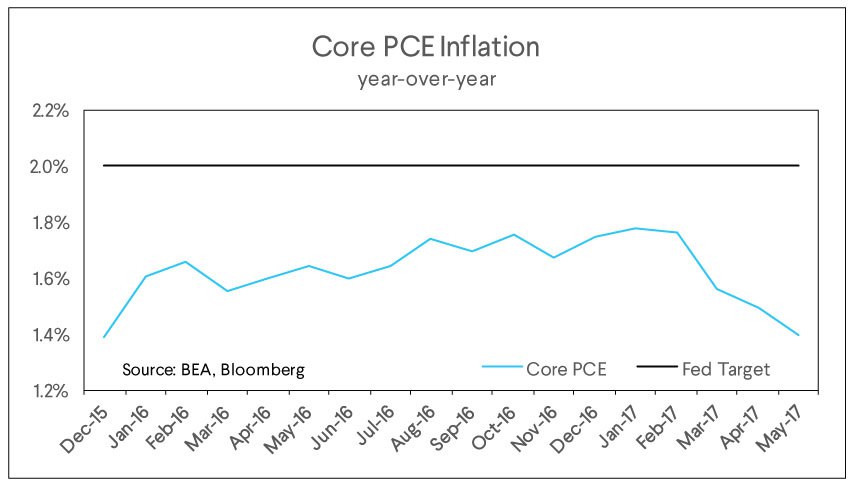

In fact, Fed Chair Janet Yellen is in a similar position in the U.S. The recent deceleration in inflation has prompted Yellen to reassure the market that the Fed is paying attention and may not need to raise rates much more than it already has. As we can see in the chart below, inflation has turned down sharply in recent months after slowly approaching the Fed’s 2% target.

This deceleration is due to many factors, including renewed weakness in oil.. While it is possible the Fed could hike rates at least once more this year, Yellen’s comments were meant to convince markets that we are not moving into the top right box of our matrix, The Fed will not blindly induce a recession by raising rates unnecessarily. She and other Fed officials have maintained that they remain flexible and data dependent. Like the ECB, they will change which box they are in if data is convincing one way or another. As a result, interest rates in the US have receded some from their recent highs. This has proven a tailwind for equities, which have rebounded strongly.

What does all this mean for the future? It is hard to say. What we do see is a clear effort by central bankers to guide markets towards a future with higher interest rates while attempting to convince those same market participants that they will not begin a full hiking cycle unless they see significant evidence of inflation. We think equities and high yield fixed income will perform well in this environment, although there may be hiccups along the way. We think interest rates will rise gradually but persistently over the next several years and that holding fixed income in short duration securities is a wise strategy to protect and grow capital.