SoFi Quarterly Career Trends Report — Spotlight on Livable Cities

At SoFi, we know how much time, effort, and money go into your education and career. We also understand that to make the best decisions, you need timely and accurate information. That’s why we create a quarterly career trends report. Read on to get the skinny on what’s happening in the job market today and how it all relates to you and those career goals you’re working so hard to achieve.

The Big Picture

In recent months, global and industry slowdowns have inspired fears of recession. Economic growth in China has slowed, leading to a dramatic drop in the Chinese stock market, and energy prices have fallen, triggering oil and gas industry layoffs. Although the United States economy has held fast, there are troubling signs that things are about to slow down.

The U.S. Bureau of Labor Statistics reported an average of 209,000 jobs added per month in the United States in the first quarter of 2016. Strong numbers, for sure; however, those numbers have started to drop in the last two months, increasing some people’s concerns that the economy is losing some steam.

Employment Trends

The employment and unemployment rates in the U.S. have remained relatively flat since August 2015. After averaging over 200,000 new jobs in each of the first three months of 2016, only 123,000 were added in April, and just 38,000 in May.

Even with this lower trend in the second quarter, there is still some good news for SoFi members. Candidates with a college degree or higher continue to do well in the job market, and if you are strategic in where you choose to live, there are great opportunities to grow your career while keeping your cost of living down. That’s more money. This is particularly true in growing job markets in cities like Austin and Salt Lake City.

In the SoFi member community, a mixed bag of jobs data emerged. Not surprisingly, SoFi members far outperform the labor market as a whole with a minute 0.1% unemployment rate, compared to 5% nationwide. There has also been a recent trend of more candidates losing jobs than accepting new offers, but with a positive second quarter predicted by workforce solutions provider The Manpower Group, we do not expect this trend to last for long.

Compensation Trends

A strong labor market leads to both an increase in employment and take-home pay. Average earnings increased 1.4% in March 2016, compared to the prior year. Wage growth has lagged for some time, but employment data site PayScale expected a slight increase in the second quarter, projecting a 2% year-over-year increase for June.

Related: Why You Need To Ask For a Raise, And How To Get It Like These NYC Lawyers

Some specific career paths have seen better results than the economy as a whole. For example, law firms are paying New York market-level bonuses, regardless of job location. However, in the majority of professions, compensation has been generally flat, and that trend is expected to last at least through the end of the year.

Spotlight On: Livable Cities

From picking the right graduate school to choosing the best industry and function for your skills, every decision leading to this point in your life path has helped shape your career and salary. One of the biggest impacts you’ll make on your career and on your life goals deserves special attention: location!

Many people choose to live near family or close friends. As long as they can find a competitive job in that location, there is little pressure to rock the boat and leave the area. However, looking past short-term needs and goals, it is easy to see how living elsewhere can help others build a successful career and lifestyle.

If you have never taken the time to reflect on whether you are living in the best location for your dream career and lifestyle, current labor market growth might give you the opening you need to jump to a new location where you can earn more, follow your ideal career path, and get the most bang for your buck in an affordable and enjoyable city.

Job Market

Job markets can be inconsistent and difficult to predict. Depending on your industry, you may be attracted to the financial markets of New York City, the tech companies of San Francisco, or the energy industry mecca of Houston.

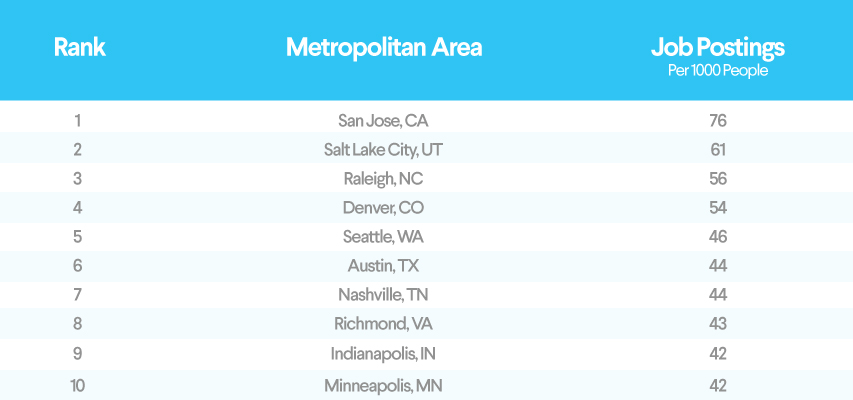

However, looking at employment trends in those locations, you may be surprised to see flat employment numbers, or even declines. When considering a move, look past the current unemployment rate and focus on unemployment trends over time and the number of jobs posted in that specific metro area.

Look for markets where unemployment is on the decline, as that is an indicator of jobs being created. Also, look at job postings per capita, which indicates whether the local labor market is clamoring for new workers or if most positions are filled.

Cost of Living vs. Compensation

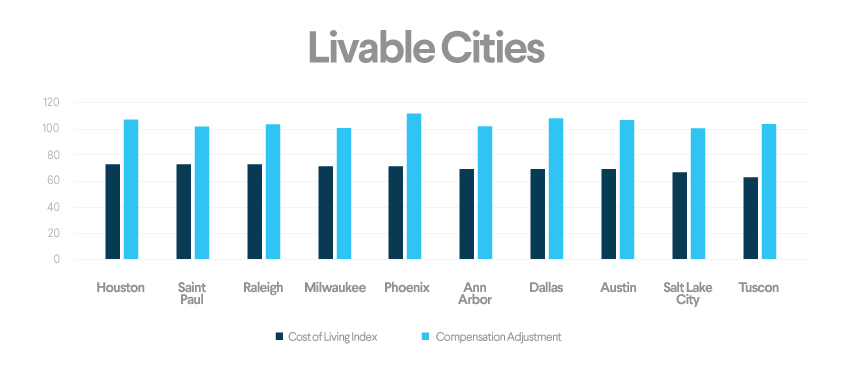

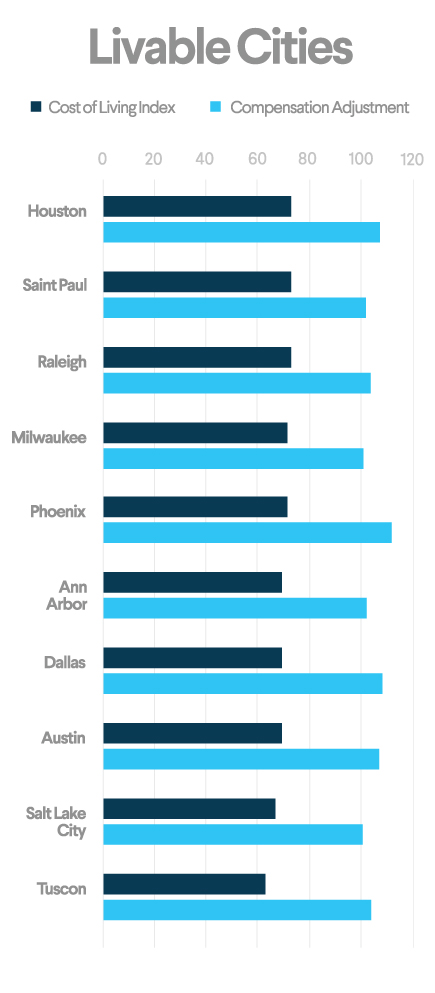

New York and San Francisco come up again and again as high paying cities, but big paychecks in those locations do not go as far as slightly lower paychecks might go in much less expensive areas.

Recommended: Should You Rent or Buy a Home in the Bay Area

If you are moving to a new market, look at both the cost of living difference and salary difference. If you are offered a job in a big city with a 20% raise, but the cost of living increase is more than 20%, you’ll actually come out on the losing end financially.

For example, Salary.com shows that the cost of living when moving from Buffalo to New York City goes up by a whopping 80%. At the same time, typical compensation increases when making that move are only about 25%, causing a net decrease in quality of living and a potential strain on personal finances.

The Right Market for Your Career

When looking at these cities, consider whether they offer options for your specific skills. If you work in a niche field, you might want to skip a job offer in an area where only one employer is hiring for your skill set. Instead, choose a city with lots of options for the future. Remember that a career is a marathon not a sprint, and jumping at the first opportunity may leave your options limited for long-run success.

SoFi’s Impact on Career Success

SoFi is known for providing its members with savings on student loans, but there is a lot more that SoFi does to invest in your professional success. SoFi members can contact their career coach for one-on-one career management and job search advisory services, including personal compensation reports that prepare you with the best information for interviews and salary negotiations.

If you are looking at moving to a more livable city to advance your career, start by connecting with your career coach. SoFi wants to see members succeed in all aspects of their financial life, including paying off debt and maximizing income.

*All statistics in this article are current as of the publication date.

Read more