In 2020 and 2021, one of Bitcoin’s defining features was that its price always seemd to be rising.

In reality, however, the price of Bitcoin doesn’t always go up. To get these screaming vertical price increases, there needs to be some death-defying falls as well. Bitcoin’s very volatility makes this popular crypto a tempting investment for some, and a quite dangerous one for others. Trading crypto might not be for all investors — especially those with a low tolerance for risk.

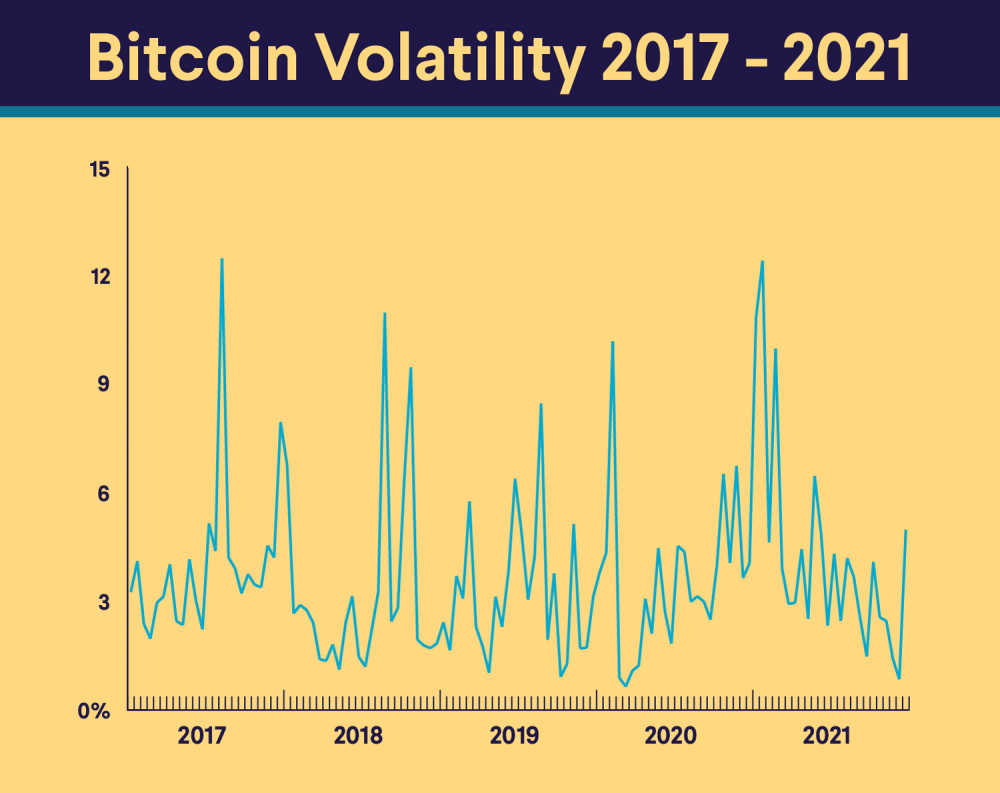

Bitcoin Price Volatility

There’s no denying that cryptocurrencies, including Bitcoin, are volatile. For instance, in the first half of 2021, Bitcoin doubled in value, reaching a record-breaking high price of $64,000. But it tumbled back to less than $30,000 during the summer months. Then in November, Bitcoin’s price soared again; this time to $68,000 (for another all-time high) only to slip to below $35,000 in January 2022.

And this is just one example. Since its launch in 2009, Bitcoin’s price history has been impressive and experienced more than a few conspicuous crashes.

Volatility is essentially a given across all types of cryptocurrencies, given the general air of legal, political, institutional, and technological uncertainty that floats around them. But it’s more noticeable with Bitcoin. Bitcoin was the very first cryptocurrency created. Not only is it the most expensive crypto, but likely the most visible, and has become a flagship for the entire crypto/blockchain space. Arguably, Bitcoin could be the coin that led the government, the public, and traditional financial services companies to take cryptocurrencies seriously. Increasingly, millions of ordinary people view Bitcoin as a vehicle for investing, trading, and saving. But before investing in cryptocurrency, an investor would want to consider its volatility seriously.

Why Does Cryptocurrency Volatility Matter?

There’s a reason that nearly anyone who’s well-versed in cryptocurrency would caution novice crypto investors to invest no more than you’re willing to lose. With a highly volatile asset like cryptocurrency, an investor’s overall portfolio value could suddenly shoot much higher or much lower than they would expect, or are prepared for, based on big changes in its price.

Bitcoin is not the only cryptocurrency to experience big price swings that can lead to large gains or losses for investors. Volatility does not play favorites, and most crypto coins, even more familiar assets, like plain vanilla stocks, can experience the phenomenon of volatility. From the second-largest crypto, Ethereum — and popular established coins like Dogecoin and Uniswap — to crypto projects you might not know, all have experienced price volatility.

Is Bitcoin Particularly Volatile?

There are at least a few reasons why Bitcoin’s price is so unstable.

Liquidity

In financial markets, liquidity is a concept that relates how much a given purchase or sale of an asset will move its overall price. Liquidity, in general, supports overall asset values. Say you have an item that costs $500 but when you go to sell it, there’s no one to buy it; In that case, the $500 price tag is not very meaningful. Low liquidity may be rendering the price of Bitcoin unstable.

A particular concern with Bitcoin is that a huge portion of all the Bitcoin circulating in the world — at this writing, more than 18.5 million bitcoin — will never be bought or sold by anyone. This could be because the coin is stranded in wallets for which the private keys have been forgotten or because they’re held by investors who will never sell, no matter the price. Moreover, Bitcoin’s existence is finite; no more than 21 bitcoin will ever be mined.

By shrinking the amount of Bitcoin in circulation beyond the limits built into the system, Bitcoin’s liquidity could dry up. This means that movements to buy or sell could quickly influence its price, driving it up or down violently.

Speculation

One of the biggest debates surrounding cryptocurrencies is, what’s it for, exactly? Why are people buying it? For individuals who live in countries with unstable or despotic governments, Bitcoin can be a lifeline of stable value. But for many, it is not an especially convenient payment mechanism compared to the fiat currency of existing banking systems.

And yet, many people are buying Bitcoin and willing to pay ever-higher prices for it. The main reason seems that they expect the price to get even higher in time. Some people think the price will go up because Bitcoin is protected against inflation because of its 21-million cap on coin. Some expect wider adoption of Bitcoin as a payment protocol. And some expect it to become widely used by financial services institutions as a store of value.

The FOMO Factor

Essentially, interest in Bitcoin is generated by the idea that other people are going to buy it in the future, at a higher price than it’s selling for today. This expectation is fed by regular headlines about a company or celebrity buying into Bitcoin and the massive profits people are generating from Bitcoin they bought years — or even weeks — ago. In the crypto community, this behavior is known as fear of missing out (FOMO). Speculative investing like this often leads to volatility, because the price can turn down as sharply as it turns up.

At this time, many analysts believe that the questions surrounding cryptocurrency, as well as FOMO, are precisely what are keeping Bitcoin’s prices high. An asset’s price likely would swing if a large portion of investors are trying to get in front of buyers who come in later. Those who buy a crypto immediately when it comes to market could dump the coin just as quickly. This could happen if an investor made a profit, or they no longer believe that more investors will buy into the crypto.

The Takeaway

Bitcoin’s volatility is based on at least two factors: its potentially low liquidity, and the plethora of unanswered questions about crypto, a still-new asset class. Investors and anyone who follows the news are aware of shocking highs and lows in Bitcoin’s value.

FAQ

In general, are cryptocurrencies more volatile than stocks?

Yes. Investing in the stock market has been a mainstay of the U.S. economy since the late 1700s. Stocks are also regulated, subject to oversight by the SEC, and other government agencies. Cryptocurrencies as an asset class are quite new, not fully regulated, and do not yet have a proven track record in U.S. markets. As we discussed, crypto is considered a speculative investment. Complex assets — like high-yield bonds, options, mortgage-backed securities, and other derivatives, including crypto — are subject to greater volatility than are plain vanilla stocks.

Which cryptocurrency is the most volatile?

The answer: It changes every day. And, volatility is not selective. Popular coins, like Bitcoin (BTC) and Ethereum (ETH), take their turns at being “most-volatile” just as often as do the tiny cryptos you might not have heard of . Cryptocurrency’s volatility has spawned a number of reliable indexes that track and report its daily price fluctuations, including Yahoo Finance and Shufflup .

Is volatility a good thing for crypto?

Volatility is neither good nor bad. Rather, it’s a phenomenon that exists in all financial markets for a mix of reasons. Cryptocurrency skeptics might see crypto’s volatility as a danger sign, a reason to stay away. However, sometimes volatility can benefit a new fast-growing asset, like crypto.

This is happening currently, with profit-seeking traders and wealthy venture capitalists streaming toward crypto. Venture capital funding can help seed new start-ups and advance technical innovation. And new money flowing into a sector often brings heightened liquidity, which makes for healthy financial markets.

The FOMO factor, which we discussed above, and just plain curiosity also can have a positive effect on crypto. For example, some large traditional financial services (TradFi) institutions that were prior crypto-naysayers are now showing an interest in the crypto sector.

Crypto: Bitcoin and other cryptocurrencies aren’t endorsed or guaranteed by any government, are volatile, and involve a high degree of risk. Consumer protection and securities laws don’t regulate cryptocurrencies to the same degree as traditional brokerage and investment products. Research and knowledge are essential prerequisites before engaging with any cryptocurrency. US regulators, including FINRA , the SEC , and the CFPB , have issued public advisories concerning digital asset risk. Cryptocurrency purchases should not be made with funds drawn from financial products including student loans, personal loans, mortgage refinancing, savings, retirement funds or traditional investments. Limitations apply to trading certain crypto assets and may not be available to residents of all states.

Disclaimer: The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results.

SoFi Invest®

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

SoFi Invest encompasses two distinct companies, with various products and services offered to investors as described below:

Individual customer accounts may be subject to the terms applicable to one or more of these platforms.

1) Automated Investing and advisory services are provided by SoFi Wealth LLC, an SEC-registered investment adviser (“SoFi Wealth“). Brokerage services are provided to SoFi Wealth LLC by SoFi Securities LLC.

2) Active Investing and brokerage services are provided by SoFi Securities LLC, Member FINRA (www.finra.org)/SIPC(www.sipc.org). Clearing and custody of all securities are provided by APEX Clearing Corporation.

For additional disclosures related to the SoFi Invest platforms described above please visit SoFi.com/legal.

Neither the Investment Advisor Representatives of SoFi Wealth, nor the Registered Representatives of SoFi Securities are compensated for the sale of any product or service sold through any SoFi Invest platform.

Stock Bits

Stock Bits is a brand name of the fractional trading program offered by SoFi Securities LLC. When making a fractional trade, you are granting SoFi Securities discretion to determine the time and price of the trade. Fractional trades will be executed in our next trading window, which may be several hours or days after placing an order. The execution price may be higher or lower than it was at the time the order was placed.

Photo credit: iStock/MixMedia

SOIN0322033