Wealth Market Commentary (Week of August 21, 2017)

Good Data, Bad Geopolitics, and Exchange Rates

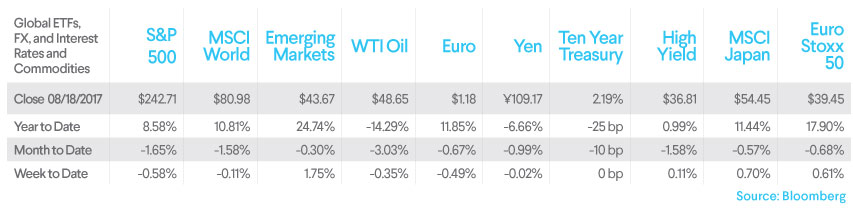

Asset prices remained relatively flat over the past month, caught between the push of positive economic data on equities and the pull of geopolitical tensions. While North Korea’s nuclear threats sent equities and interest rates down, we see these events subsiding without major implications for global markets. In determining where the markets will go over the next few months, it’s important to take a look at the interaction between economic data, central bank policy, exchange rates, and equity prices.

In recent posts, we’ve talked about the difficult situation currently facing central bankers. Their mandates essentially require them to begin raising interest rates just when the market’s starting to take off in order to curb inflation. It’s like the host taking away the punch bowl just when the party’s really getting started.

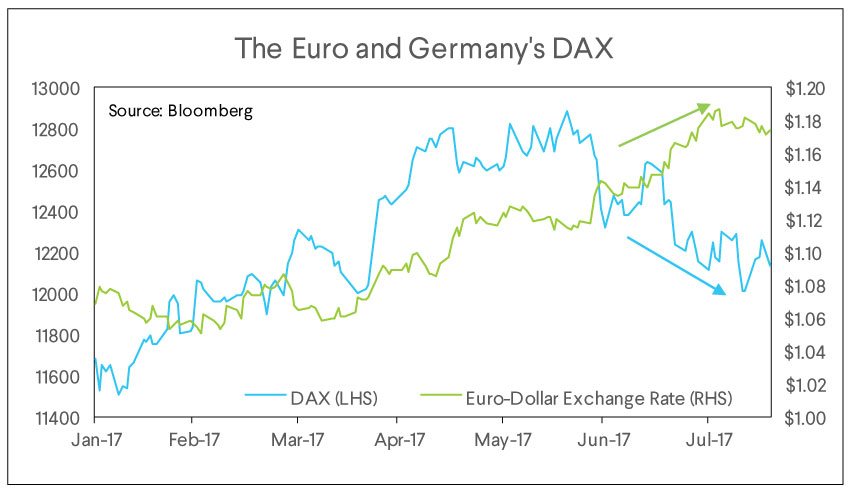

The economic data coming in from Europe suggests that party is beginning to get loud. Growth continues to accelerate across most countries in the region. As we discussed in last month’s commentary, this news has market participants wondering when European Central Bank President Mario Draghi will start reducing monetary stimulus. Draghi has been careful not to worry investors after his comments in late June spooked markets, but that hasn’t stopped the markets from pricing in an eventual end to the ECB’s asset purchases. Since central bank policies affect the supply of money, the anticipation of tighter monetary policy will often cause currencies to appreciate in the present.

A notable post-crisis trend is that these large moves in exchange rates have partially accomplished what higher interest rates would have. As a result, interest rate hikes are proceeding much slower than what would have been expected otherwise. A stronger currency makes foreign goods cheaper. This means domestic producers cannot raise prices or risk being uncompetitive. In turn, the demand for domestic exports goes down as they are now more expensive relative to other international producers. This hurts some equity markets more than others. For instance, Germany is a large exporter of goods. Equities there were able to weather the initial appreciation of the euro earlier this summer, but they have stagnated since. The implications of a stronger currency on earnings earned abroad outweigh accelerating domestic growth.

A stronger currency can thus have similar effects to an interest rate hike, though the effect is smaller in a large economy like the Eurozone. We can see in the chart below that inflation has dipped after moving closer to the ECB’s target earlier in the year.

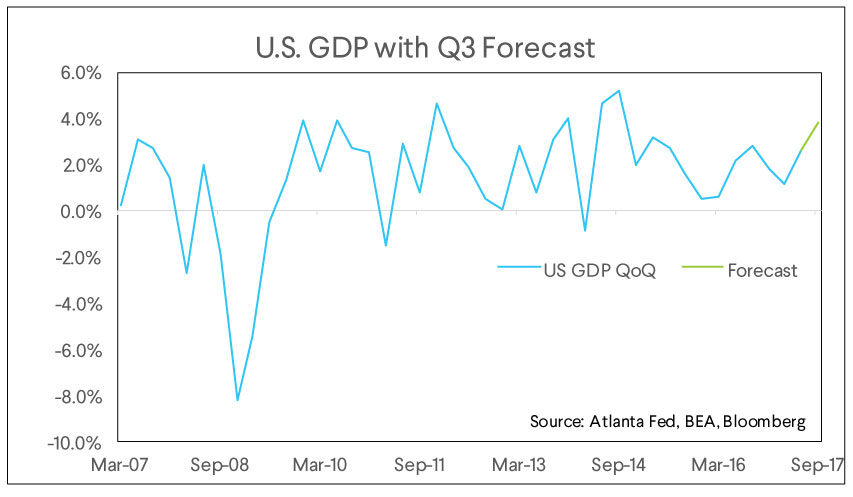

The other side to having a stronger euro is having a weaker dollar and it looks as though the U.S. is starting to see the benefits of a weaker currency. After relatively slow market growth in the first half of the year, things have begun to pick up. The most recent release of retail sales data indicated that consumption growth remains robust. The Federal Reserve Bank of Atlanta’s GDPNow indicator, a “nowcast” for GDP Growth, is currently predicting 3.8% real GDP growth this quarter. If the U.S. meets that expectation, it would be the fastest growing quarter since 2014.

What does all this this mean for asset prices? European equities will likely lag behind their developed market peers until there is more clarity on how the ECB plans to exit monetary stimulus–or until the recent run-up in the euro is retraced. However, we think global monetary stimulus will be reduced at a rate that is acceptable to market participants and equities will continue to perform well. Interest rate hikes are likely to proceed a bit faster than the market expects, but slower than expected by many central banks. As a result, we remain biased to fixed income that is less sensitive to rising rates.