HODL is short for “hold on for dear life,” and it’s a popular term among crypto investors. Although it looks like a funny misspelling of the word “hold” — and some say that’s how it began — HODL is also related to the traditional buy-and-hold investment strategy, as one way to cope with volatility.

For newcomers to cryptocurrency investing, HODL is one of many insider terms used in forums and articles. Call it crypto lingo: Words like FUD, Moon, Sats, and HODL that originated as chat room slang have become common terms that crypto investors need to know. But as HODL has gained traction in other market sectors, you’ll hear other investors use it, too.

Here’s the story of how this term has become one of the most popular bits of cryptocurrency jargon in the industry — and, more important, how it might help your investing strategy as well.

HODL Meaning

What does hodl stand for, and how does the phrase “hold on for dear life” play into the deeper HODL meaning? For many investors, it’s easier to understand HODL in the context of another familiar investing term: buy and hold.

If you’re wondering whether to “hodl stock,” for example, then you’re essentially talking about buy-and-hold strategies. Buy-and-hold investors purchase stocks and other securities with the intention of holding onto them for the long term, regardless of market volatility.

The goal is to weather market ups and downs with an eye toward long-term gains, as history has shown that over time the stock market tends to trend upward (although past performance is no guarantee of future returns). Or to put it another way: You want to hodl stock not sell it, if the market gets bumpy. This is a common tactic used by value investors.

But what does hodl mean when discussing cryptocurrencies? It can be one of two things.

First, the basic hodl meaning can apply to a buy-and-hold strategy when talking about Bitcoin or other cryptocurrencies. Again, the idea is to “hold on for dear life” rather than selling off cryptocurrency in a panic if volatility increases — which, in the crypto markets, is a likely scenario.

The second hodl meaning can refer to a specific type of cryptocurrency token called — what else? — HODL. HODL, or hodl, is a community-driven token that operates on the Binance Smart Chain.

The Origin of HODL

The term HODL originated as a misspelling of the word “hold.” Ultimately the acronym “hold on for dear life” was attached to the term.

Here’s the story. On the fateful day of December 18, 2013, Bitcoin traders were on edge: In the prior 24 hours the price of Bitcoin (BTC) had fallen 39%, from $716 to $438. This was after a year-long bull run in which Bitcoin rose from $15 in January 2013 to a high of over $1,100 in December 2013.

A trader with the username GameKyuubi (who later admitted to having had a whiskey or two), posted the following on a Bitcointalk forum:

“I AM HODLING,” he began his memorable, drunken rant.

Despite the turmoil, GameKyuubi had made up his mind to stop trying to time the markets, and to simply hold his Bitcoin from that point on.

“WHY AM I HOLDING? I’LL TELL YOU WHY,” the rant continued.

“It’s because I’m a bad trader and I KNOW I’M A BAD TRADER. Yeah you good traders can spot the highs and the lows … Just like that and make a millino bucks sure no problem bro.”

Despite the confusing spellings, GameKyuubi was voicing a common frustration among traders with managing crypto price fluctuations. But GameKyuubi defended his hodl strategy.

“You only sell in a bear market if you are a good day trader or an illusioned noob. The people in between hold. In a zero-sum game such as this, traders can only take your money if you sell.”

The cryptoverse went wild. HODL became an internet meme within the hour, and its use as a legitimate investing term spread from there.

So, the TL:DR version of the hodl meaning? It came about as the result of a typo.

Hodl and Cryptocurrencies

As mentioned, hodl can mean one of two things when discussing cryptocurrencies. Investors may be talking about a specific HODL strategy they’re using to gauge when to buy or sell crypto. Or they may be referring to the HODL token itself.

At the core of the hodl approach is the idea that crypto investors shouldn’t be trading based solely on short-term pricing moves. Instead, cryptocurrency investors should hold on to their coins or tokens, riding out periods of volatility as they come and go. Even though cryptocurrencies may dip, pricing still has potential to rebound, making up for losses over time.

This is what happened with the June 2021 crypto market crash. Many Bitcoin investors saw all of their 2021 gains wiped out after the cryptocurrency’s price dropped dramatically. Other cryptocurrencies, including Ethereum and Dogecoin, also charted sizable losses. But the down market proved to be temporary, as many crypto prices have inched back toward their pre-crash levels.

Crypto investors who cashed out in the midst of the crash may have netted substantial losses. But those who chose to HODL instead may be eventually rewarded instead with much higher pricing moves as the cryptocurrency market rebounds.

Understanding the HODL Strategy

The strategy of HODLing is more extreme than simply holding, hence the acronym Hold On for Dear Life. Hodl can be used especially when the market is going down, to help investors resist the urge to panic-sell. This is especially important for amateur investors who are more prone to emotional or impulsive behavior.

Investors who don’t use the HODL strategy may be similar to day traders or forex traders who seek to profit from volatility in the market. These investors attempt to buy low and sell high, or to short sell, profiting from smaller market movements rather than looking at the long term.

Although anything is possible, it’s unlikely that a downturn in the markets overall will result in a crash of the total crypto market, which is why a hodl strategy could make sense. It’s important to remember that even in the most dire downturns, like the market crash that precipitated the Great Recession, there was a noteworthy recovery.

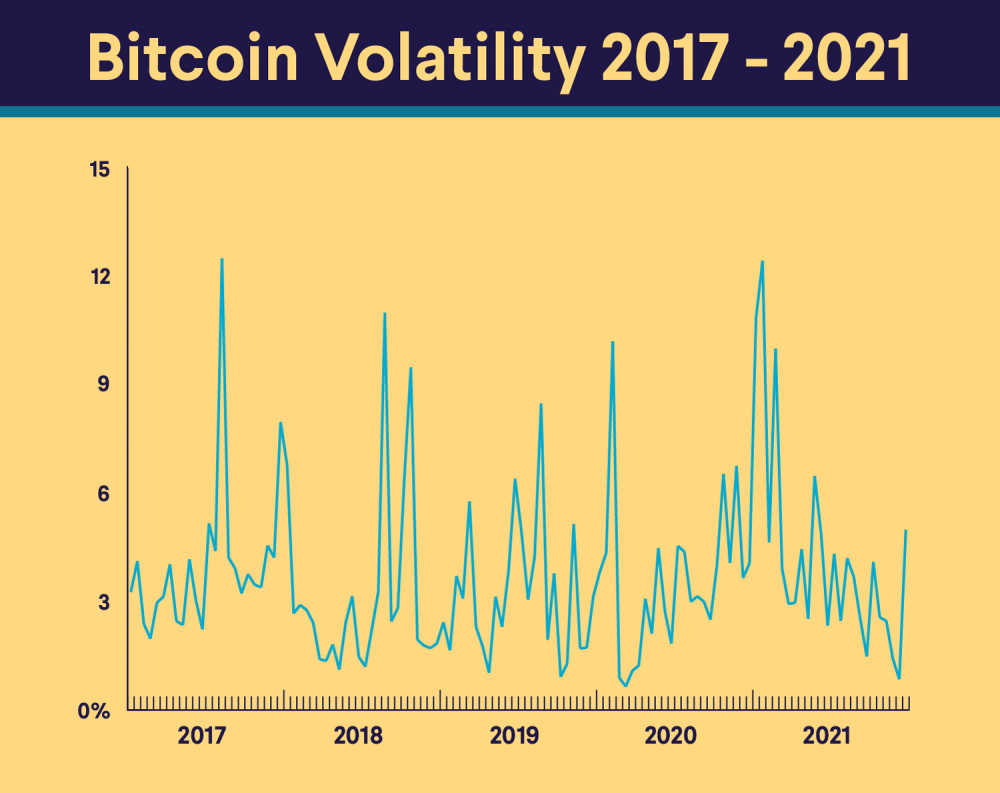

As you can see in the chart, the price of Bitcoin alone has seen some dramatic highs and lows.

Knowing When to HODL

Deciding when to hold or sell cryptocurrencies is a personal choice, and investors should do their research and due diligence before making those decisions. Some investors choose to adopt a HODL strategy across the board, meaning they buy cryptocurrencies to add to their portfolio and don’t plan to sell them for many months or years.

While this is a good move for people who believe in the long-term value of cryptocurrencies, it’s unclear what the outcome might be. The future of the industry is yet to be seen: hacks, bad news, and other world events can affect crypto prices (as they can in any market sector).

Some choose to HODL certain coins, but actively trade other coins that they don’t believe have as much potential for growth. Some HODL coins tend to be more established and stable, although HODLing a coin with a lower market cap could result in higher profits if it grows significantly over time.

The HODL strategy may be a good choice for investors who don’t want to spend a lot of time on their cryptocurrency portfolio or are new to the technical analysis of crypto investing.

No matter what sector you’re investing in, it’s always smart to build a diversified portfolio, so that if one market segment drops, others might be doing well and help to mitigate losses elsewhere. There are thousands of different cryptocurrencies available to invest in to build a diversified portfolio.

That said, the cryptocurrency market is still very volatile. As with any investment, it’s important to do research, pay attention to the market, and know that anything can happen, even the loss of an entire portfolio.

HODLing Coins and Crypto Wallets

If an investor is planning on holding onto a cryptocurrency for a long period of time, they’ll want to make sure their holdings are as secure as possible. Using a crypto wallet is the way to go. Crypto wallets are digital ways to store the passwords — or private keys — that give you access to your coins on the blockchain. Crypto wallets keep your coins safe from hackers but accessible to you, so you can send and receive different types of cryptocurrencies.

What is a crypto wallet, exactly? They come in different forms, including hardware wallets that look like a USB stick to mobile apps that even allow you to shop using crypto, the same way you would with any mobile wallet.

Knowing What to HODL

For HODLers, as with all investors, building and maintaining a diversified portfolio may be advantageous.

This may mean the investors need to add more money to their portfolios over time, or that they need to sell one cryptocurrency for another. For example, in previous years the price of certain coins has increased significantly, while other coins haven’t grown as much.

If you invest in a coin that dramatically increases in value, your portfolio could end up imbalanced with a large percentage of your holdings in that coin — which leaves you more vulnerable to losses if that coin fluctuates. In that scenario, you may want to consider rebalancing your portfolio to maintain your original allocation and proper diversification.

While HODLing may be a good strategy, it’s not completely passive and involves paying attention to your portfolio and making sure your asset allocation makes sense for you.

Alternatives to HODLing

Besides day trading and HODLing, others choose to SPEDN or BUIDL using their cryptocurrencies. These terms are twists on “spend” and “build,” inspired by the creative misspelling of HODL. But these are different from holding on for dear life, as they are strategies to help the industry grow, with the hope of making cryptocurrencies more valuable.

The philosophy behind spending (SPEDN) is that by using cryptocurrencies to buy goods and services, it encourages the adoption of crypto use in the real world. These days, with a growing number of outlets accepting crypto as a form of payment — and now some governments recognizing crypto as legitimate forms of currency — the SPEDN strategy could become an effective way to put more crypto in circulation.

Also, the cryptocurrency industry is young, and needs a lot of development and work. This is why some choose to build (BUIDL) companies, platforms, apps, and tools to use with cryptocurrencies. In fact, BUIDLers cast themselves somewhat in opposition to HODLers, making it their mission to encourage more people to build and contribute to the blockchain.

HODL in the Media

HODL has earned its fair share of attention in the media. Publications such as The Washington Post and CNBC have written articles explaining the hodl meaning for investors who are new to cryptocurrency trading. There’s even a site called The Daily HODL that publishes regular cryptocurrency news and updates.

Social media influencers and tech innovators have also embraced hodl as part of the modern vernacular.

The Takeaway

Although HODL (or hodl) seems like a hip new crypto term for standing your ground in the face of volatility, hodling can trace its origins back to the time-honored investment strategy of buy-and-hold. In this new iteration, though, there is a stronger inclination to hold onto your crypto and not panic-sell.

As with any investment, selling during a downturn can lock in losses, whereas sometimes if you hold steady you may see a recovery — hence the wisdom of hodling.

FAQ

Who first said HODL?

The first known use of HODL is widely attributed to a crypto trader using the moniker GameKyuubi. He was ranting about Bitcoin’s price volatility after a recent dip, in a Bitcointalk forum in 2013, and misspelled the word “hold.”

How is HODL pronounced?

HODL is pronounced with a long ‘o’ sound, like the word toe, followed by ‘dl’, similar to the final syllable of cradle: Ho – dl.

What is the opposite of HODL?

Since HODL has come to mean “hold on for dear life,” and some people compare it to a buy-and-hold strategy, the opposite would be investors who trade frequently: trying to make the most of market ups and downs.

SoFi Invest®

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

SoFi Invest encompasses two distinct companies, with various products and services offered to investors as described below:

Individual customer accounts may be subject to the terms applicable to one or more of these platforms.

1) Automated Investing and advisory services are provided by SoFi Wealth LLC, an SEC-registered investment adviser (“SoFi Wealth“). Brokerage services are provided to SoFi Wealth LLC by SoFi Securities LLC.

2) Active Investing and brokerage services are provided by SoFi Securities LLC, Member FINRA (www.finra.org)/SIPC(www.sipc.org). Clearing and custody of all securities are provided by APEX Clearing Corporation.

For additional disclosures related to the SoFi Invest platforms described above please visit SoFi.com/legal.

Neither the Investment Advisor Representatives of SoFi Wealth, nor the Registered Representatives of SoFi Securities are compensated for the sale of any product or service sold through any SoFi Invest platform.

Crypto: Bitcoin and other cryptocurrencies aren’t endorsed or guaranteed by any government, are volatile, and involve a high degree of risk. Consumer protection and securities laws don’t regulate cryptocurrencies to the same degree as traditional brokerage and investment products. Research and knowledge are essential prerequisites before engaging with any cryptocurrency. US regulators, including FINRA , the SEC , and the CFPB , have issued public advisories concerning digital asset risk. Cryptocurrency purchases should not be made with funds drawn from financial products including student loans, personal loans, mortgage refinancing, savings, retirement funds or traditional investments. Limitations apply to trading certain crypto assets and may not be available to residents of all states.

Investment Risk: Diversification can help reduce some investment risk. It cannot guarantee profit, or fully protect in a down market.

SOIN0722045

| First Trade Amount | Bonus Payout | |

|---|---|---|

| Low | High | |

| $50 | $99.99 | $10 |

| $100 | $499.99 | $15 |

| $500 | $4,999.99 | $50 |

| $5,000+ | $100 | |