What Is WAVES Crypto?

Updated: March 15, 2022

Waves is a blockchain platform that allows users to build Web 3.0 decentralized applications (dApps). Waves is also a smart contracts solution, and it functions as a decentralized exchange (DEX). Notably, Waves allows users with little programming knowledge to create their own custom tokens and launch their own digital currencies.

Instead of using smart contracts, tokens are created and managed via scripts that run in user accounts on the Waves blockchain. These assets, or tokens, are traded on Waves’s built-in decentralized exchange (DEX) called WAVES.Exchange. WAVES is the native crypto for this project, and it’s used for staking and to pay transaction fees.

Read on to learn about WAVES crypto, why it appeals to investors, and what the future holds for this crypto widely used for crowdfunding applications.

How Does WAVES Work?

The Waves ecosystem is designed to be flexible and multifunctional — and most important, accessible to a wide range of users.

Waves makes it possible for anyone, with or without a technology background, to launch their own crypto token. The result is that users can apply Waves tokenization to real-world applications. Examples include crowdfunding, simple initial coin offerings (ICOs), and loyalty programs.

The Development of Smart Assets

The Waves team also created a new programming language named RIDE, which was developed for the smart contract segment of the platform. RIDE allows users to create “smart assets” and “smart accounts,” which are designed to be Turing-complete.

Smart assets are virtual currency tokens that represent tangible and intangible assets from the real world. These can be bought, sold and exchanged based on the script rules which are valid on the Waves network. In this case, the script attached to the asset is in charge of validating each transaction relating to it. As such, the smart assets are supposed to offer greater autonomy, anonymity, and lower transaction fees.

The Waves DEX

Another aspect of the Waves network: Smart assets are designed to trade within the Waves built-in decentralized exchange or DEX (Waves.Exchange). The Waves DEX facilitates trade between tokens created on the Waves blockchain with other WAVES crypto tokens and fiat currencies.

The growing popularity of DEXs versus centralized exchanges (CEX) may in part be due to their ability to skirt some financial regulations. The company that builds a DEX isn’t acting as a financial intermediary or counterparty, and thus does not have to meet know-your-customer (KYC) or anti-money laundering (AML) standards because it operates autonomously.

Another trade-off between DEXs and CEXs comes down to whether users would rather hold their crypto in their own crypto wallet or entrust it to the exchange. CEXs typically require that users place assets in a custodial wallet on the exchange — sometimes restricting investors’ ability to move their crypto off the exchange as well. The Waves DEX, like others, allows traders to store their crypto in their own wallets.

Nodes and Staking

Similar to some other forms of crypto, the Waves blockchain relies on a two-tier architecture with both lightweight and full nodes to maintain the network.

Full Nodes: These are miners that validate transactions and add new blocks to the blockchain. Miners stake their WAVES coin to earn rewards.

Lightweight nodes: The lightweight nodes speed up network communications and transactions. Because the lightweight nodes do not download the blockchain, they are faster. They rely on the full nodes for transaction confirmations and interactions.

Custom Application Tokens (CATs): CATs are the user tokens created on the platform. Anyone can create a token, launch, and trade it using the lite client software for PC, Android, and iOS.

WAVES uses a variation of the proof-of-stake (PoS) consensus mechanism called leased proof-of-stake (LPoS). With the LPoS, nodes can lease their balance to full nodes and earn a certain payout percentage. This is also considered a more eco-friendly form of transaction validation.

Advantages and Disadvantages of WAVES

Here are some pros and cons of the Waves platform and WAVES crypto.

Advantages

Waves’s appeal is that it is easy for anyone, even without deep technical knowledge, to leverage blockchain technology. By contrast, Ethereum requires developers to be fluent in programming languages like Solidarity.

Waves is also user-friendly in that it’s open-source, and allows users to create and launch their own coins which can then be traded on the Waves DEX.

Thanks to the two-tier system on the Waves blockchain, transactions are processed faster and fees are typically lower (currently less than $0.01).

Transaction speeds are 100 transactions per second (tps) compared to a max of 7 tps for Bitcoin (BTC). Fees are as low as 0.001 WAVES for regular transactions or 0.005 WAVES for script transactions.

Users can also earn rewards by leasing their WAVES crypto to full nodes for staking, thereby earning rewards.

Disadvantages

A big challenge for Waves is that it competes with the established market leader Ethereum in a rather saturated market for both ICOs and for providing an adaptable environment for the creation of dapps.

Although Waves has been around since 2016, it is still an emerging platform. As such, Waves has yet to see widespread adoption and use of the WAVES crypto.

|

Advantages |

Disadvantages |

|

• Ease of use: Users do not need a tech background to launch tokens. |

• Waves faces stiff competition from Ethereum and other networks for the creation of dapps. |

|

• Transaction speeds are 100 transactions per second (tps) compared to a max of 7 tps for Bitcoin. |

• Waves looks to crowdfunding as one of its prime functions, but it’s a saturated market. |

| • Waves LPoS consensus mechanism allows anybody with WAVES tokens to earn rewards by leasing their tokens to mining nodes. |

• Waves is still an emerging platform, which may cause investors to delay financial commitment. |

Who Created WAVES?

Ukrainian entrepreneur Alexander (Sasha) Ivanov founded the Waves blockchain in 2016. It was designed as an alternative to Ethereum to encourage blockchain mass adoption.

The WAVES team held an initial coin offering (ICO) for WAVES coin in April 2016 and raised the equivalent of $22 million.

Why Does WAVES Have Value?

WAVES offers multiple solutions to its users, bringing various blockchains onto one unified network. The developers behind the Waves platform believe that Waves can gain traction in the rapidly growing sector of tokenization, particularly because its low-carbon footprint solutions are accessible to a non-technical audience.

Investors may also want to add the WAVES coin to their portfolio, if they believe the market is inclined to favor protocols that facilitate custom tokens and dapps.

Price of WAVES

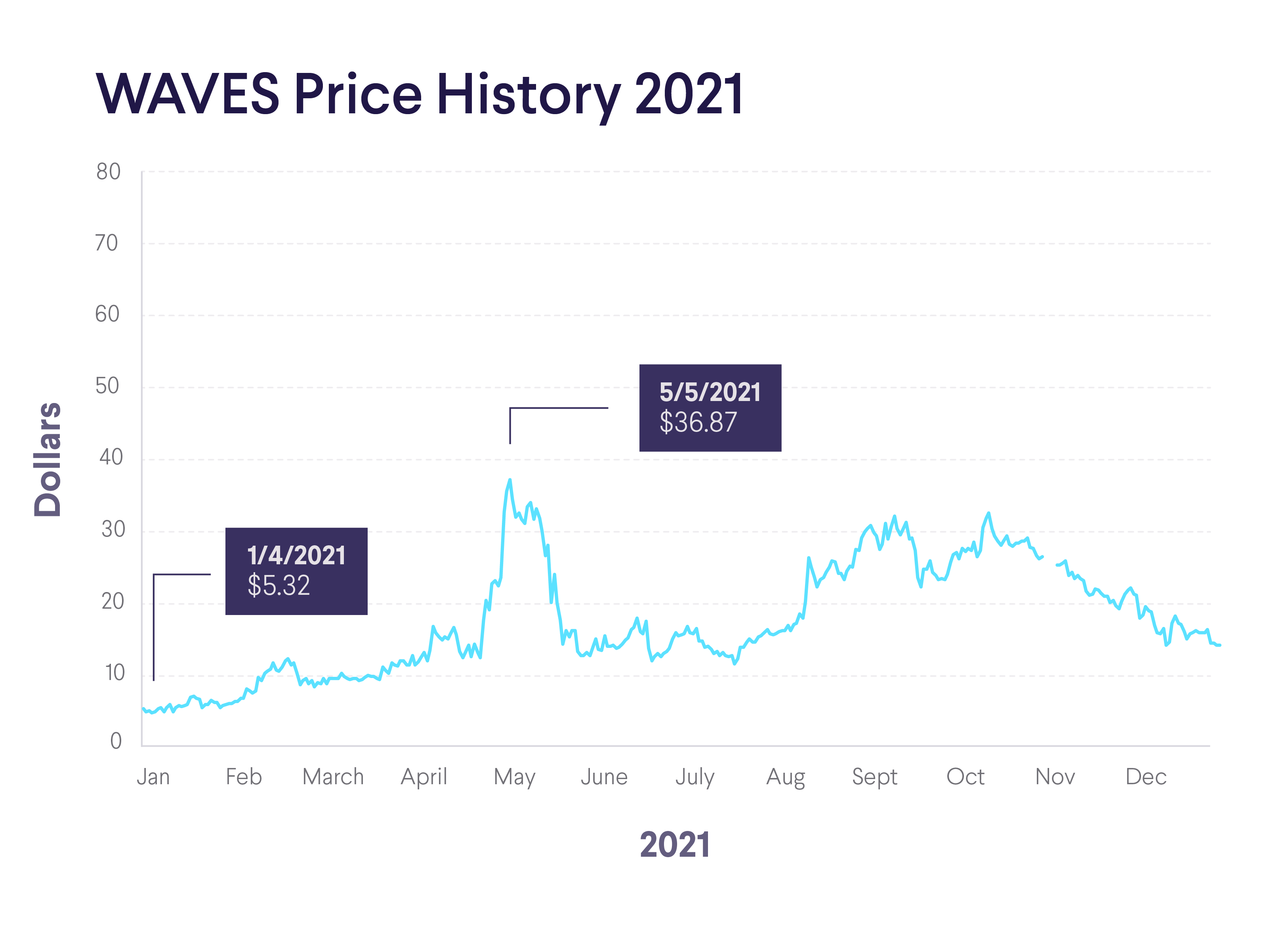

WAVES crypto has a market cap of $1.9 billion as of March 2, 2022, and a circulating supply of over 107 million WAVES. Like all cryptocurrencies, the price is extremely volatile.

Why Use WAVES?

Waves is a completely open-source protocol. Its source code is accessible on Github, where an active community discusses the project and its enhancements. Waves believes it has the potential to gain market share in many sectors, such as security, finance, personal identity, and gaming. At the moment transactions on Waves are cheaper, and there are fewer transaction bottlenecks, which makes it scalable.

Also, the platform is forging new partnerships. In 2020, the platform announced a collaboration with the Fantom network to establish an open ecosystem based on the Gravity protocol. In October 2020, WAVES announced two significant collaborations with notable DeFi projects and Matic. Also in October 2020, WAVES achieved another milestone and integrated the WAVES token onto the Ethereum network.

How Can I Buy WAVES?

You may have to do a little research to find platforms that enable WAVES trades. Also, be sure to review how crypto exchanges work, as well as any fees that may apply.

Step 1. Open an account.

Set up a crypto trading account and then fund your account with a secure wire transfer from your bank, or even with a credit or debit card transfer (but check with your bank in the case of restrictions). Fees may apply.

Step 2. Fund your account.

Just as you might keep money in a physical wallet, cryptocurrencies are held in digital “wallets.” Be sure to select a crypto wallet that supports WAVES.

Note that some crypto exchange accounts come with a custodial wallet, and there may be restrictions about moving your crypto off-platform.

Step 3. Trade WAVES

Once you’ve executed the trade, you can transfer your holdings to your wallet. You may want to leave your holdings there if you plan to keep trading.

Sharing Personal Data

Depending on where you choose to trade your crypto, different platforms may require different forms of identification. Some exchanges adhere to Know Your Customer (KYC) rules, a common set of standards that require investors to disclose certain information. Others may allow anonymous or P2P transactions.

Associated Costs

Similar to trading securities, there are fees to consider when trading crypto. Be sure to understand the associated costs that may come with trading crypto on one platform versus another, or using one form of payment versus another.

How to Sell WAVES

Once you’ve decided to sell your WAVES crypto, the next step is deciding whether you plan to cash out for a fiat currency like U.S. dollars (USD) or trade another type of crypto.

Step 1. Set up your trade.

If you’re exchanging WAVES for USD, the steps may be different than if you’re buying another form of crypto — or you may have to complete a more extensive KYC identification.

Step 2. Find the best price.

Crypto prices fluctuate by the minute, so do your research beforehand so you know a good offer when you see one.

Step 3. Sell WAVES.

Complete the trade and move your crypto (or cash) to your wallet, unless you plan to keep trading on the exchange.

Step 4. Keep taxes in mind.

Remember that crypto gains are subject to taxes. Be sure to consider the tax implications of selling WAVES coin, and consult a professional as needed.

Does WAVES Have Staking?

Yes. WAVES users can stake their crypto in return for rewards. Users must have 1,000 WAVES for a full staking node on the network. Stakers receive two types of reward: WAVES and Miner Reward Tokens (MRT).

Miners receive 60 MRT for the first 70 blocks they create each day and an additional 30 MRT per additional block. If miners don’t have the required 1,000 WAVES for a node, they can lease WAVES to a public mining pool and share in the mining rewards.

The Takeaway

Waves is a blockchain platform accessible to a non-technical audience. Users with no programming skills can use the Wave ecosystem to create custom tokens and launch their own digital currencies. Waves is used for crowdfunding, simple initial coin offerings (ICOs), and loyalty programs. These coins can be traded on the Waves DEX.

Waves is designed to be open-source and flexible, by giving users the ability to create smart assets without necessarily having to develop smart contracts to support them — a DeFi innovation.

Waves is an emerging crypto and competes with the second most popular crypto, Ethereum. However, proponents of Waves see its future applications in sectors such as finance, personal identity, and gaming because it has low fees and is scalable.

More Crypto Guides

Related resources

SoFi Invest®

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

SoFi Invest encompasses two distinct companies, with various products and services offered to investors as described below:

Individual customer accounts may be subject to the terms applicable to one or more of these platforms.

1) Automated Investing and advisory services are provided by SoFi Wealth LLC, an SEC-registered investment adviser (“SoFi Wealth“). Brokerage services are provided to SoFi Wealth LLC by SoFi Securities LLC.

2) Active Investing and brokerage services are provided by SoFi Securities LLC, Member FINRA (www.finra.org)/SIPC(www.sipc.org). Clearing and custody of all securities are provided by APEX Clearing Corporation.

For additional disclosures related to the SoFi Invest platforms described above please visit SoFi.com/legal.

Neither the Investment Advisor Representatives of SoFi Wealth, nor the Registered Representatives of SoFi Securities are compensated for the sale of any product or service sold through any SoFi Invest platform.

Crypto: Bitcoin and other cryptocurrencies aren’t endorsed or guaranteed by any government, are volatile, and involve a high degree of risk. Consumer protection and securities laws don’t regulate cryptocurrencies to the same degree as traditional brokerage and investment products. Research and knowledge are essential prerequisites before engaging with any cryptocurrency. US regulators, including FINRA , the SEC , the CFPB , have issued public advisories concerning digital asset risk. Cryptocurrency purchases should not be made with funds drawn from financial products including student loans, personal loans, mortgage refinancing, savings, retirement funds or traditional investments. Limitations apply to trading certain crypto assets and may not be available to residents of all states.

SOIN0122045